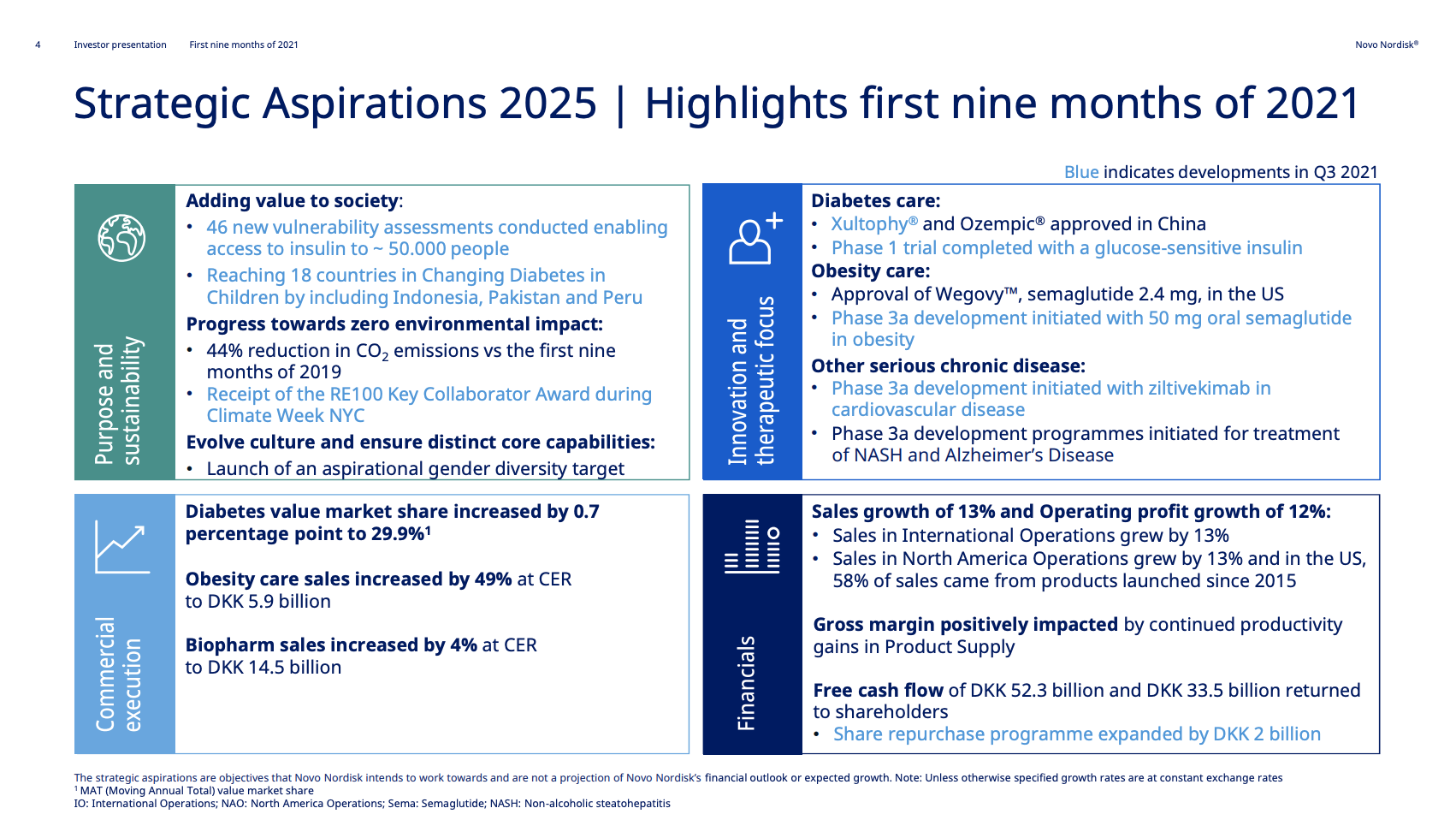

Riding the First Wave: Wegovy® and Zepbound® 🏄

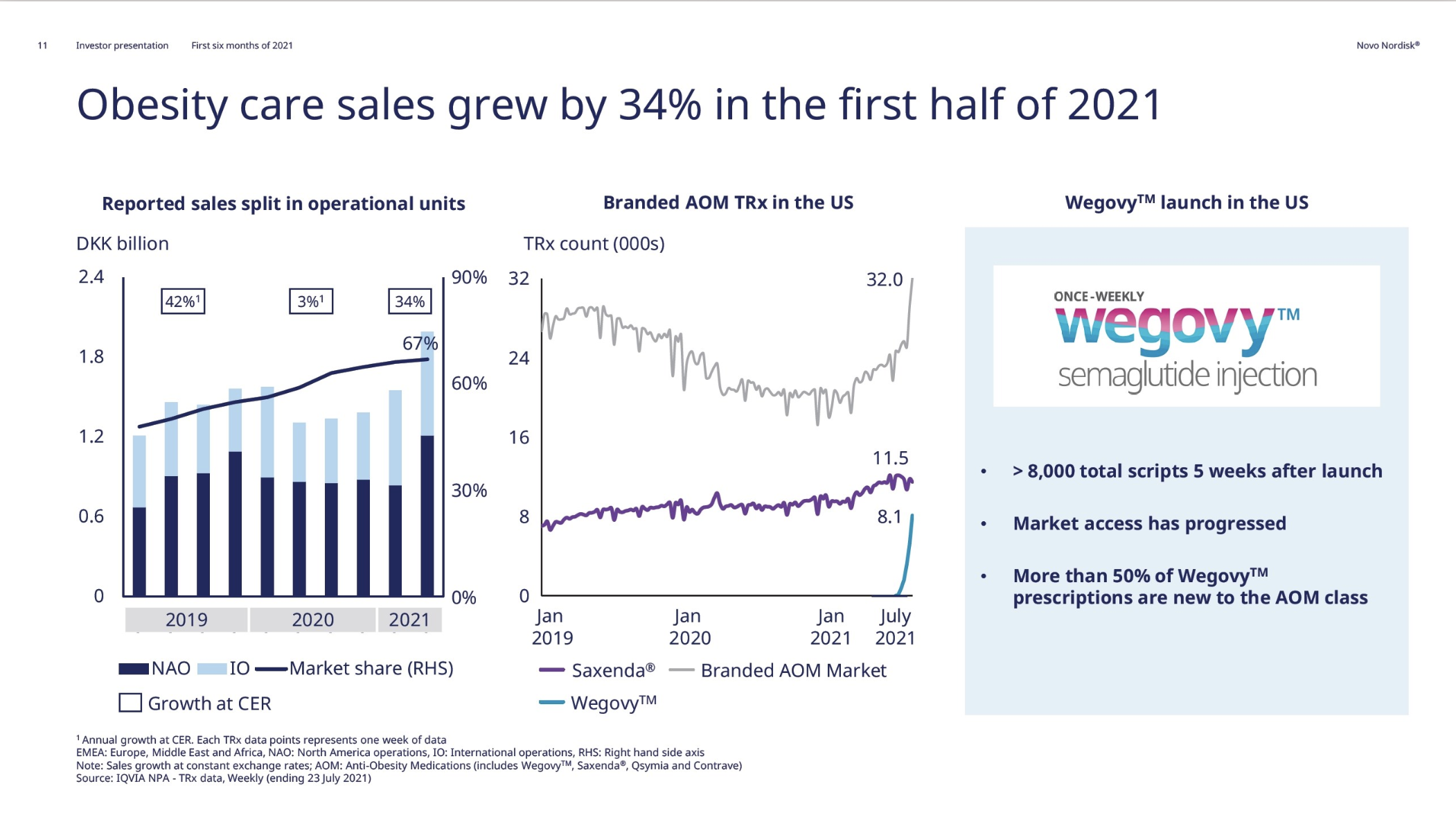

GLP-1 weight loss drugs Wegovy® (semaglutide) and Zepbound® (tirzepatide) from Novo Nordisk and Eli Lilly hit markets like a tsunami, when they were approved in June 2021 and November 2023, due to their unprecedented weight-loss efficacy 🌊 The next waves might not be as colossal, but they still hold potential for investors navigating these waters.

Riding the Wave: Recent Developments

December 2024 brought two consecutive waves of news for investors. First, Eli Lilly unveiled phase 3b SURMOUNT-5 trial results for Zepbound® (tirzepatide), showing a 20.2% superior weight loss (72 weeks, 15 mg, n=741, baseline obese) – well above 13.7% for Wegovy®. Soon after, Novo Nordisk released data from its phase 3 REDEFINE-1 trial for CagriSema (cagrilintide + semaglutide). While the reported 20.4% weight loss (68 weeks, 2.4 mg, n=3,417, baseline 106.9 kg) was strong, it fell short of the anticipated 25%, fueling disappointment and contributing to a ~20% stock price drop.

Taken back-to-back, these developments underscored how quickly sentiment can shift in the fiercely competitive GLP-1 landscape – and just how high investor expectations have become.

Product Portfolios: A GLP-1 Tidal Shift

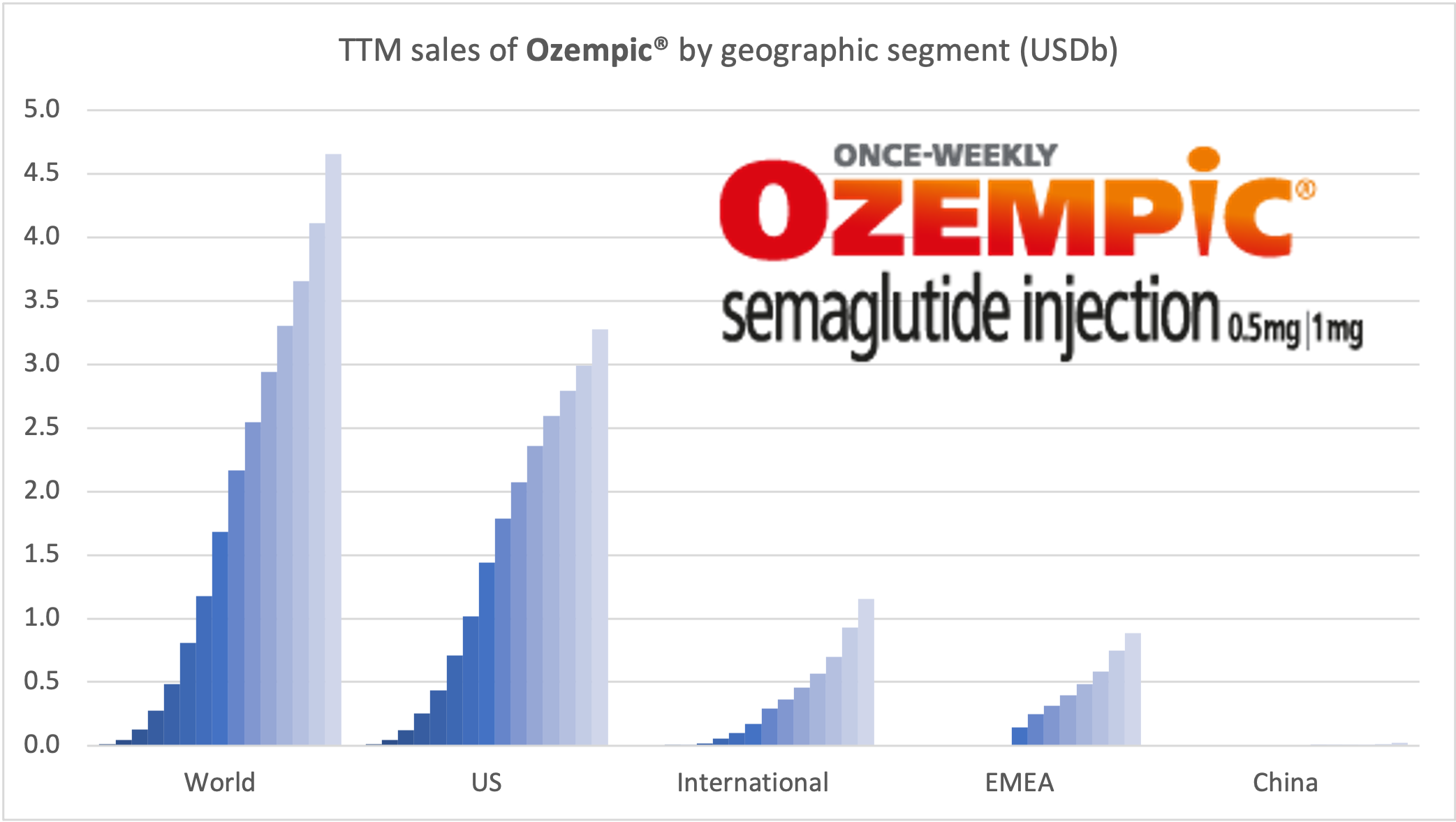

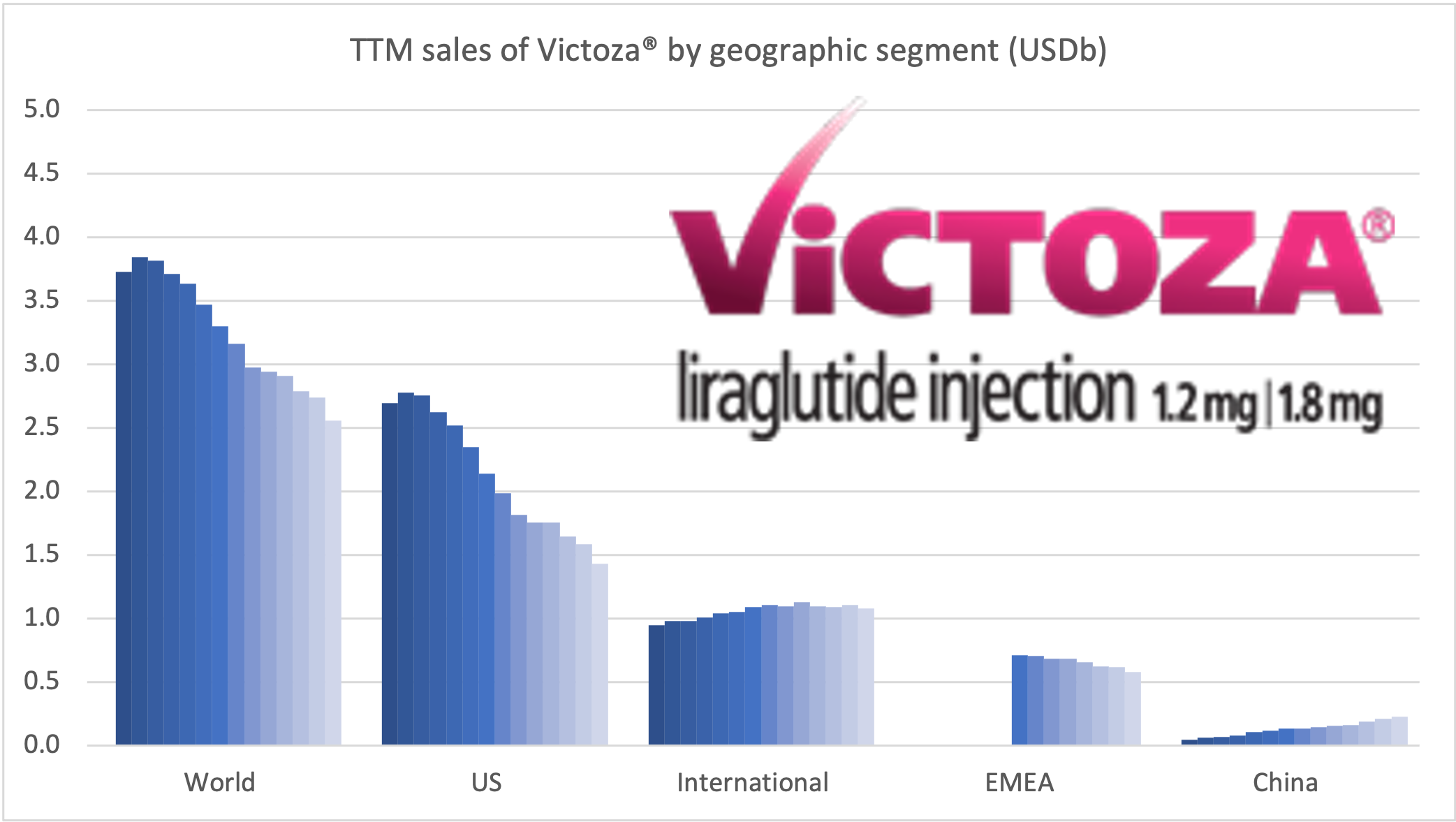

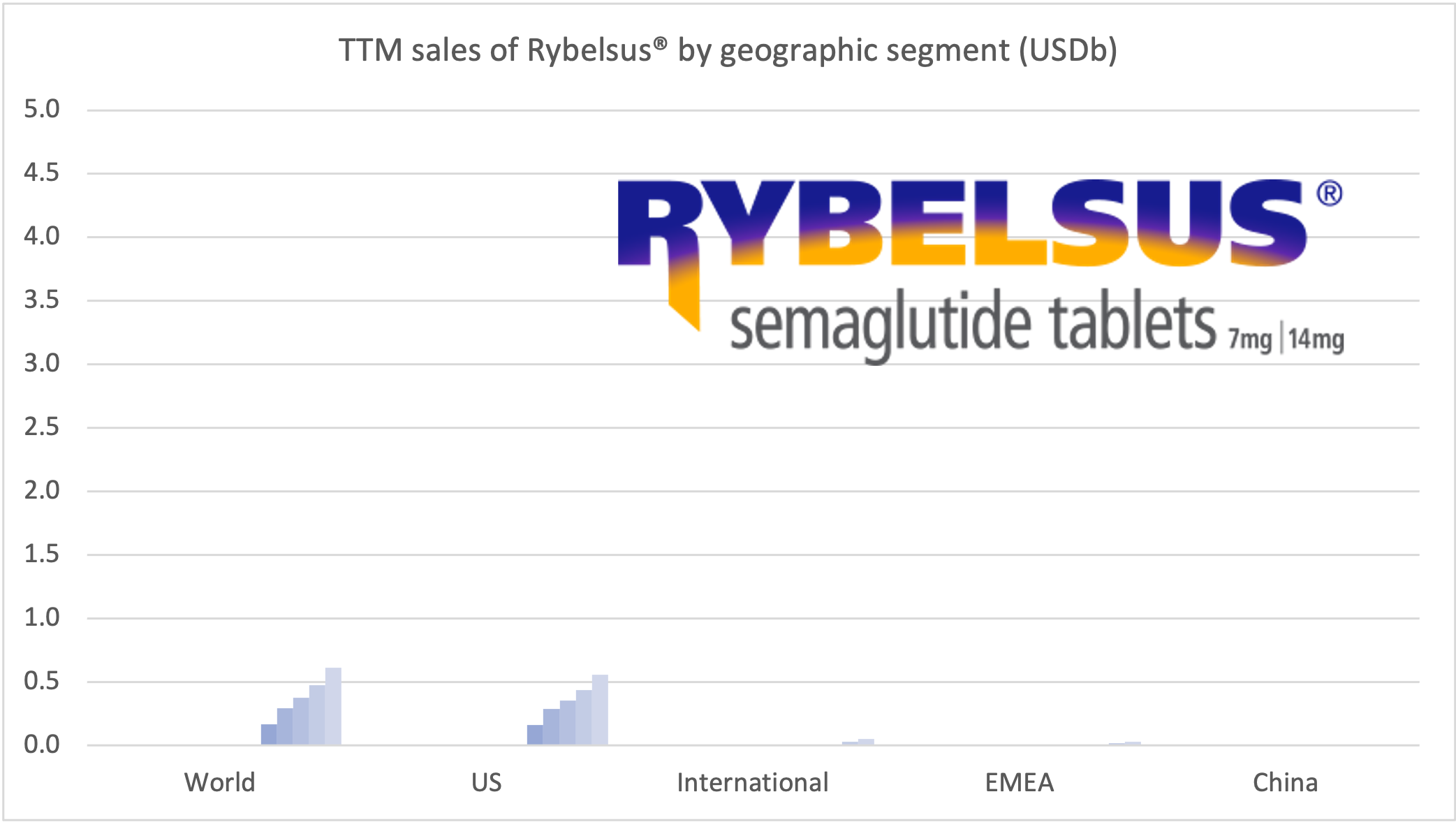

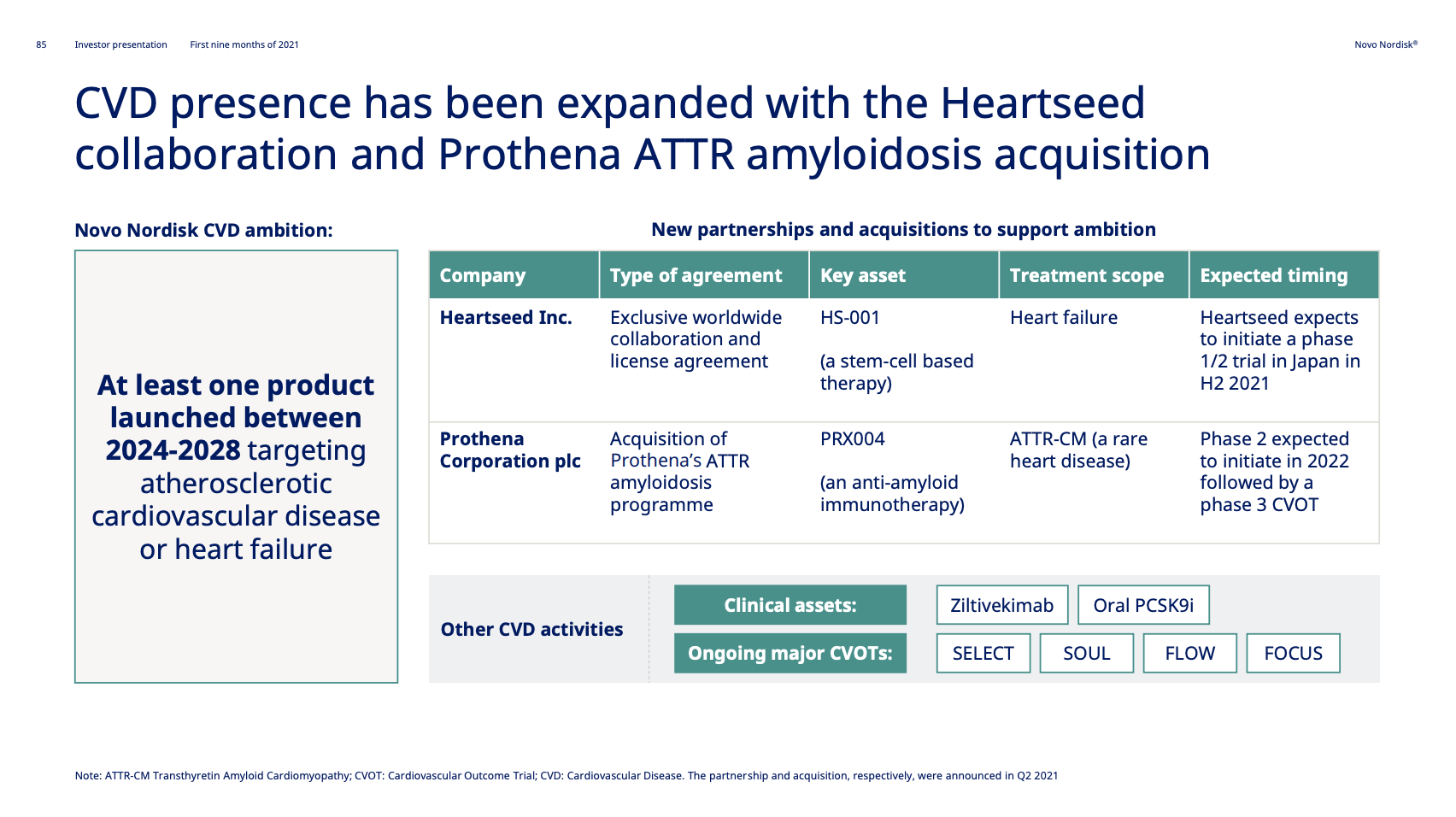

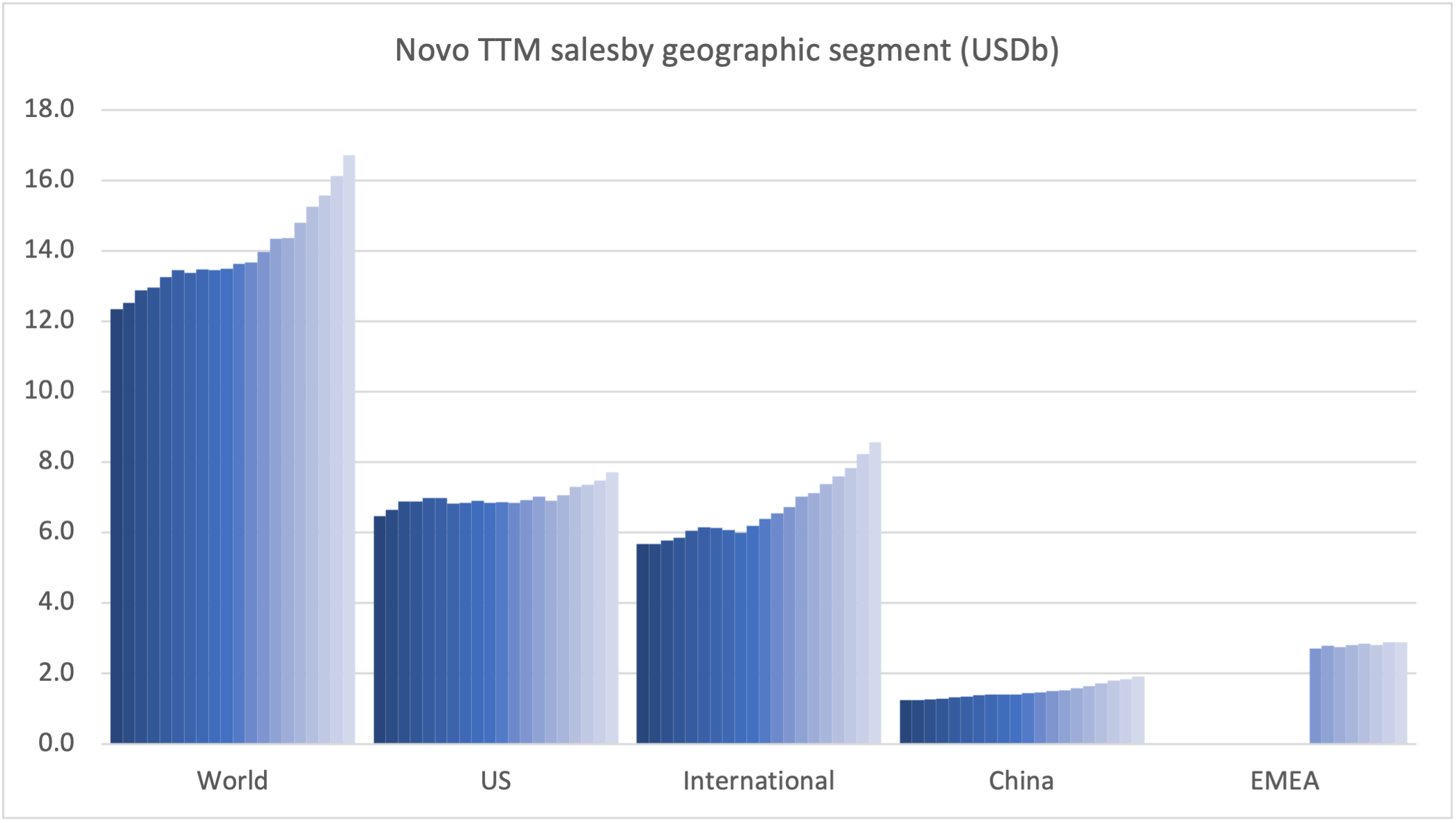

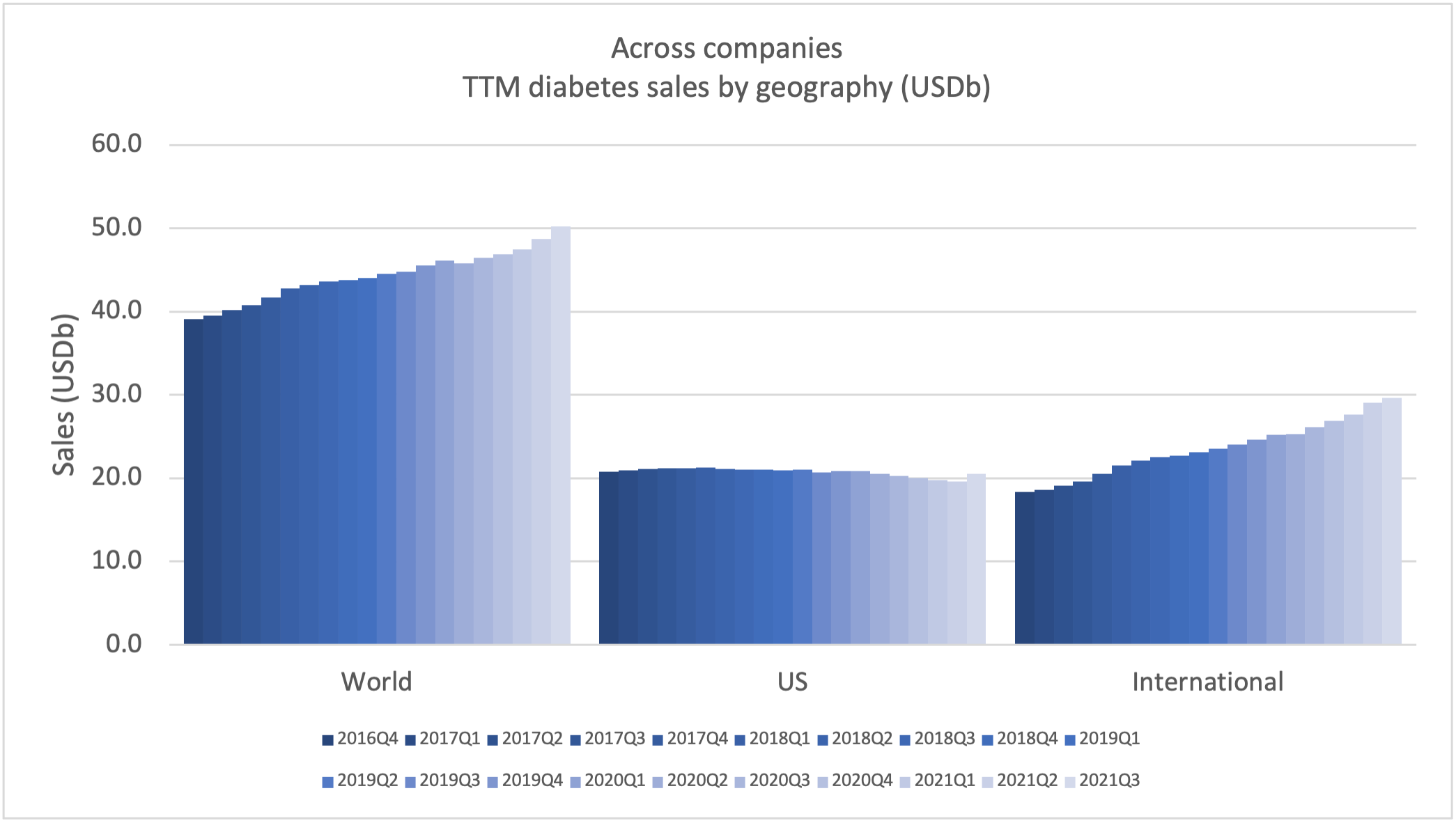

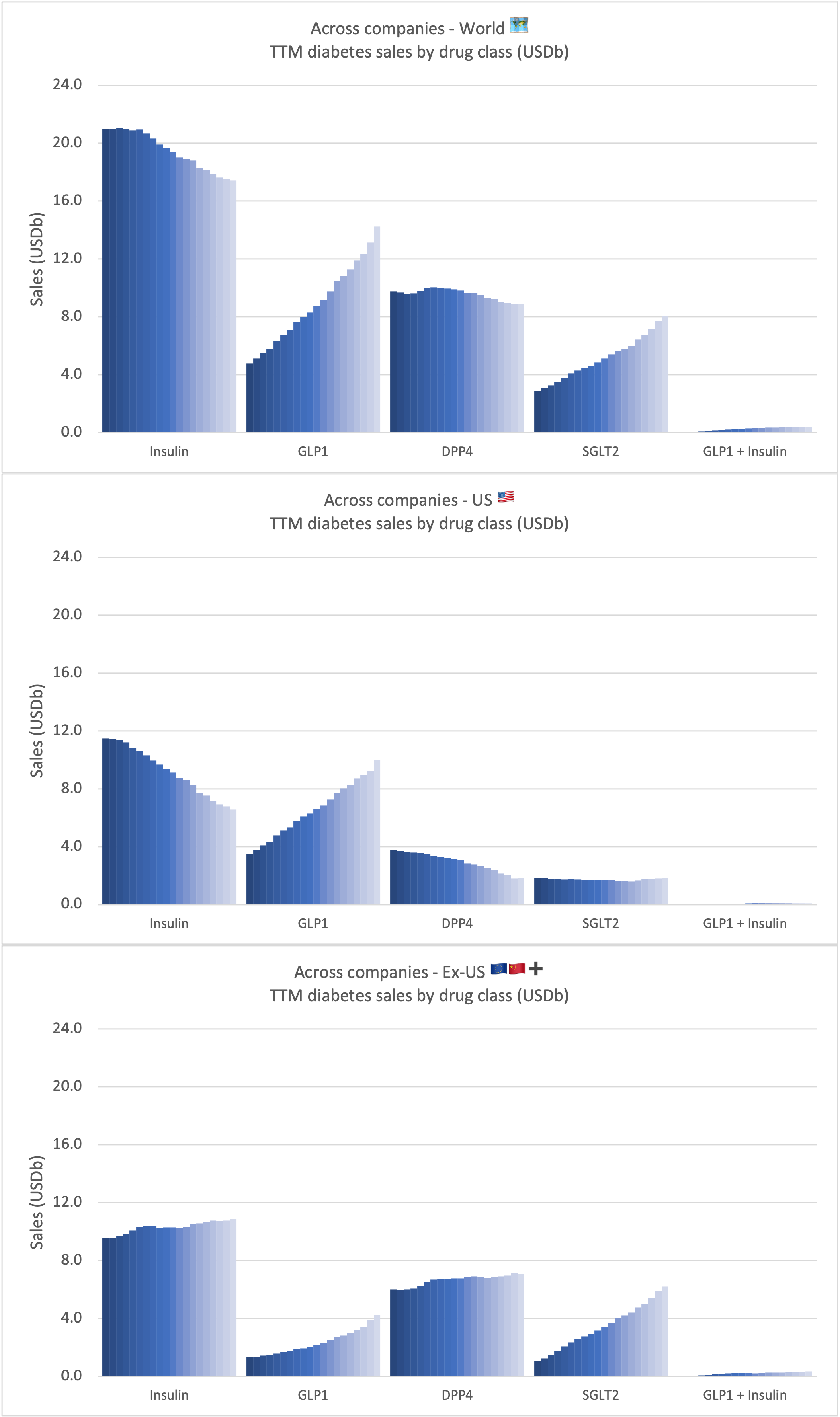

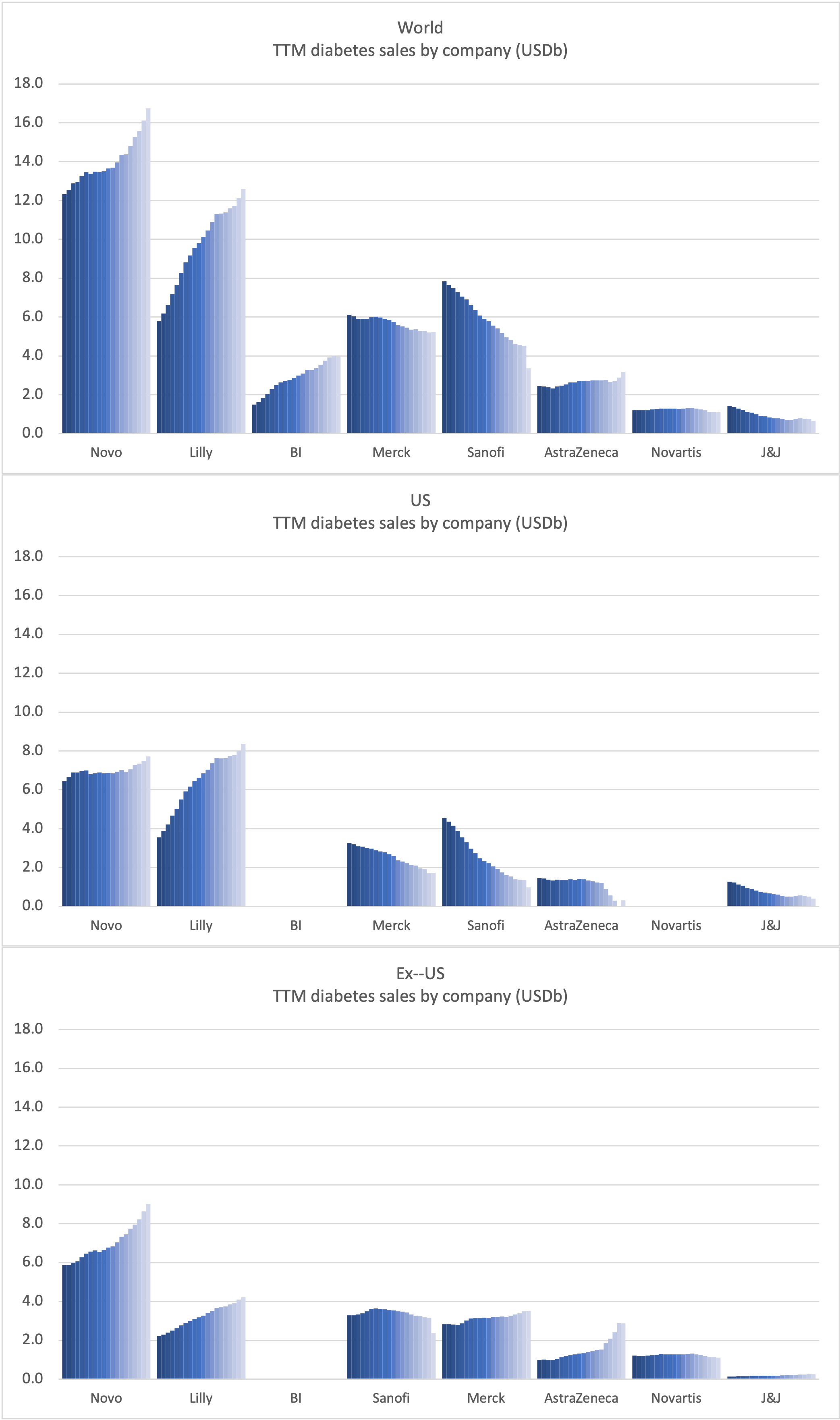

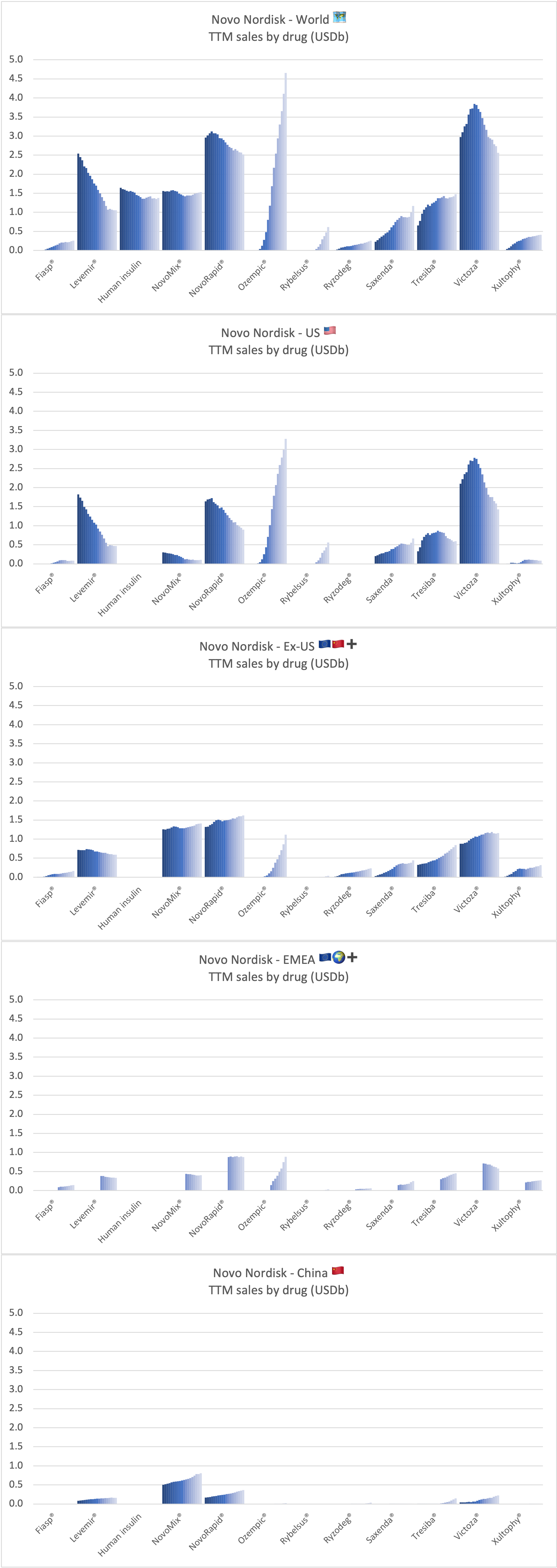

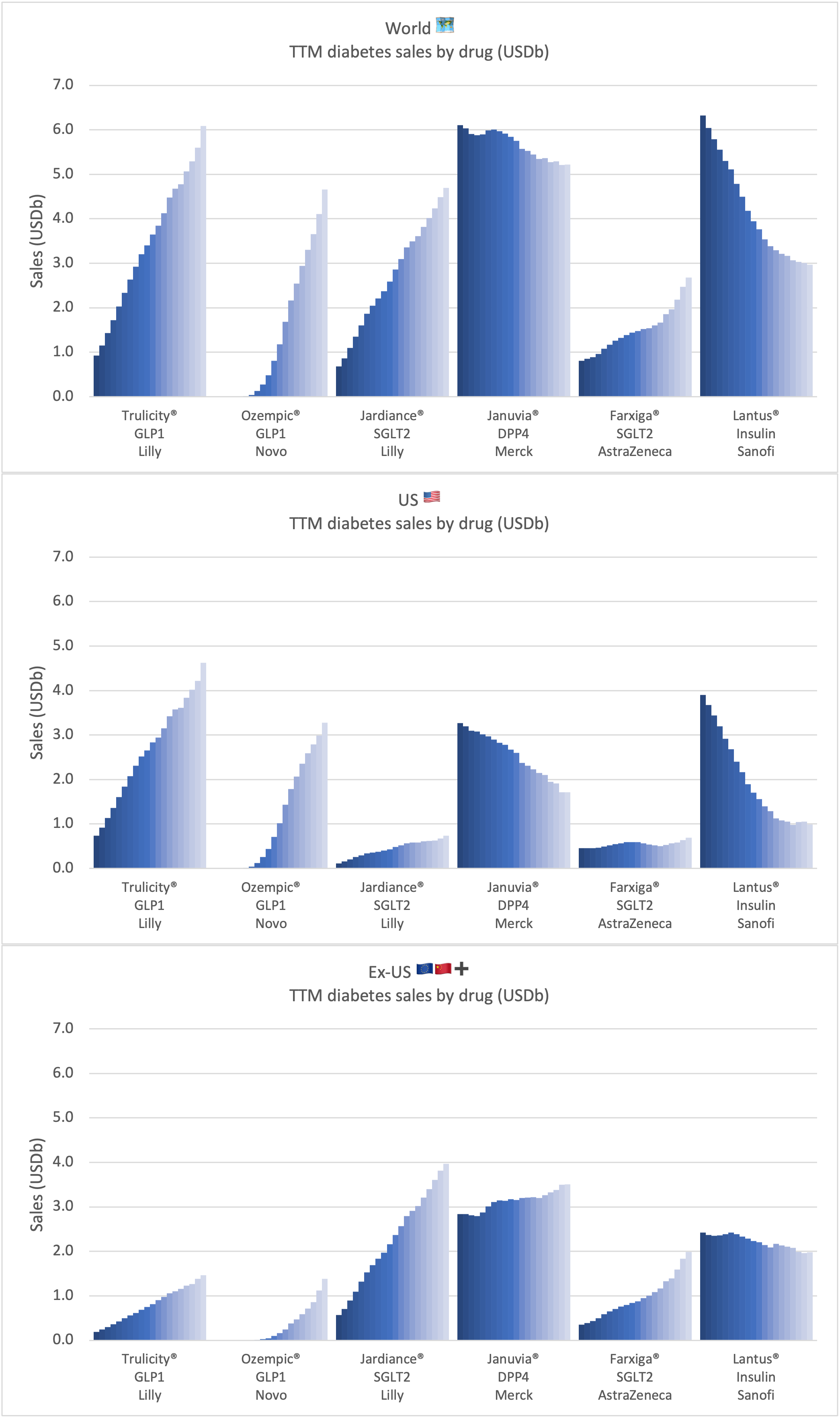

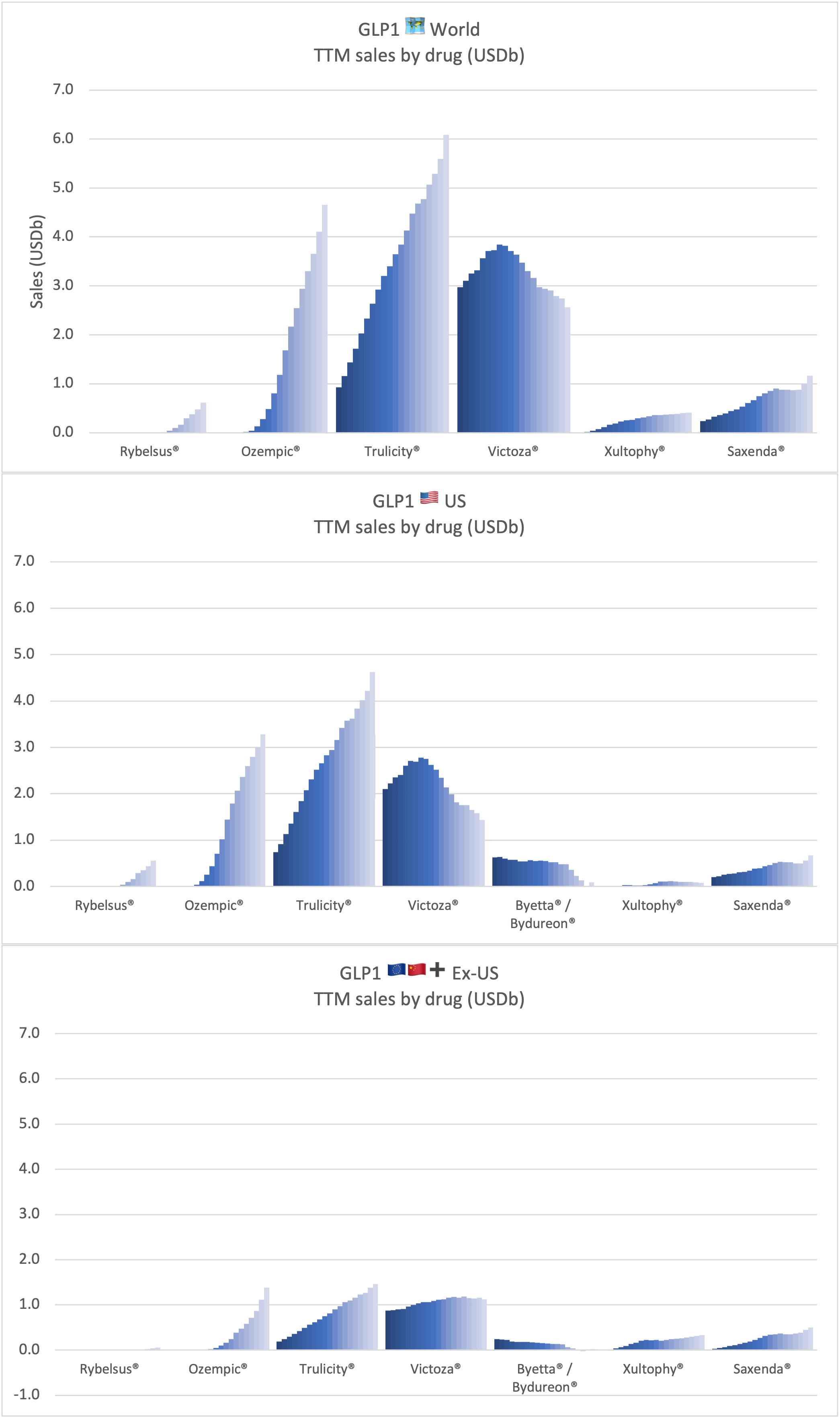

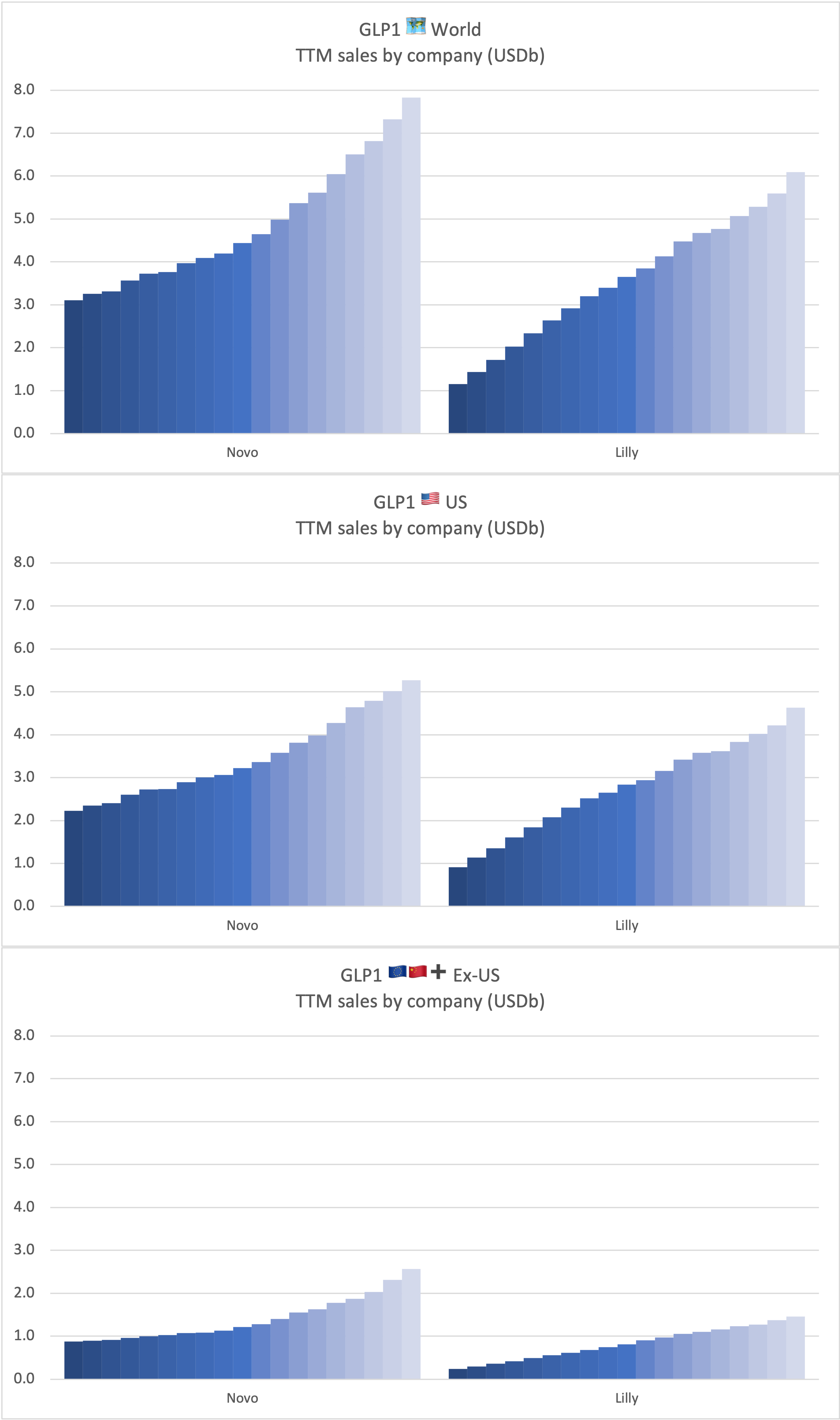

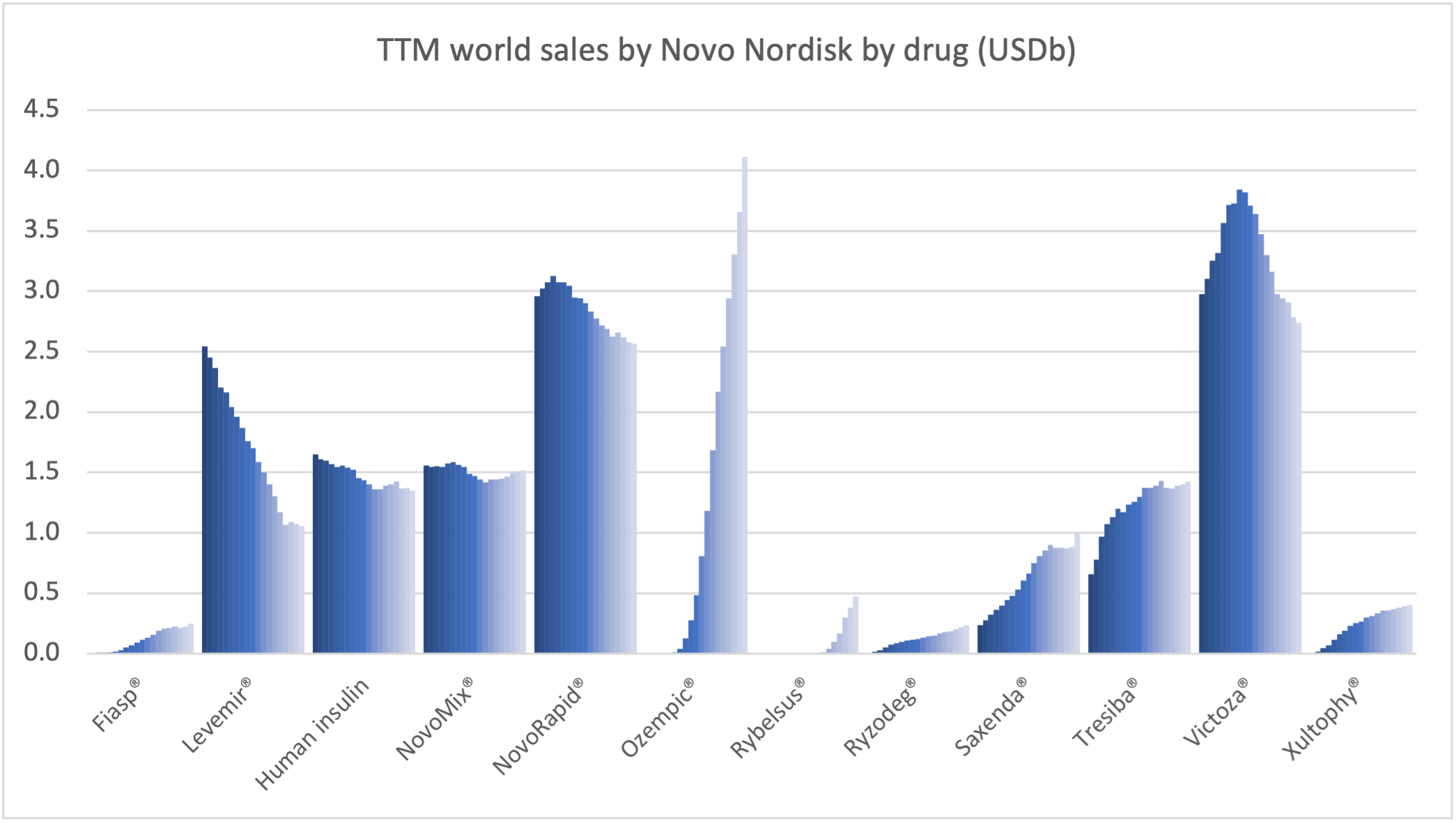

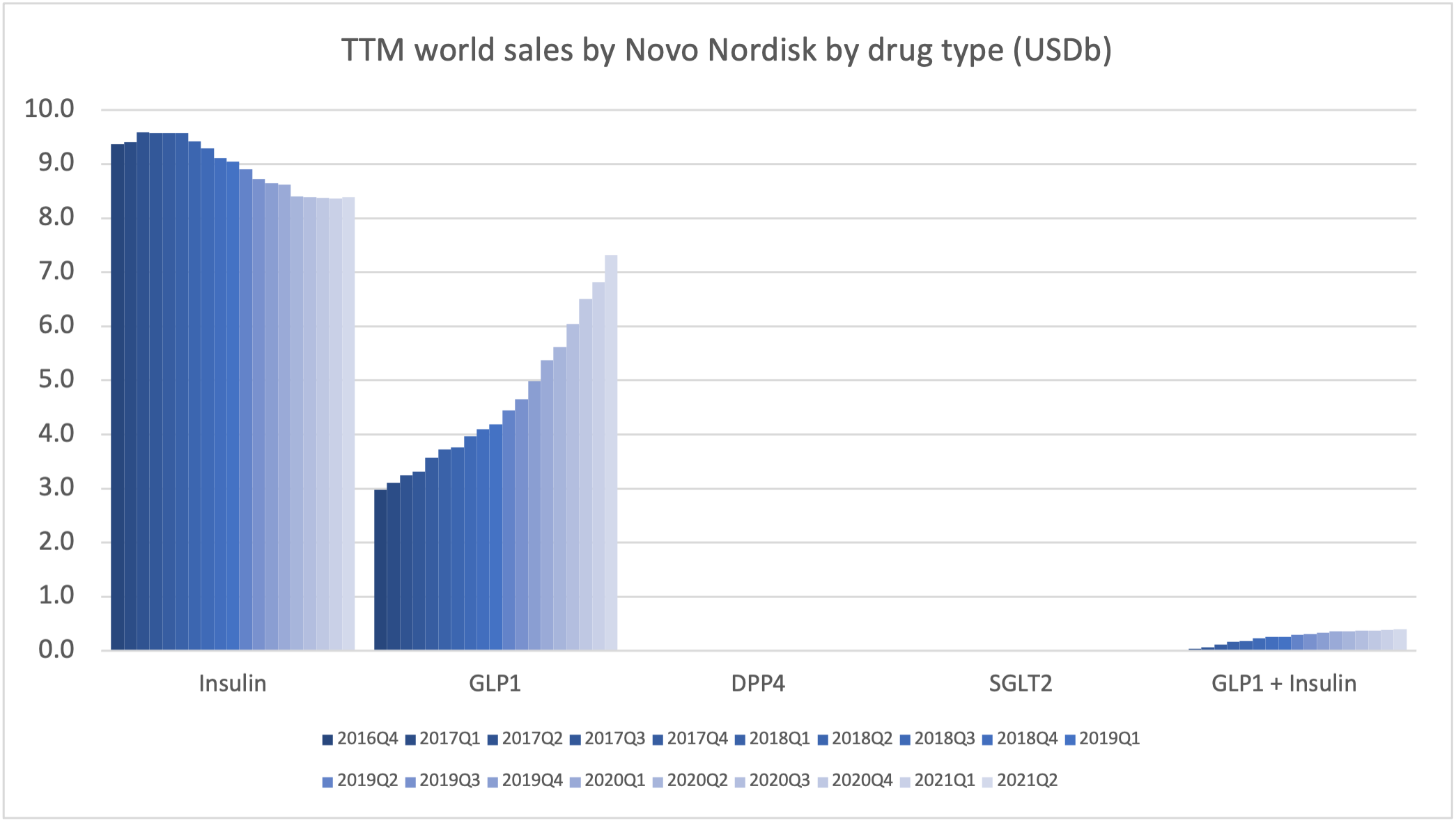

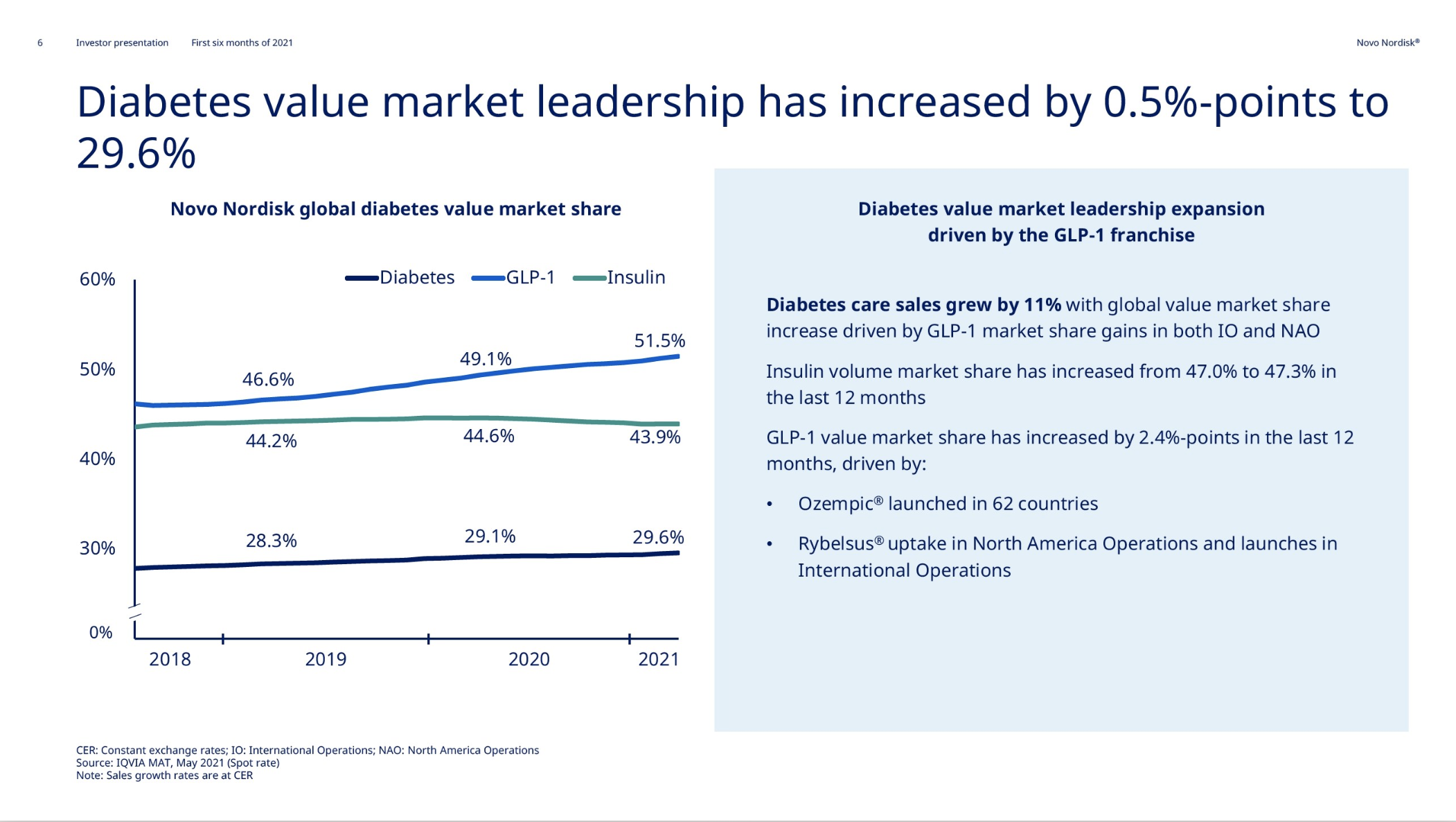

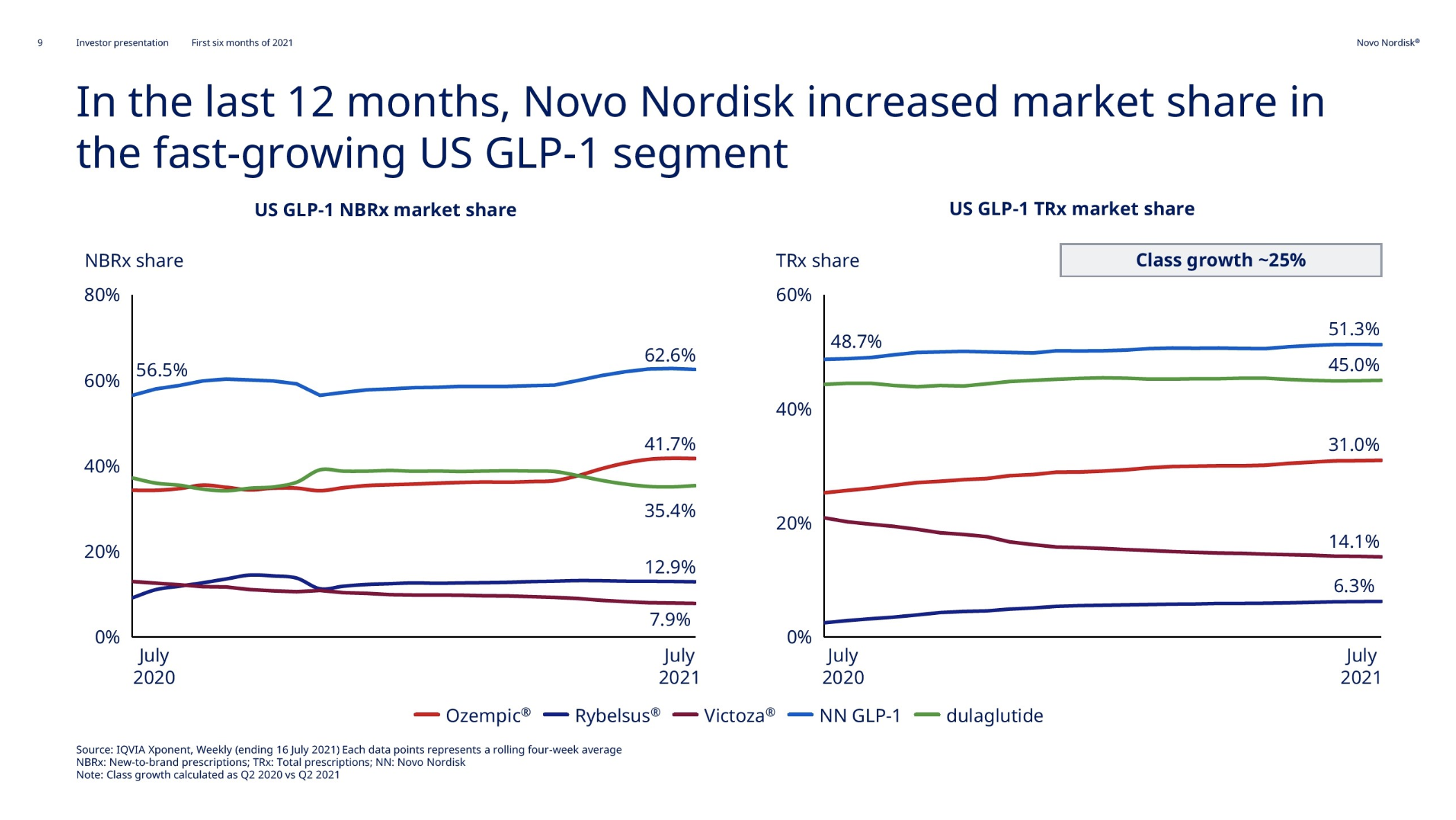

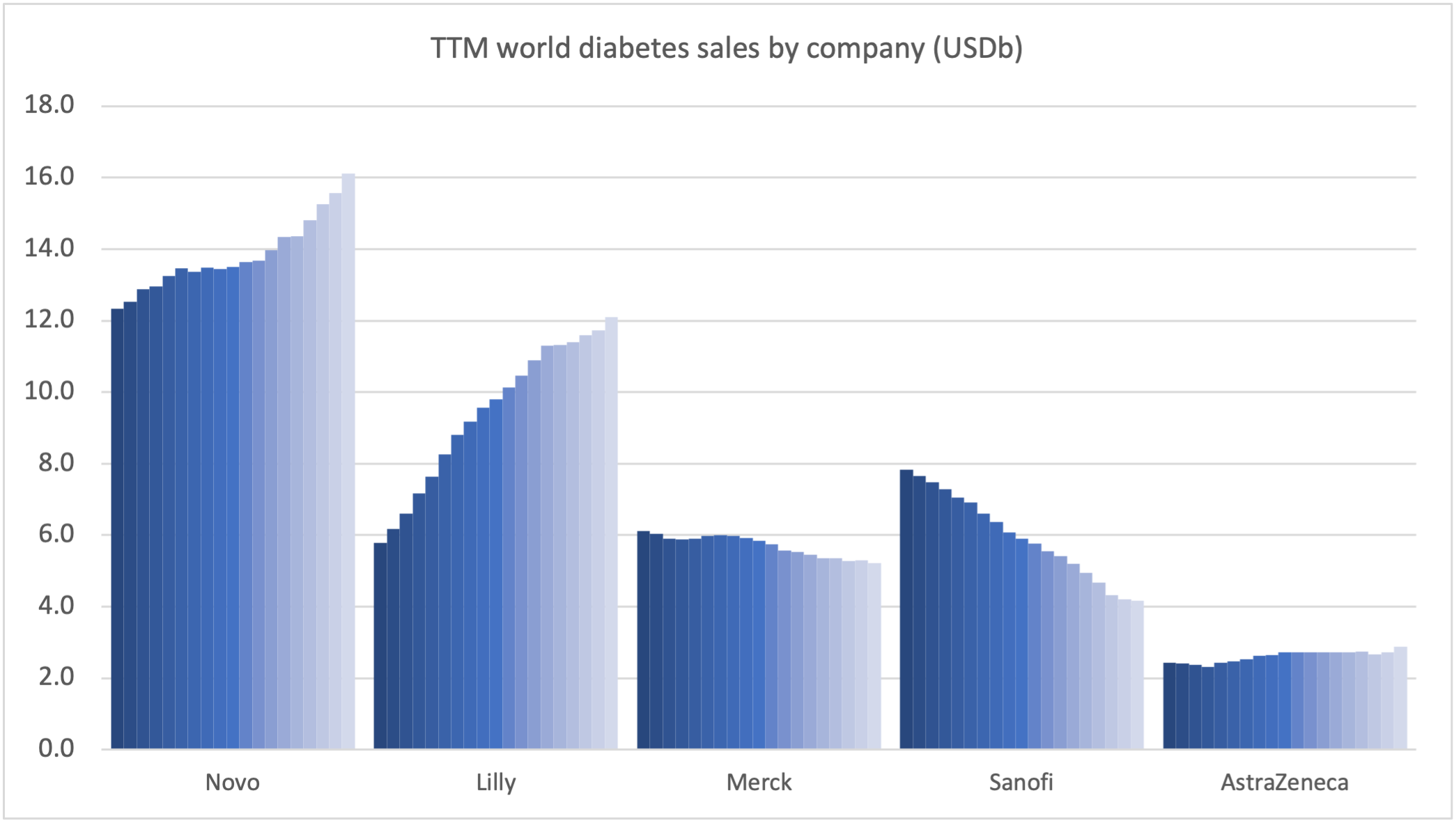

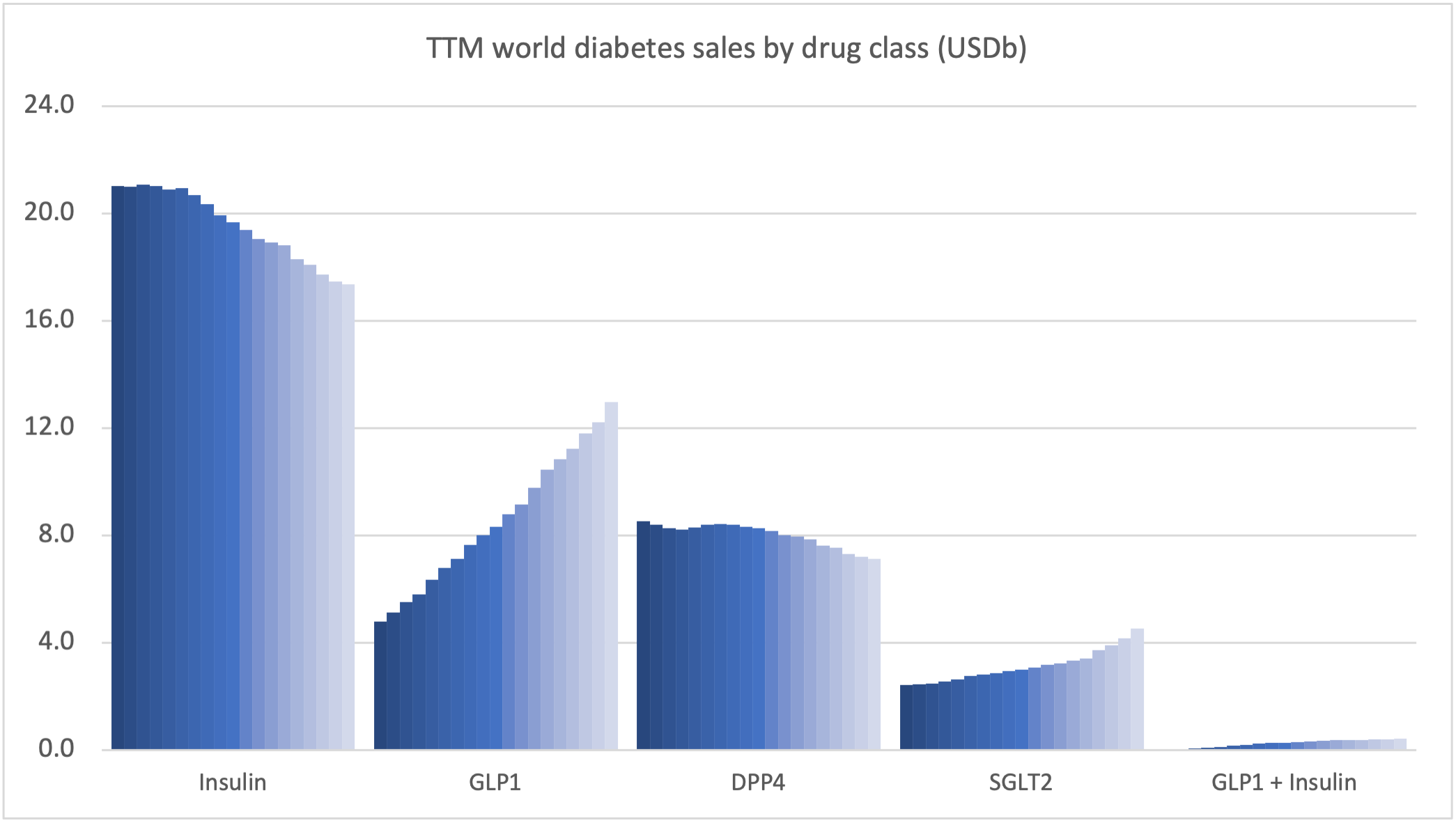

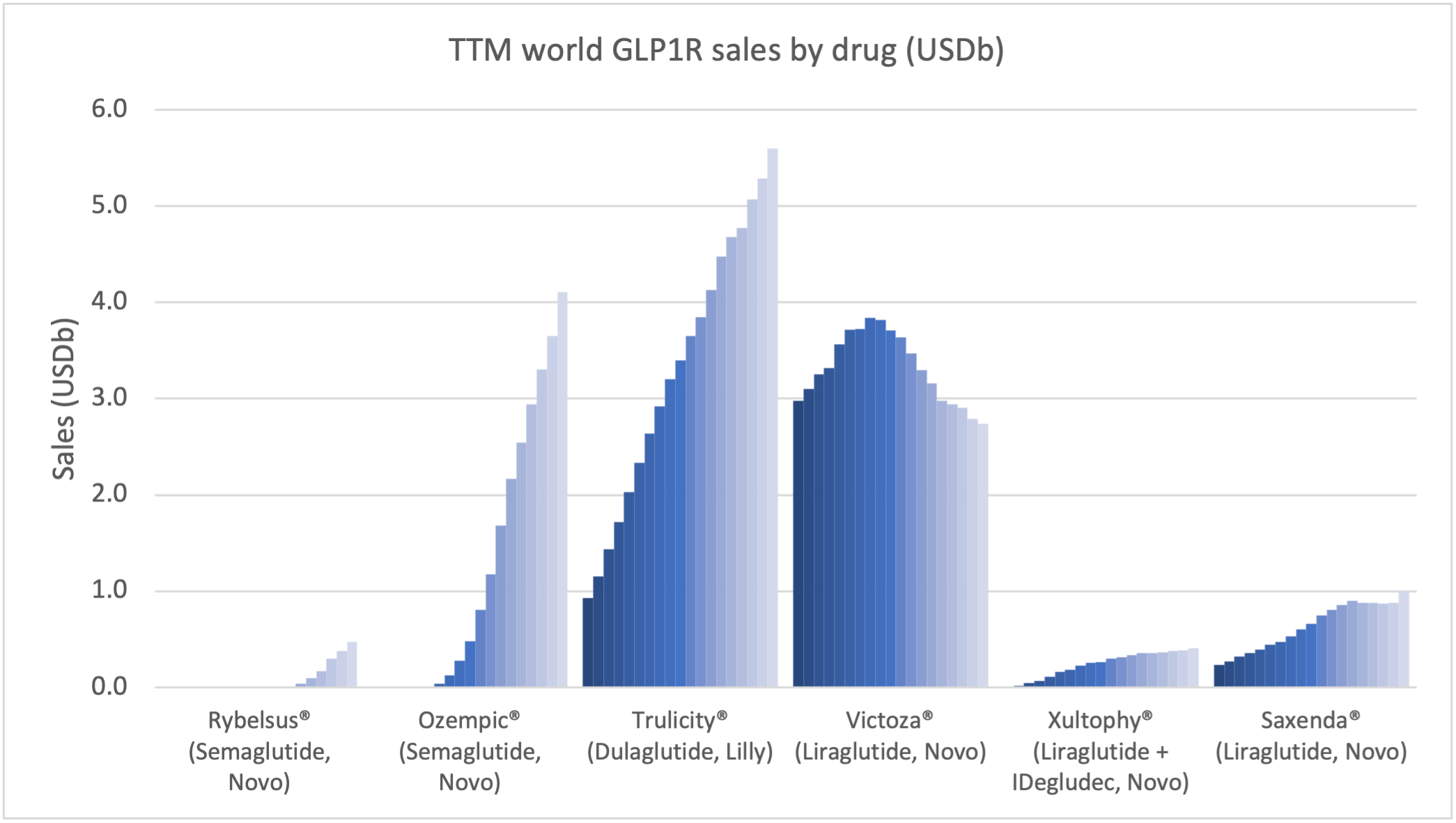

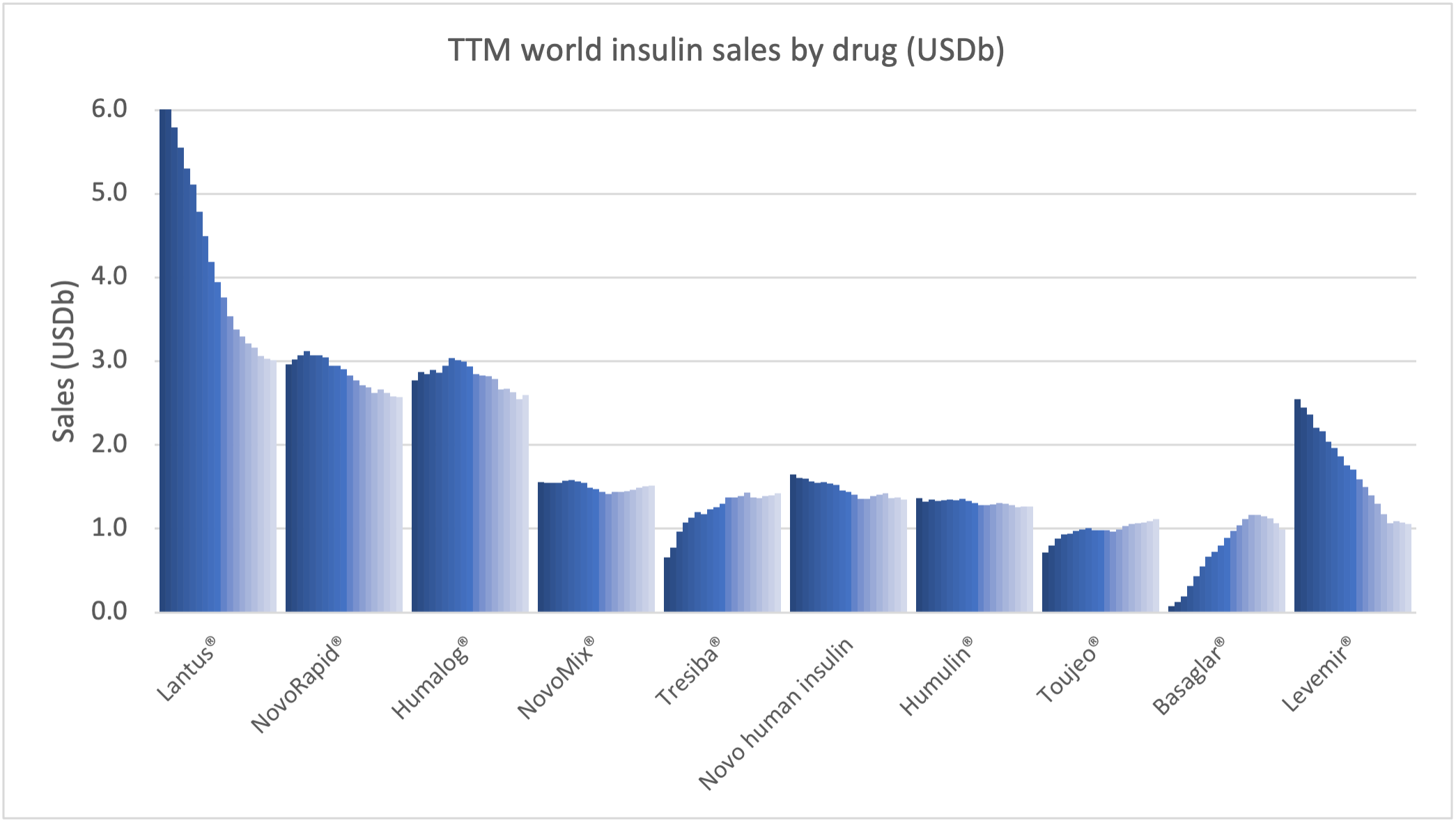

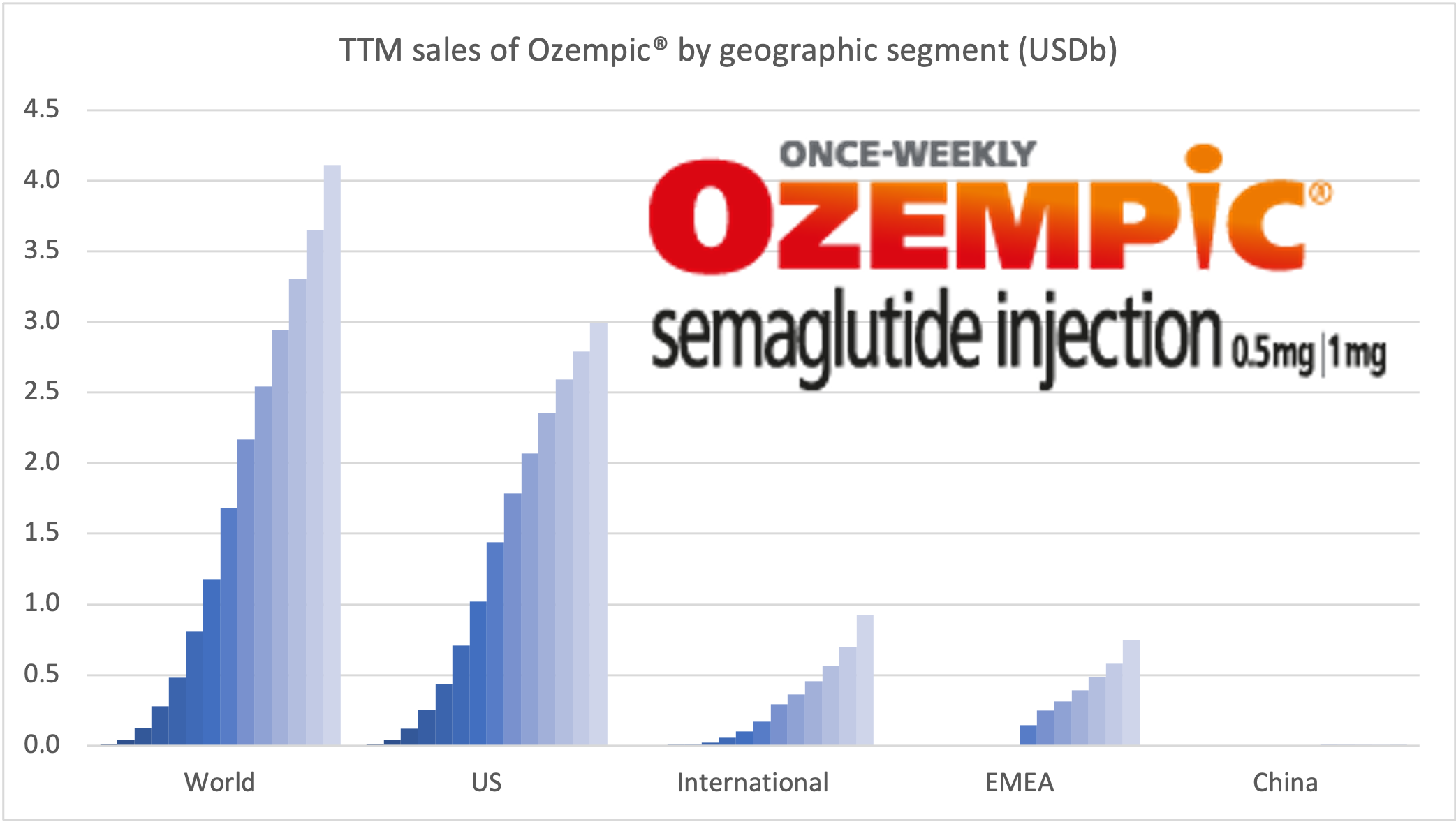

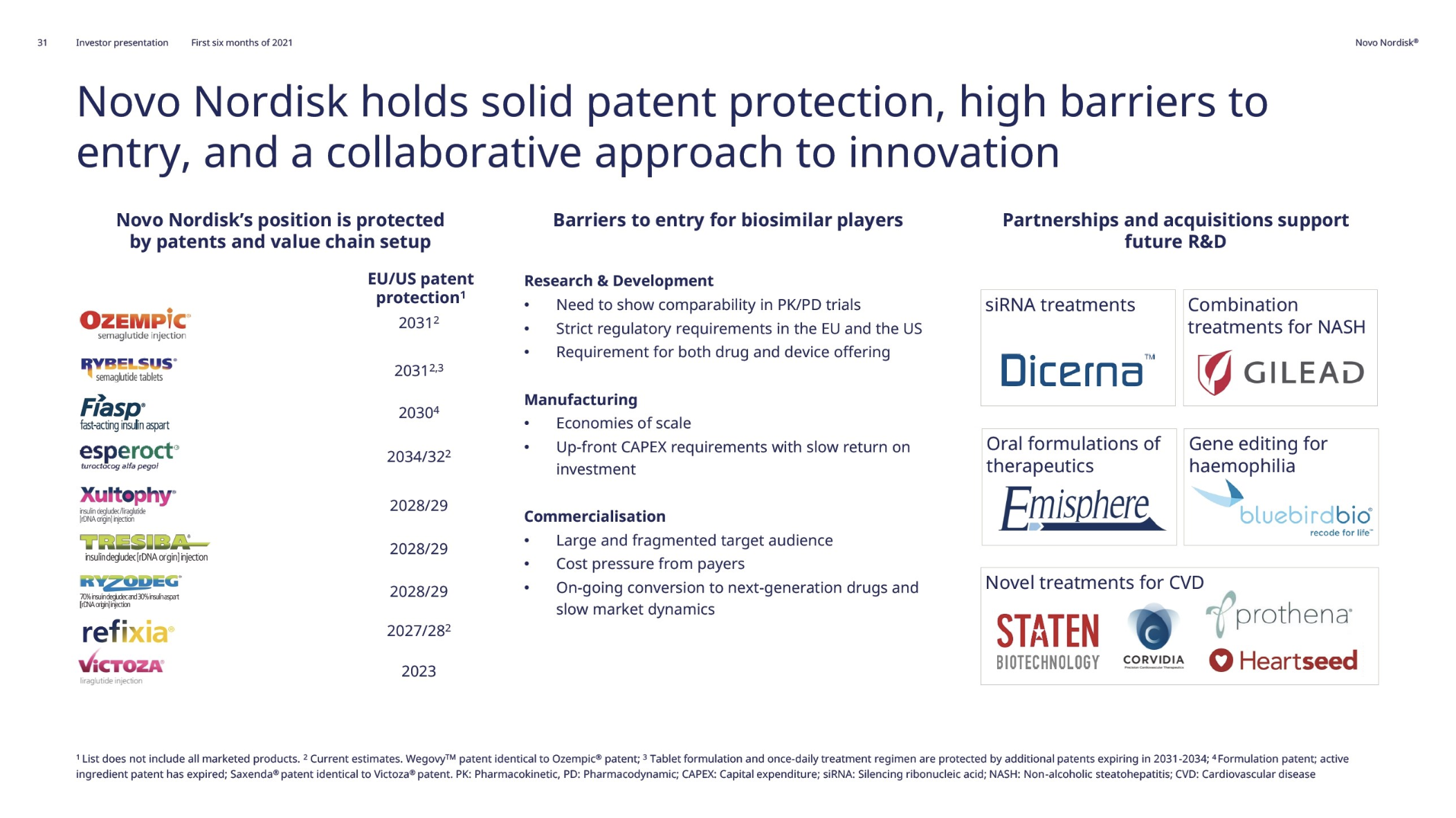

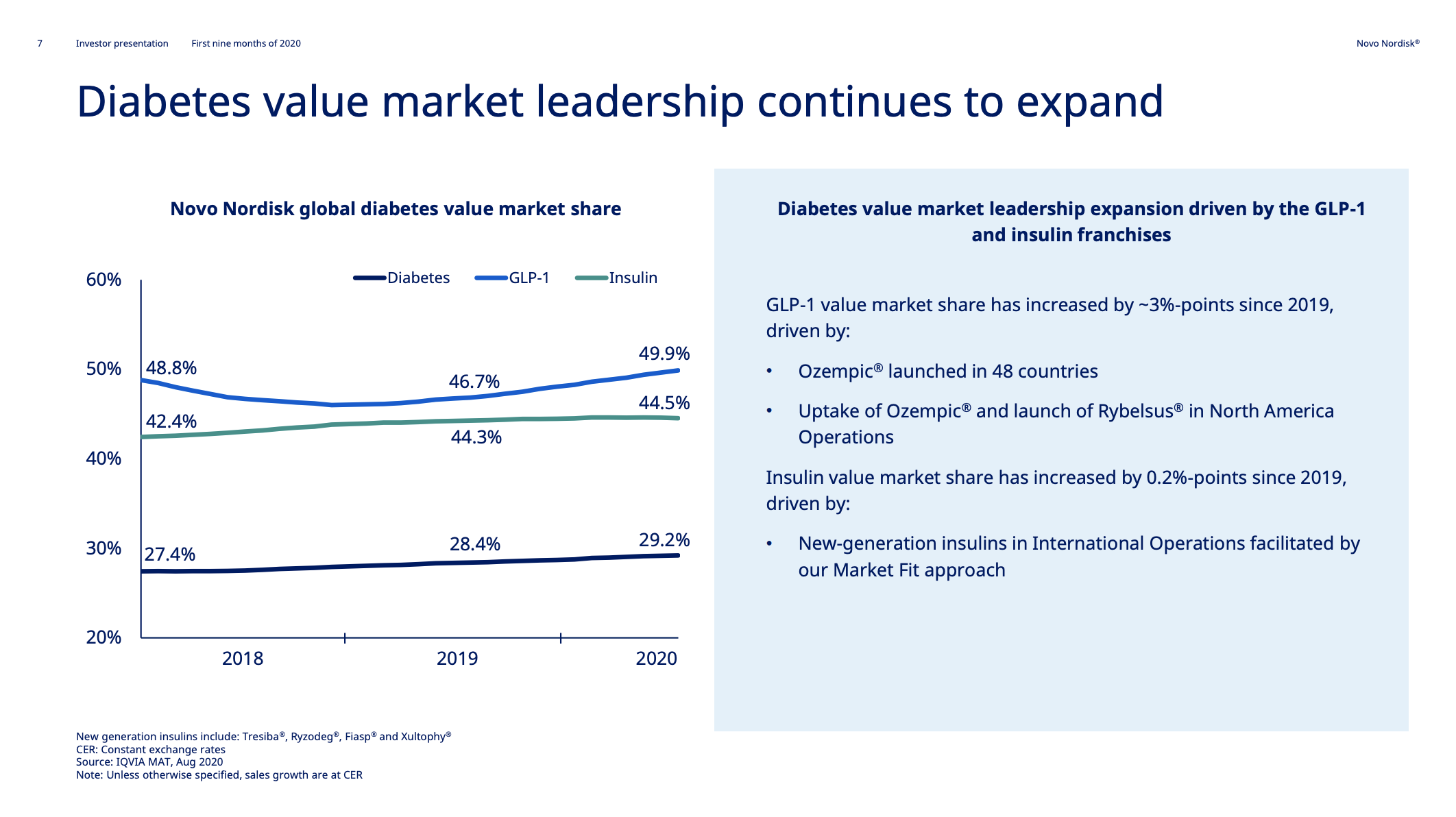

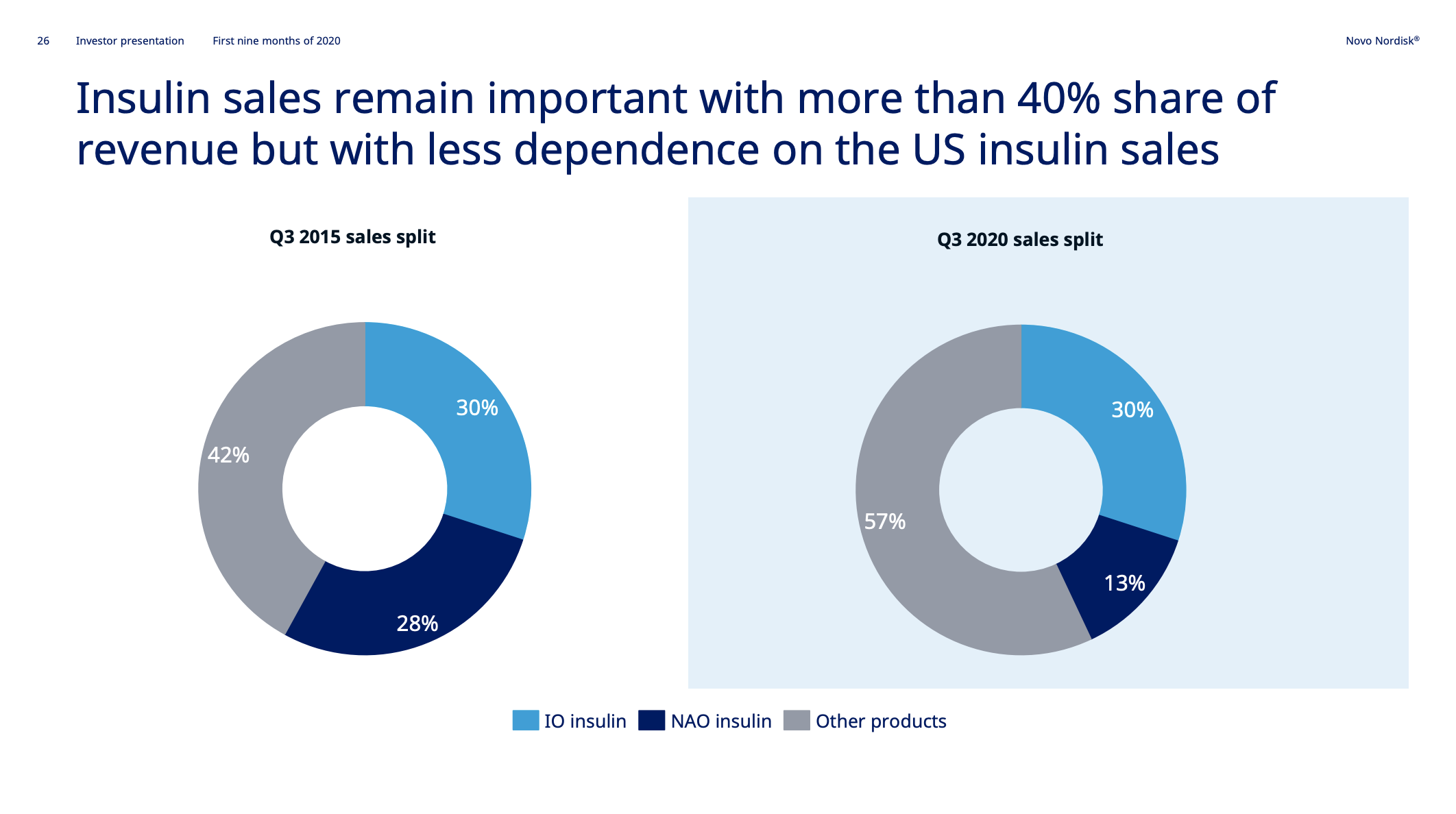

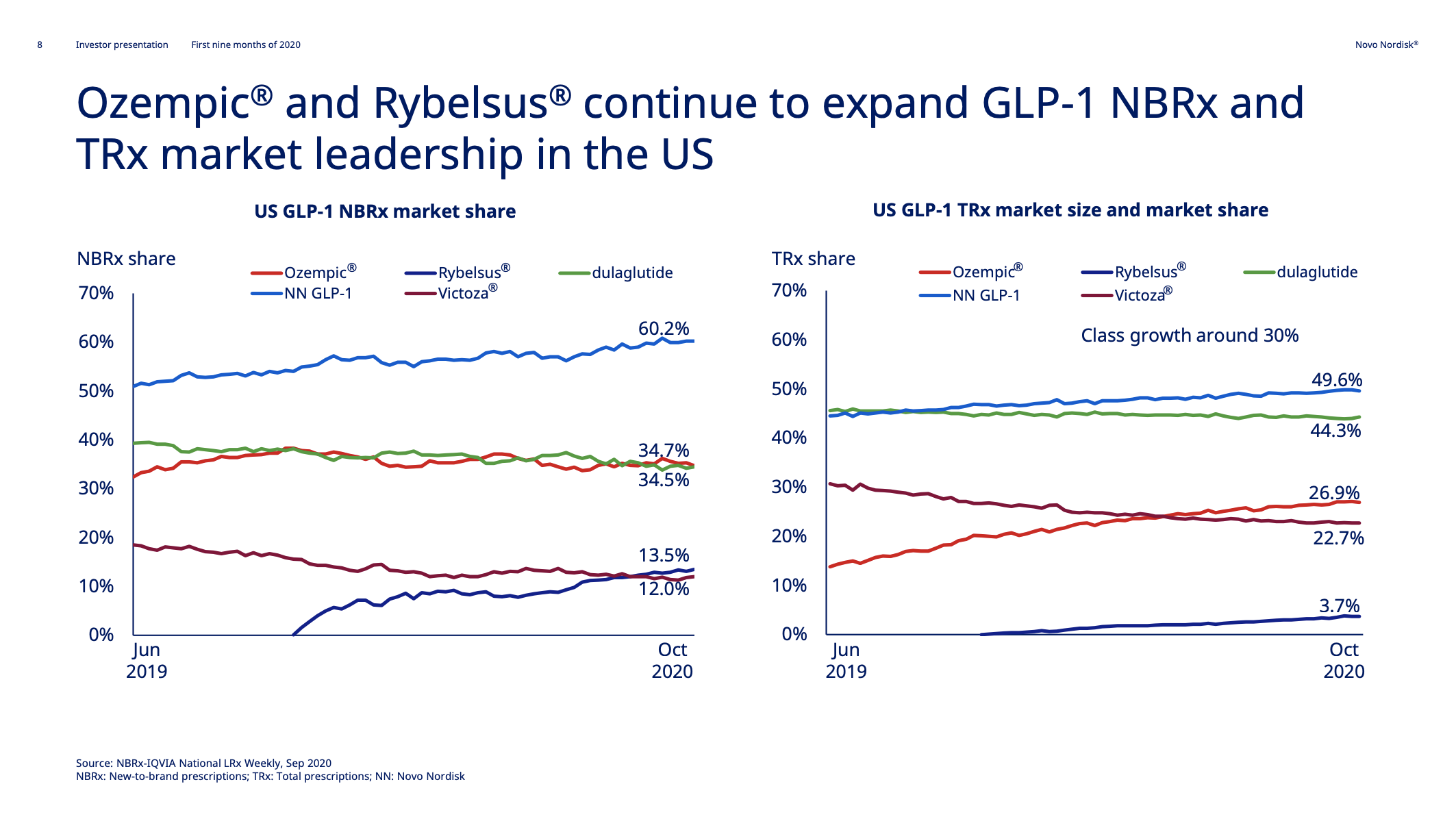

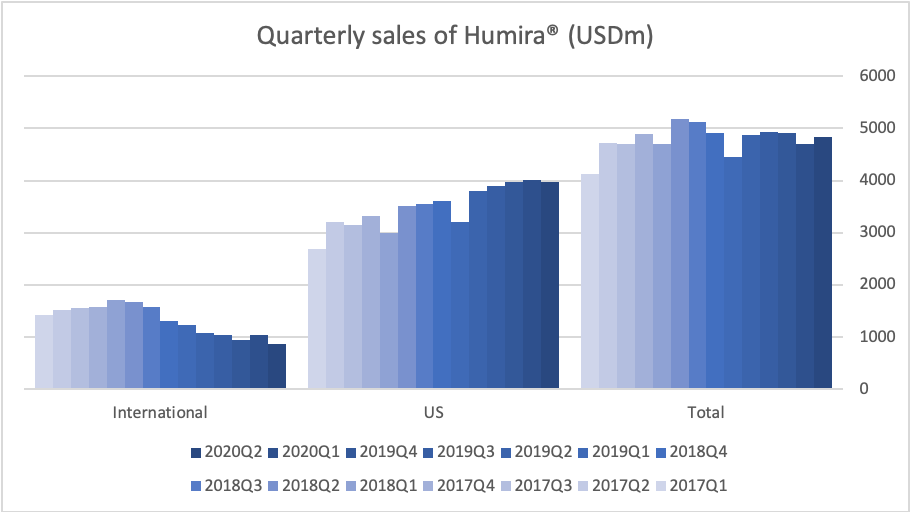

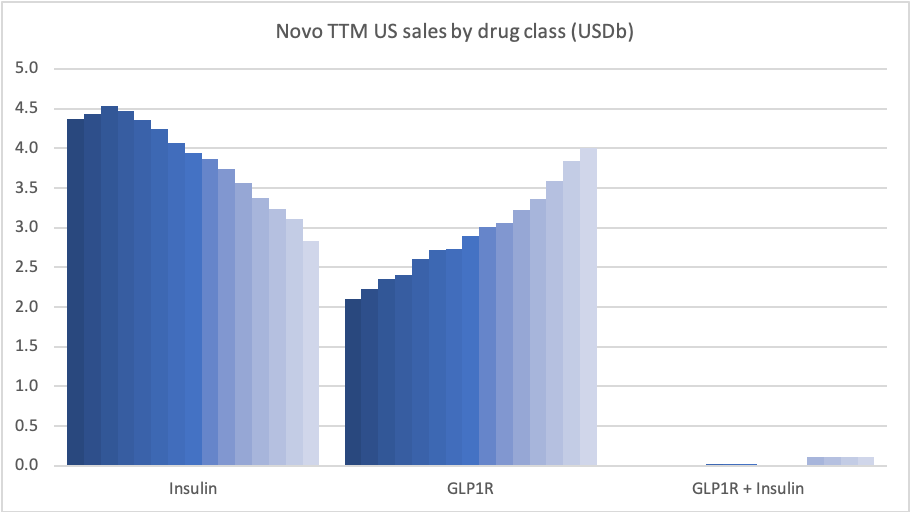

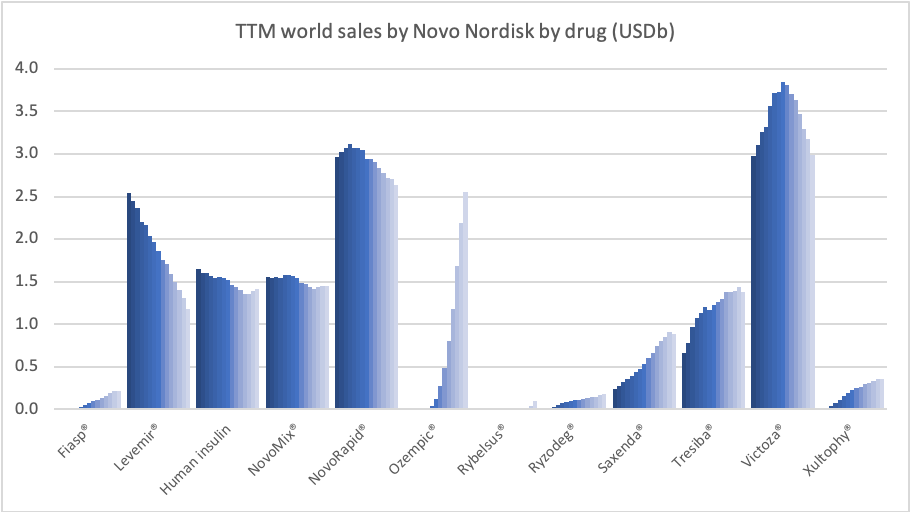

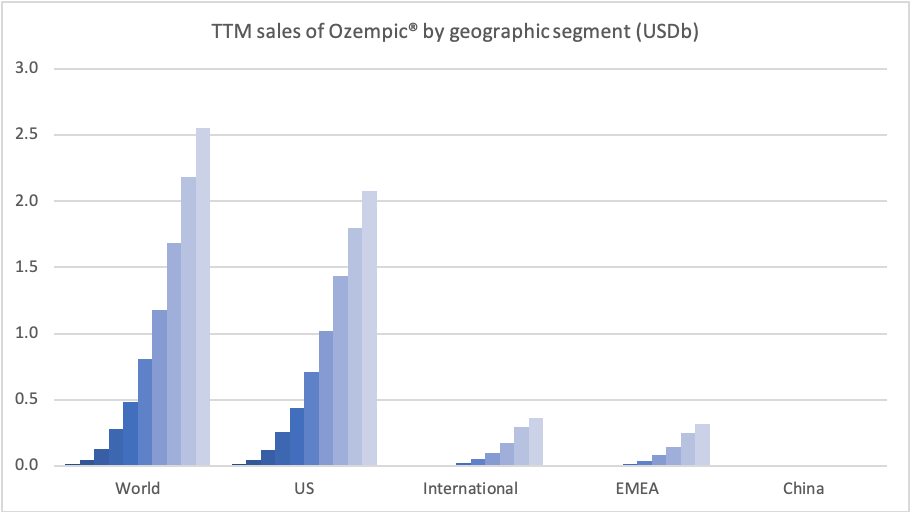

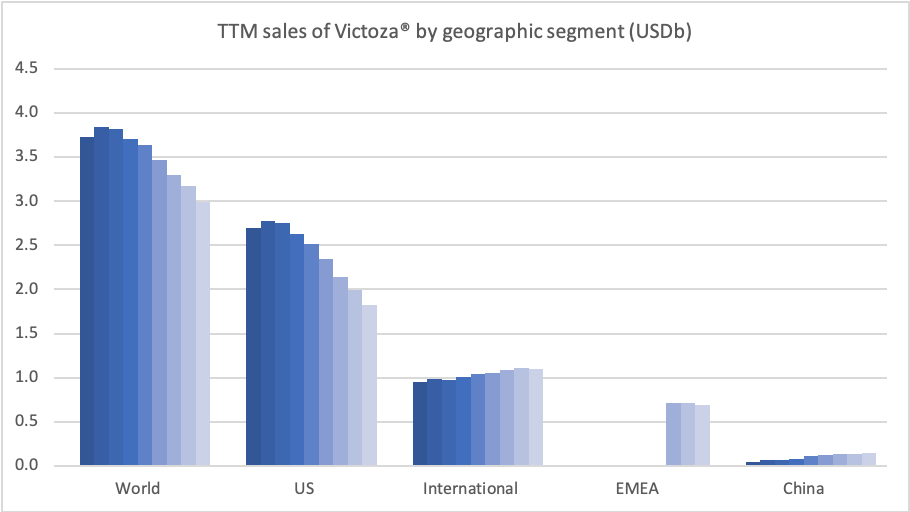

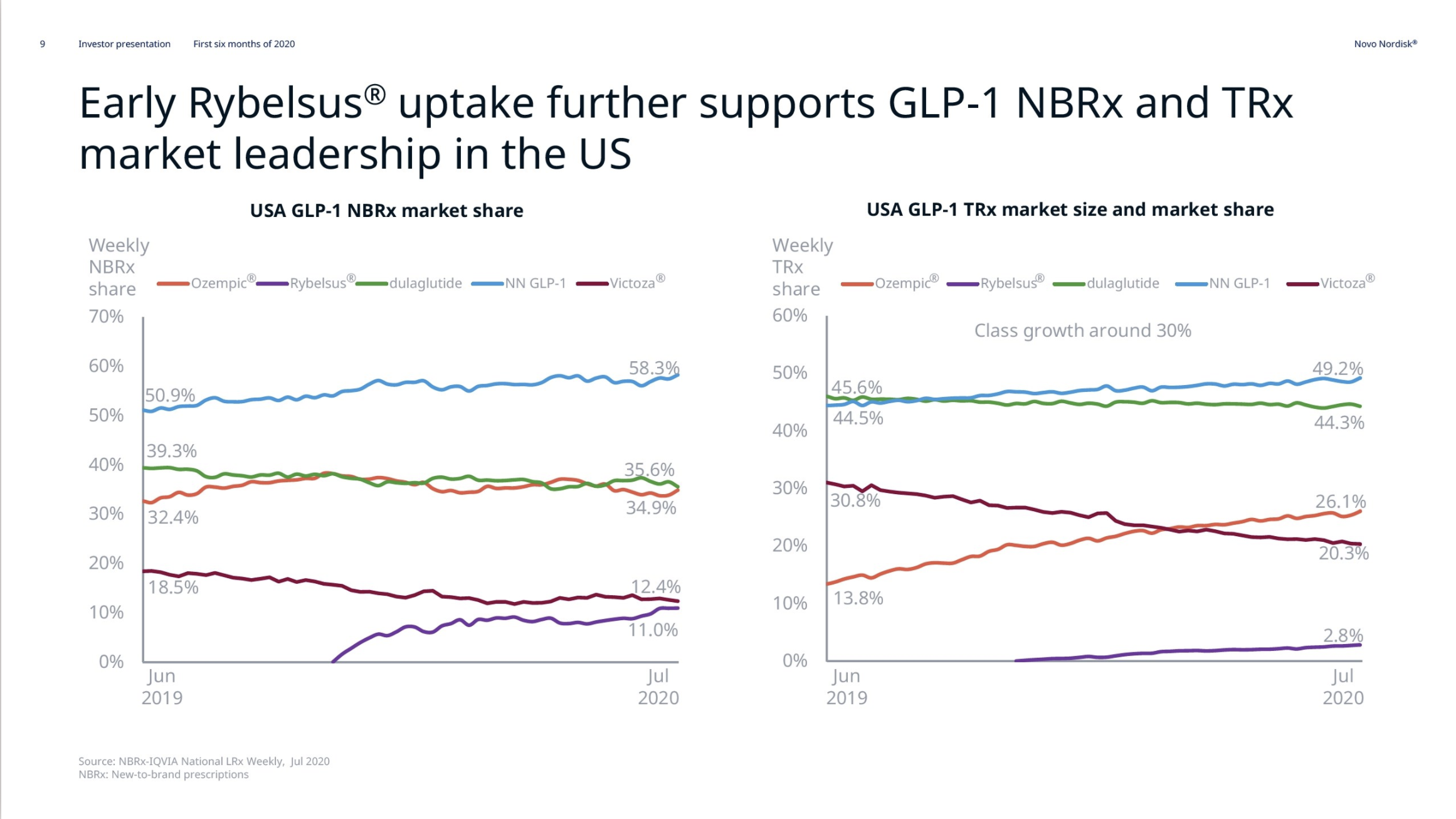

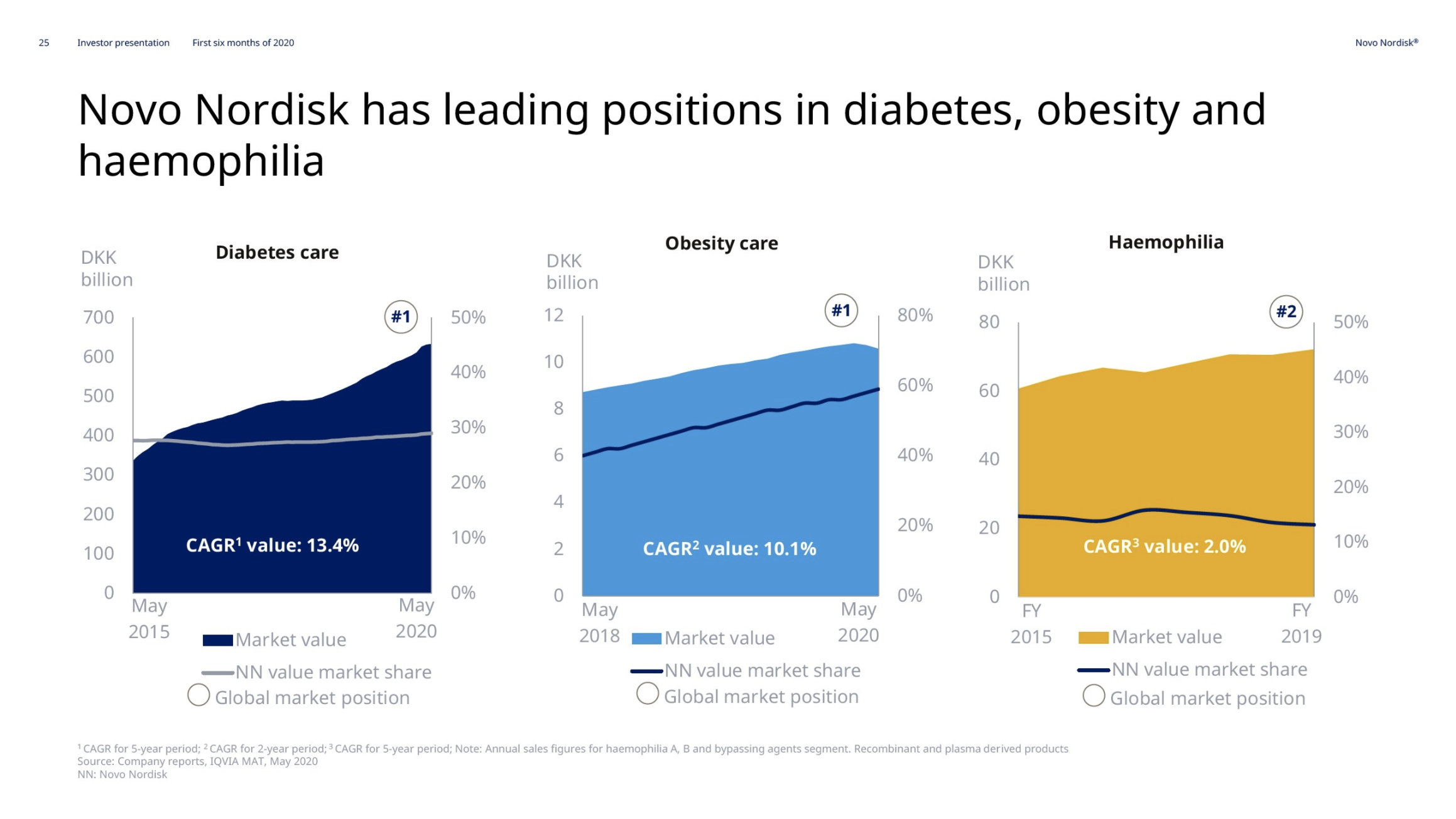

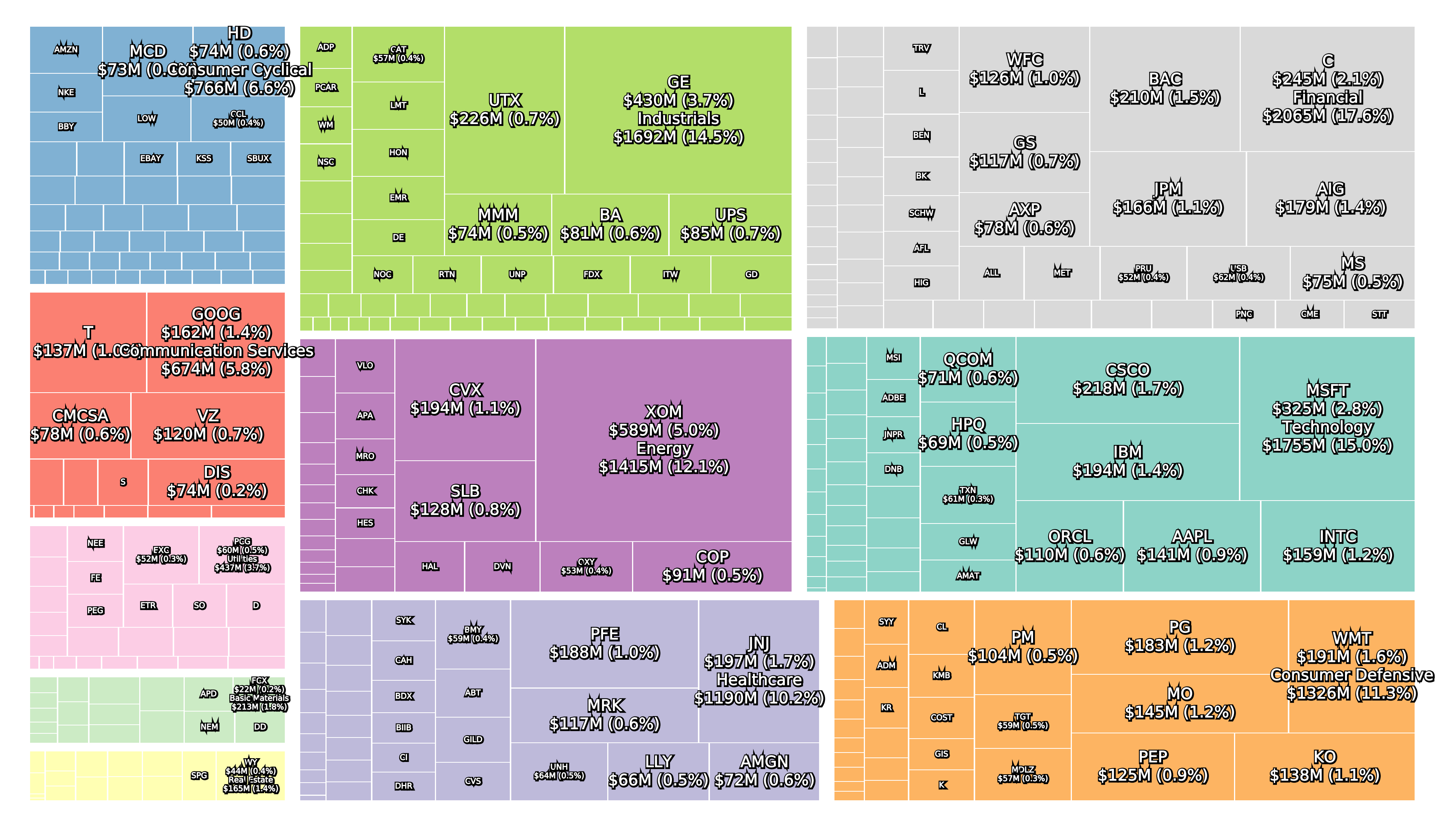

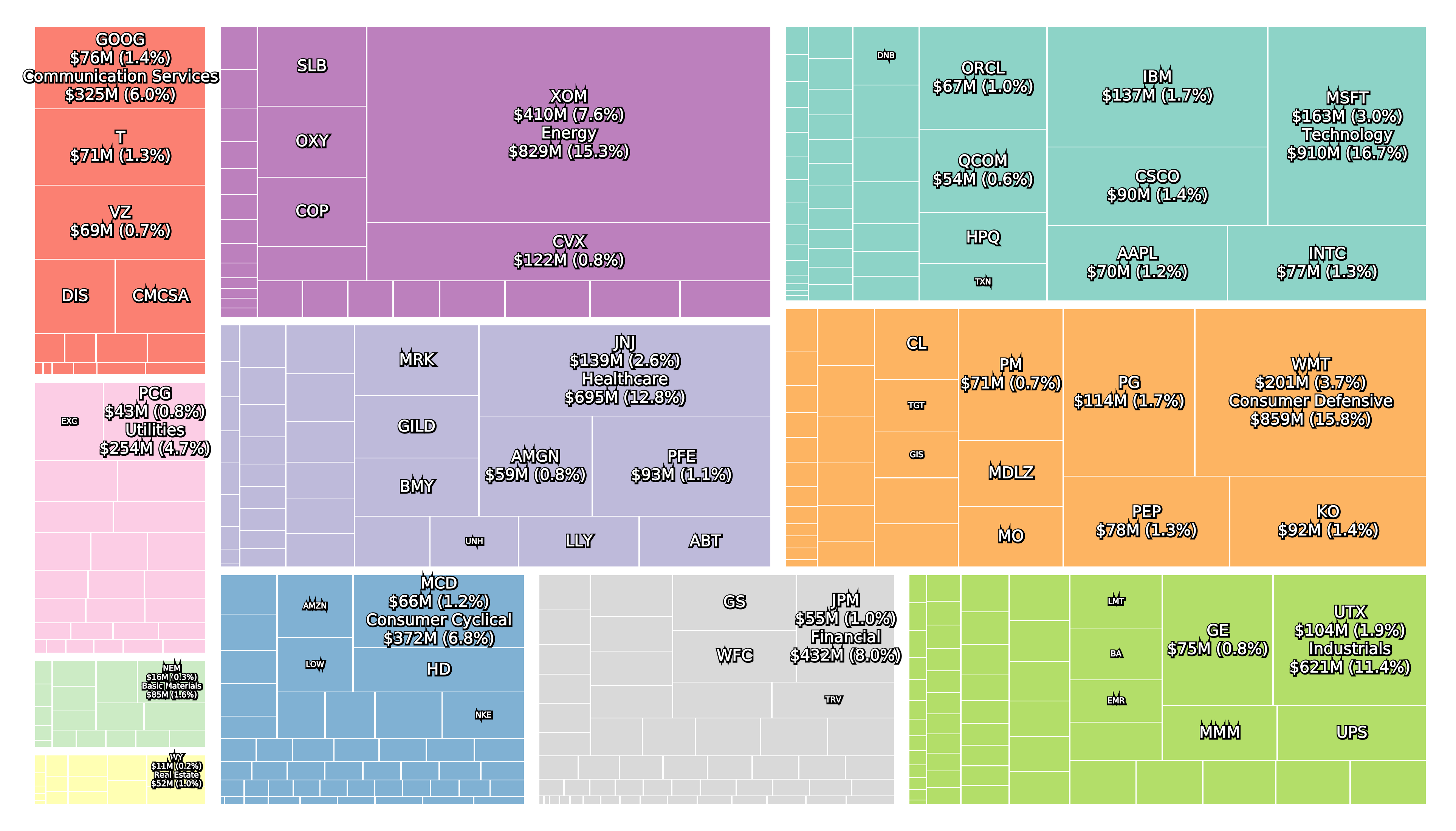

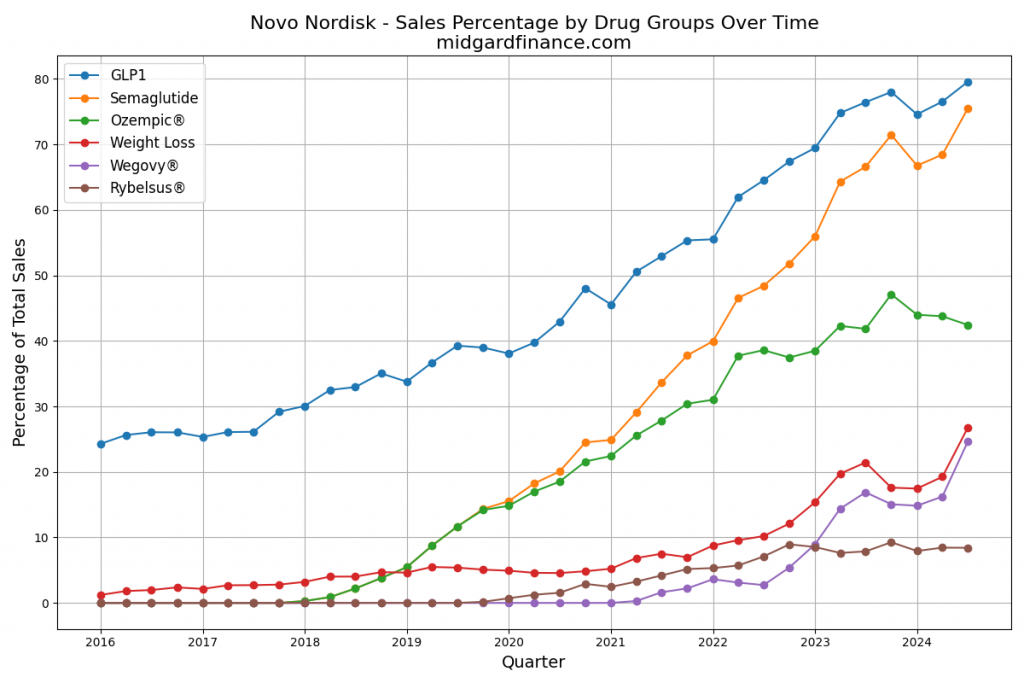

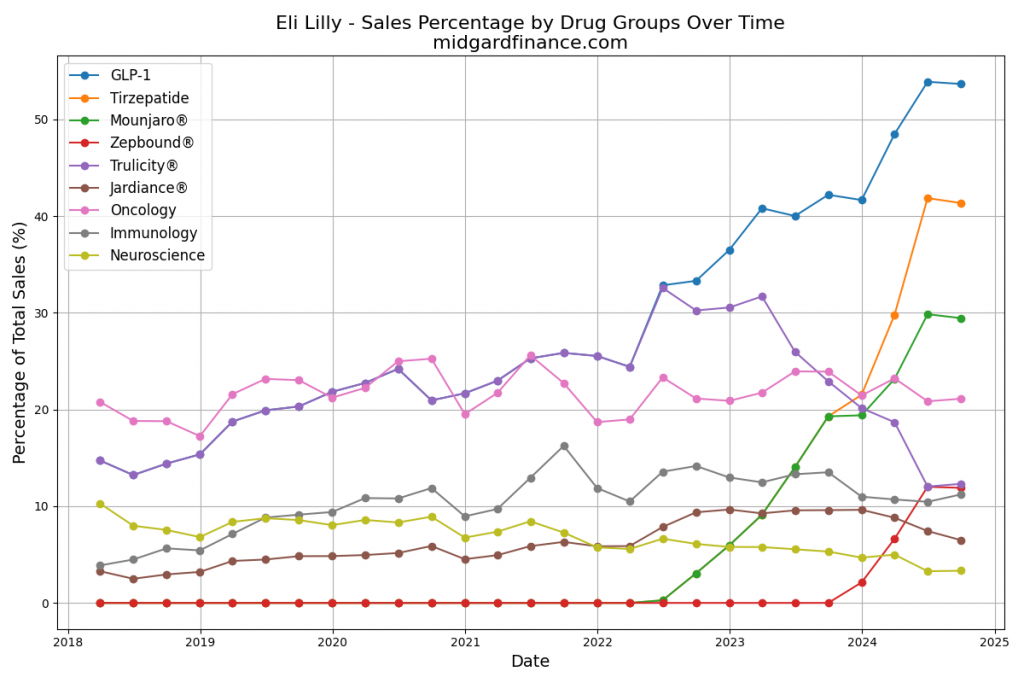

Recent figures show GLP-1 therapies now make up 80% of Novo Nordisk’s total revenue and 55% of Eli Lilly’s—highlighting how both companies rely heavily on these blockbuster weight loss medications. For Novo Nordisk in particular, semaglutide has become the flagship product that needs replacing or reinforcing once its patents run aground.

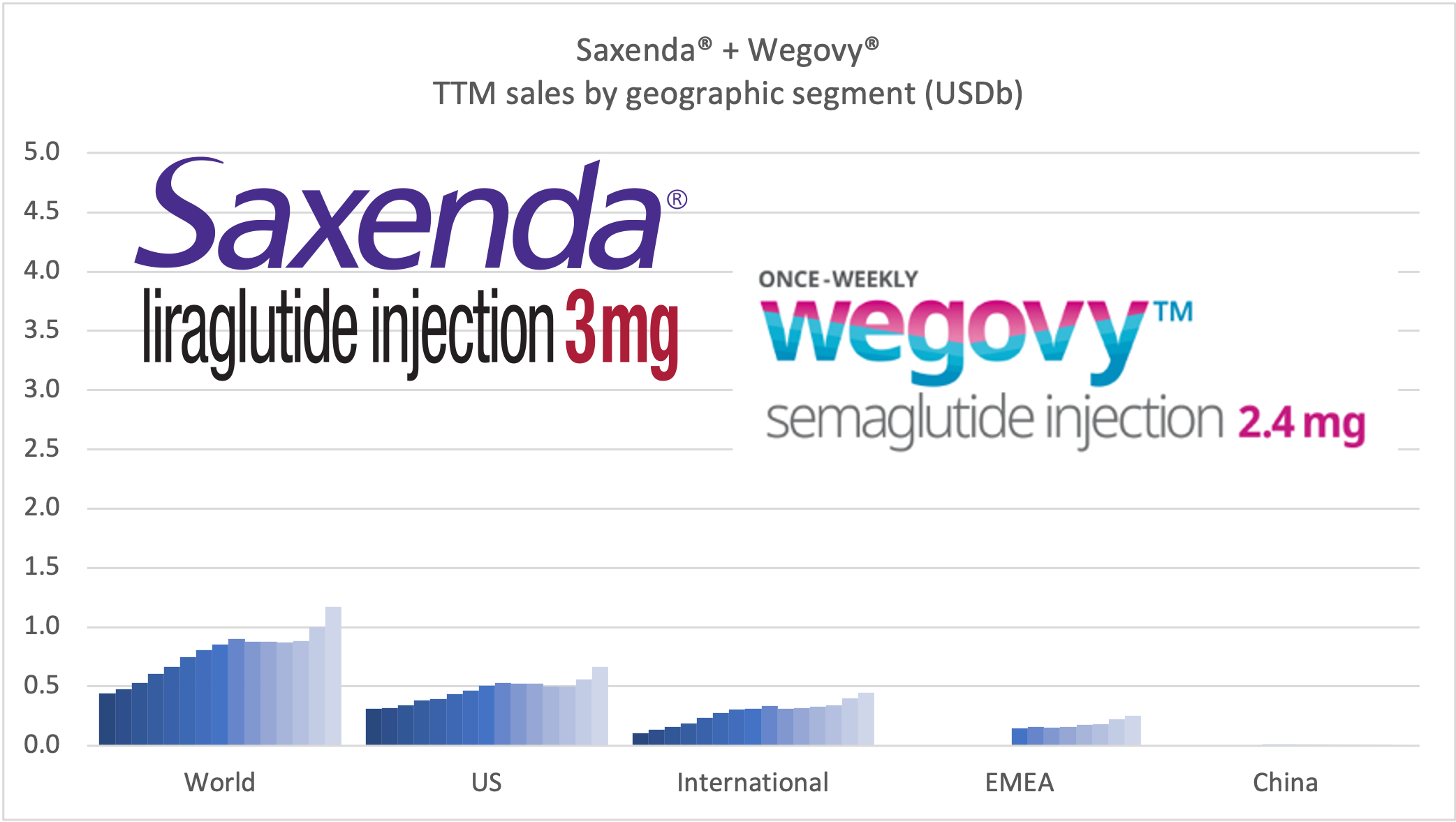

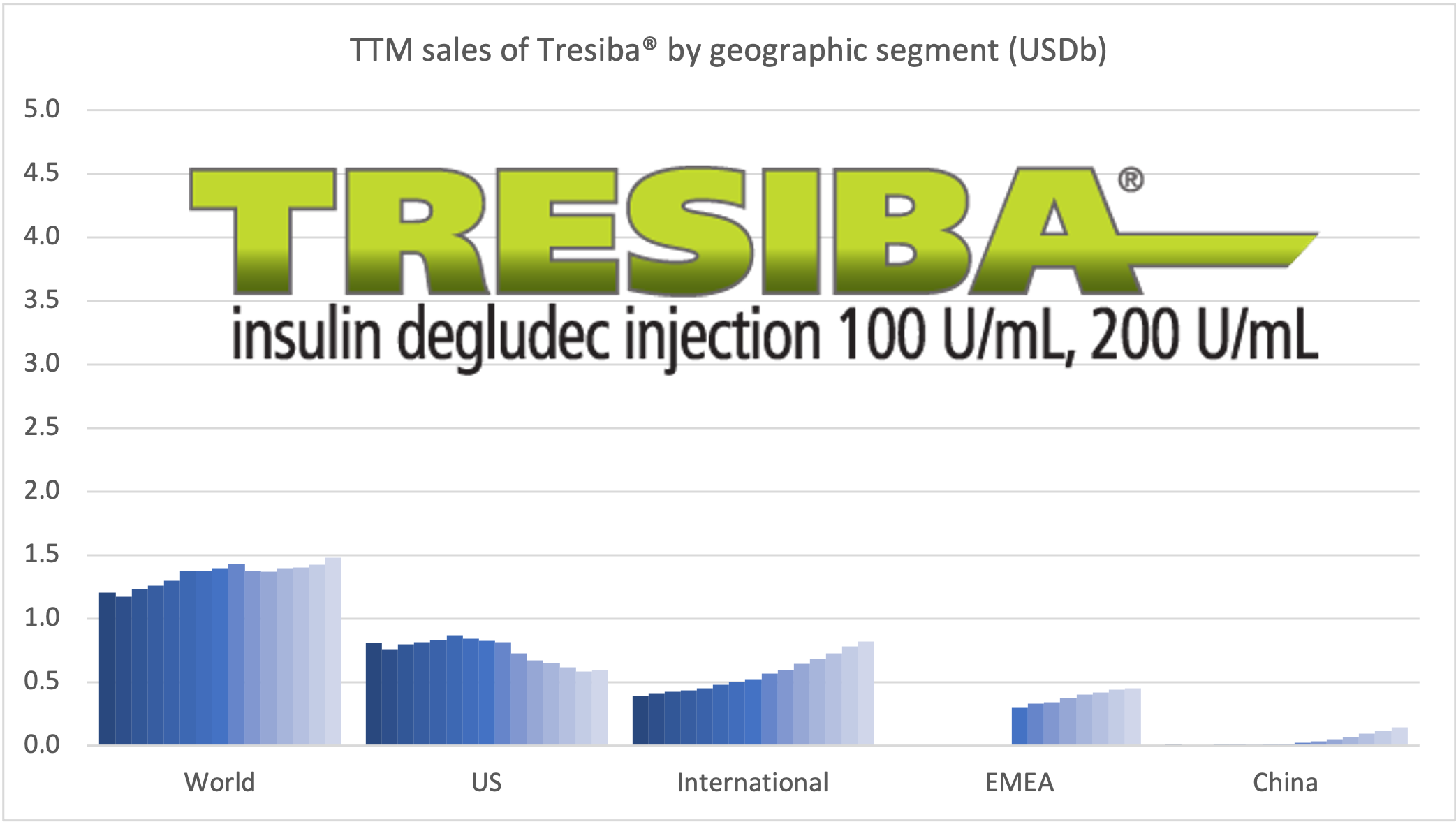

Anchoring Success: Approved Medications

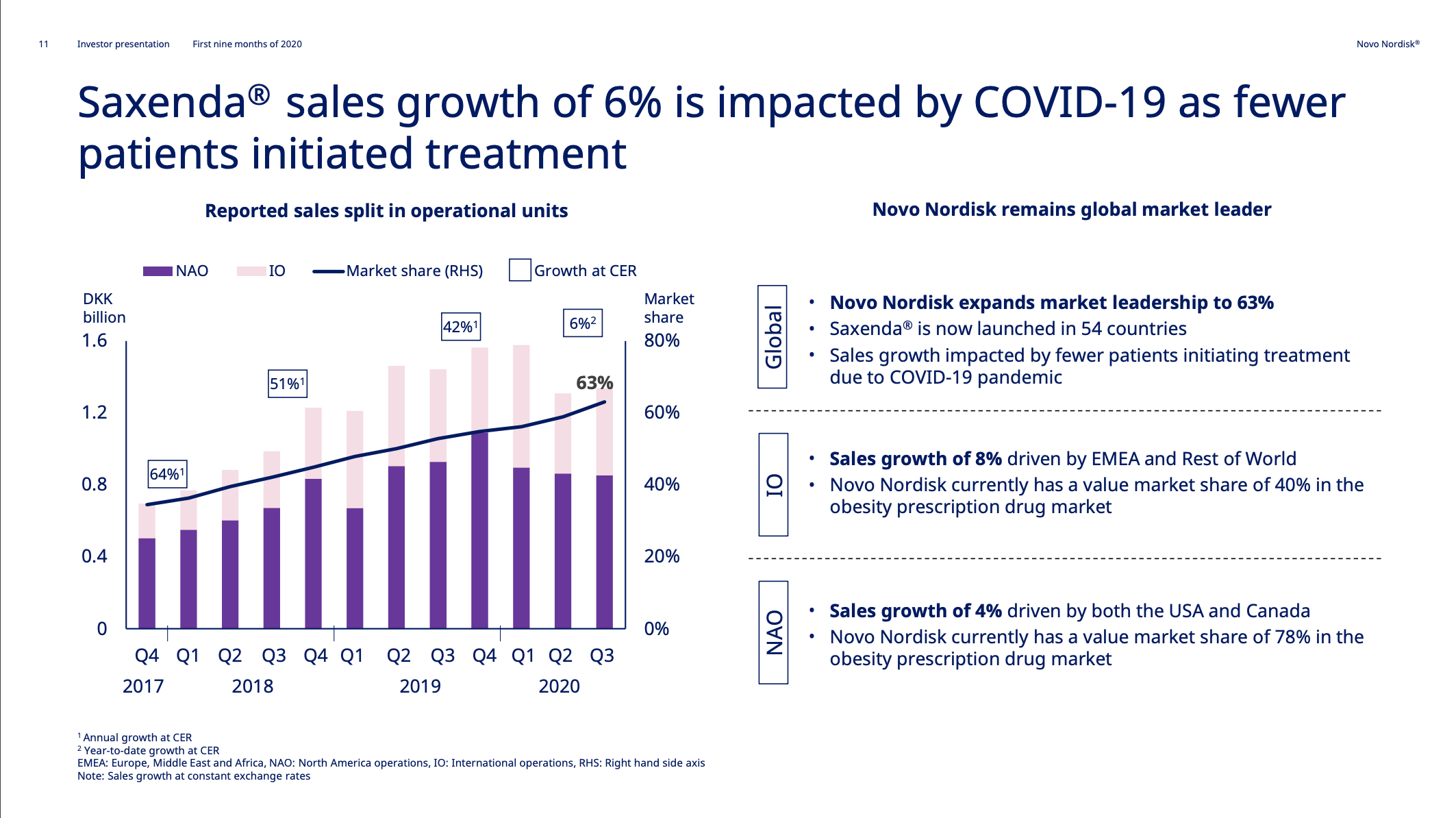

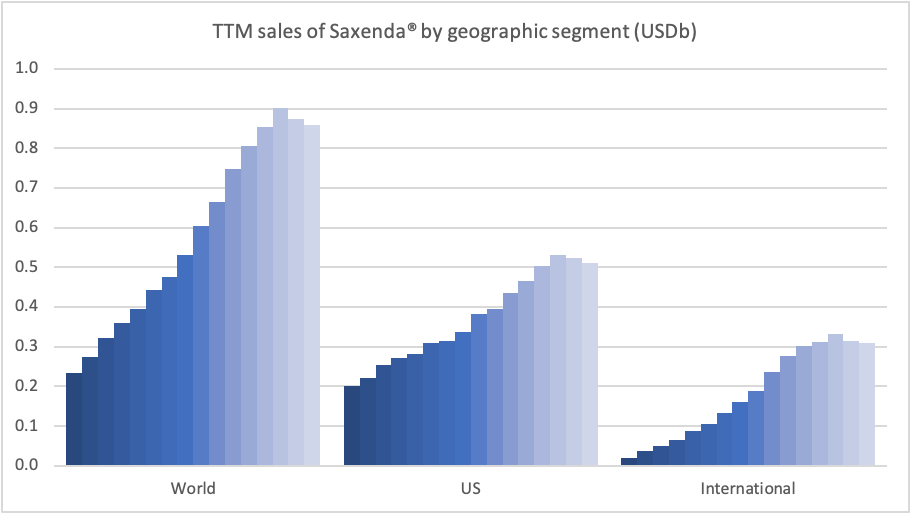

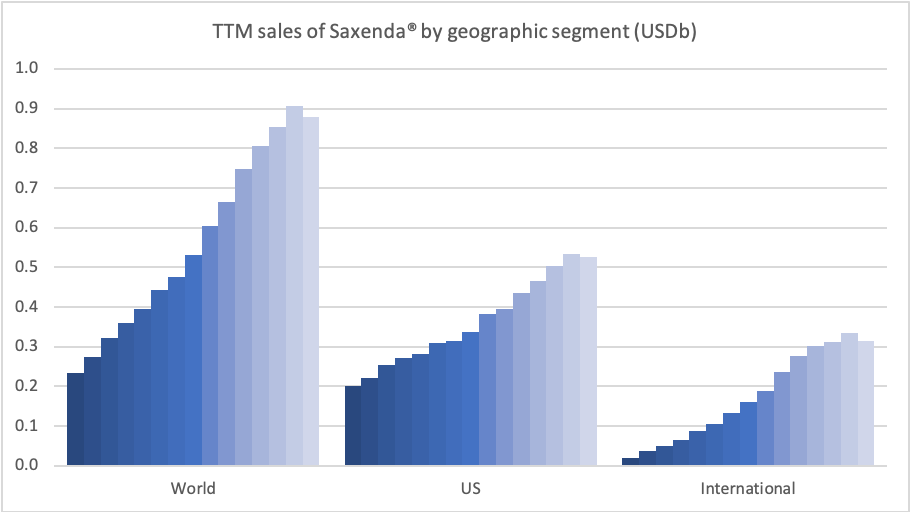

These anchor therapies—Saxenda®, Wegovy®, and Zepbound®—have already reshaped the obesity market by delivering significant weight loss. As one can see in Table 1, looming patent expirations and emerging competition could stir up choppier waters, pushing companies to innovate or risk losing their edge.

| Company | Name | Generic | Doses | Administration | FDA Approval | Weight Loss | Patent Expiration |

|---|---|---|---|---|---|---|---|

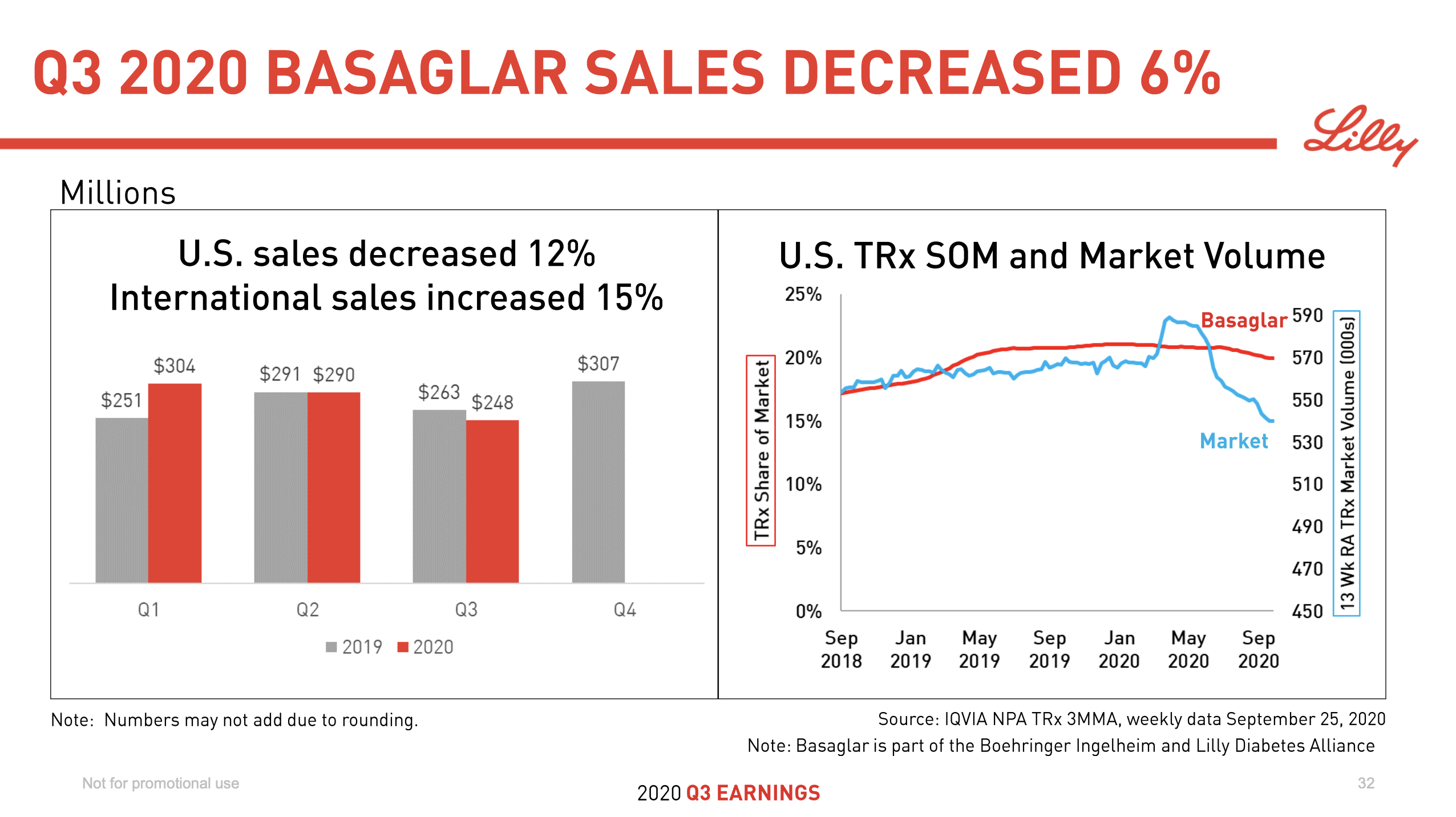

| Novo Nordisk | Saxenda® | Liraglutide | 3mg | Daily Injection | 2014 | ~8% (56 weeks) | 2024 |

| Novo Nordisk | Wegovy® | Semaglutide | 2.4mg | Weekly Injection | 2021 | 14.9% (68 weeks) | 2026 |

| Eli Lilly | Zepbound® | Tirzepatide | 15mg | Weekly Injection | 2023 | 20.9% (72 weeks) | 2039 |

Pipeline Candidates: Innovation on the Horizon

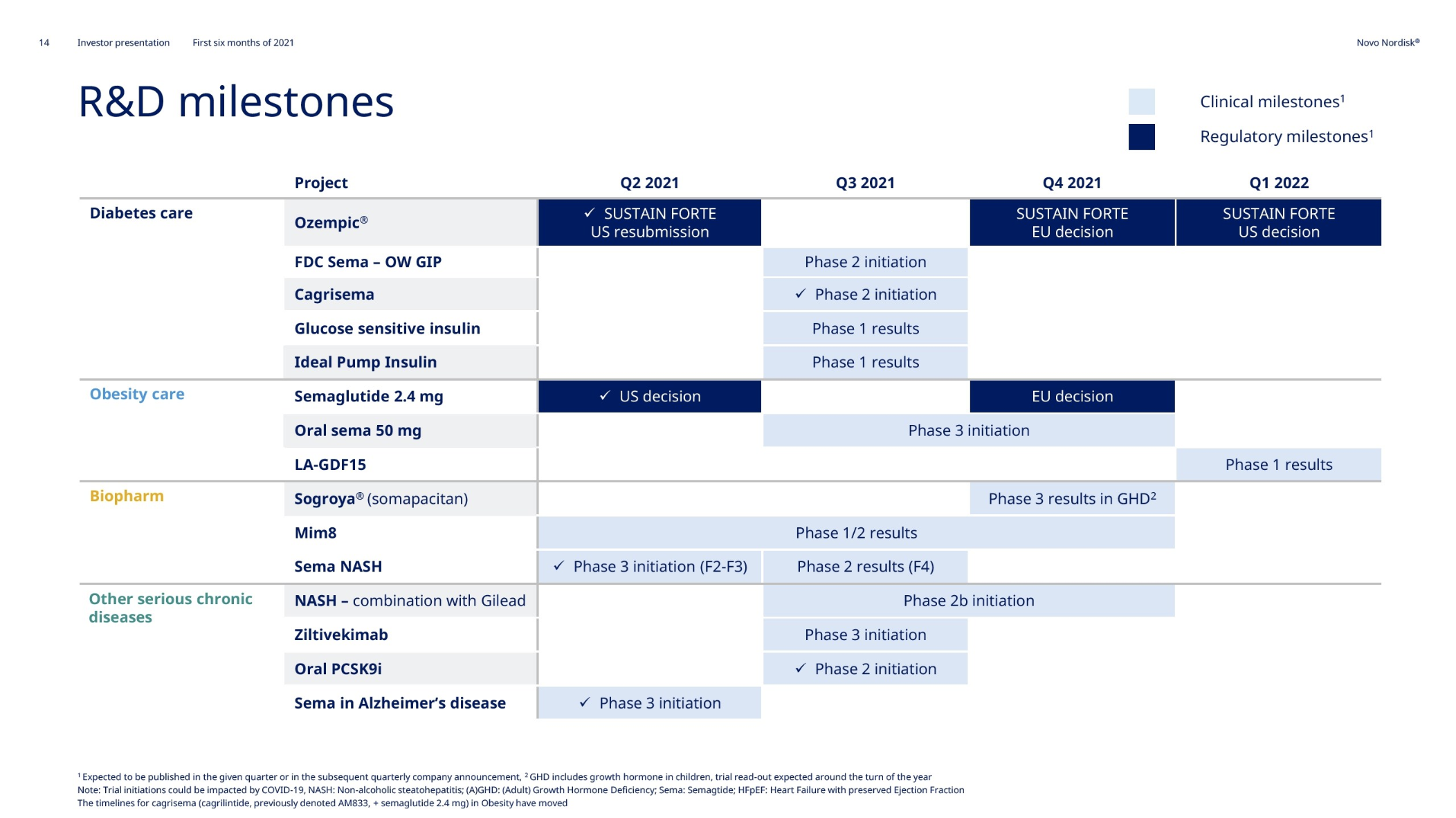

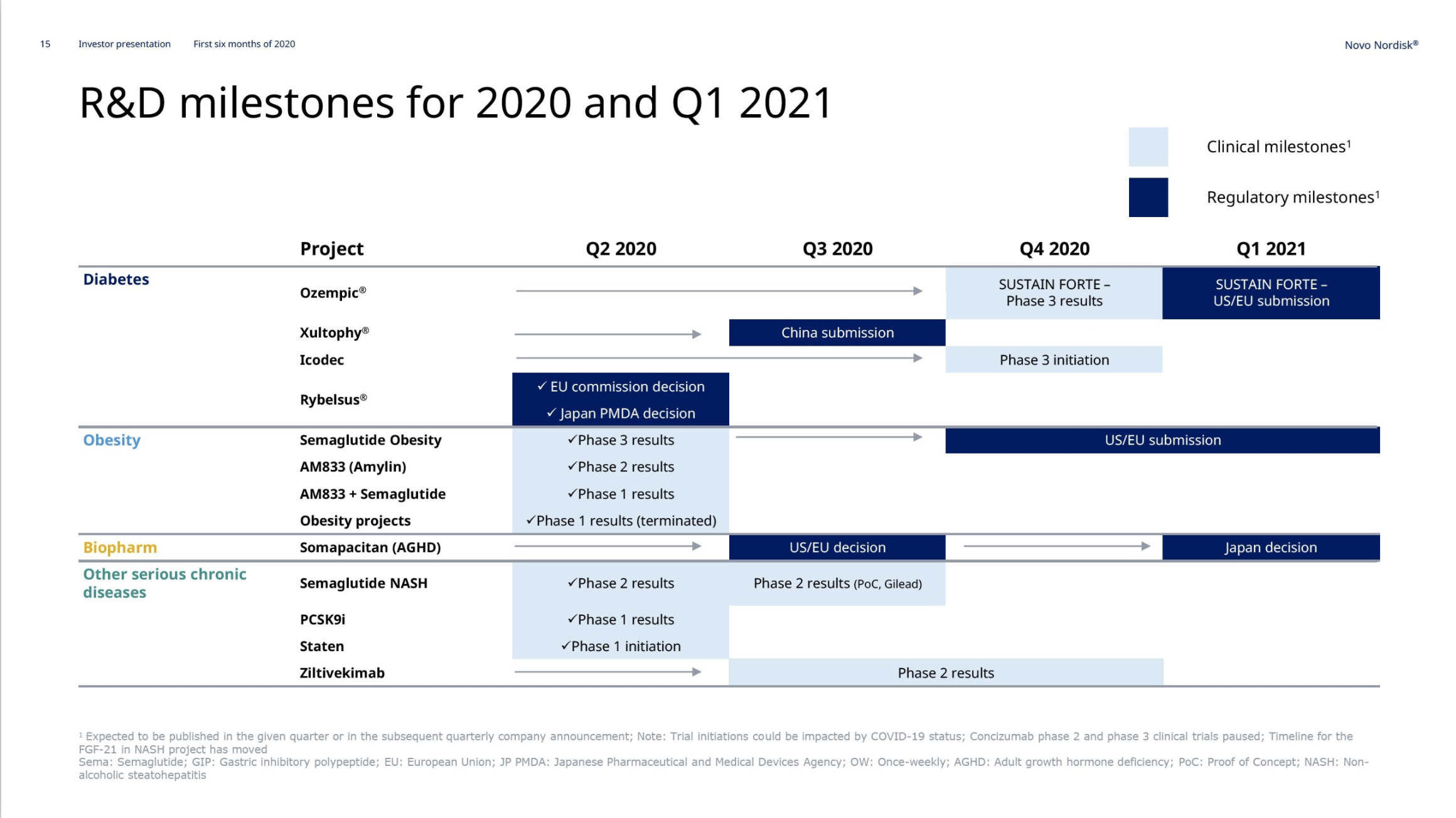

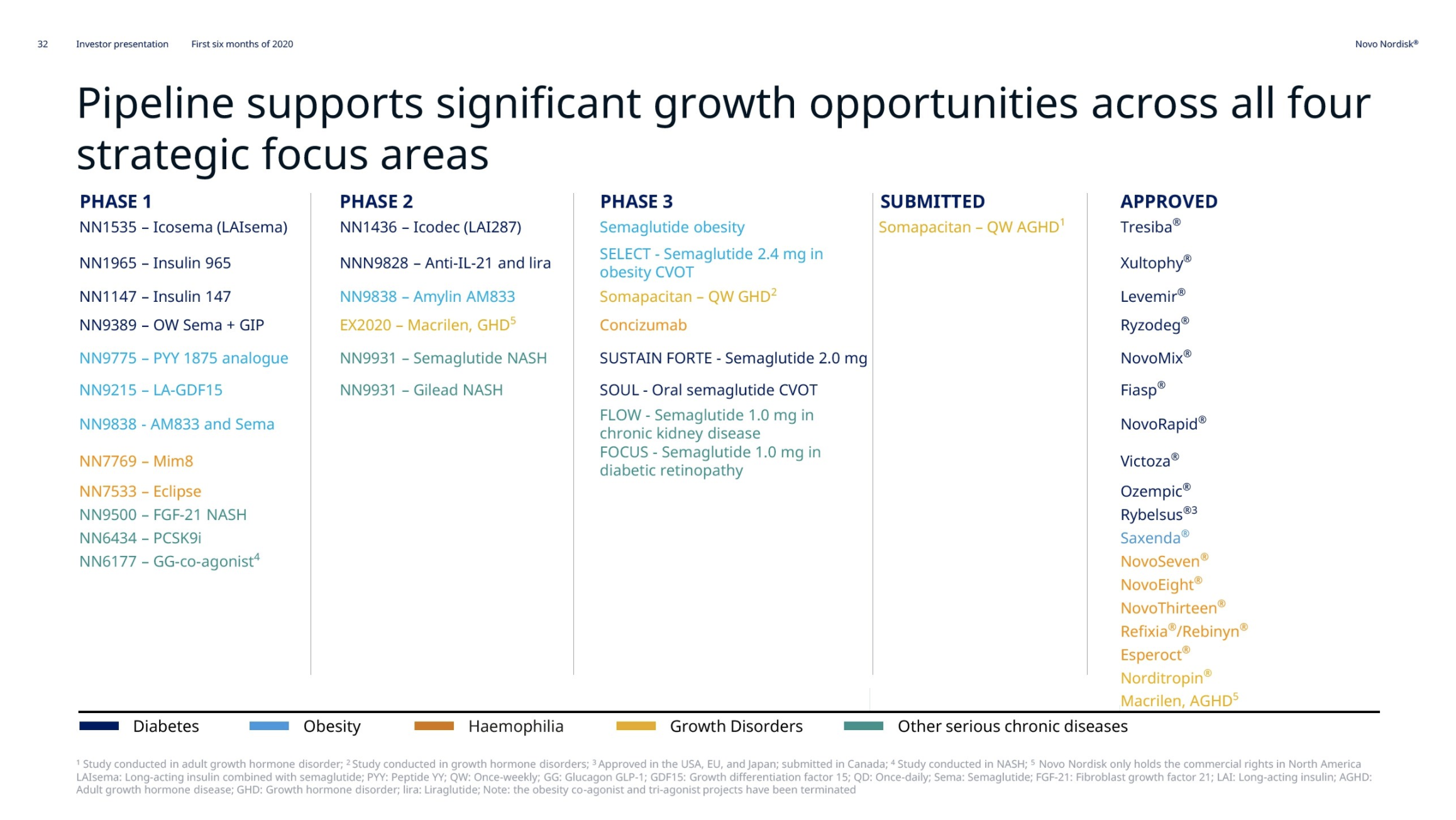

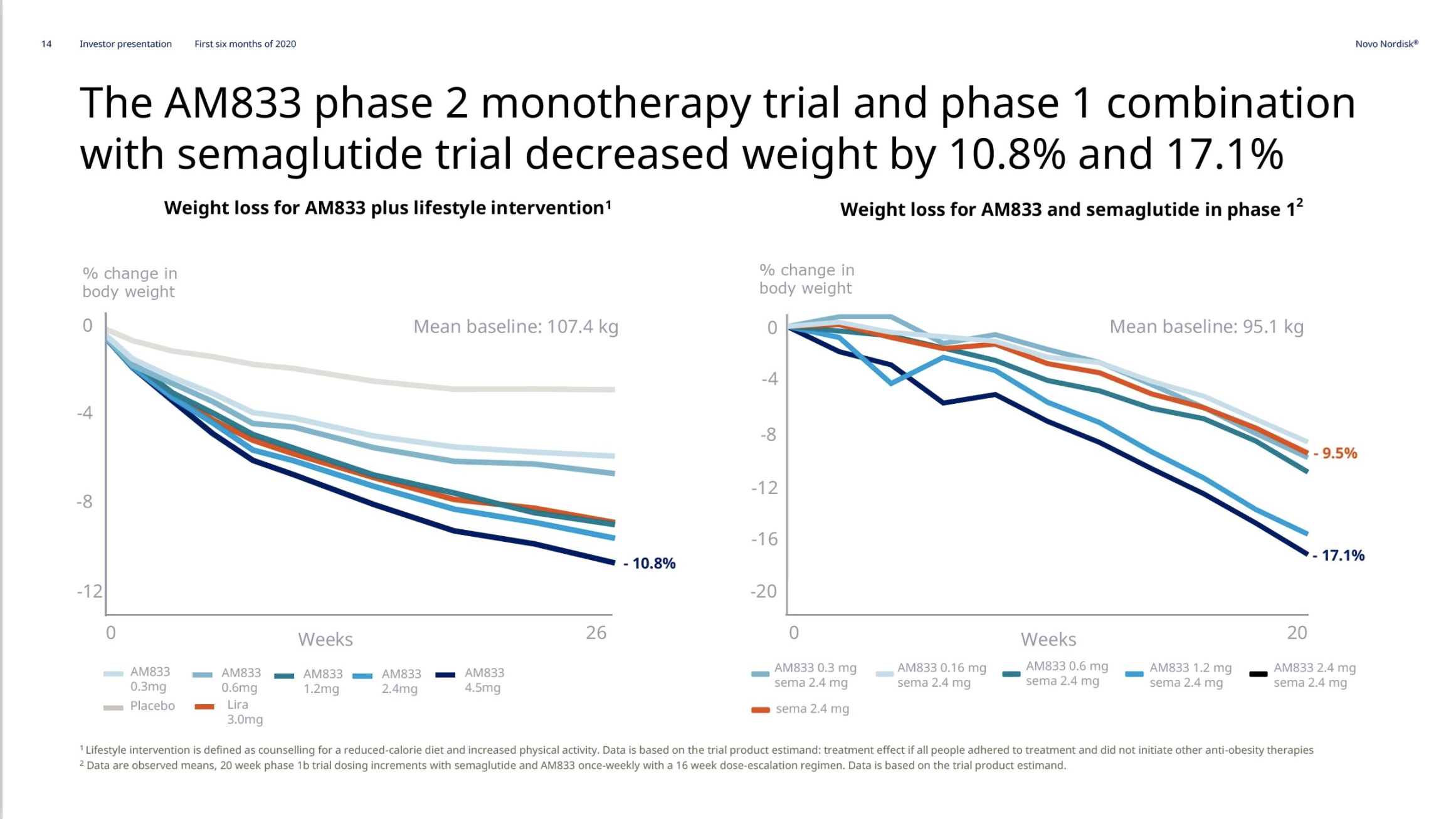

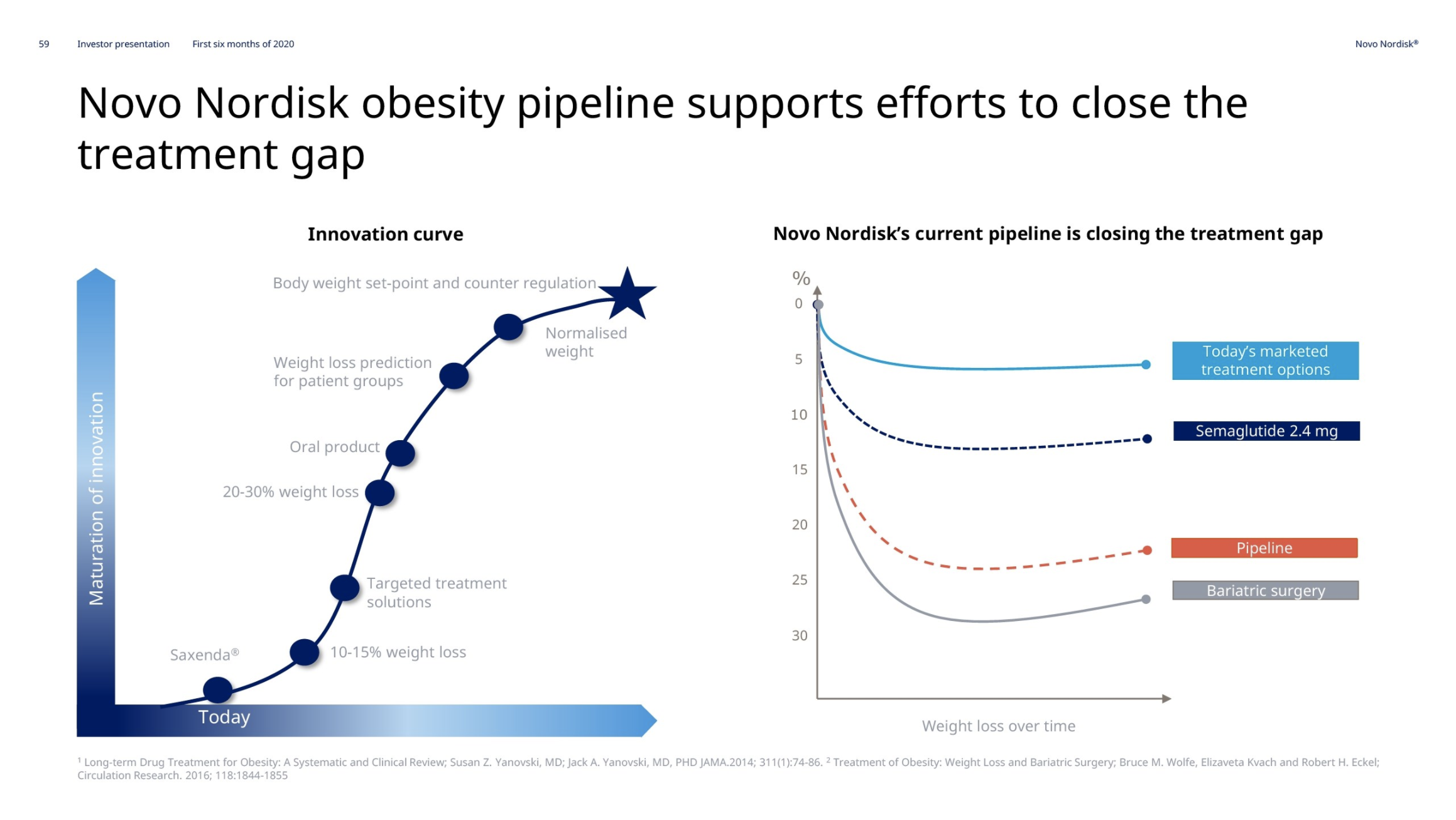

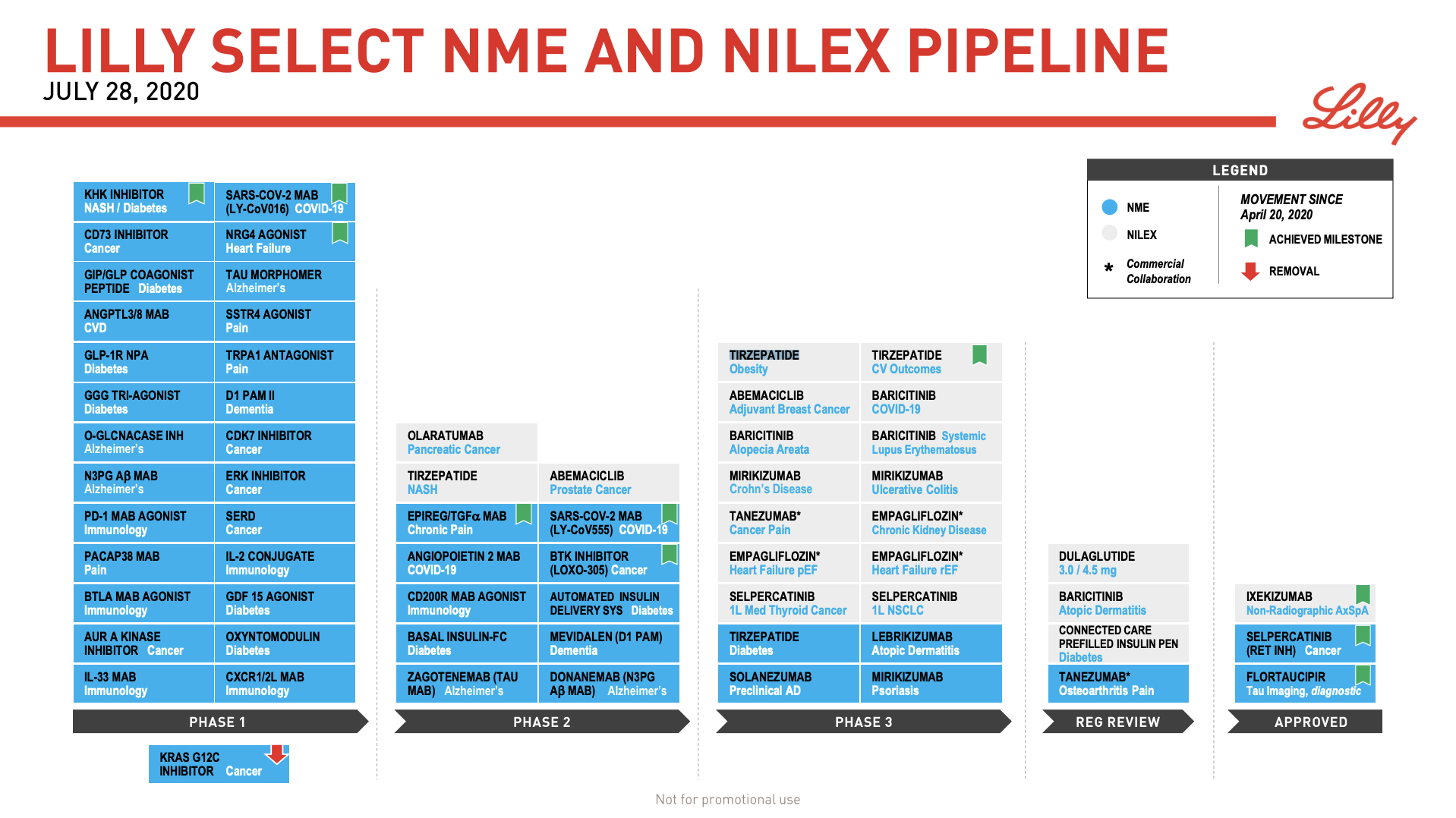

While Wegovy®, Saxenda®, and Zepbound® have already proven the market’s appetite for GLP-1 therapies, a new fleet of candidates is gearing up to reshape the obesity landscape. From dual and triple hormone agonists to next-generation oral formulations, each entry in Table 2 could represent the next wave – if their clinical trials keep delivering smooth sailing.

| Candidate | Sponsor | Type | Receptors | Administration |

|---|---|---|---|---|

| CagriSema | Novo Nordisk | Peptides (GLP-1 and Amylin) | GLP-1 (Semaglutide) + Amylin (Cagrilintide) | Subcutaneous |

| Amycretin (NNC0487-0111) | Novo Nordisk | Peptide (Amylin) | GLP-1, Amylin | Oral / Subcutaneous |

| Survodutide (BI 456906) | Boehringer Ingelheim | Peptide (Glucagon) | GLP-1, GCG | Subcutaneous |

| Retatrutide (LY3437943) | Lilly | Peptide | GLP-1, GIP, GCG | Subcutaneous |

| Orforglipron (LY3502970) | Lilly | SMD | GLP-1 | Oral |

Mapping the Waters: Insights from Clinical Trials

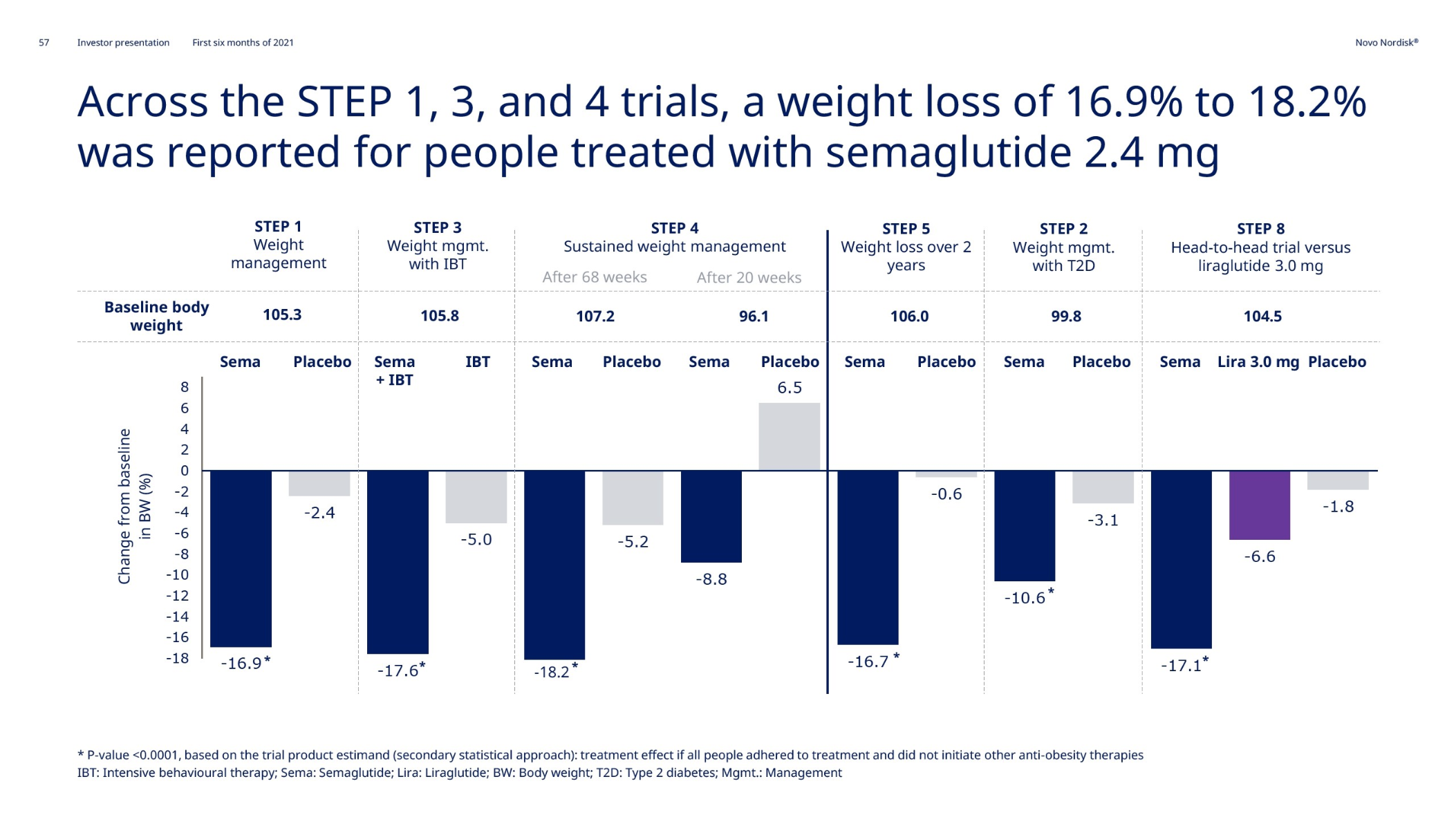

As competition in the obesity-drug space intensifies, clinical trial data can make or break a company’s voyage. Table 3 compares superior weight loss percentages, doses, and timelines across recent mostly phase 3 (and 3b) trials. Notably, candidates like Amycretin and CagriSema are hitting impressive numbers above 20% – but each new wave of data also raises the tide of investor expectations.

| Candidate | Superior Weight Loss | Dose | Weeks | Baseline | Date |

|---|---|---|---|---|---|

| Amycretin | 22.0% | 20mg | 36 | 92.7kg | 2025-01-24 |

| Semaglutide | 20.7% | 7.2mg | 72 | 113kg | 2025-01-17 |

| CagriSema | 20.4% | 2.4mg | 68 | 106.9kg | 2024-12-20 |

| Tirzepatide | 20.2% | 15mg | 72 | Obese | 2024-12-04 |

| Retatrutide | 24.2% | 12mg | 48 | BMI>27 | 2023-06-26 |

| Survodutide | 14.9% | 4.8mg | 46 | Obese | 2023-06-23 |

| Orforglipron | 14.7% | 45mg | 36 | 109kg | 2023-06-23 |

Plotting the Course: Clinical Trial Highlights

Building on these outcomes, Table 4 charts the finer points of key trials—from participant profiles and dosage regimens to primary outcomes. Navigating this data reveals not only each therapy’s potential but also the crowded seas ahead, where even a small setback can send ripples across the market.

| Candidate | Trial | Primary Outcome | Participants | Weeks | Sample Size |

|---|---|---|---|---|---|

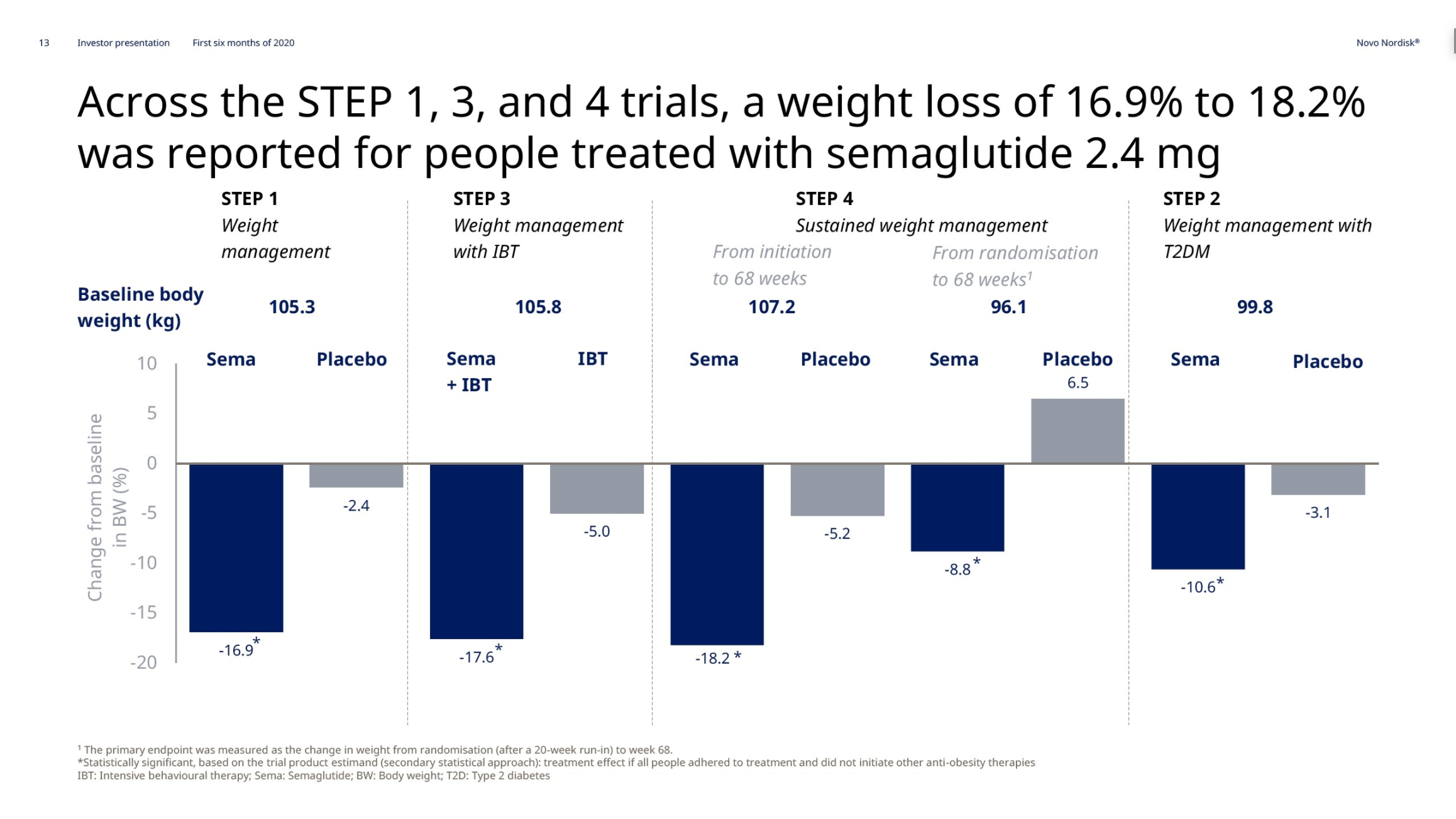

| Semaglutide | STEP-1 | Weight loss vs placebo | Adults with obesity or overweight | 68 | 1,961 |

| Semaglutide | STEP-2 | Weight loss vs placebo | Adults with obesity or overweight with type 2 diabetes | 68 | 1,210 |

| Semaglutide | STEP-3 | Weight loss vs placebo as adjunct to intensive lifestyle intervention | Adults with obesity or overweight | 68 | 611 |

| Semaglutide | STEP-4 | Weight loss maintenance vs placebo | Adults with obesity or overweight | 68 | 902 |

| Semaglutide | STEP-UP | Superiority of semaglutide 7.2 mg vs placebo on weight loss | Adults with BMI ≥30 kg/m² without diabetes | 72 | 1,407 |

| Semaglutide | STEP-UP T2D | Superiority of semaglutide 7.2 mg vs placebo on weight loss | Adults with obesity and type 2 diabetes | 72 | 512 |

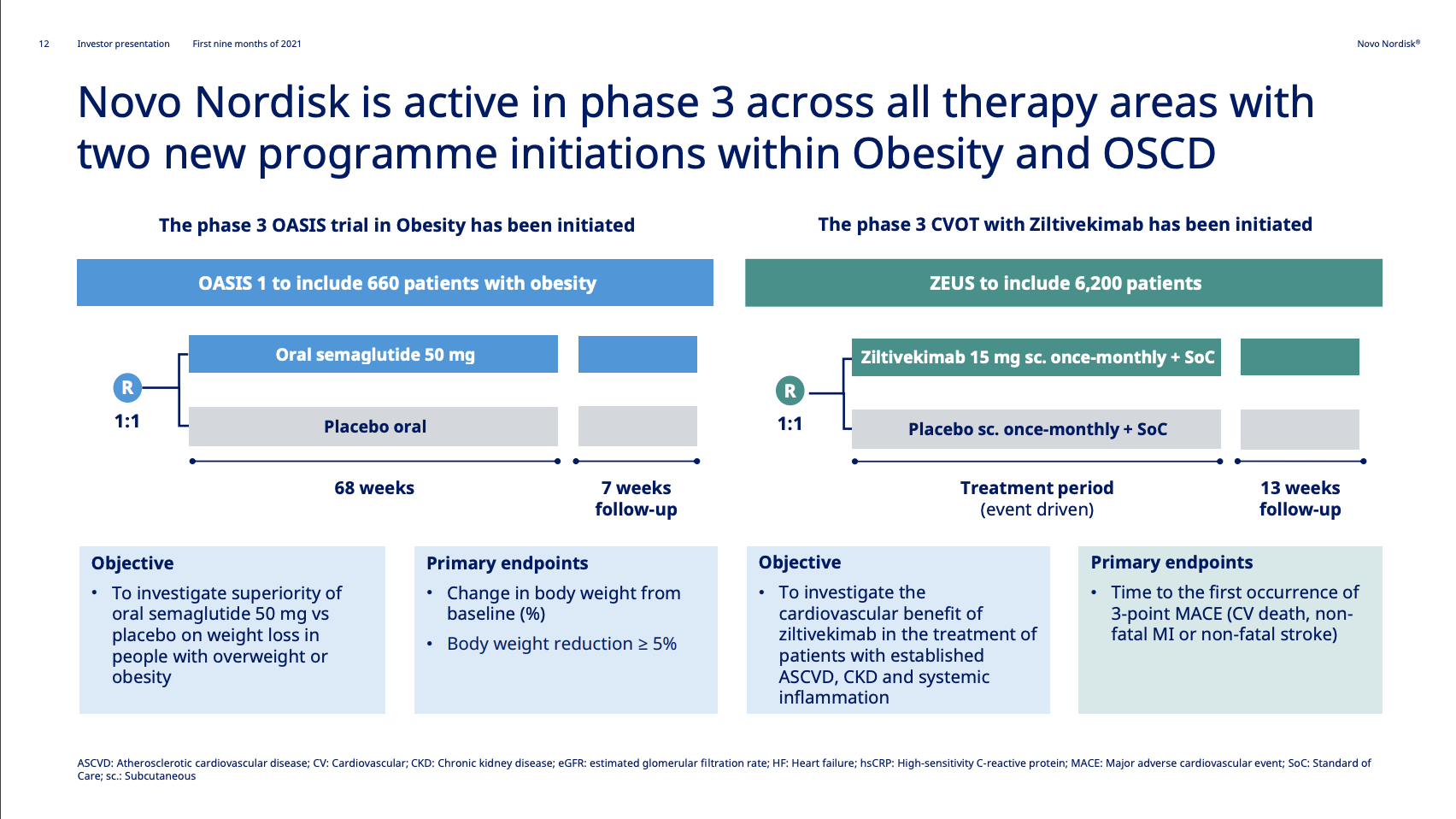

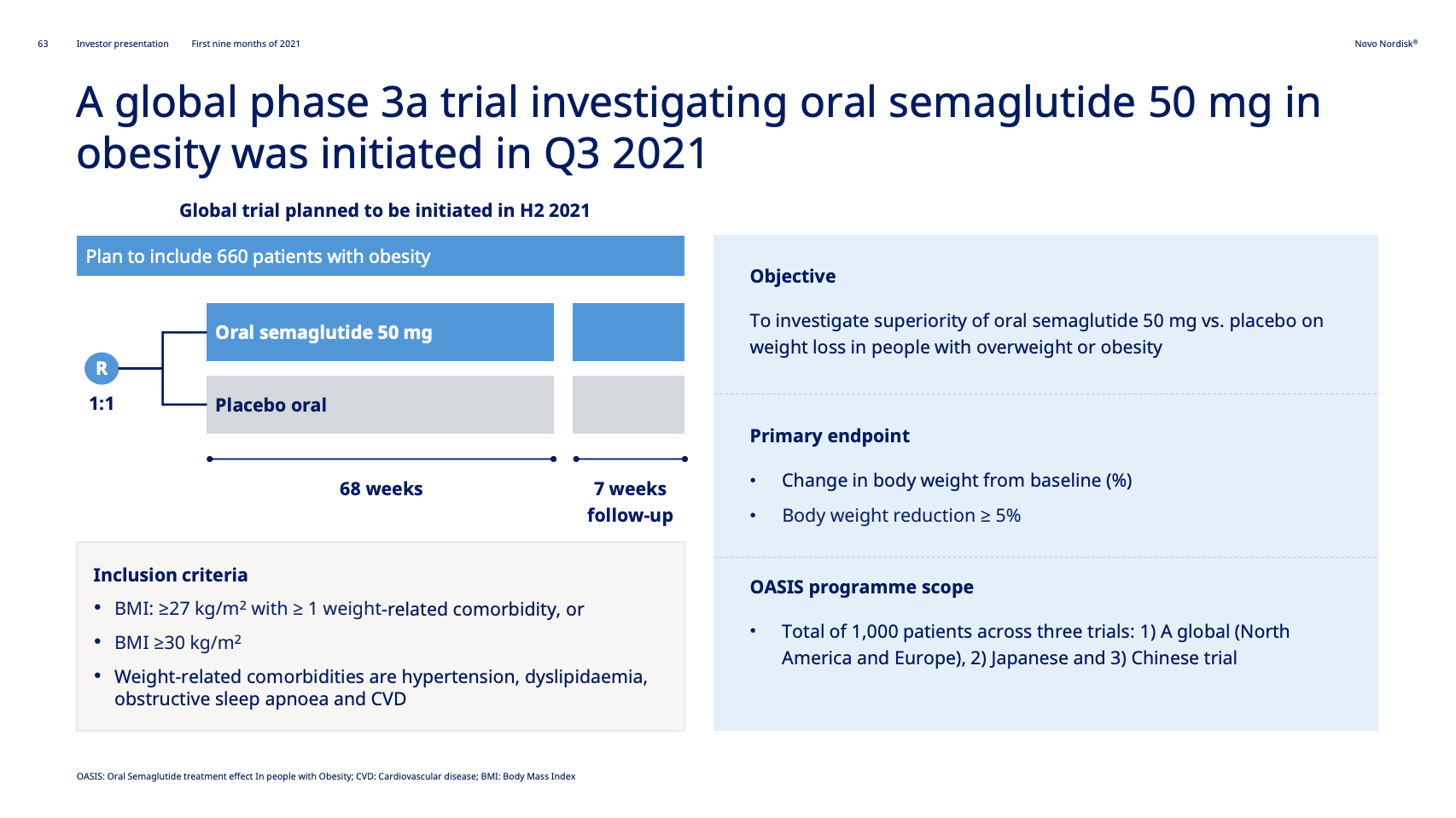

| Semaglutide | OASIS-1 | Weight loss vs placebo | Adults with overweight or obesity | 68 | 1,102 |

| Semaglutide | OASIS-2 | Weight loss maintenance vs placebo | Adults with obesity | 52 | 921 |

| CagriSema | REDEFINE 1 | Efficacy and safety of CagriSema vs semaglutide 2.4 mg vs placebo | Adults with obesity or overweight and comorbidities without T2D | 68 | 3,400 |

| CagriSema | REDEFINE 2 | Efficacy and safety of CagriSema vs placebo | Adults with T2D and obesity or overweight | 68 | 1,200 |

| CagriSema | REDEFINE 3 | Cardiovascular outcomes of CagriSema vs placebo | Adults with CVD with or without T2D | Event-driven | 7,000 |

| CagriSema | REDEFINE 4 | Efficacy and safety of CagriSema vs tirzepatide 15 mg | Adults with obesity | 72 | 800 |

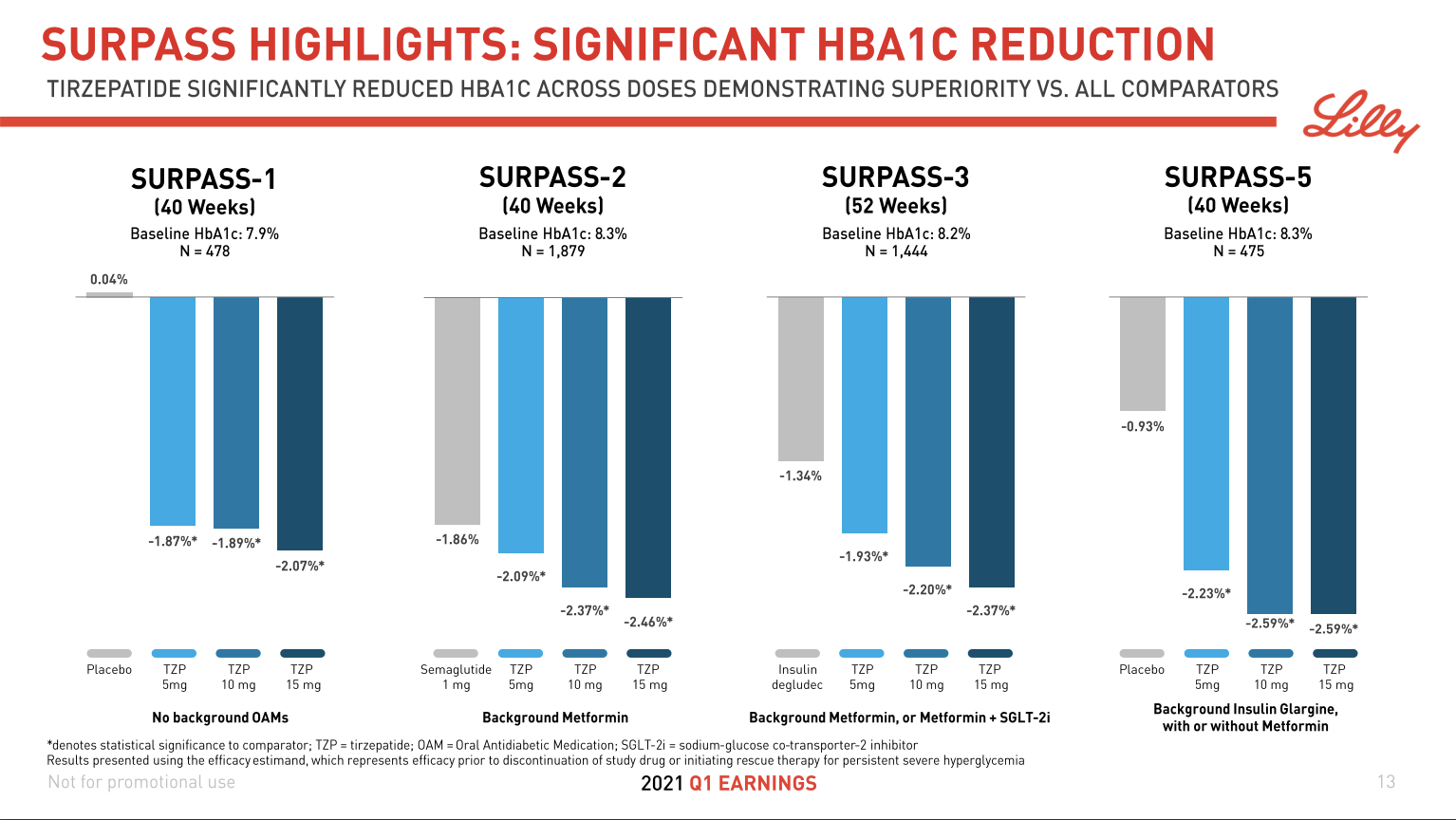

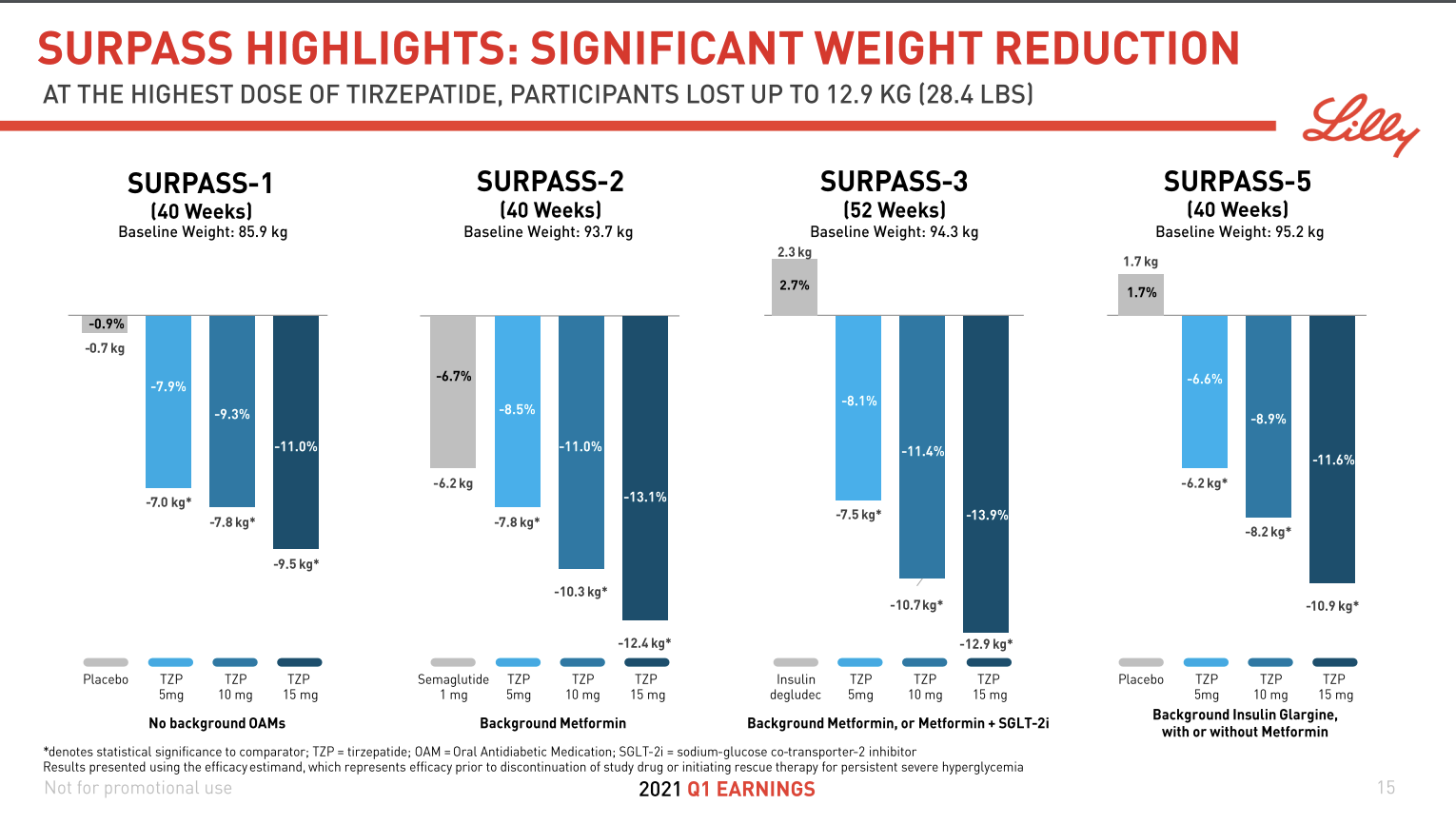

| Tirzepatide | SURMOUNT-1 | Superiority of tirzepatide vs placebo on weight loss | Adults with obesity or overweight without diabetes | 72 | 2,539 |

| Tirzepatide | SURMOUNT-2 | Superiority of tirzepatide vs placebo on weight loss | Adults with obesity or overweight with T2D | 72 | 938 |

| Tirzepatide | SURMOUNT-3 | Efficacy of tirzepatide as an adjunct to intensive lifestyle intervention | Adults with obesity | 72 | 669 |

| Tirzepatide | SURMOUNT-4 | Weight loss maintenance with tirzepatide vs placebo | Adults with obesity | 52 | 783 |

| Tirzepatide | SURMOUNT-5 | Superiority of tirzepatide vs Wegovy® (semaglutide 2.4 mg) | Adults with obesity or overweight | 72 | 741 |

| Retatrutide | TRIUMPH | Superiority of retatrutide vs placebo on weight loss | Adults with obesity or overweight | ||

| Survodutide | VOLITION | Superiority of survodutide vs placebo on weight loss | Adults with obesity or overweight without diabetes | 46 | 650 |

| Orforglipron | ATTAIN | Superiority of orforglipron vs placebo on weight loss | Adults with obesity or overweight | 36 | 272 |

Navigating Choppy Seas: Risks and Opportunities for Novo Nordisk

Despite commanding a leading position in the GLP-1 space, Novo Nordisk faces several challenges that could roil its outlook:

1️⃣ Regulatory Headwinds

- FDA Approval of Generic Liraglutide (December 2024) 🗜️

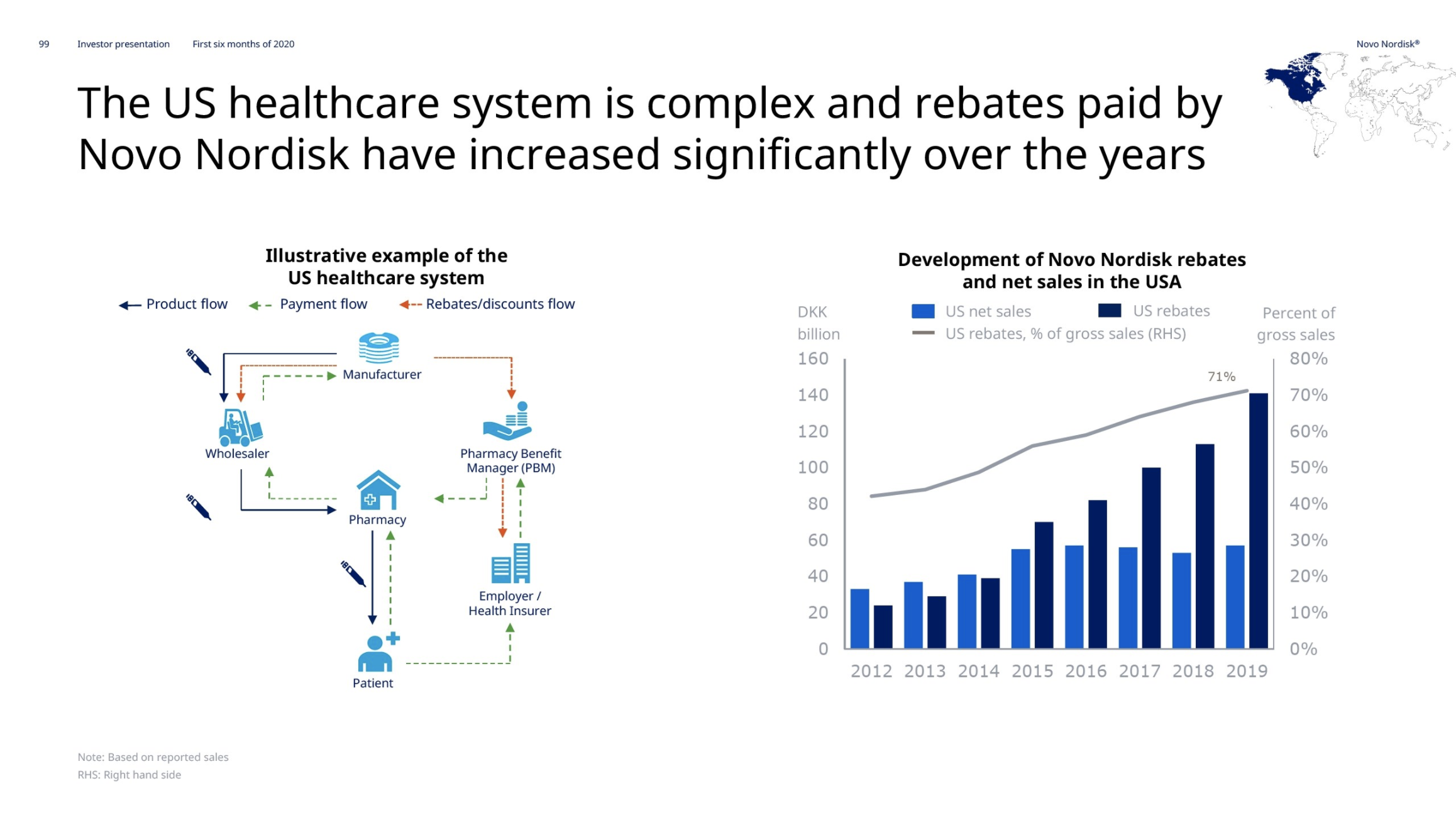

Generic competition will likely squeeze prices and margins. - Medicare Price Negotiations (January 2025) 💵

Wegovy® entering Medicare negotiations adds another layer of pricing pressure.

2️⃣ Market Competition

- Tirzepatide’s Sleep Apnea Approval 😴

Lilly’s Zepbound® success in December 2024 in a major comorbidity (sleep apnea) extends its lead. - Limited Diversification 🚨

Novo Nordisk’s heavy reliance on GLP-1 therapies leaves it vulnerable if competitors advance other modalities.

3️⃣ The Patent Cliff Beyond 2032

- No Clear Ozempic®/Wegovy® Successor 🧑🔬

The pipeline has promising candidates, but no obvious megablockbuster appears ready to replace semaglutide yet.

- Wegovy® Patent Expiration ⏳

Losing patent protection could significantly erode market share and revenue after 2032.

4️⃣ Additional Wildcards

- Potential US–Denmark Conflict 🇬🇱

Geopolitical tensions, however speculative, can create market uncertainty.

- Amycretin’s Subcutaneous Results 💉

Oral formulations lag behind, making the latest data less game-changing than some hoped.

So, Is It Still Worth the Voyage?

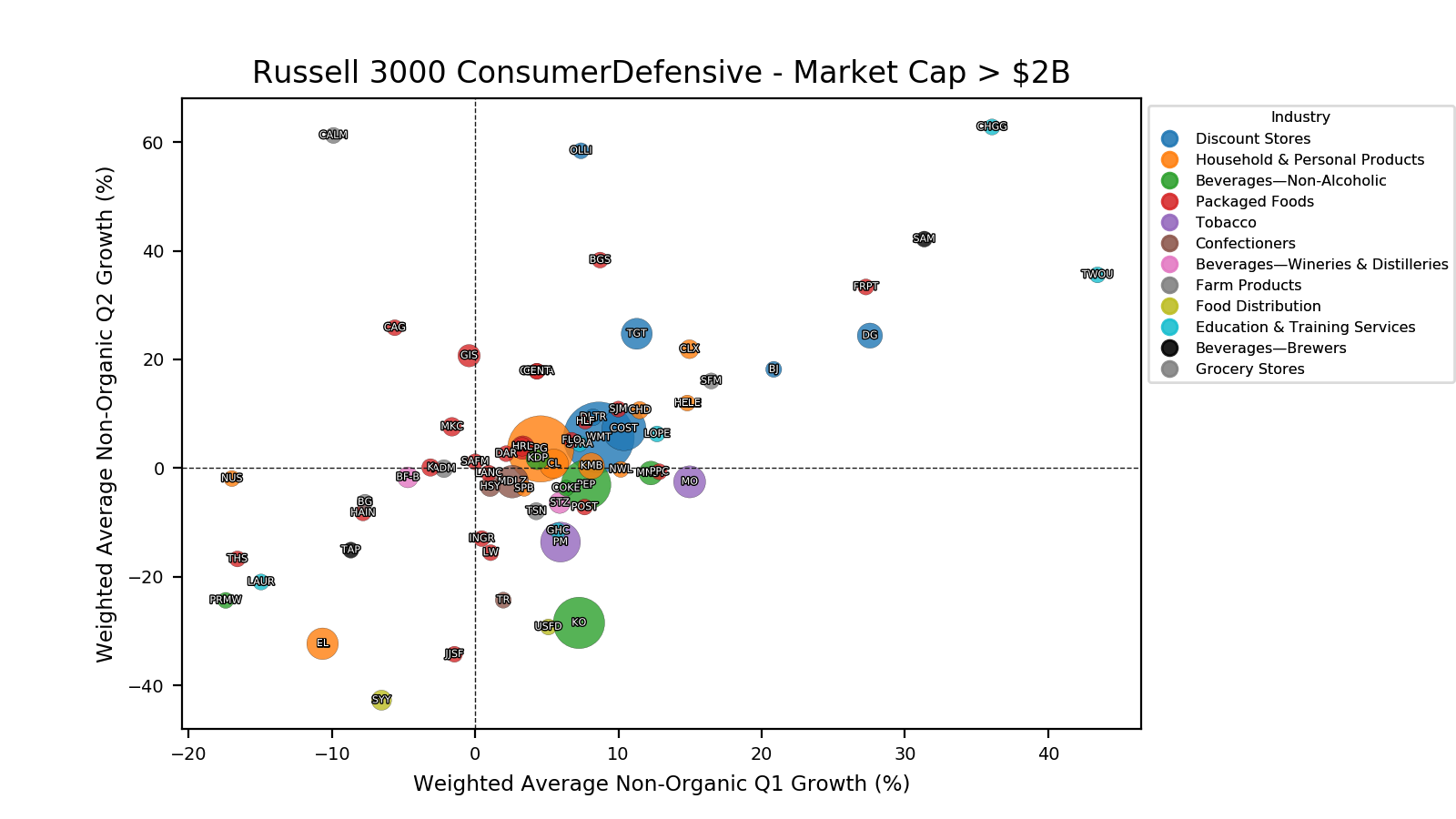

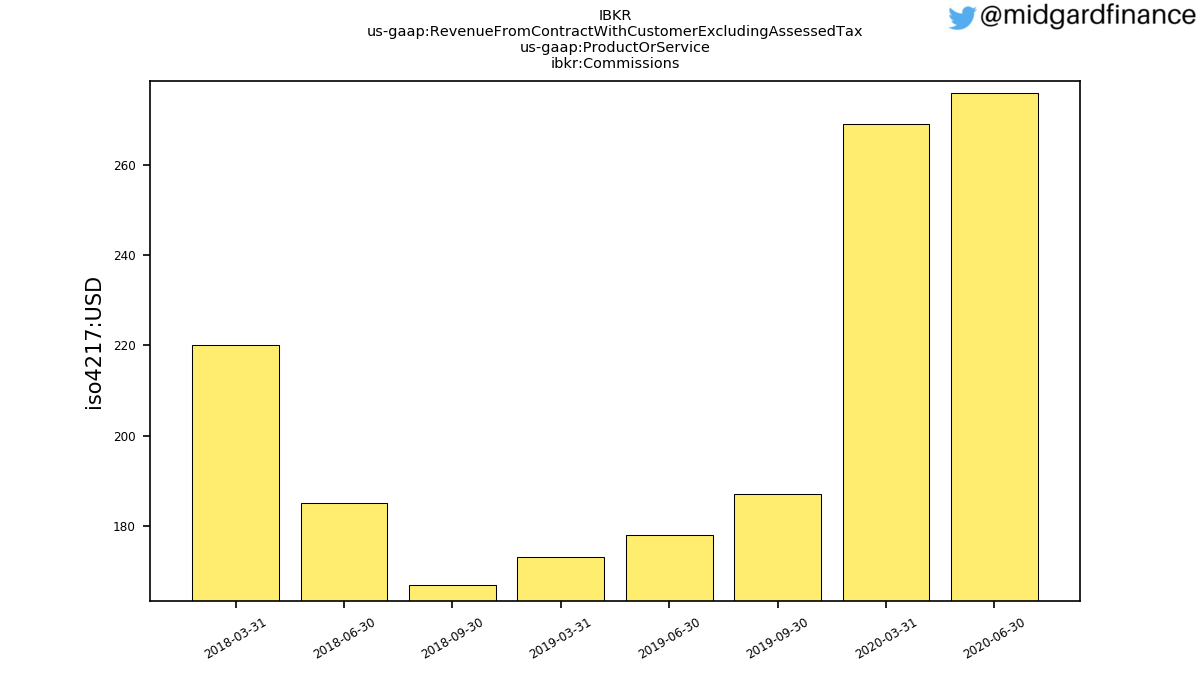

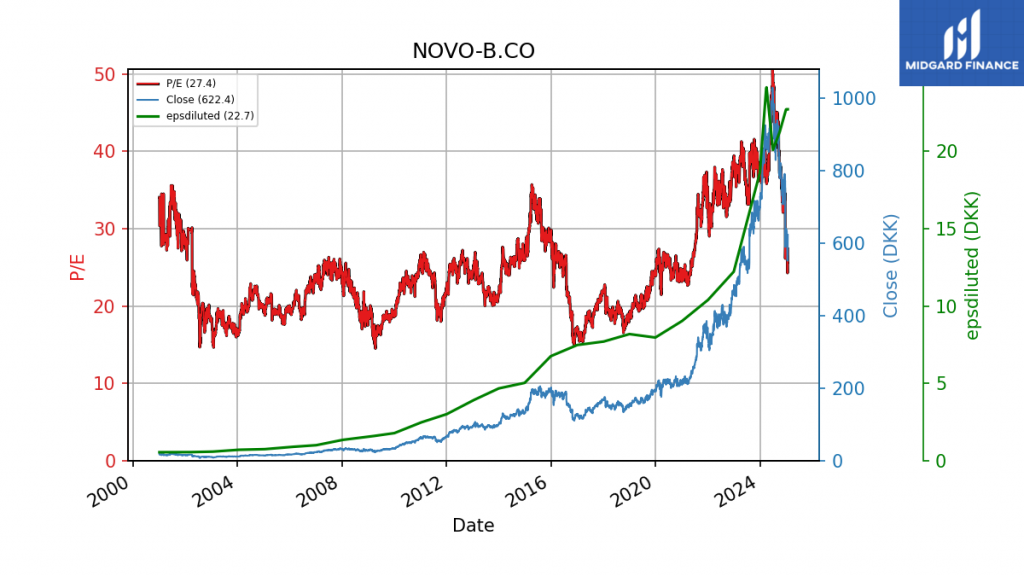

Stock Volatility and Lower Multiples (Figure 3) 📉

Novo Nordisk’s share price has plunged ~50% since summer 2024, lowering valuations. These wild fluctuations underscore how difficult it is to extrapolate earnings beyond Wegovy®’s 2032 patent expiration.

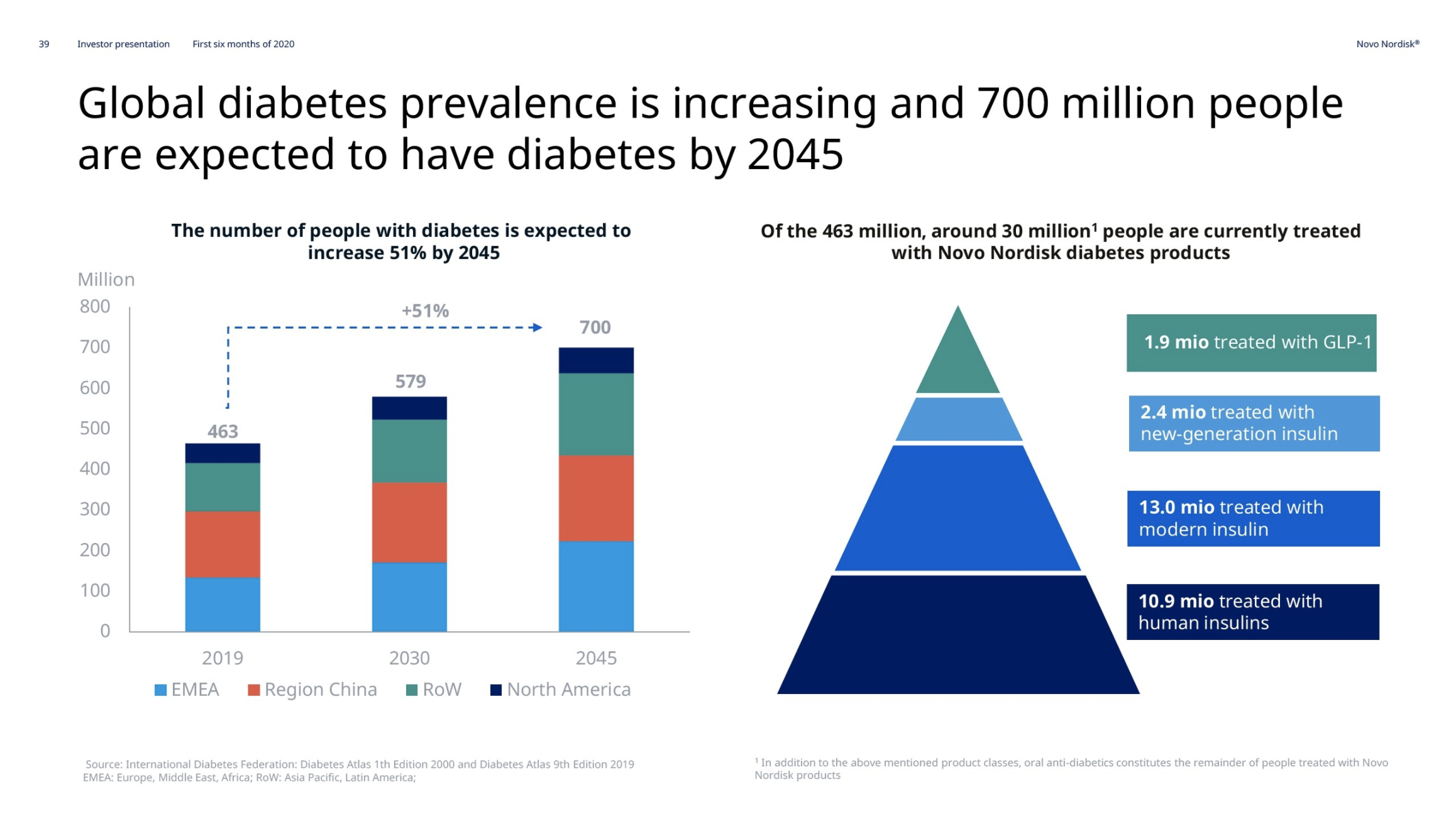

Enormous Market 🌍

Over 813 million individuals worldwide are affected by obesity.

Low Penetration 🚀

Only 1 million patients currently use obesity drugs—indicating vast room for growth.

Dueling Giants 🌌

Only Lilly and Novo Nordisk have approved GLP-1 obesity therapies, and both are far ahead of competitors in development and market presence.

Yes, Novo Nordisk’s near-term prospects may look cloudy: the company faces patent cliffs, new competition, and regulatory hurdles. But given the scope of the global obesity crisis and Novo’s proven GLP-1 expertise, the waters ahead might still offer lucrative opportunities—if investors are prepared to weather the volatility.

Disclaimer: This post is for informational purposes only and does not constitute financial advice.