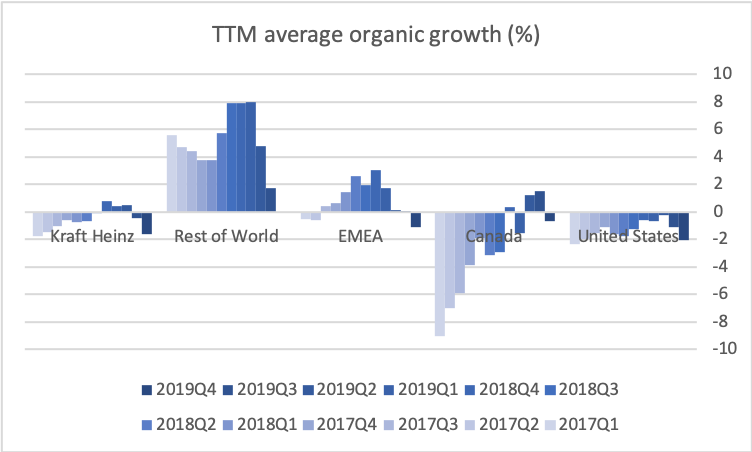

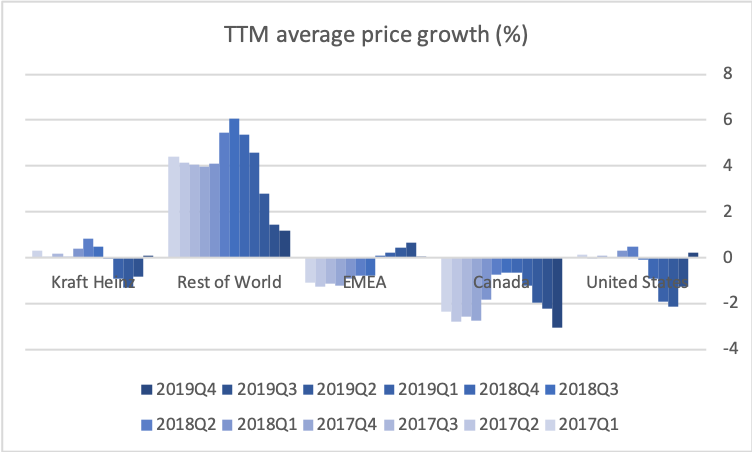

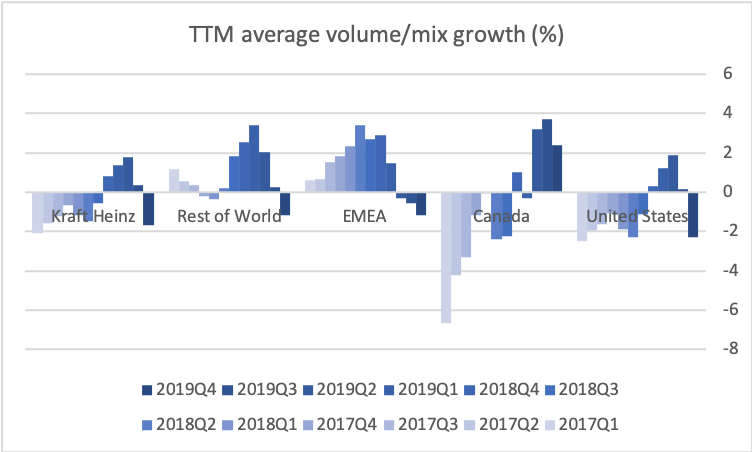

- Organic net sales down 2% due to volume/mix declines in response to higher pricing in the US and to a lesser extent lower pricing in Canada

- Further impairments of goodwill (453 USDm) and intangible assets (224 USDm)

- Strategy presentation will be in early May and not in March. No guidance or outlook for 2020 has been presented.

- Bonds downgraded to junk by S&P and Fitch.

- Despite headwinds Kraft Heinz can maintain its dividend and still pay down the debt.

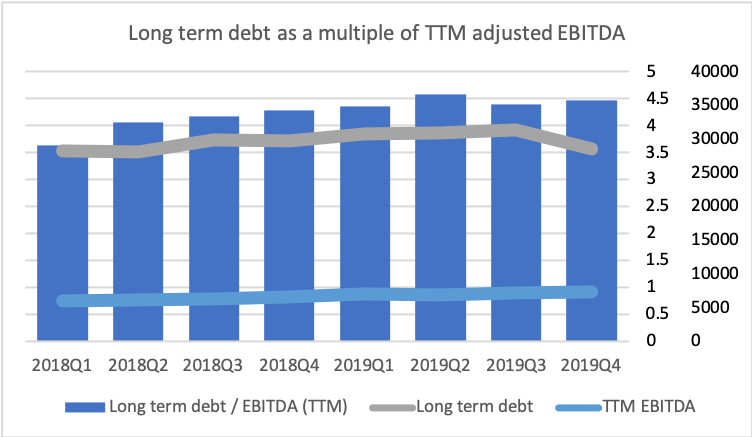

Kraft Heinz issued a press release on their Q4 earnings on February 13th. Kraft Heinz pays an annual dividend of approximately $500M and has debt of approximately $29B. Is Kraft Heinz able to maintain the current dividend while paying down the debt? CFO Paulo Basilio had the following comments on the earnings call regarding the dividend.

Finally, earlier today, we, together with our Board of Directors, announced that we are maintaining our current dividend. We believe our cash generation will remain at healthy levels, fully fund our plans and initiatives and allow us to continue meeting all our obligations as we transform the business and return Kraft Heinz to sustainable growth.

For instance, we will meet all of our 2020 debt maturities from cash already on hand. At the same time, we will not sacrifice necessary investments in the business because we are even more confident in our long-term prospects behind our new enterprise strategy, portfolio prioritization and the growth initiatives we will unveil in May. After meeting our obligations and invest in the business, maintaining a strong dividend to shareholders is a priority of the company, especially during this important period of transformation.

Investment-grade status also remains important to us, but we understand that the decline of our leverage may not come as rapidly as desired. We will utilize excess cash generation as well as potential divestiture proceeds to reduce leverage below 4x as soon as practical. And regarding the prospect of divestitures, we will continue to evaluate opportunities that are consistent with our strategy, in no rush and with price discipline as always.

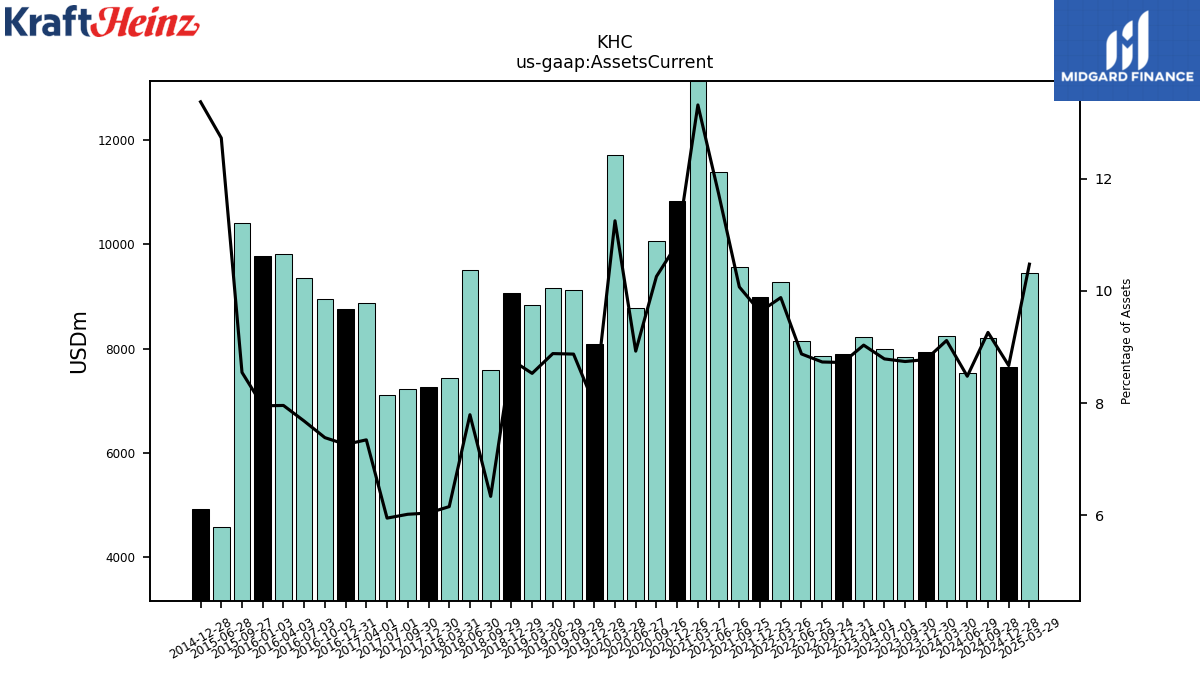

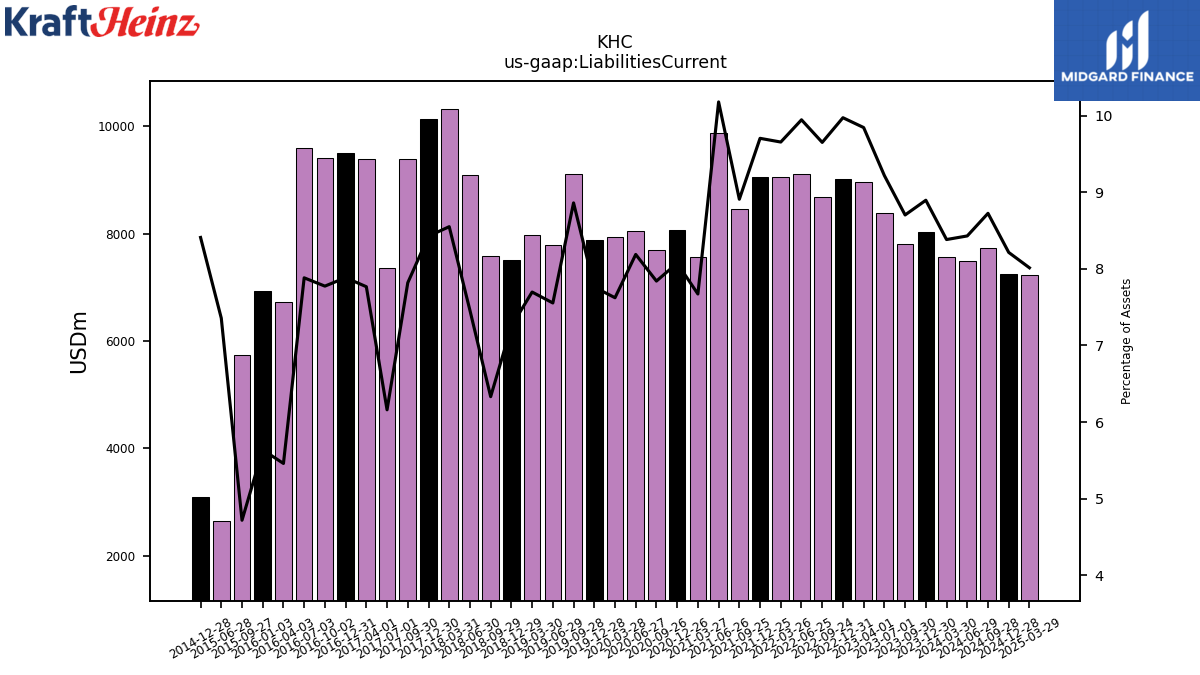

With just over $6 billion in adjusted EBITDA and considering cash interest expense, taxes, patient contributions, working capital and capital expenditures, we generated roughly $2.8 billion of cash in 2019 that was available for dividend and debt reduction. This was closer to $3 billion, excluding tax repaid on divestitures. As a result, and together with divestiture proceeds, we reduced net debt by $3 billion in 2019, closing the year with nearly $2.3 billion of cash on balance sheet. These are critical variables to consider as we think about our ability to meet our commitments as we undertake our turnaround and business transformation, which brings me to our financial outlook.

To begin, I think it’s important to recognize that 2020 will be the first full year of what we expect will be a multiyear turnaround. For our first phase in 2020, specifically, we have set three priorities: one, establish a strong base of sales and earnings; two, rebuild the underlying business momentum; and three, continue to reduce debt, while maintaining our current dividend.

CFO Paulo Basilio on the Q4 earnings call.

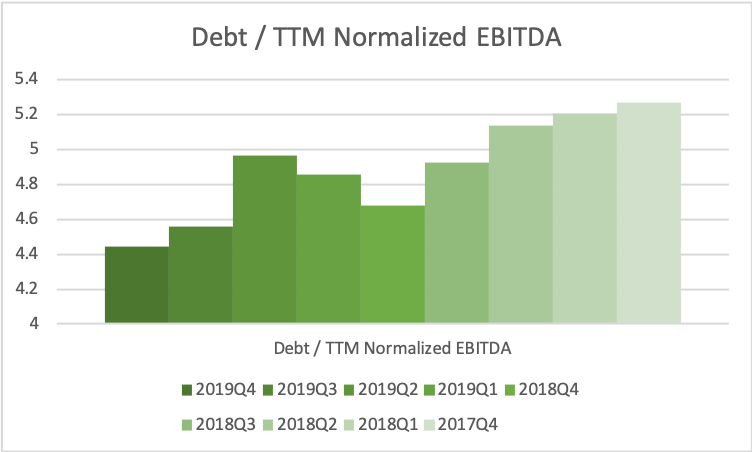

Due to asset sales and continued strong cash flow from operations debt has been reduced, but EBITDA is also lower than two years ago, and thus the ratio between the two has remained somewhat constant above 4x.

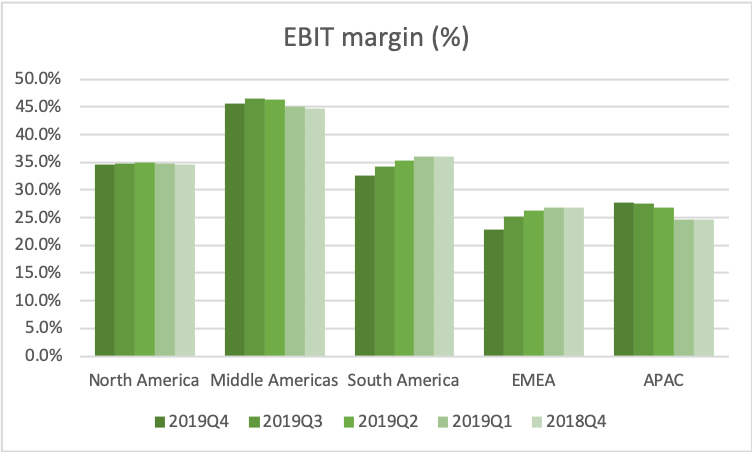

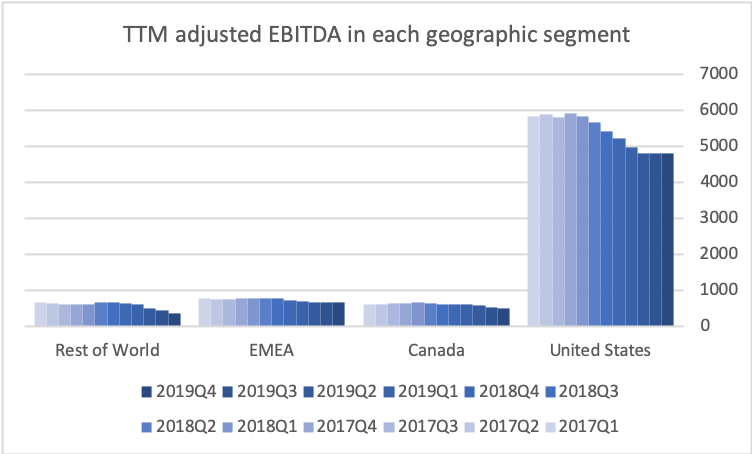

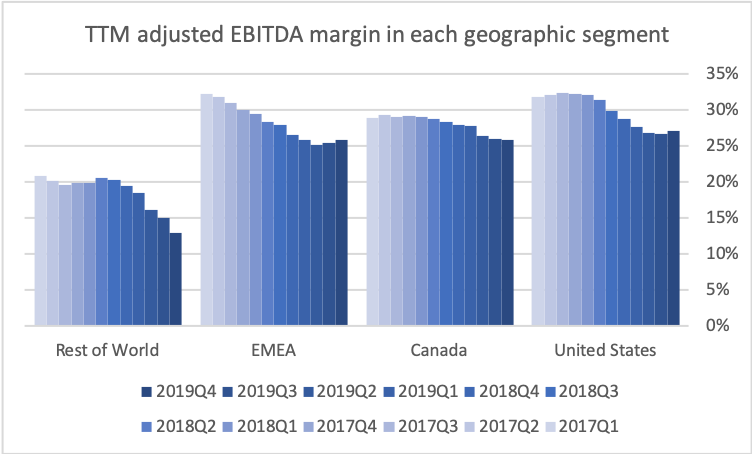

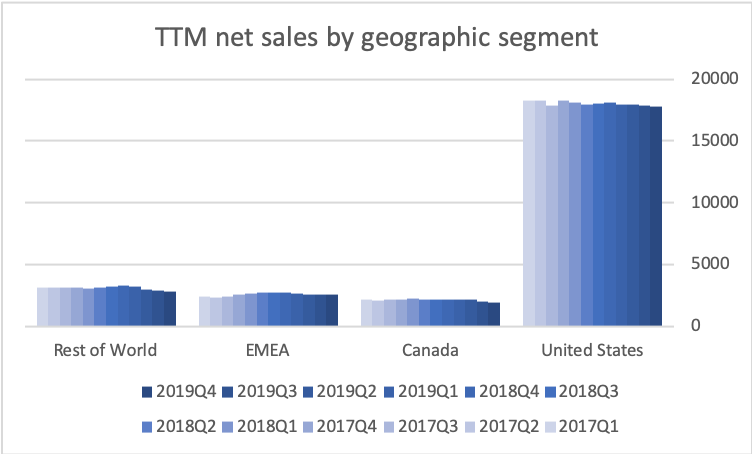

The US is by far the biggest and most important geographic segment. Adjusted EBITDA and the adjusted EBITDA margin have stabilized in the US segment.

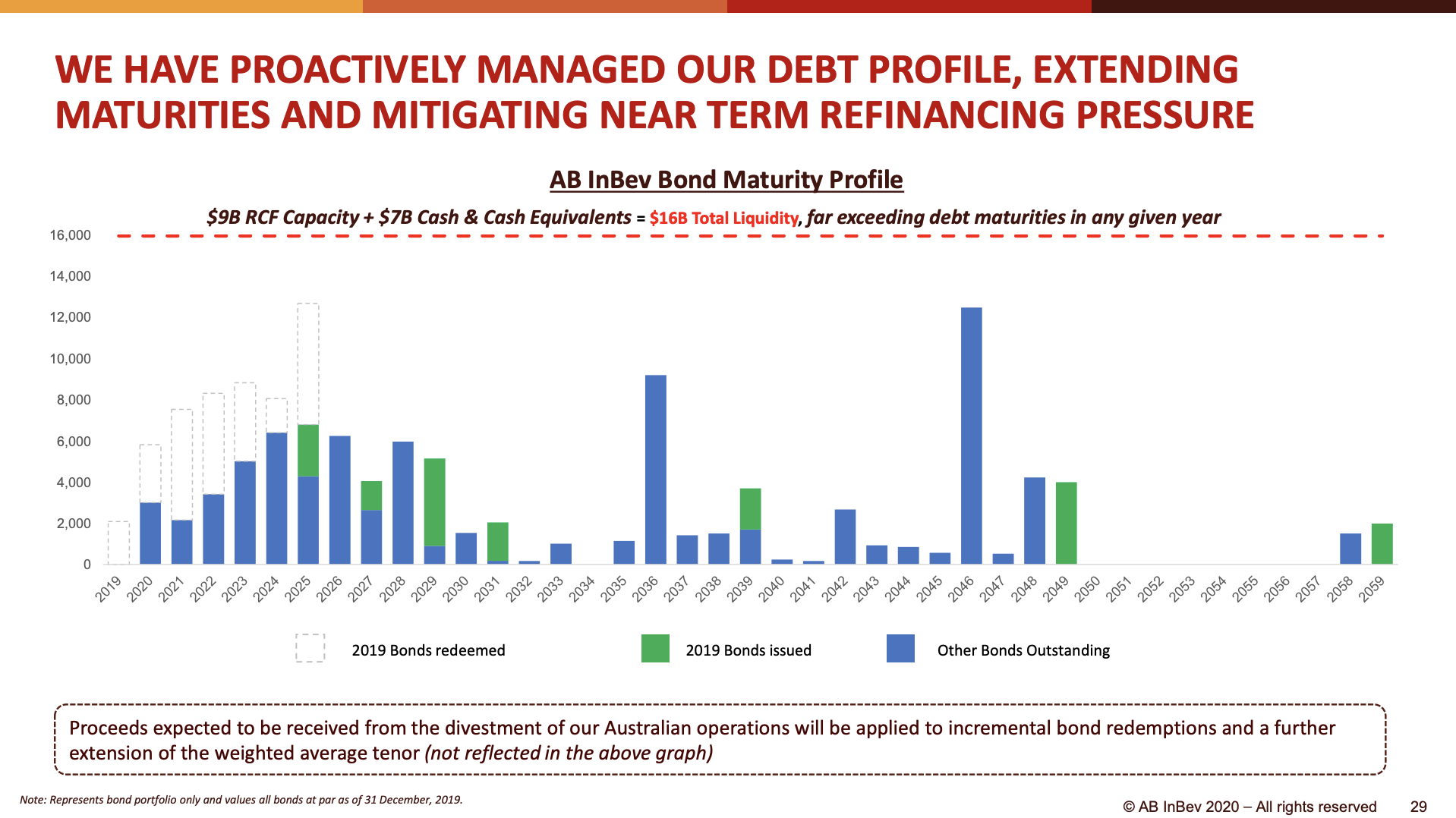

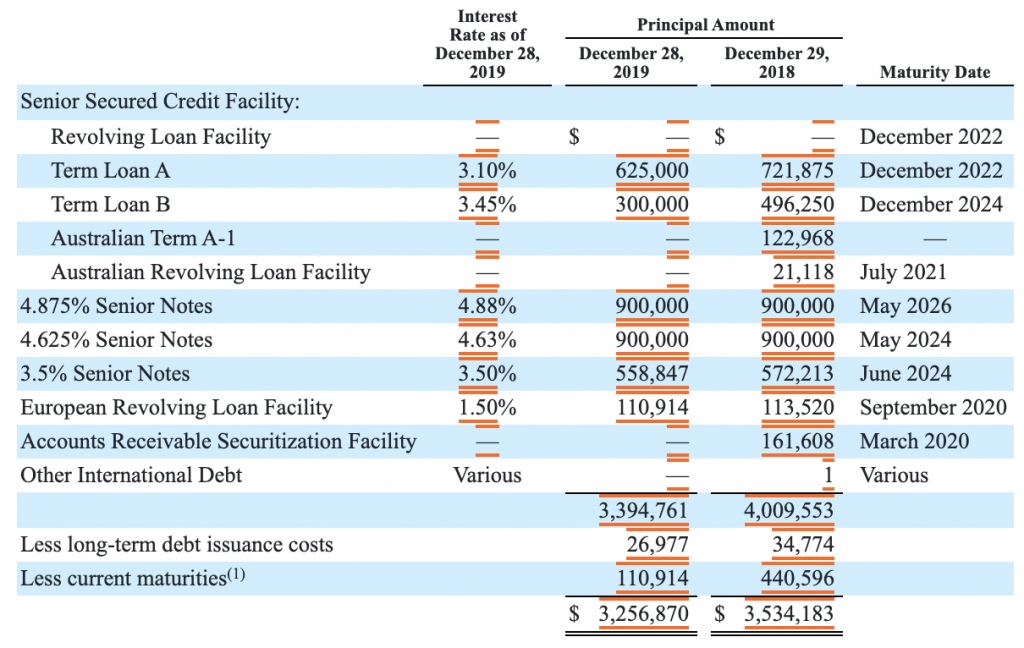

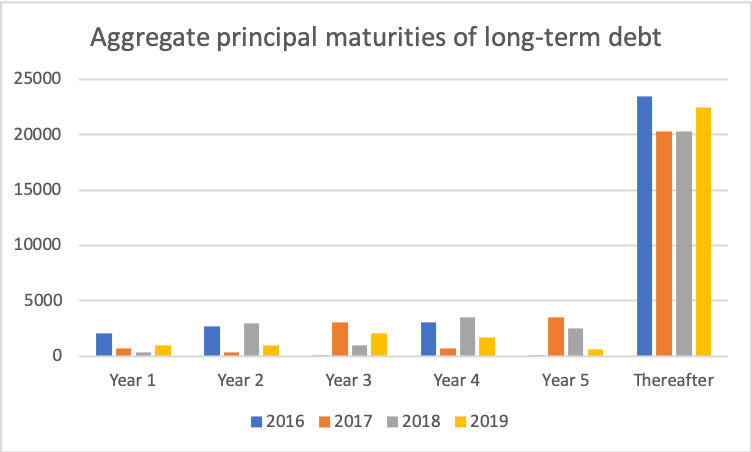

Maturity dates on long-term debt have been pushed forward in time. 2 USDb of 3.950% US senior notes are due July 2025 (US50077LAK26). Other than that little refinancing is necessary in the short term.

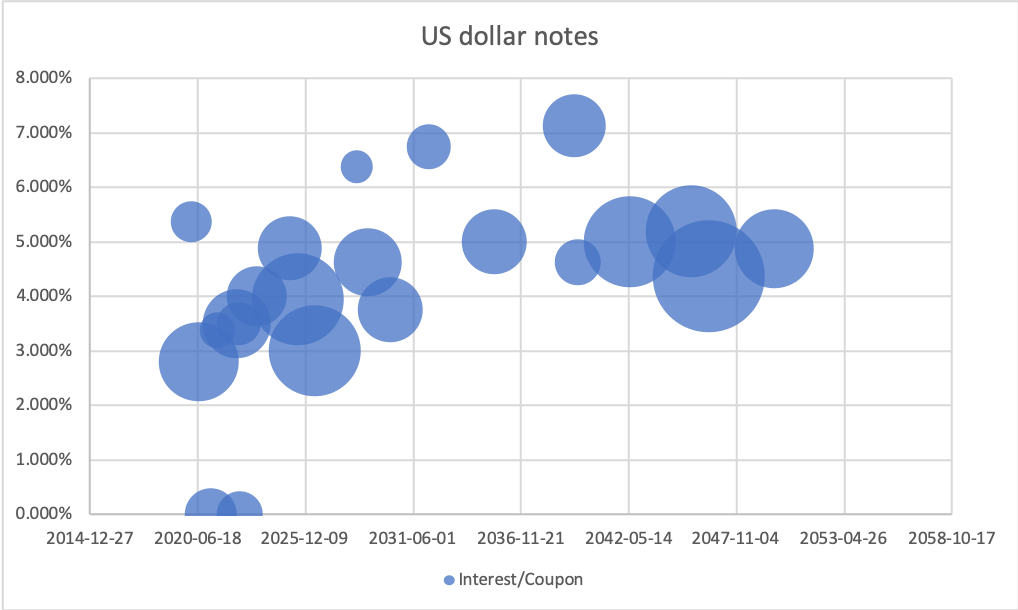

Kraft Heinz spends a bit more than $300M on interest payments each quarter.

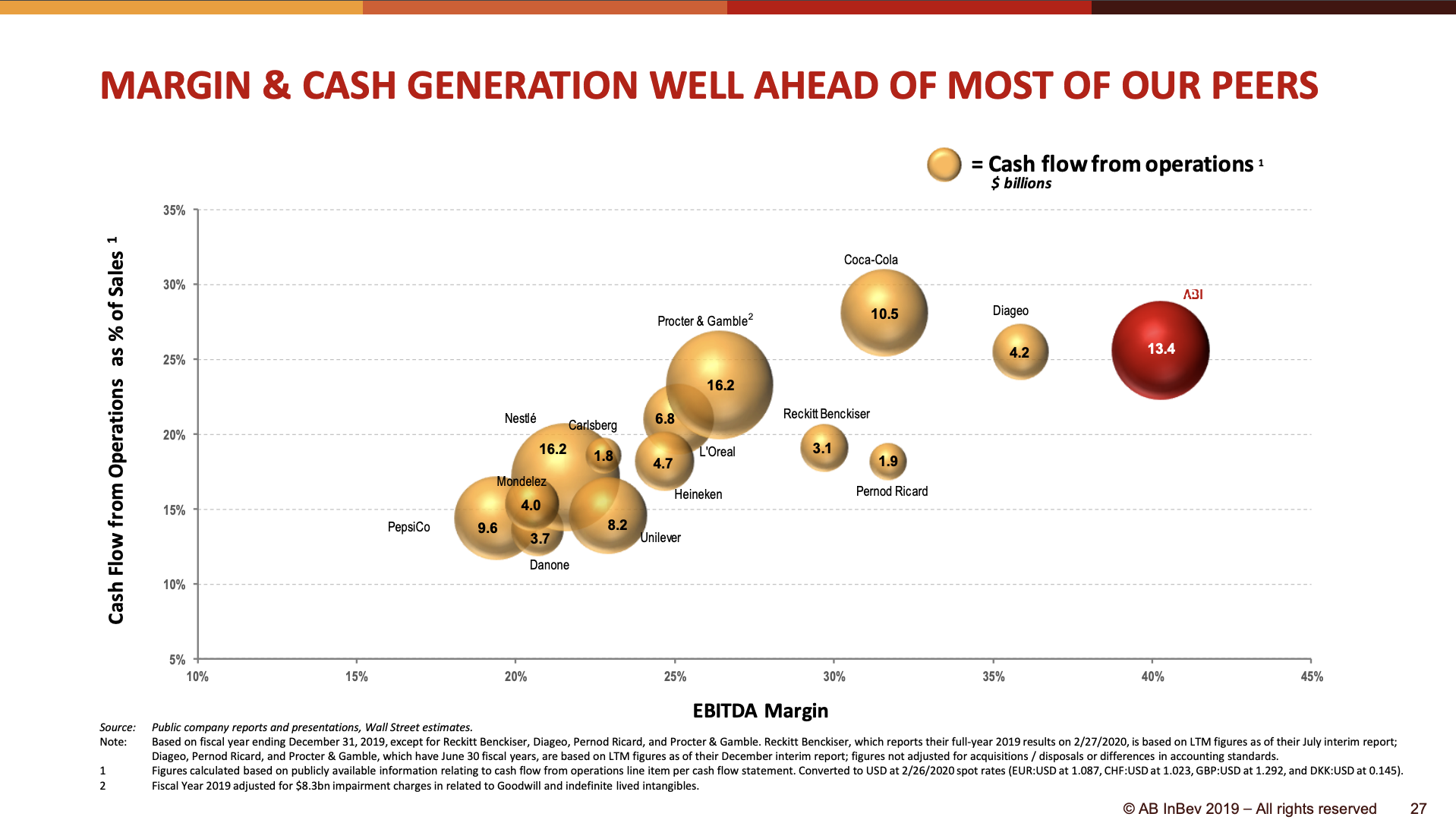

Kraft Heinz will be paying an overall interest rate on its long-term debt of approximately 4.7% in 2020, which is more than both European peers (Danone 2.4%, Unilever 2.5%, Nestlé 3.3%) and US peers (Campbell’s 4.2%, Conagra 3.7%, General Mills 3.6%, PepsiCo 3.5%, Kellogg’s 3.2%, Mondelez 2.6%). Interest payments are expected to make up approximately 5.4% of revenue in 2020 (Unilever 1.2%), which is a lot compared to the fact that operating margins are approximately 20%.

Despite the debt maturing in 2025 carrying lower interest rates, the interest expenses are likely to remain constant due to the continued deleveraging.

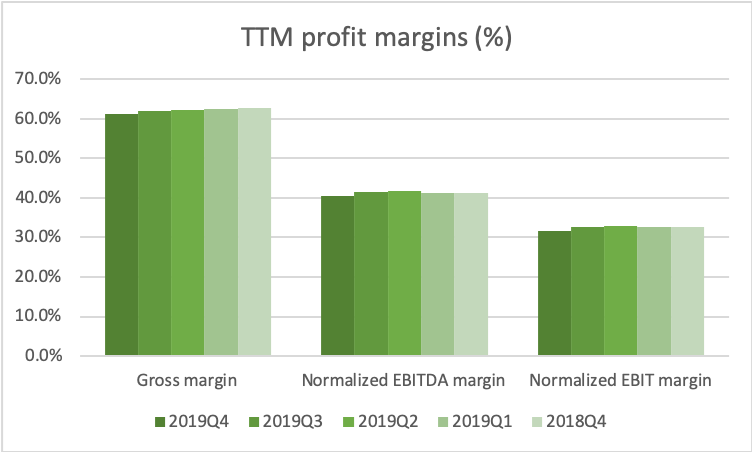

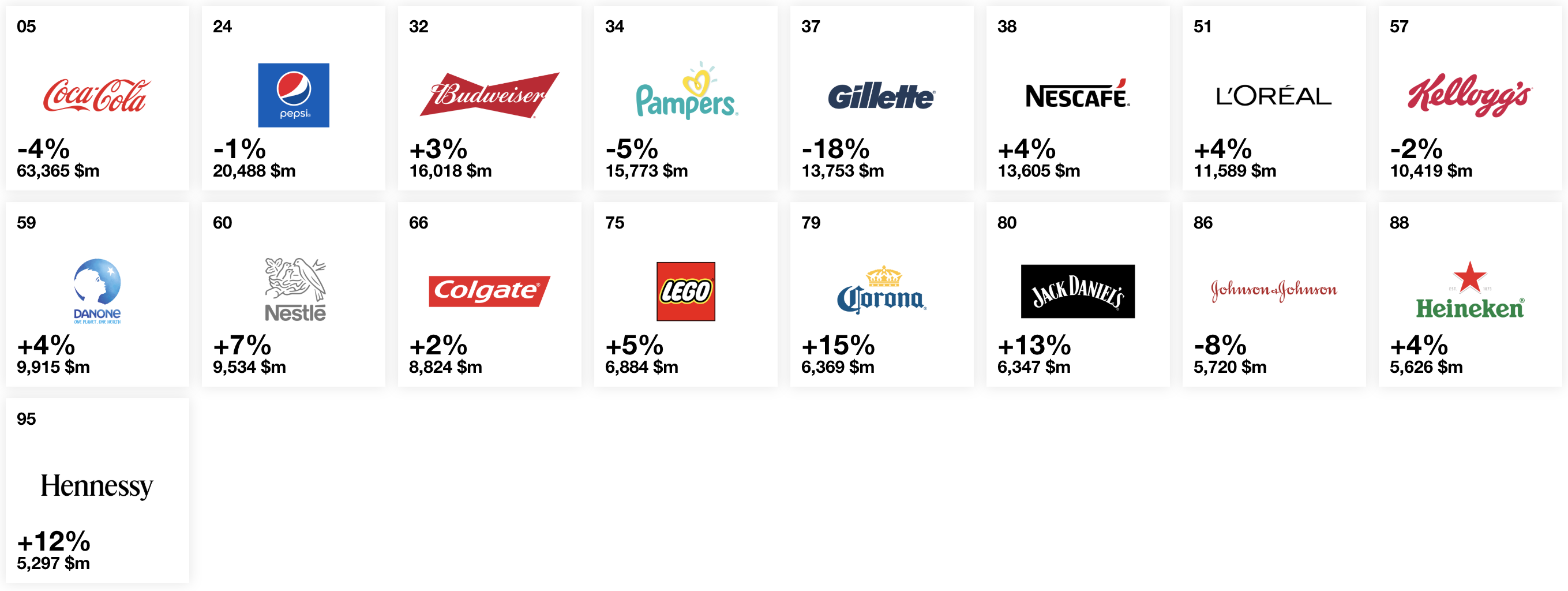

Can the share price fall further? Absolutely, but the multiples are approaching record lows for the industry, and Kraft Heinz is a better company than many of its peers in terms of multiple metrics. Kraft Heinz has better margins in terms of operating income and operating costs.

EBITDA adjusted for impairment losses was 6,064 USDm in 2019 (7,024 in 2018). Depreciation and amortization was 994 USDm. Net property, plant and equipment was 7,055 USDm at year-end. Thus pre-tax income on non-cash net tangible assets was 72%. This compares favorably to other US food companies ($GIS 67%, $CPB 52%, $K 42%).

If EBIT is 5 USDb going forward and the effective tax rate is 21%, then net income after payment of interest and taxes is approximately 3 USDb. Taking into consideration capital expenditures and depreciation and amortization there should still be more than 500 USDm available each year for deleveraging after payment of the dividend of 2 USDb. Without divestments the deleveraging to 2x EBITDA will not happen within the next five years. That is anything but the end of the world though.

At current multiples that are at historic lows in absolute terms and relative to its peers Kraft Heinz offers a good investment despite the currently meager growth prospects. COVID19 and the delay of the strategy plan from March to May offers a small perfect storm and a buying opportunity.

Appendix

“I think Kraft Heinz should pay down its debt. Under present circumstances, it appears that it can pay the dividend and pay down debt at a reasonable rate,” Buffett said. “And it has too much debt, but it doesn’t have debt it can’t pay down. The debt holders are going to get the interest and the debt should come down by year-end. I think it will, and I think it can with the present dividend.”

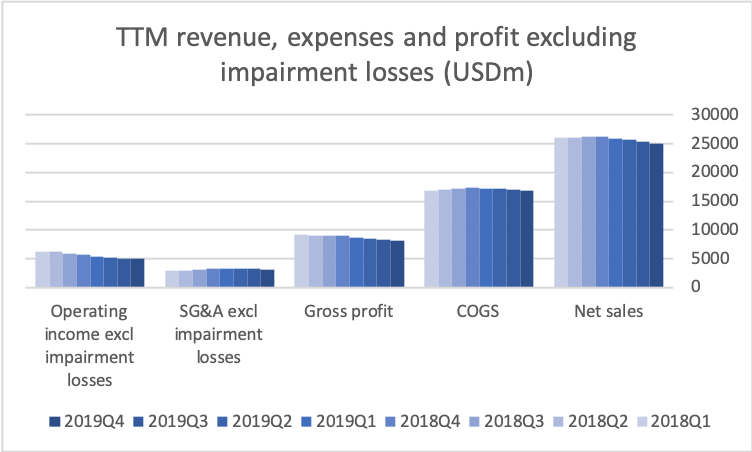

Operating income has declined by $1B in the span of two years due to negative top line growth (US and elsewhere) and divestments (Canada).

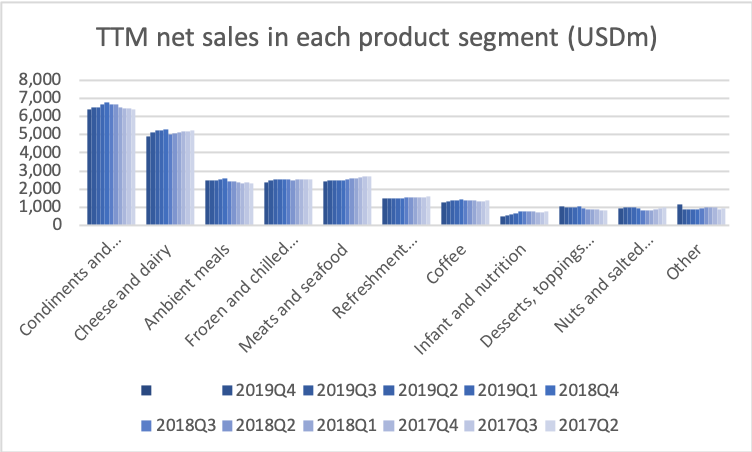

Cheese and dairy is a low margin business facing fierce generic competition. Hence it makes sense to divest parts of this product segment.

Organic growth was -2.7% in the US for the quarter, which was attributable to volume/mix (-5.8%) rather than price (+3.1%).

Kraft Heinz earns 5 USDb on net tangible assets of approximately 7 USDb, which is superior in the industry.

There were further impairments in the 4th quarter of goodwill (453 USDm) and intangible assets (224 USDm), but of a much smaller magnitude than a year ago.

The long-term debt has been reduced to $28B.

Current dividend payments amount to nearly $2B each year.

2020-02-25 Bloomberg – Kraft Heinz, Macy’s, Renault Add to Fallen Angel Fear

2020-02-14 Reuters – Kraft Heinz’s credit rating cut to ‘junk’ by Fitch

2020-02-14 Bloomberg – Kraft Heinz’s Junk Downgrade Rekindles Bond Market Jitters

2020-02-13 Reuters – Kraft Heinz takes $666 million charge, misses sales expectations

2020-02-13 Bloomberg Opinion – Kraft Heinz’s Misery Isn’t Over Yet

2020-02-13 CNBC – Kraft Heinz delays the announcement of long-term turnaround plan, shares tumble

2020-02-13 Bloomberg – Kraft Heinz Shares Sink After Sales Miss Again

2020-02-12 Bloomberg – Kraft Heinz CEO Vows to Simplify Business Ahead of Earnings

2020-01-08 Reuters – Kraft Heinz names Campbell executive to head U.S. business