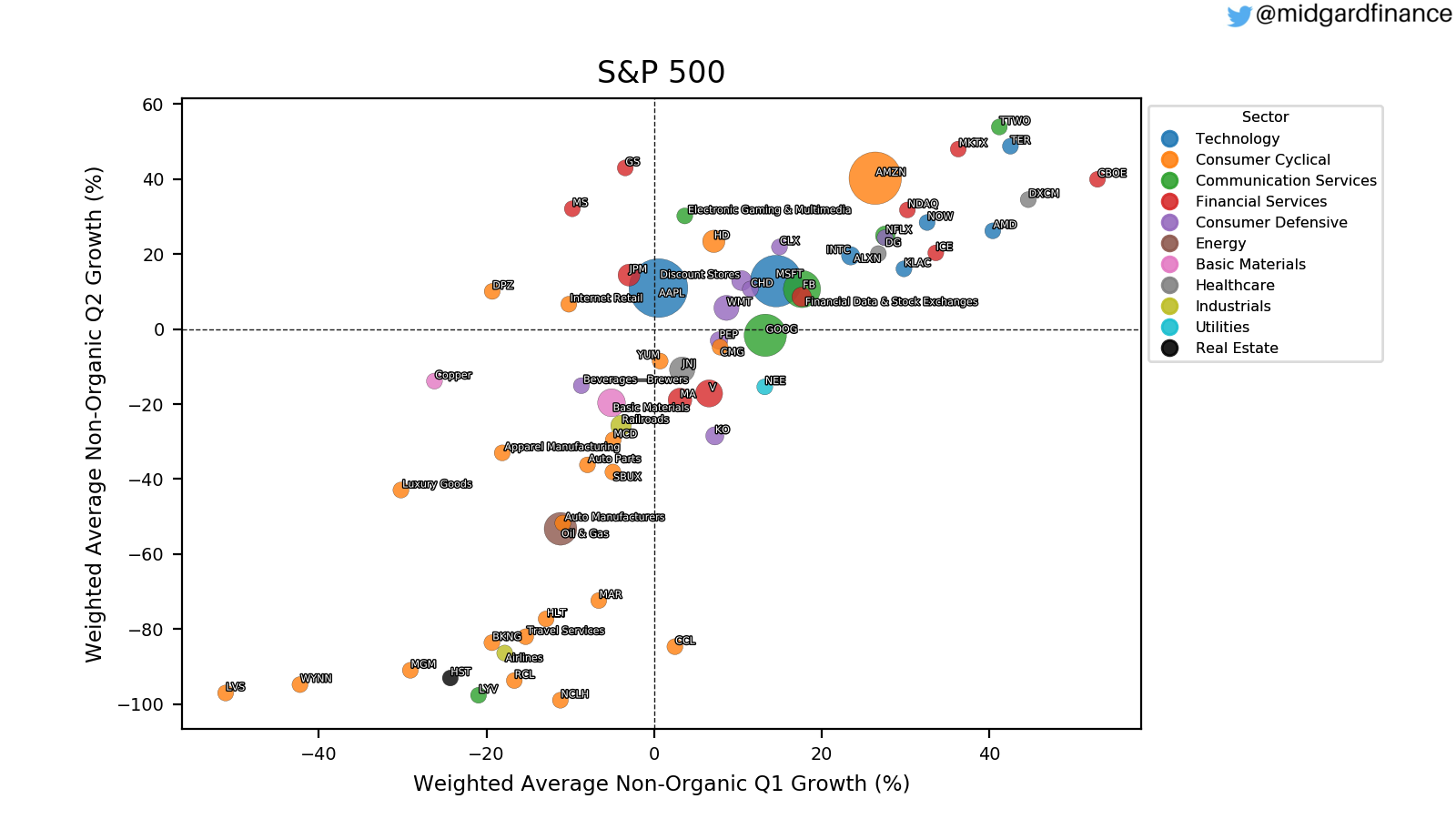

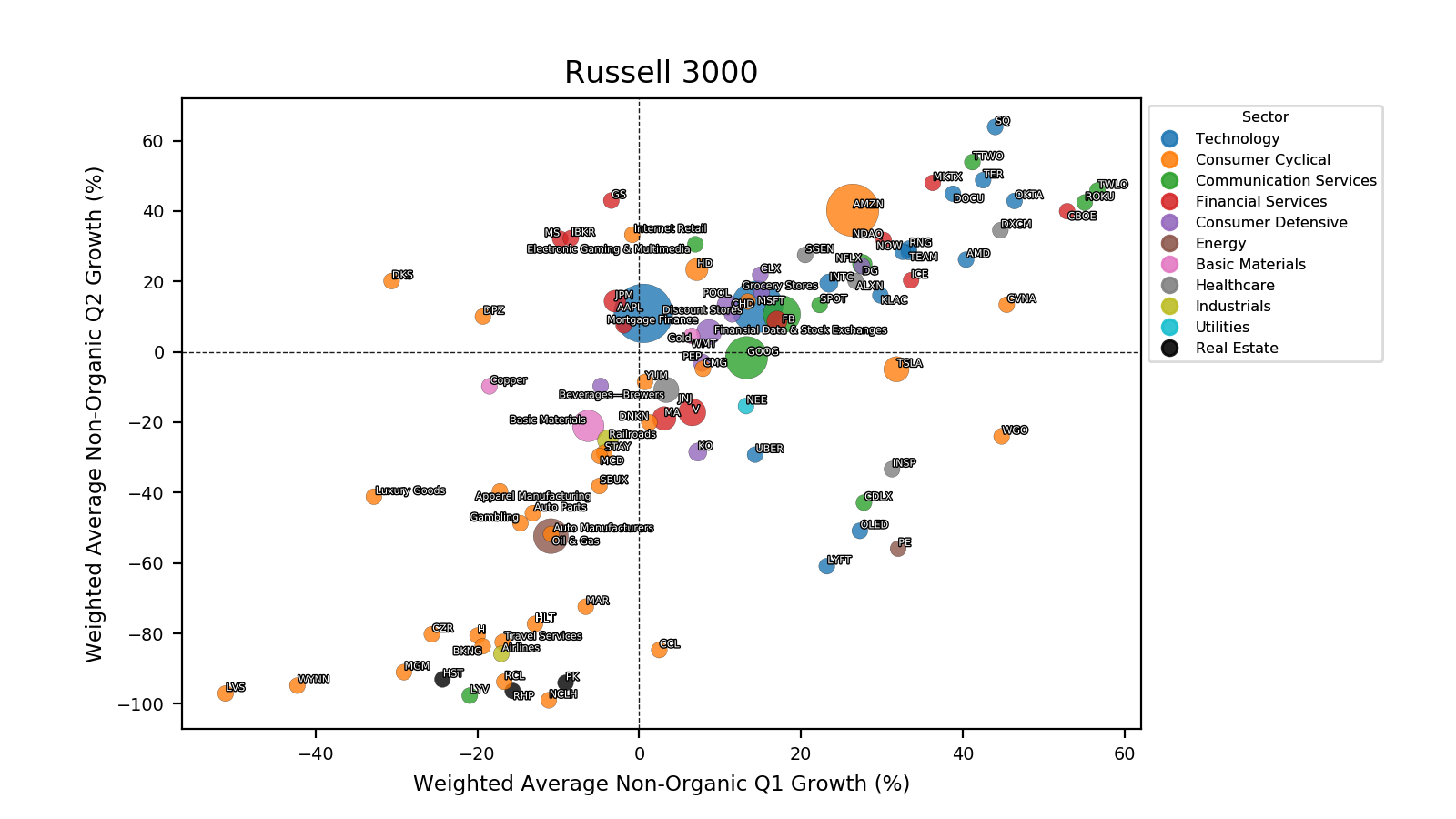

The first and second quarter of 2020 were unusual in many ways. More than a third of S&P500 companies temporarily or permanently withdrew guidance for the full year due to uncertainty surrounding impacts from COVID-19 according to FactSet. This article seeks to visualize the growth in each of the two quarters by sector and industry.

The bubble plot below shows the growth in Q1 on the x-axis and Q2 on the y-axis for selected sectors, industries and companies of the S&P 500 and the Russell 3000. The marker sizes represent market capitalization. The colors represent sectors.

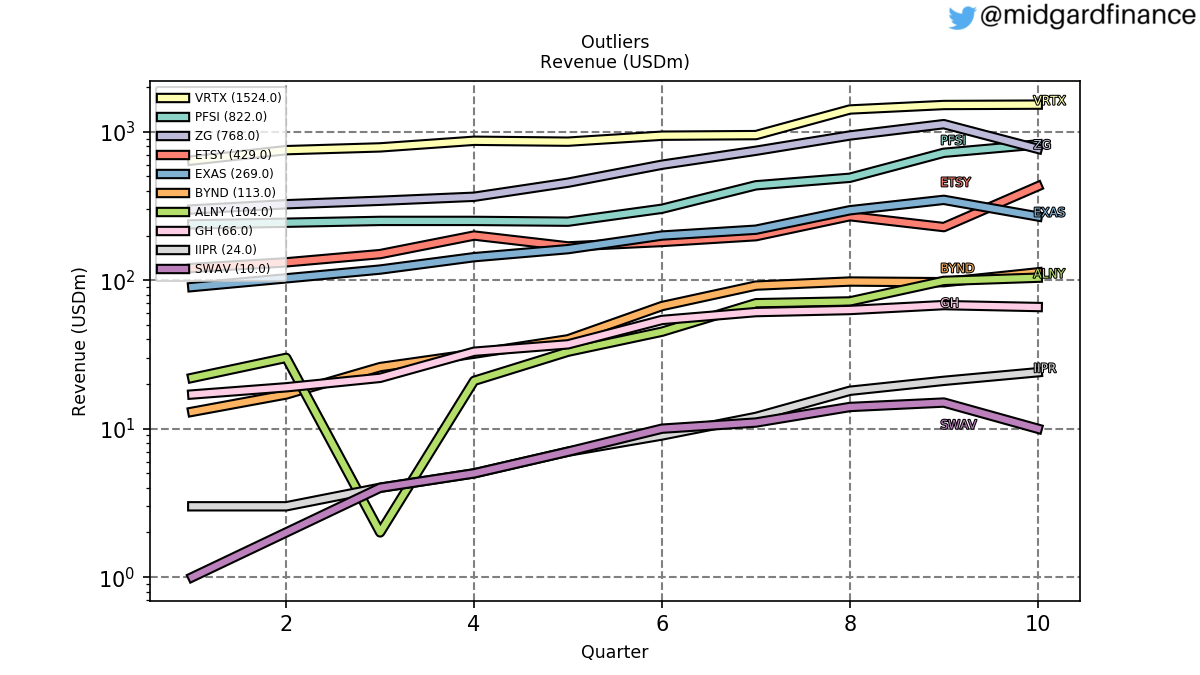

Some companies are outliers and are not displayed in the bubble charts. Instead a time series of their revenue is plotted below. Zillow ($ZG) is one of these outliers. In Q1 revenue increased by 148% due to Zillow Offers growing 499%. Vertex ($VRTX) had Trikafta® approved in October 2019 and it is currently one of the fastest growing drugs. Beyond Meat ($BYND) grew by triple digits in Q1. Beyond Meat ($BYND) grew by triple digits in Q1 and is an outlier.

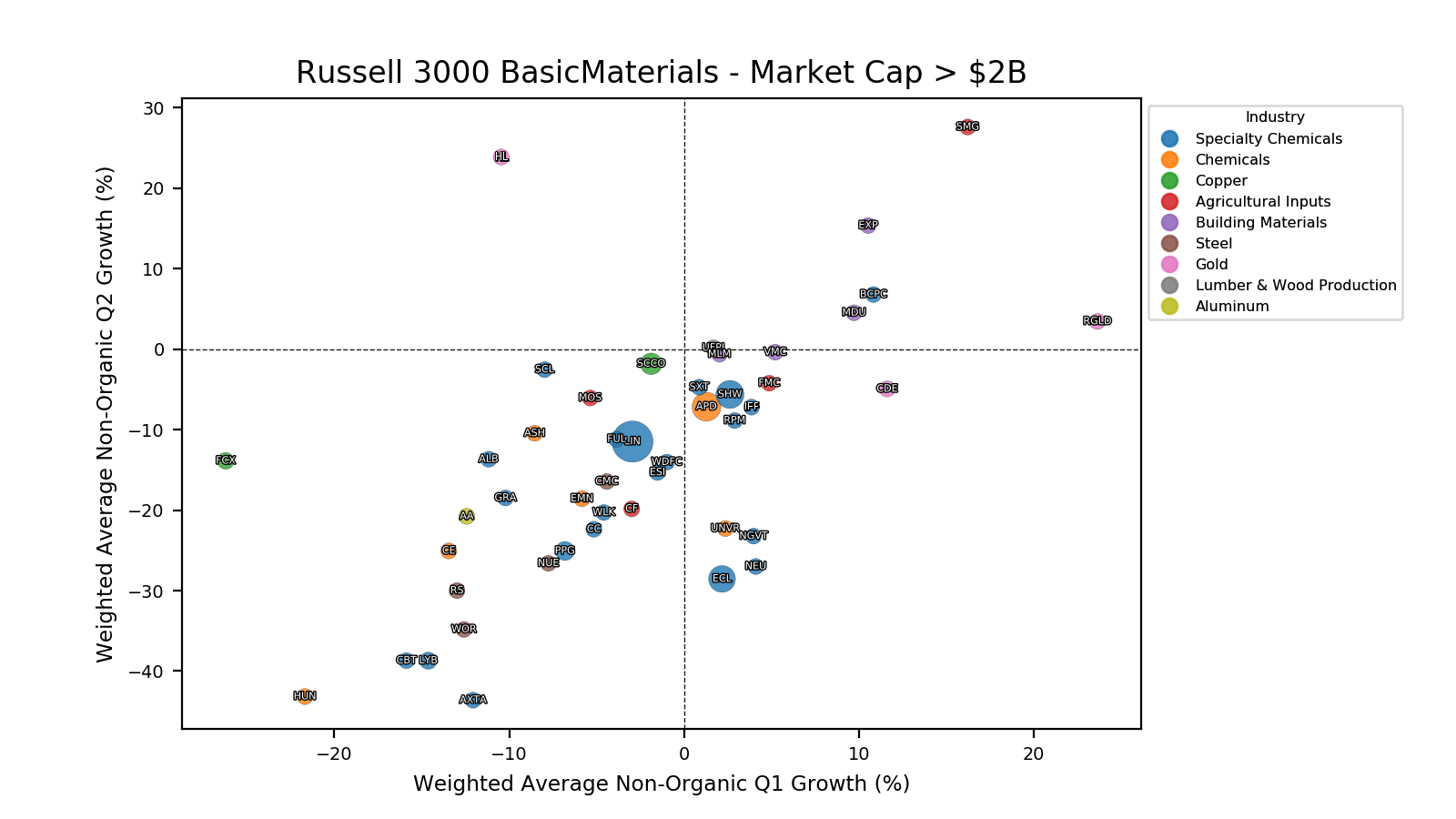

Basic Materials

In Basic Materials the copper miner Freeport McMoran ($FCX) experienced a slump. The copper price has since rebounded by 50% from $2 to $3 per pound.

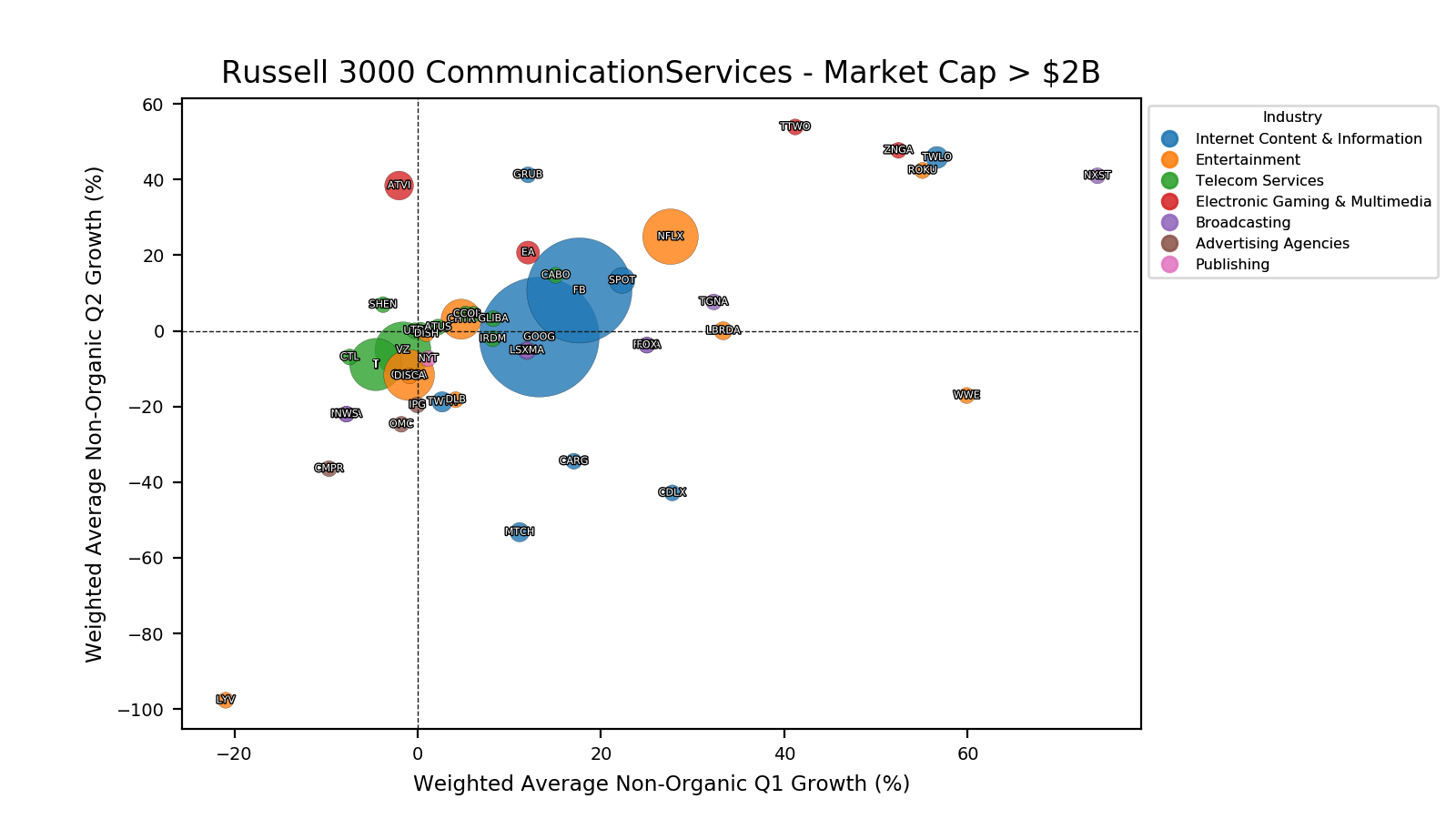

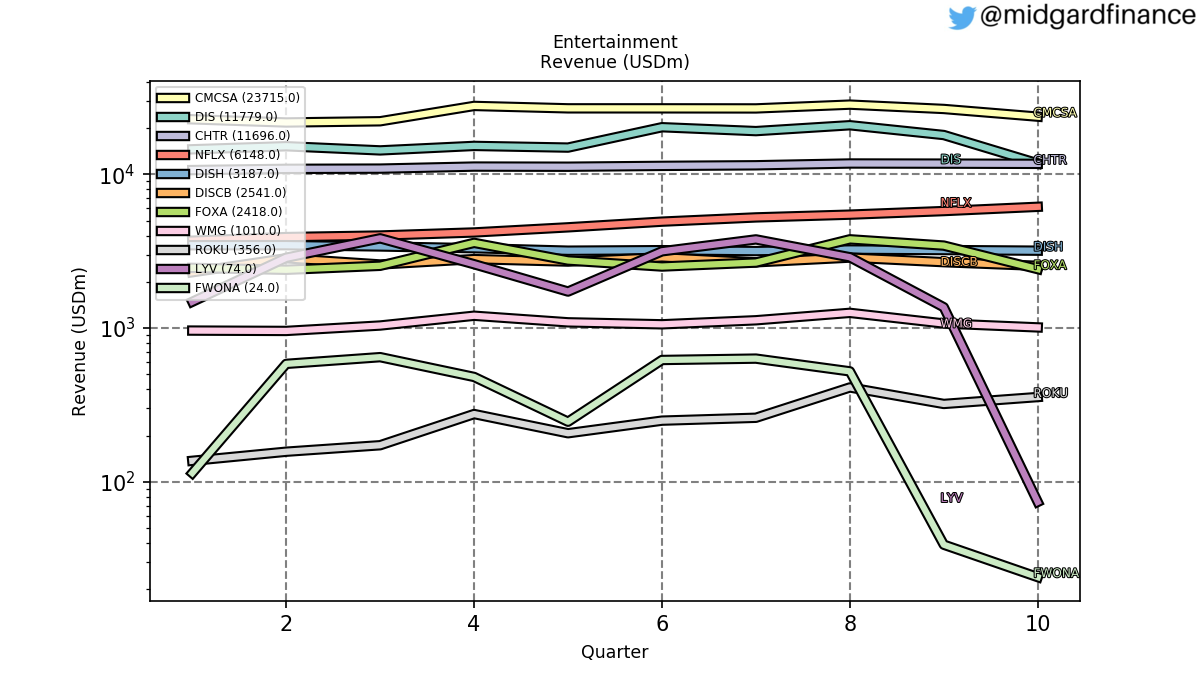

Communication Services

COVID-19 did not affect all entertainment companies. The concerts of Live Nation ($LYV), the Grands Prix of Formula One ($FWONA) and the theme parks of Disney ($DIS) were affected, whereas streaming services such as Netflix ($NFLX) and Spotify ($SPOT) and gaming thrived. The real estate service Zillow ($ZG) grew by triple digits in Q1 and is an outlier.

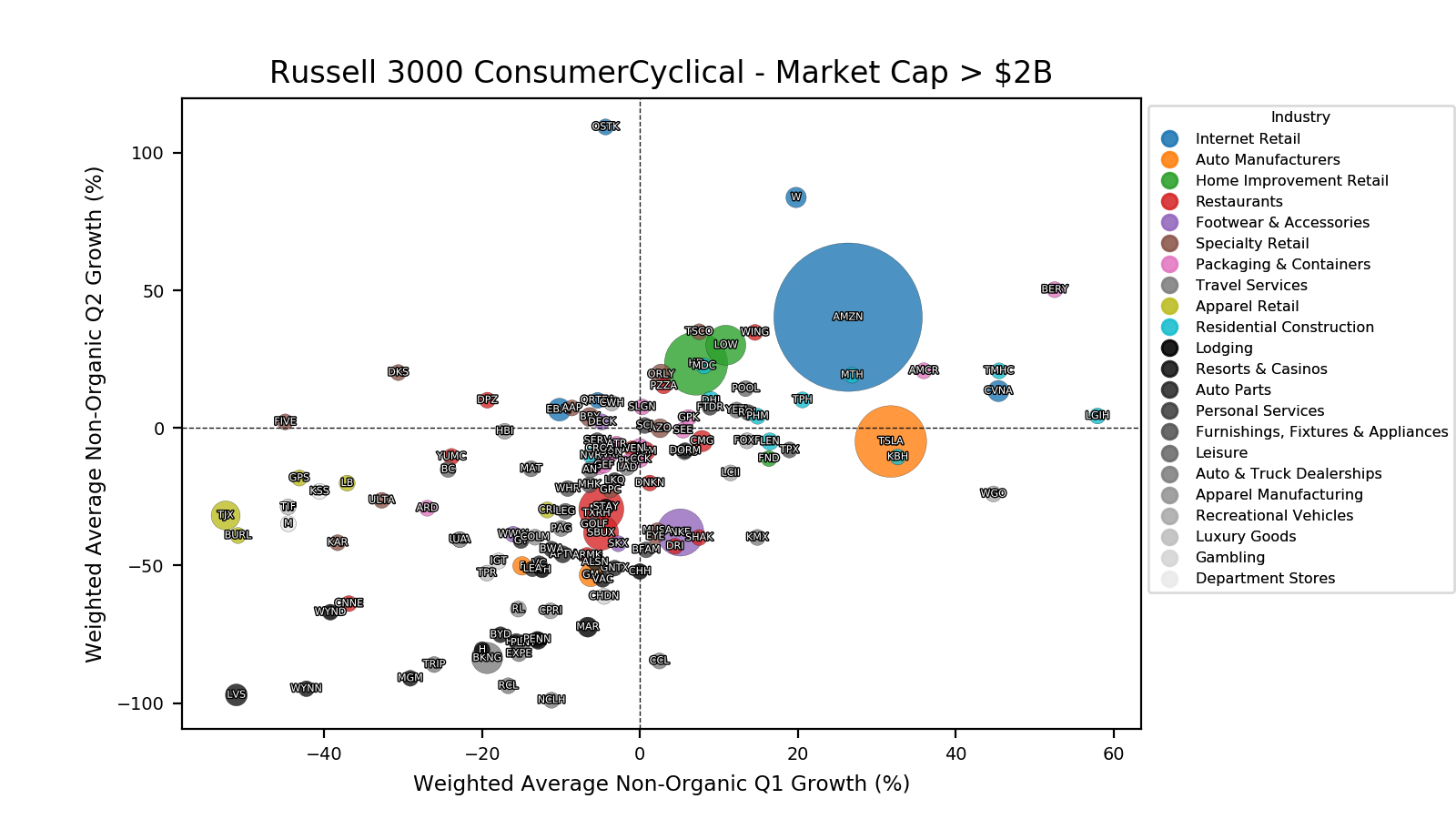

Consumer Cyclical

The Consumer Cyclical sector saw some big shifts within and between industries in Q1 and Q2.

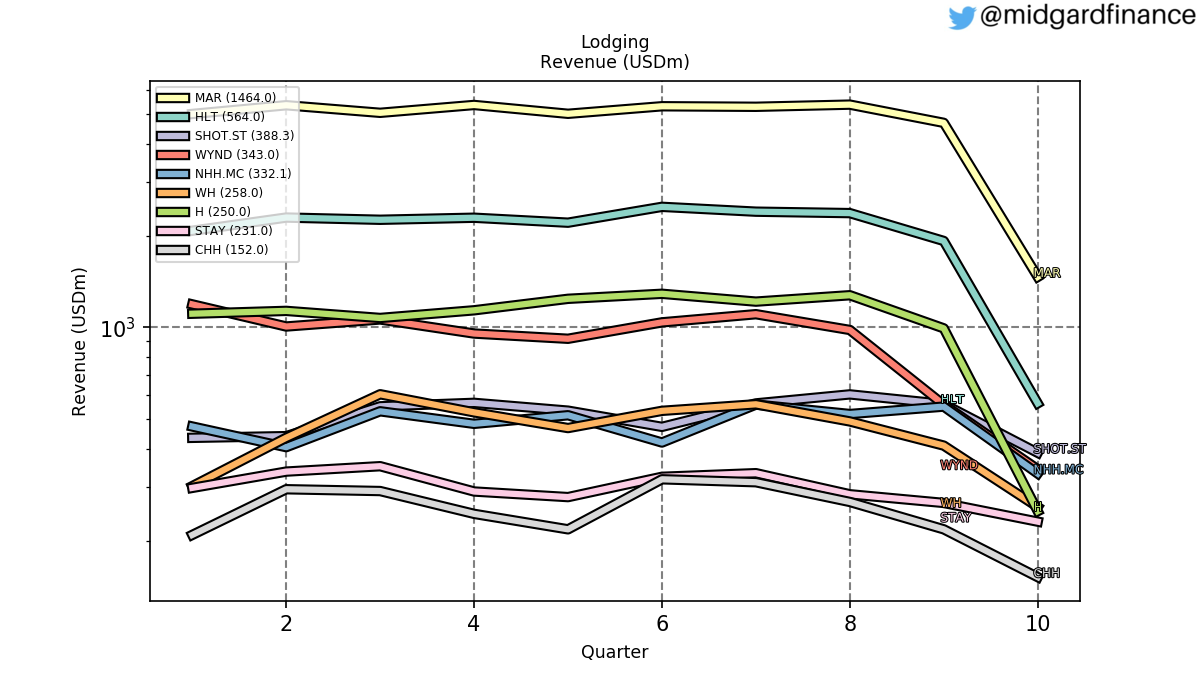

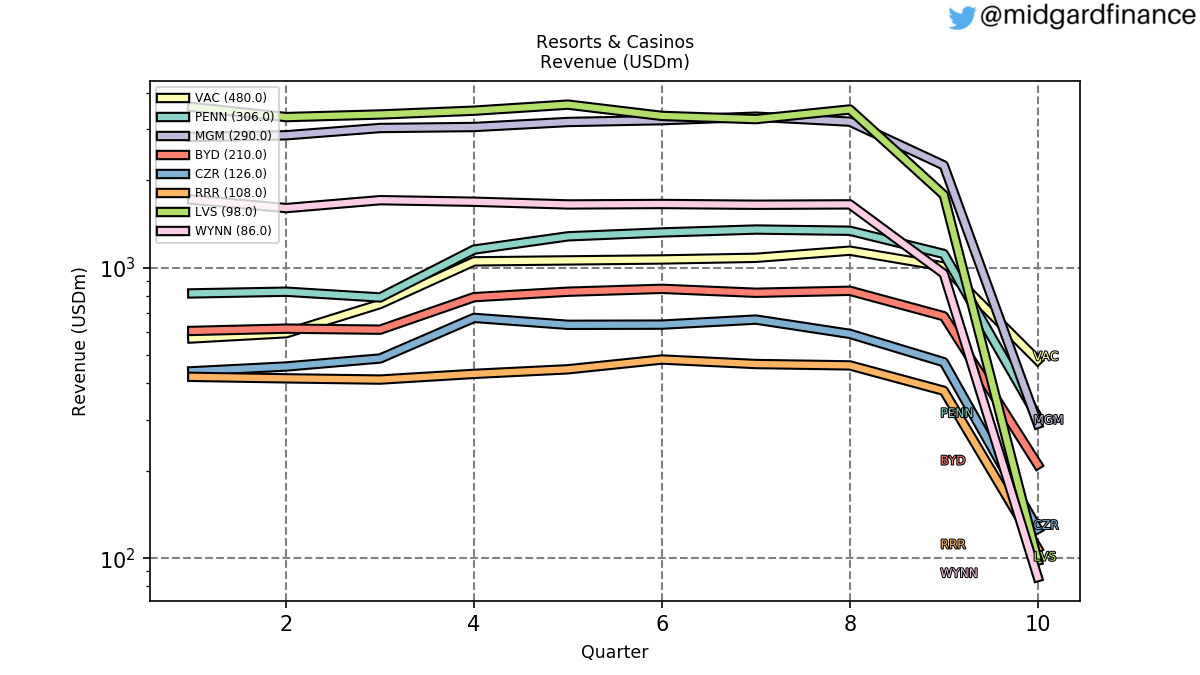

Some of the industries most impacted by COVID-19 were Casinos & Resorts – e.g. Las Vegas Sands ($LVS), Wynn Resorts ($WYNN), MGM Resorts ($MGM), Caesars Entertainment ($CZR) – Travel Services – e.g. Booking ($BKNG), Expedia ($EXPE), TripAdvisor ($TRIP) – Cruise Lines – e.g. Royal Caribbean ($RCL), Norwegian Cruise Line ($NCLH), Carnival ($CCL) – Hotels – e.g. Hilton ($HLT), Hyatt ($H), Marriott ($MAR).

Retail

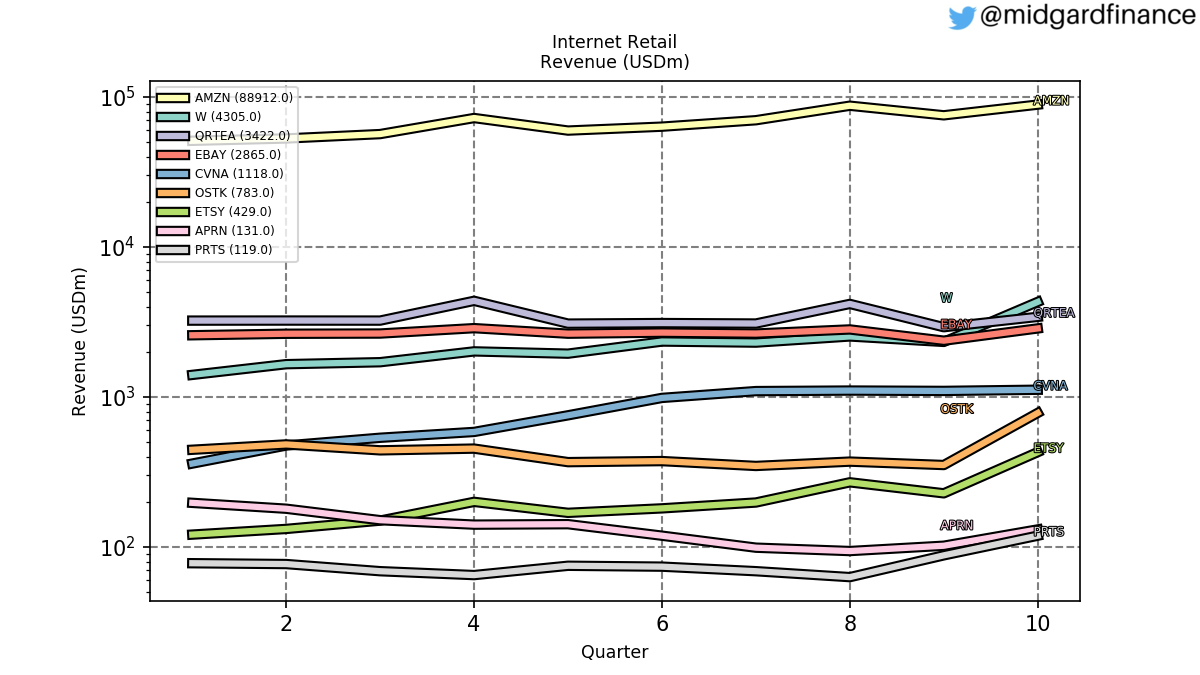

The internet retailer Overstock ($OSTK) experienced triple digit growth in Q2. Amazon ($AMZN) continued its growth trajectory in Q1 and Q2.

The retailer Dick’s Sporting Goods ($DKS) is predominantly brick and mortar, but it saw triple digit online growth in Q2. Other retailers that saw growth in Q2 include Tractor Supply Company ($TSCO) and the home improvement retailers Lowe’s ($LOW) and Home Depot ($HD).

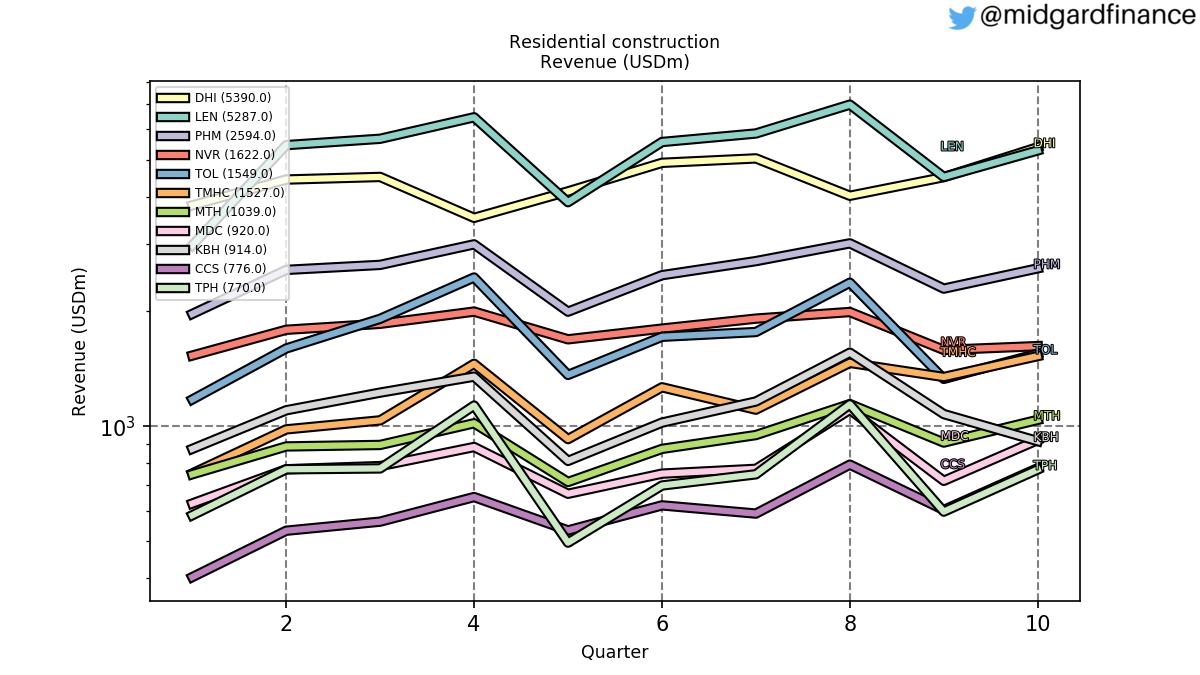

Residential Construction

Residential Construction such as Pulte Homes ($PHM) has done well in the previous two quarters, which is probably attributable to the low interest environment and the low mortgage rates. PennyMac Financial Services ($PFSI) and other mortgage finance companies also experienced growth in Q2.

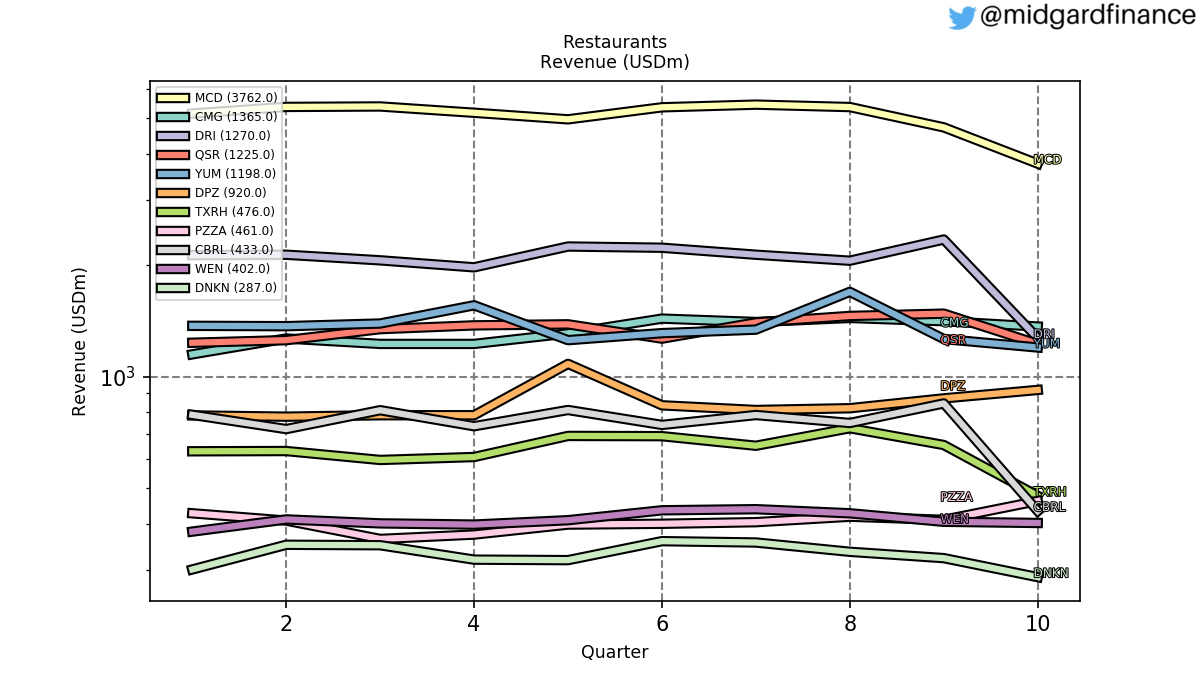

Restaurants

Restaurants not doing deliveries lost revenue. Starbucks ($SBUX) and McDonald’s ($MCD) revenue fell by 38% and 30% respectively in the quarter ended June, whereas Domino’s Pizza ($DPZ) did much better with 16% growth in Q2.

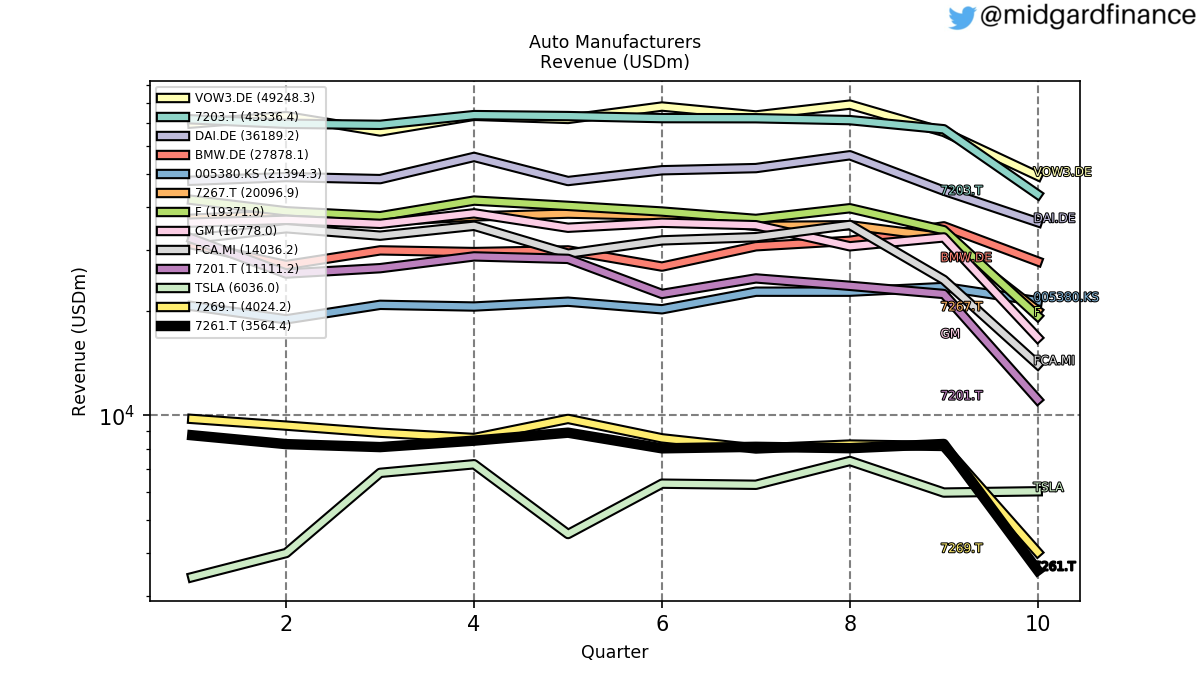

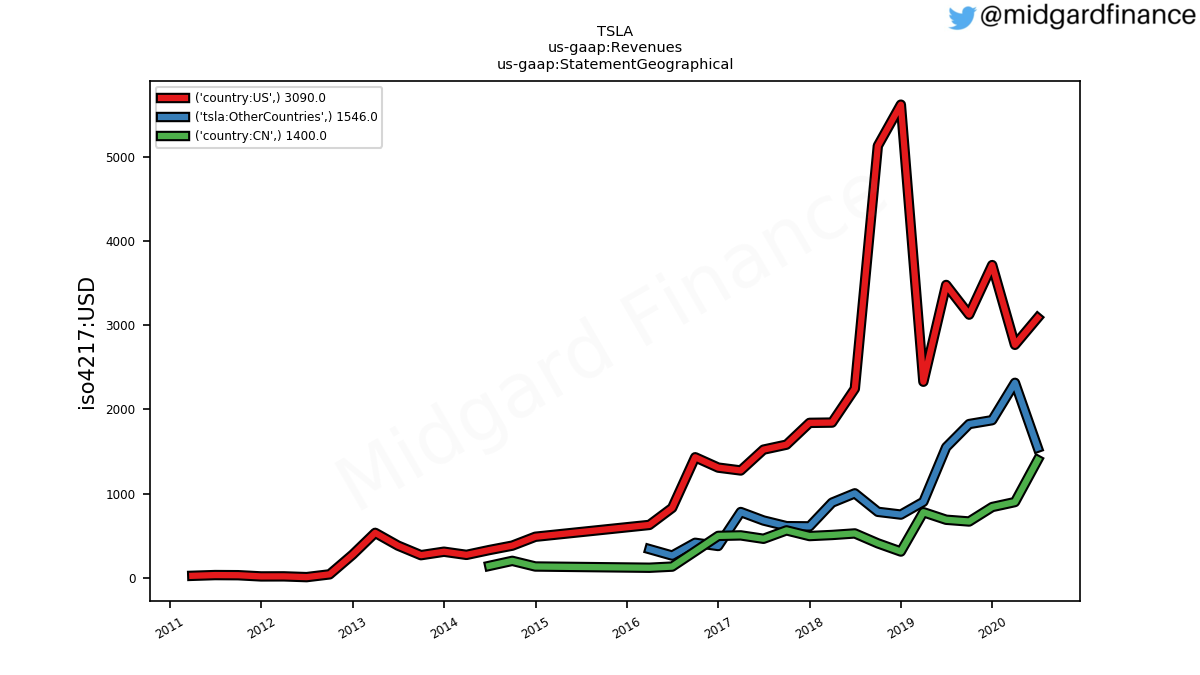

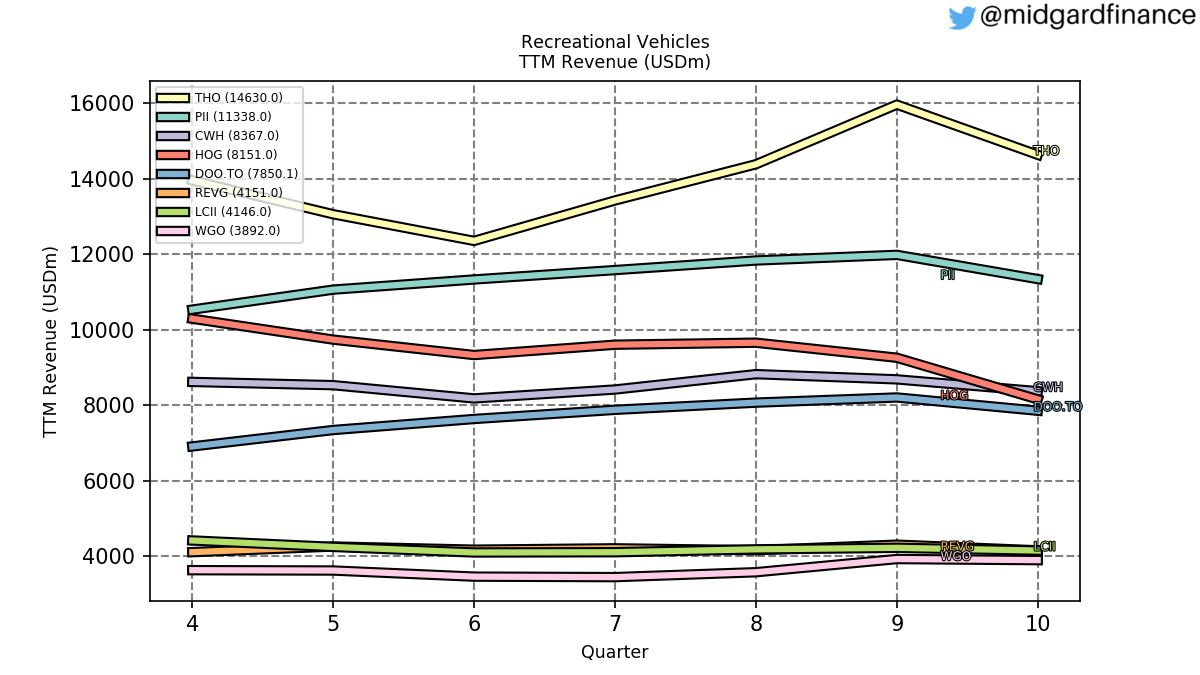

Auto and RV manufacturers

The auto manufacturer Tesla ($TSLA) experienced a halted revenue growth in Q2. The US, German and Japanese auto manufacturers such as Ford ($F), GM ($GM), Fiat Chrysler ($FCAU), Toyota ($7203.T), Volkswagen ($VOW.DE), Daimler ($DAI.DE) and BMW ($BMW.DE) have experienced a slump in Q2, which quickly manifested itself in railroad volumes, which are again returning to normal.

EV registrations in Europe were up 131% YoY in July, but Tesla unit sales imploded by 76% YoY in Europe in July.

RV manufacturers such as Winnebago ($WGO) and Thor Industries ($THO) did not see a contraction of revenue like the auto manufacturers.

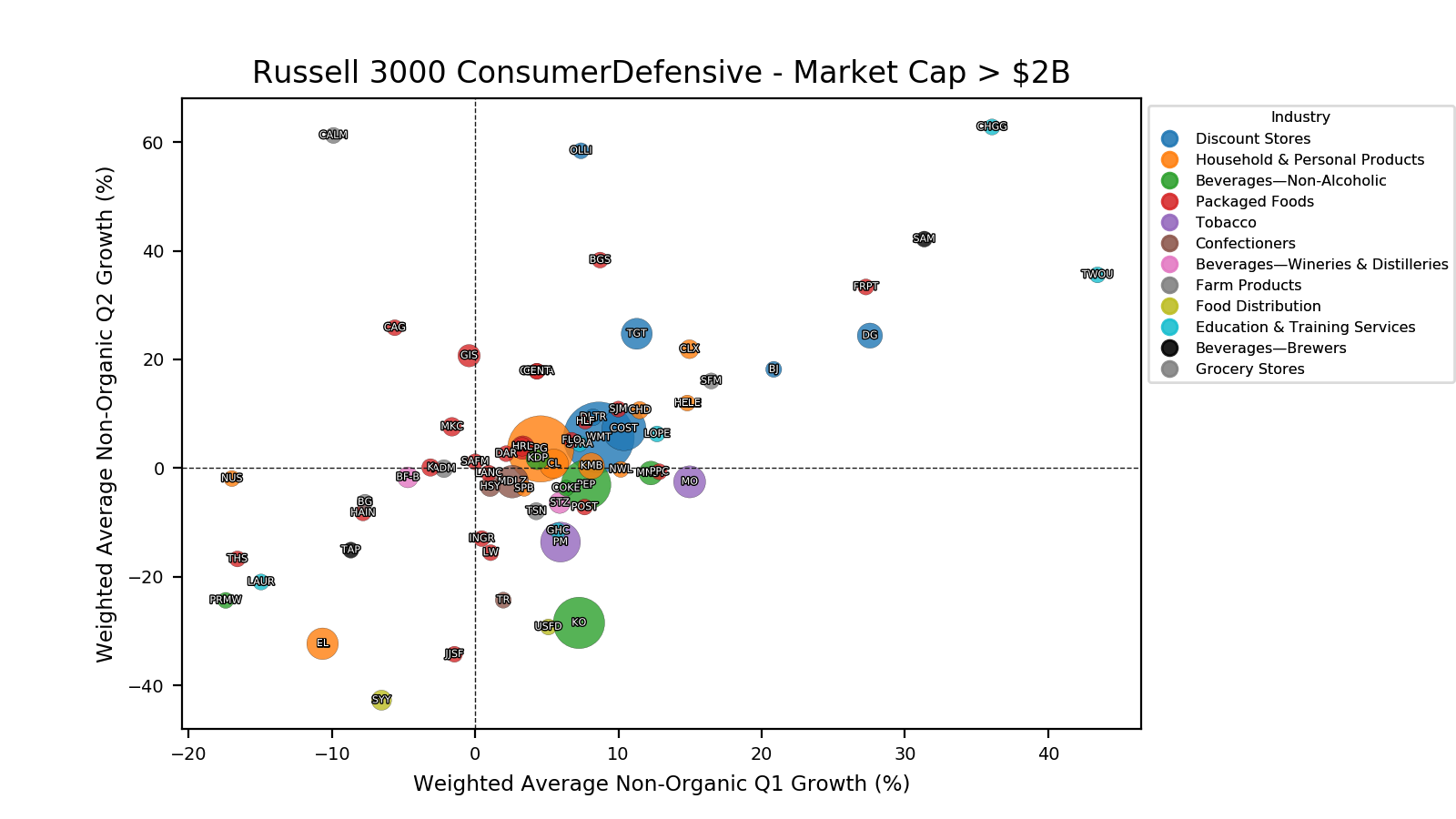

Consumer Defensive

In Consumer Defensive the bleach boom lifted sales at Clorox ($CLX). The companies Chegg and 2U operating in the industry Education & Training Services outpaced all other companies.

Lockdowns of on-site premises have affected the breweries. Despite this the brewer Boston Beer ($SAM) saw its sales increasing in Q2 and not only due to the acquisition of Dogfish Head.

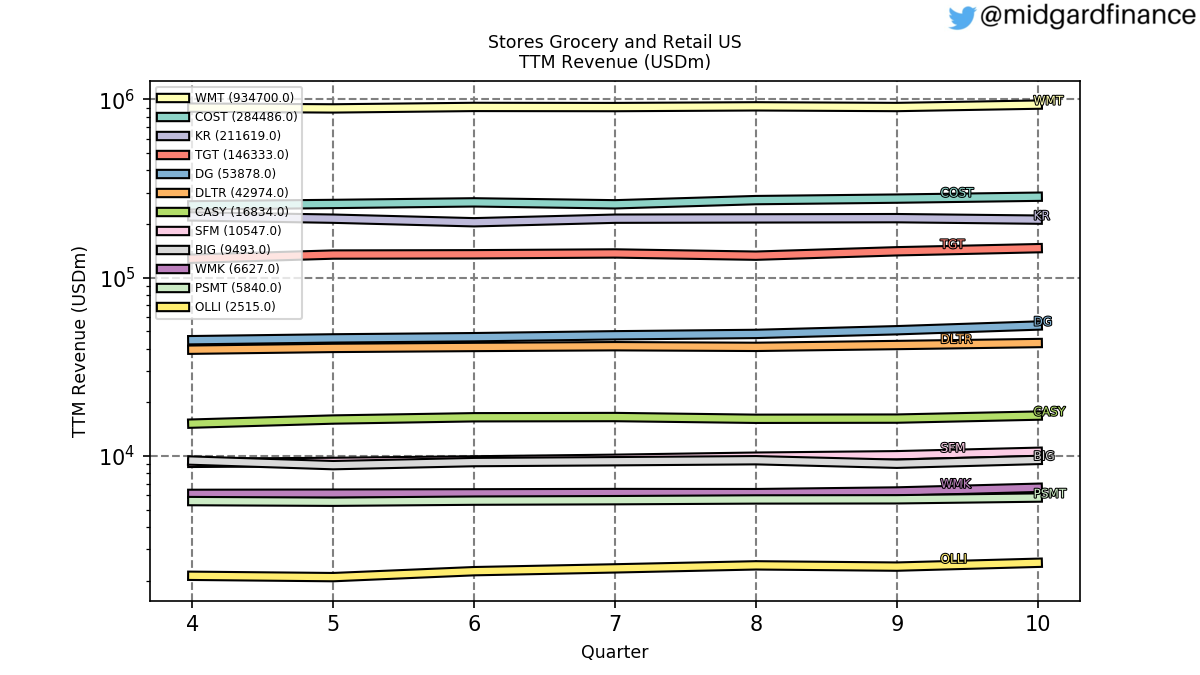

In retail grocery stores such as Kroger ($KR) and discount stores such as Walmart ($WMT) experienced growth in both Q1 and Q2. The discount store Dollar General ($DG) grew the fastest and experienced comparable sales growth of 21.5% in May, 17.9% in June and 17.2% in July.

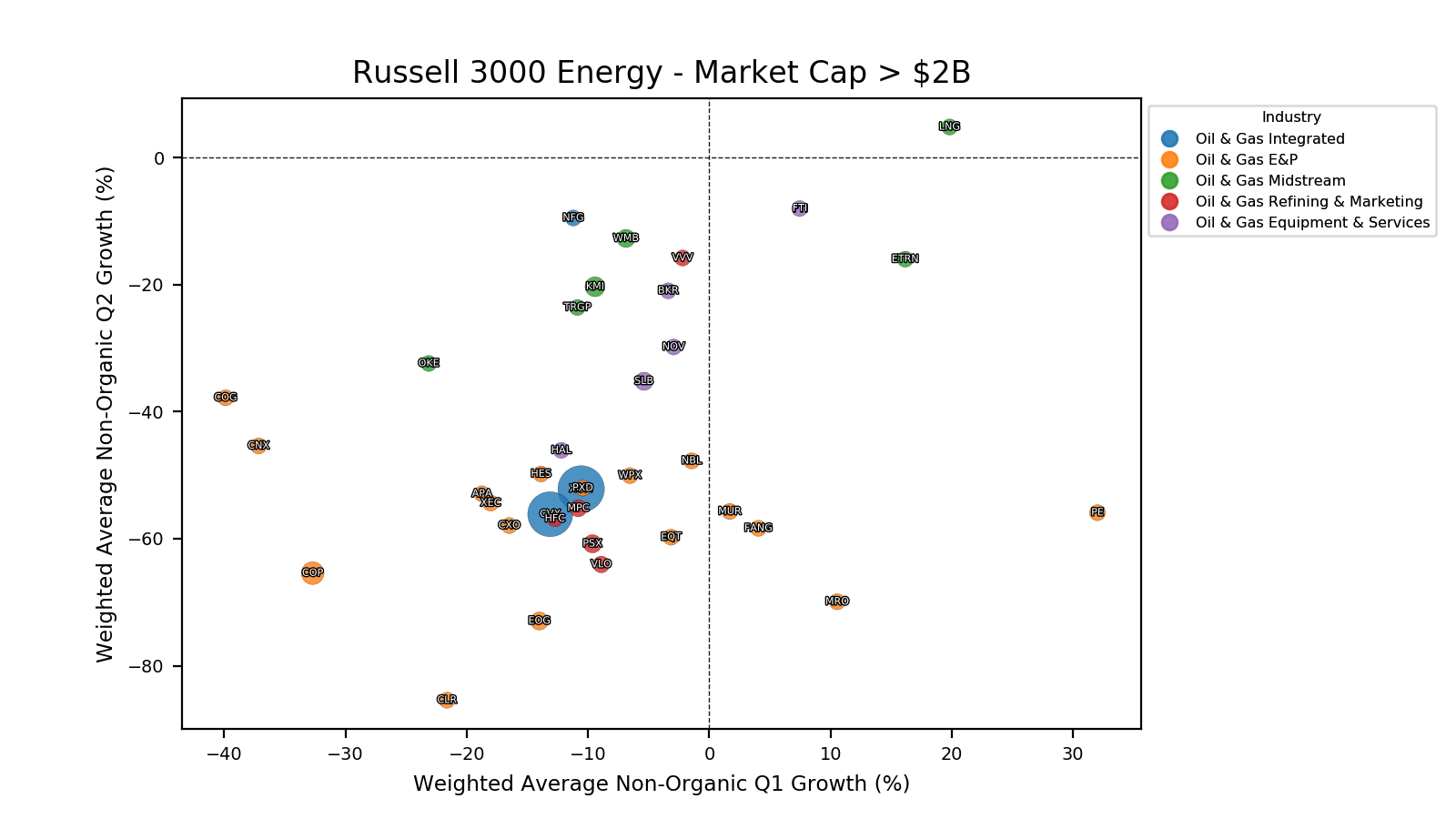

Energy

The plunge in oil prices affected Oil & Gas that coincided with the outbreak of COVID-19 and the oil price war between Russia and Saudi Arabia. In Energy most Oil & Gas companies took a severe beating, when oil futures briefly went to single digits in mid April. Q2 revenue at Exxon Mobil and Chevron dropped by more than 50%. Exxon Mobil leaves the Dow Jones Industrial Average at the end of August. Exploration & Production and Refining & Marketing was in general more affected than Midstream and Equipment & Services.

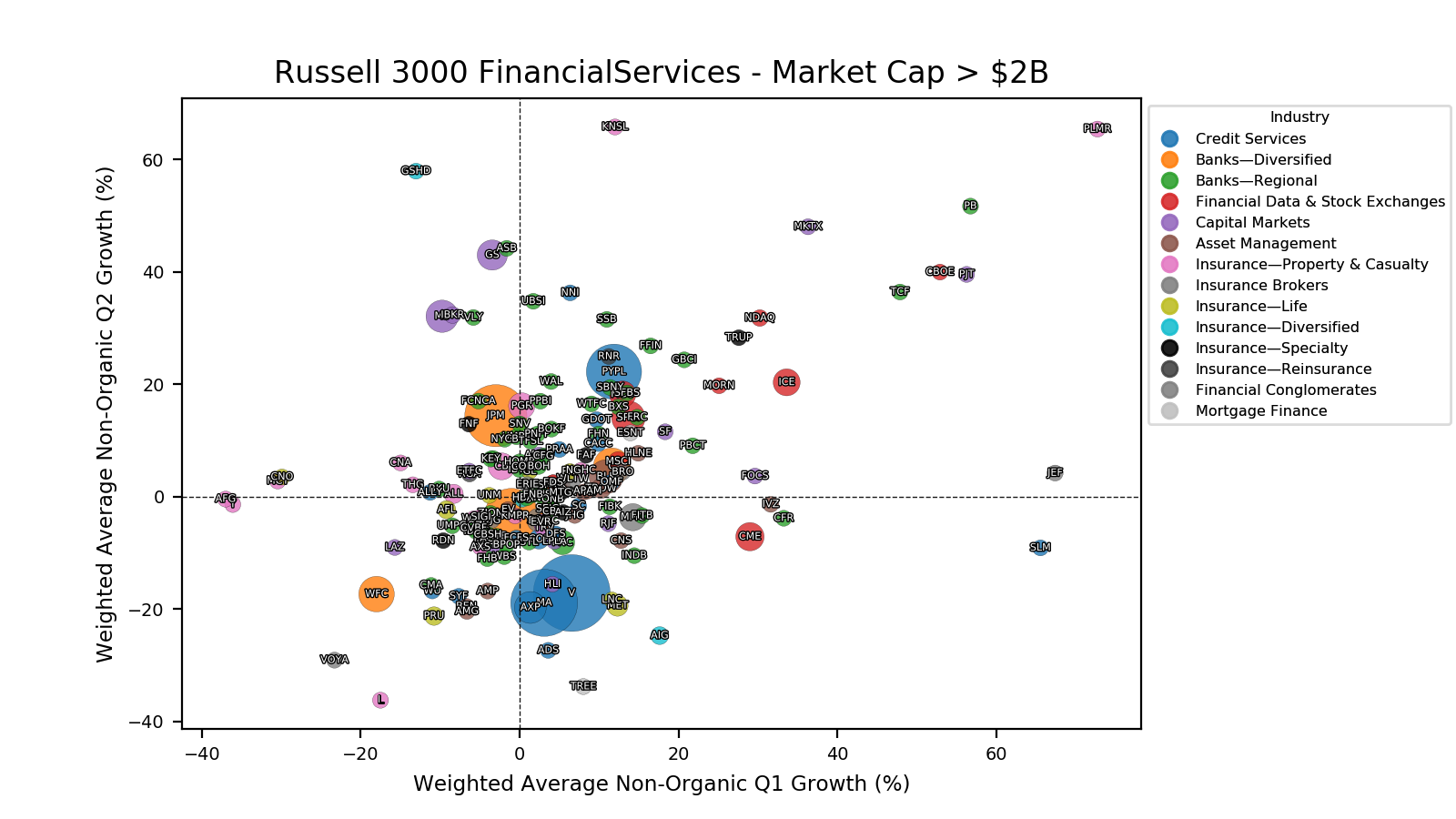

Financial Services

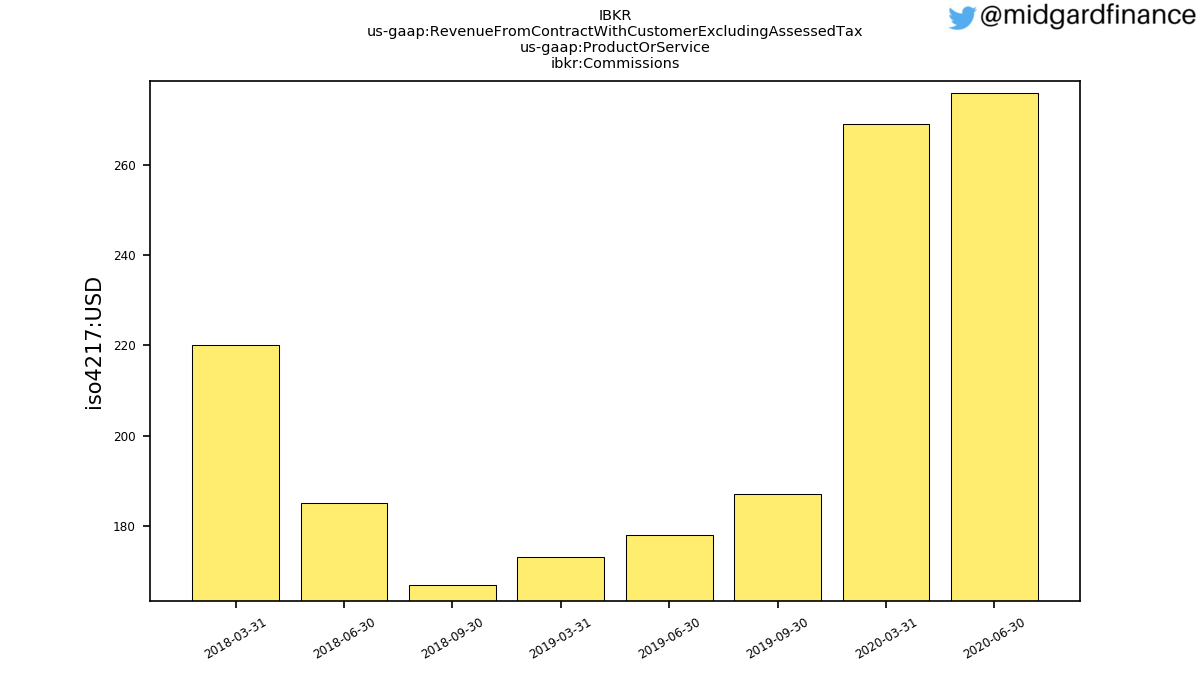

Financial Services was a mixed bag. COVID-19 affected credit card companies such as Visa ($V), Mastercard ($MA) and American Express ($AXP). On the contrary PayPal ($PYPL) continued its growth trajectory. The increased trading had a positive effect on exchanges ($CBOE, $NDAQ, $ICE). Morgan Stanley ($MS) and Goldman Sachs ($GS) both experienced negative growth in Q1 but positive growth in Q2 as did the low cost broker Interactive Brokers ($IBKR) and JP Morgan ($JPM).

Increased commission fees drove the growth at Interactive Brokers.

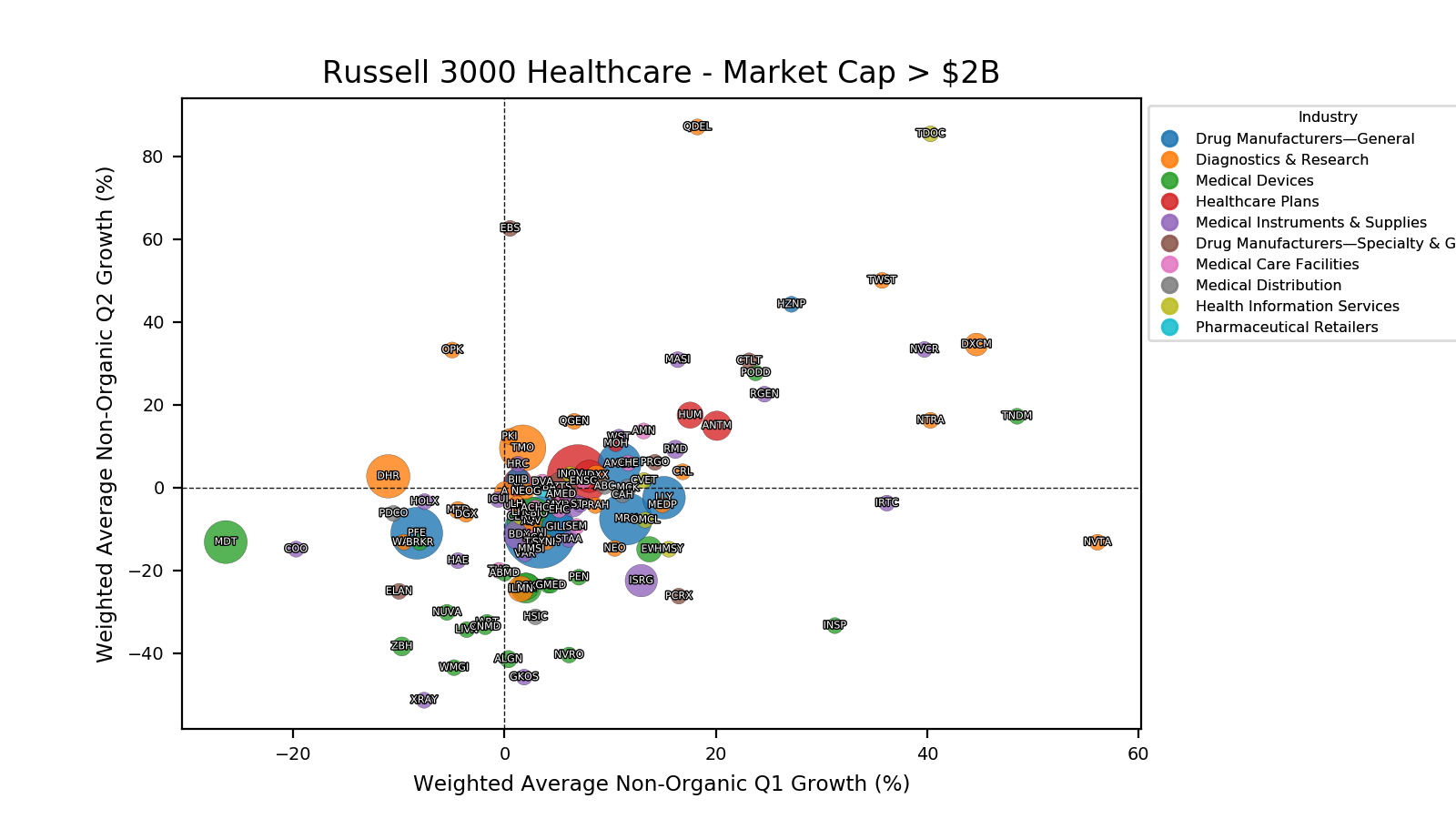

Healthcare

In Healthcare the companies Moderna ($MRNA), Translate Bio ($TBIO), Novavax ($NVAX) doing COVID-19 vaccine research saw triple- and quadruple-digit growth in Q2 due to government grants and collaborations with big pharma and they have thus been excluded. Due to new collaborative agreements the outliers Assembly Biosciences ($ASMB) and ChemoCentryx ($CCXI) have also been excluded. Qiagen ($QGEN), which nixed their merger agreement with ThermoFisher ($TMO), experienced growth due to COVID-19 testing. No healthcare company experienced as much revenue growth in Q2 as Teladoc Health ($TDOC), which was already growing at a steady rate just like Dexcom ($DXCM) and Tandem Diabetes Care ($TNDM), which both operate in the diabetes field. Other fast growers are Twist Bioscience ($TWST), NovoCure ($NVCR), CareDx ($CDNA) and Veeva Systems ($VEEV).

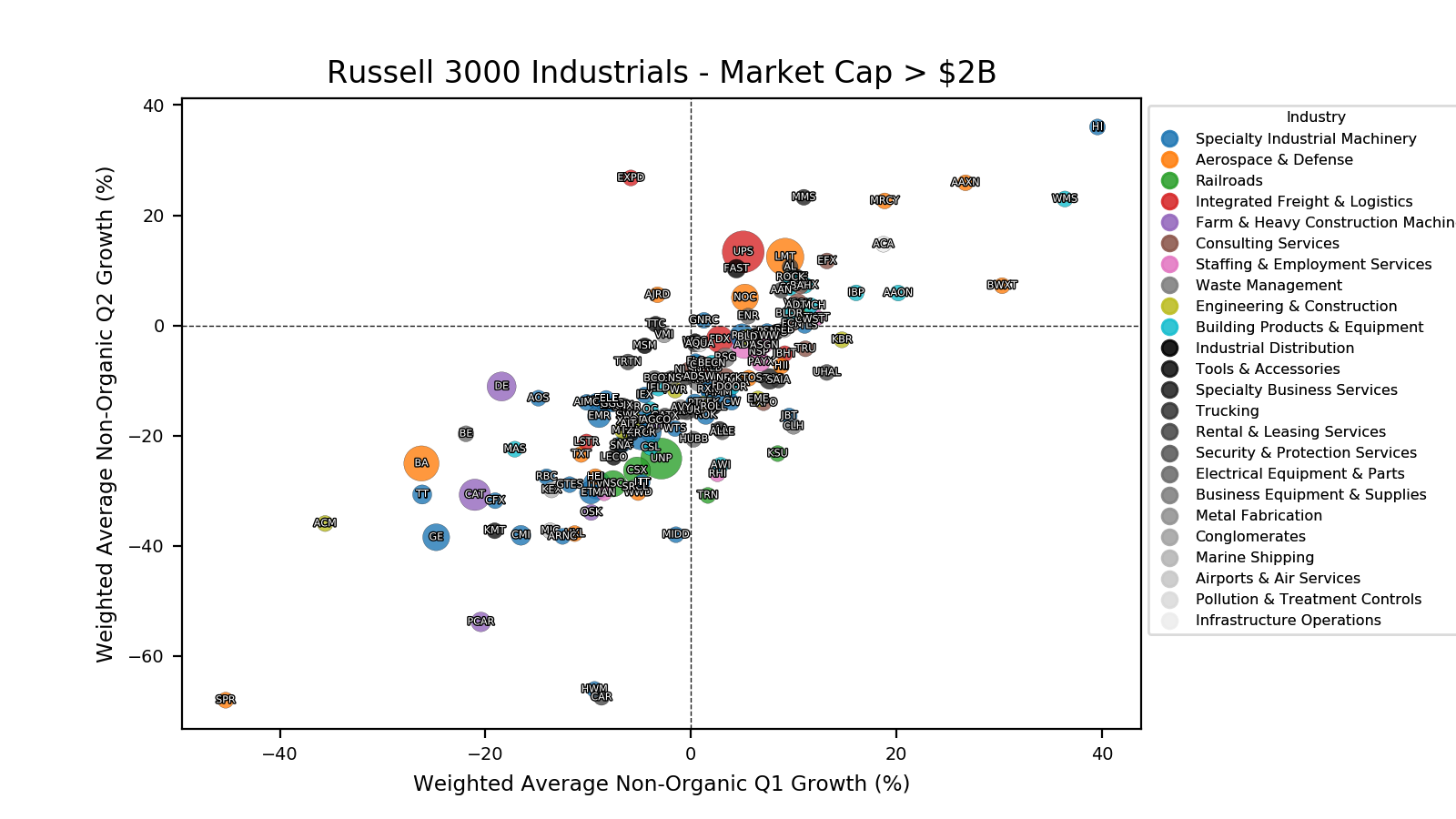

Industrials

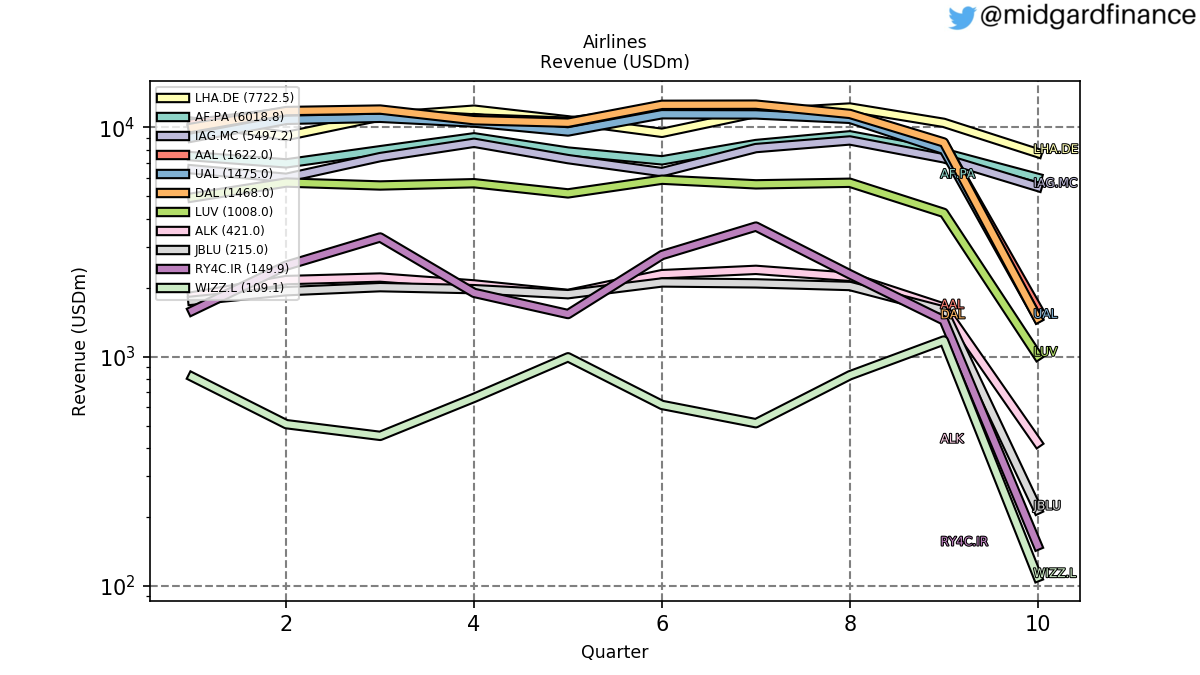

Lots of industrial companies have been affected by COVID-19, but none as much as the airlines ($LUV, $AAL, $UAL, $DAL, $JBLU, etc.) and the aviation industry; e.g. Boeing ($BA), General Electric ($GE), Spirit AeroSystems ($SPR), etc.

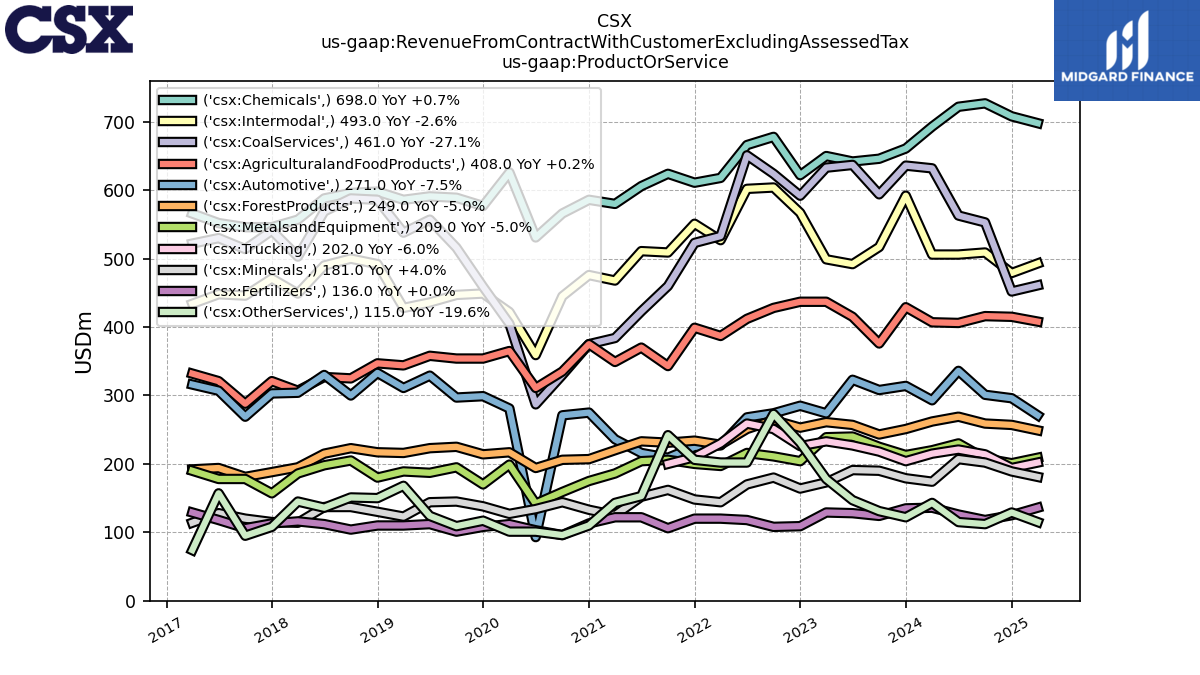

The railroads experienced a steep decline in traffic in Q2, but weekly volumes have recovered significantly since then.

Railroad revenue shrank due to auto volumes.

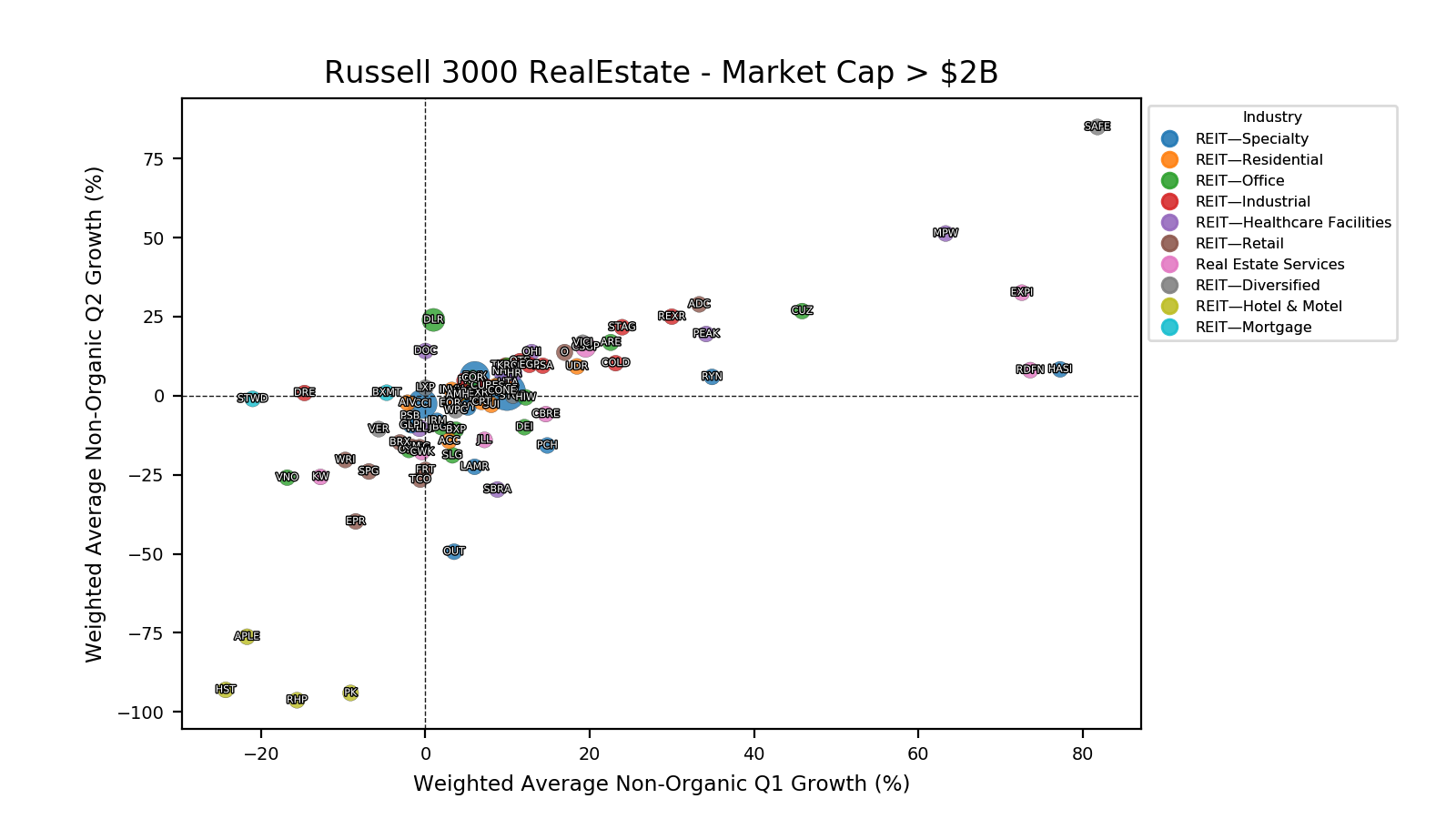

Real Estate

In Real Estate the Hotel & Motel REITs ($APLE, $HST, $RHP, $PK) have seen revenue declines of nearly 100% in Q2. The retail REITs have seen their revenue decline in Q2 due to some tenants being unwilling to pay the rent and others going bankrupt. The merger between the retail REITs Simon Property Group ($SPG) and Taubman Centers ($TCO) was cancelled.

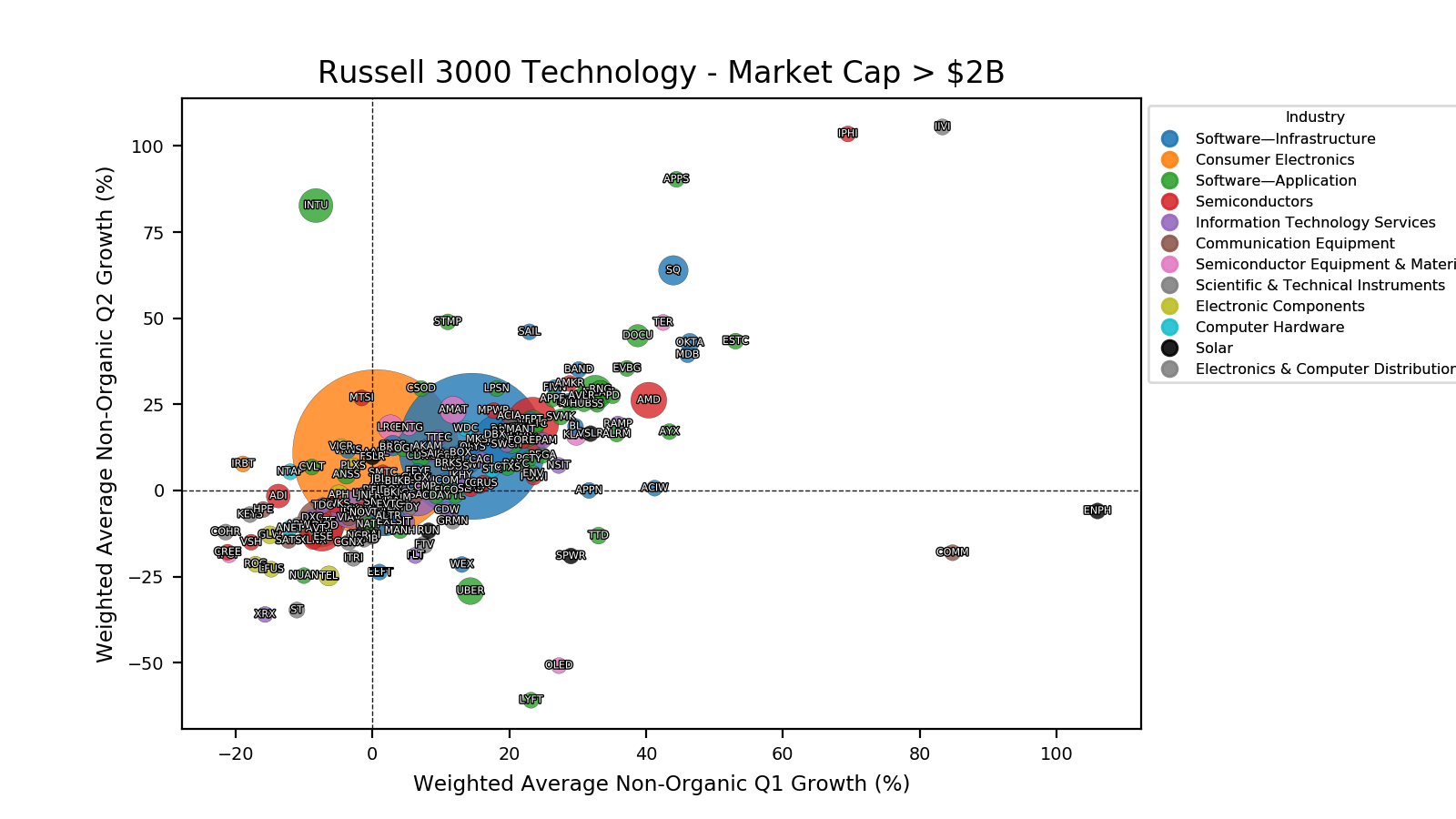

Technology

In Technology Microsoft ($MSFT) was one of many software companies growing in Q1 and Q2. The semiconductor companies Intel ($INTC), KLA Corp ($KLAC), AMD ($AMD), Teradyne ($TER) all experienced positive revenue growth in Q1 and Q2 despite some of them having murky clouds ahead of them. The ride sharing services Uber ($UBER) and ($LYFT) saw their revenue plummeting in Q1 and Q2. Uber experienced less of a decline due to deliveries with Uber Eats.

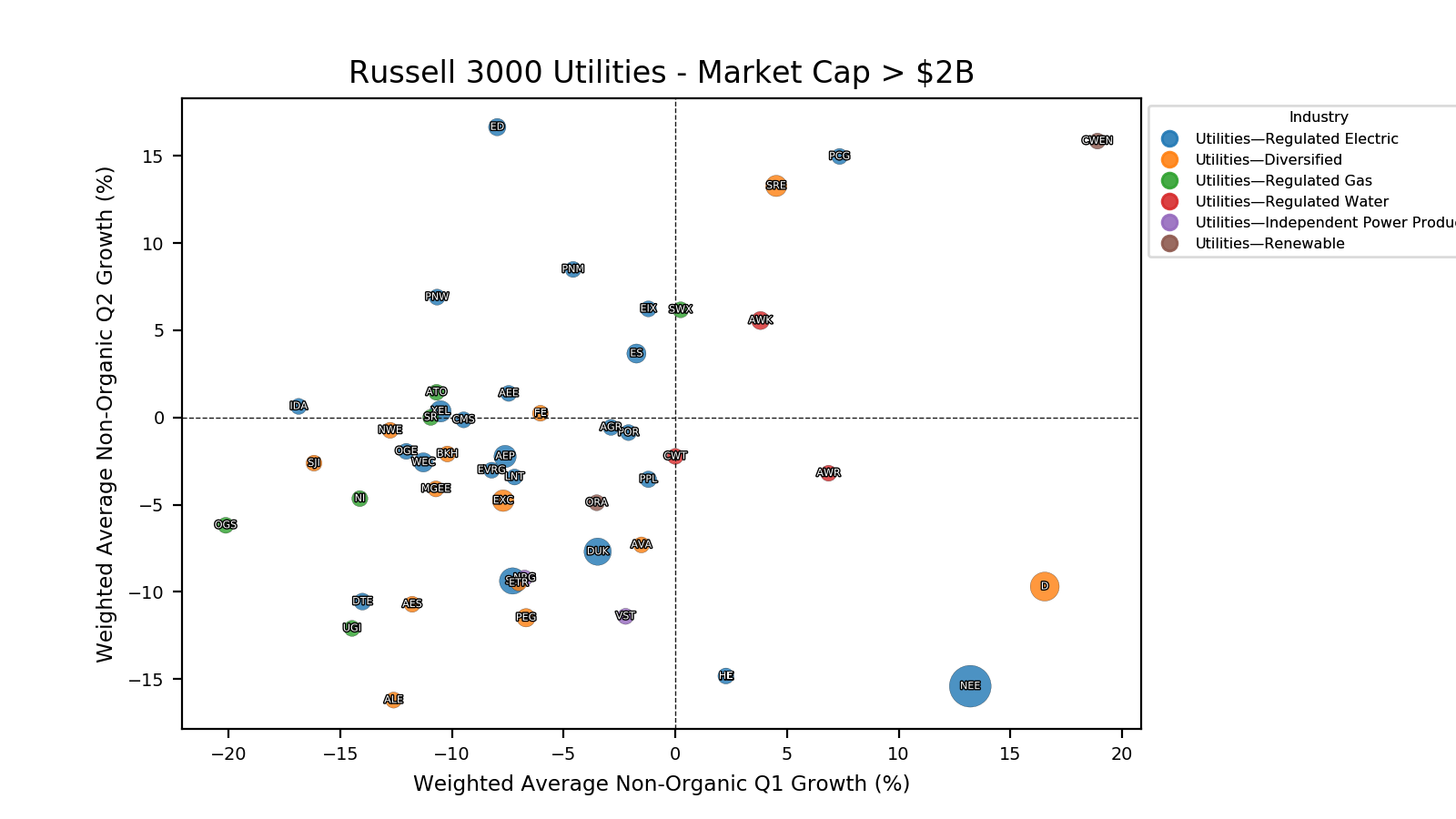

Utilities

In Utilities the water utilities ($AWK, $AWR, $CWT) have been less affected than the gas utilities.

Notes

More than 90% of all Russell 3000 companies have now reported a full quarter impacted by COVID-19; whether it’s from March to May – e.g. General Mills ($GIS) and Adobe ($ADBE) – April to June (i.e. most companies) or May to July – e.g. Walmart ($WMT) that reported on August 18th. Broadcom ($AVGO), Campbell Soup ($CPB) and Cooper Companies ($COO) will report for the fiscal quarter ended at the end of July on September 3rd. The figures will be updated accordingly.

The data is obviously backward looking, but data are available on a more current basis (e.g. weekly and monthly) for discount stores (e.g. Costco), railroads (e.g. reports from Association of American Railroads and Surface Transportation Board), auto manufacturers, etc.

Some companies such as industrials might have had large backlogs and will only have their revenue affected in upcoming quarters. It’s more relevant to look at guidance and outlook for the future in these cases.

Acquisitions and divestitures

The displayed growth is the non-organic GAAP growth. Significant acquisitions and divestitures within the past six quarters disqualified companies from inclusion. Some of these are Bristol-Myers ($BMY) acquiring Celgene ($CELG), AbbVie ($ABBV) acquiring Allergan ($AGN), Occidential ($OXY) acquiring Anadarko ($APC), FIS ($FIS) acquiring Worldpay ($WP), Fiserv ($FISV) acquiring First Data ($FDC), Wabtec $(WAB) acquiring GE Transportation, Transdigm ($TDG) acquiring Esterline ($ESL), Walt Disney ($DIS) acquiring 21st Century Fox by Disney, Truist ($TFC) after merger between BB&T ($BBT) and SunTrust Banks ($STI), ViacomCBS ($VIAC) after merger between Viacom and CBS. The gold miner Newmont Mining ($NEM) is excluded, because it acquired the Peñasquito gold mine in Mexico from Goldcorp in April 2009. DowDuPont ($DWDP) spun of Corteva ($CTVA) and DuPont ($DD) in 2019 and was renamed Dow Chemical ($DOW) and neither of these companies are displayed. NortonLifeLock ($NLOK) sold Symantec to Broadcom. VF Corp ($VFC) divested Kantoor Brands ($KTB).

Shareholder dilution

Not all growth creates value and in some cases growth is actually negative when adjusted for shareholder dilution. The table below summarizes the shareholder dilution and revenue growth YoY for Q2.

| Dilution (%) | Growth (%) | |

| CVNA | 43.5 | 13.4 |

| W | 30.4 | 83.7 |

| TSLA | 16.9 | -4.9 |

| MRNA | 15.8 | 407.7 |

| CRM | 15.1 | 30.2 |

| RNG | 14.6 | 29.3 |

| AMD | 10.6 | 26.2 |

| TWLO | 10.1 | 45.8 |

| OKTA | 8.8 | 46.4 |

| NOW | 7.5 | 28.4 |

| ROKU | 7.0 | 42.4 |

| COUP | 6.6 | 46.9 |

| DOCU | 6.4 | 38.8 |

| WDAY | 4.5 | 23.4 |

| SQ | 4.0 | 63.9 |

| SPOT | 3.9 | 13.3 |