All manufacturers of anti-diabetic drugs have issued press releases on their Q2 earnings. Novo Nordisk on August 9th and Eli Lilly on July 30th. And the 79th Scientific Sessions of the American Diabetes Association took place June 7-11, so a look at the changes in the diabetes landscape is due.

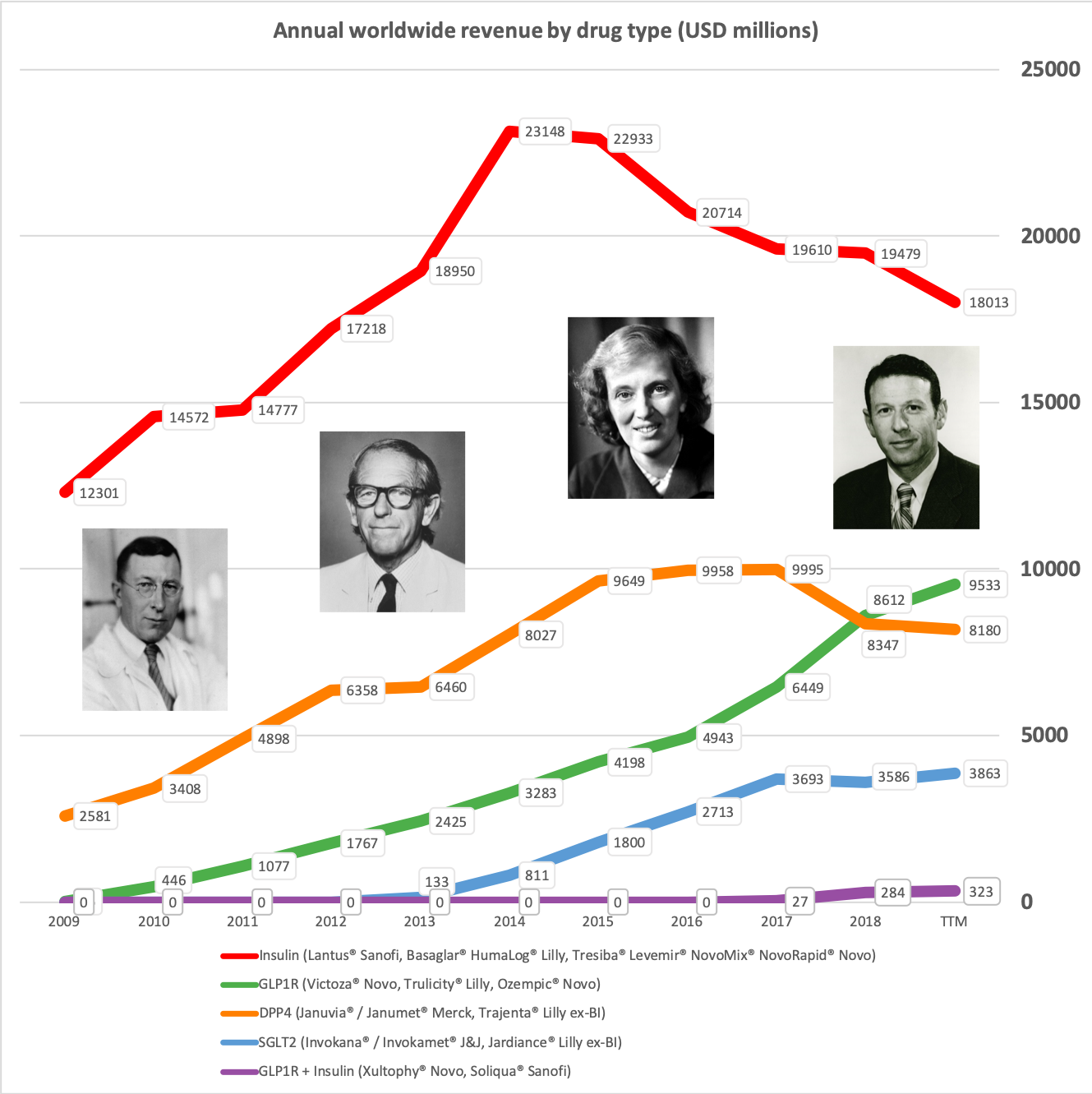

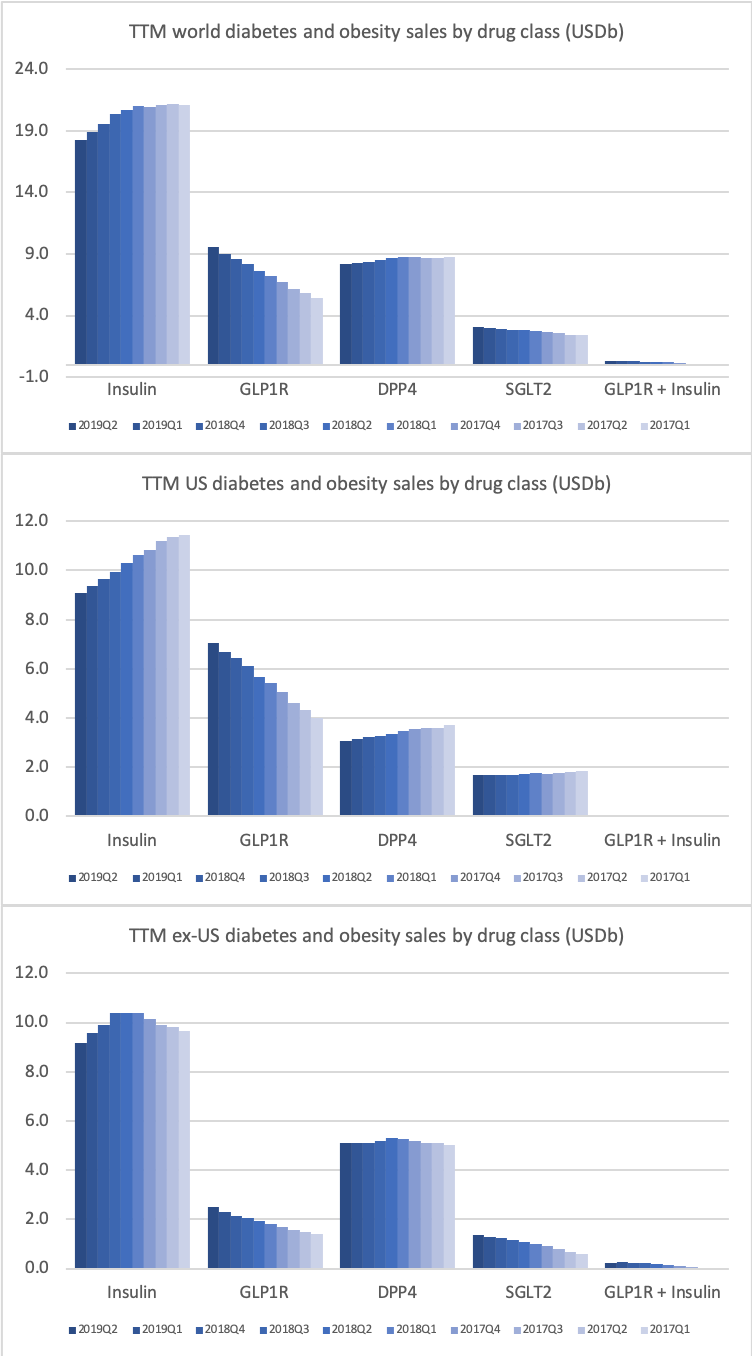

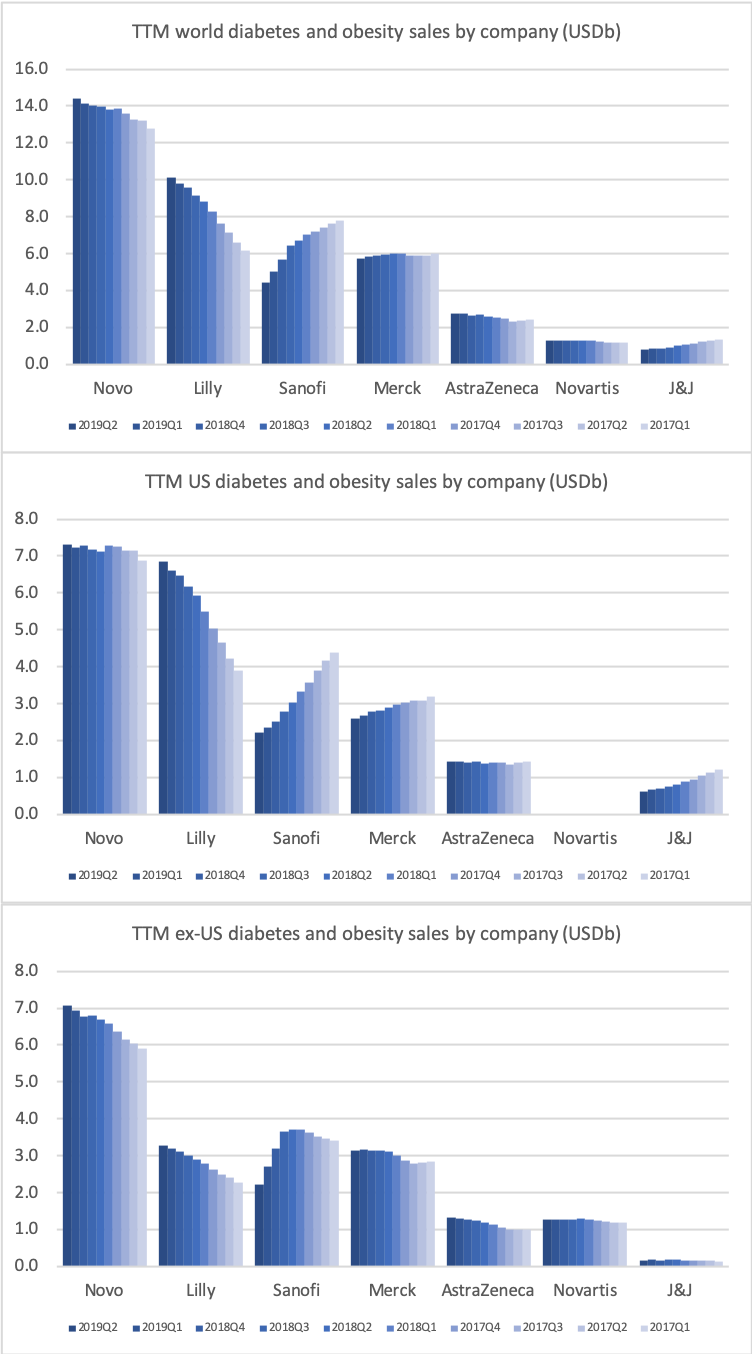

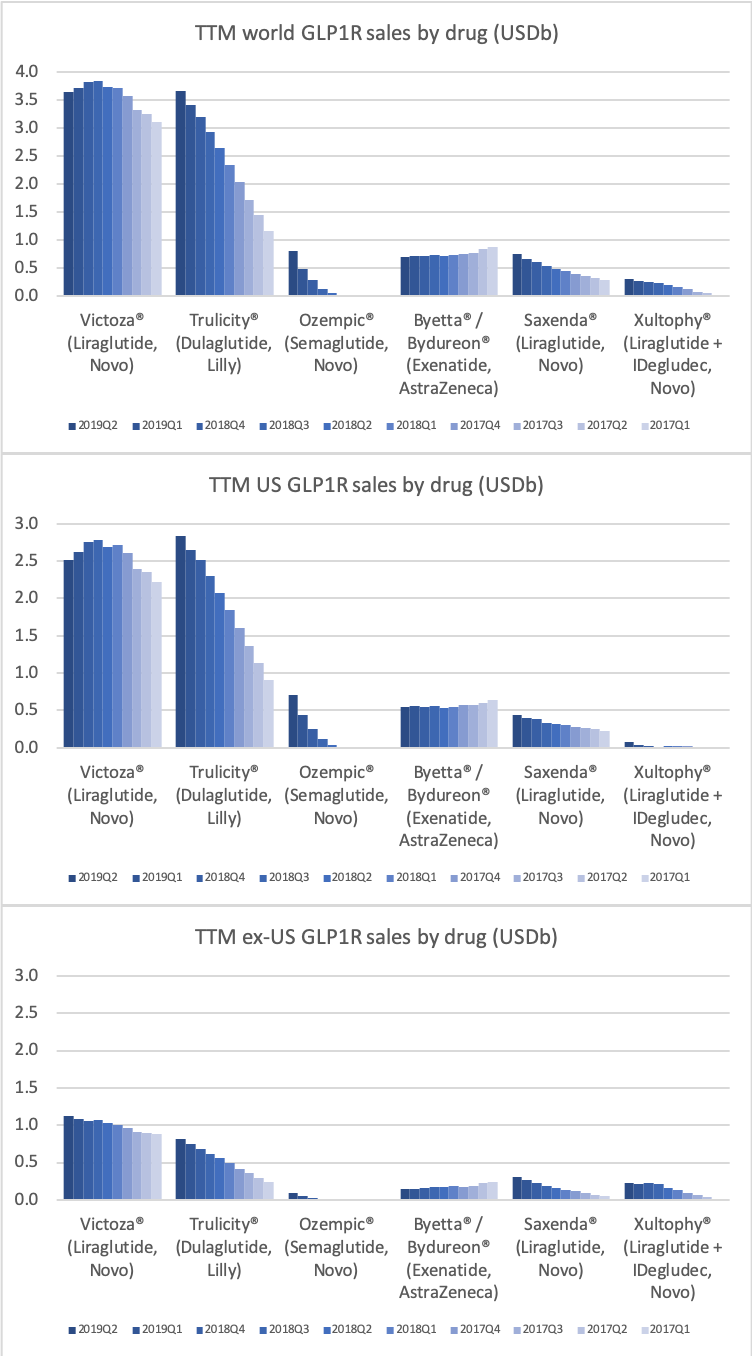

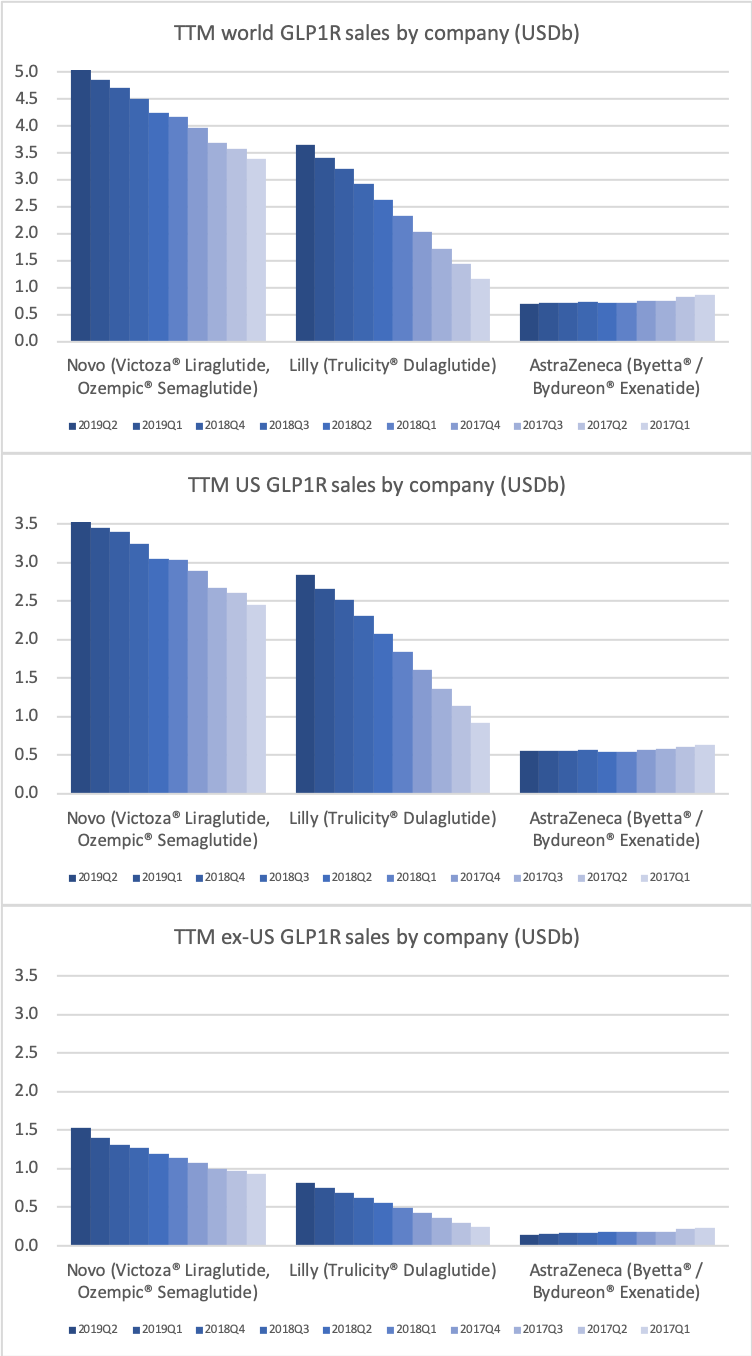

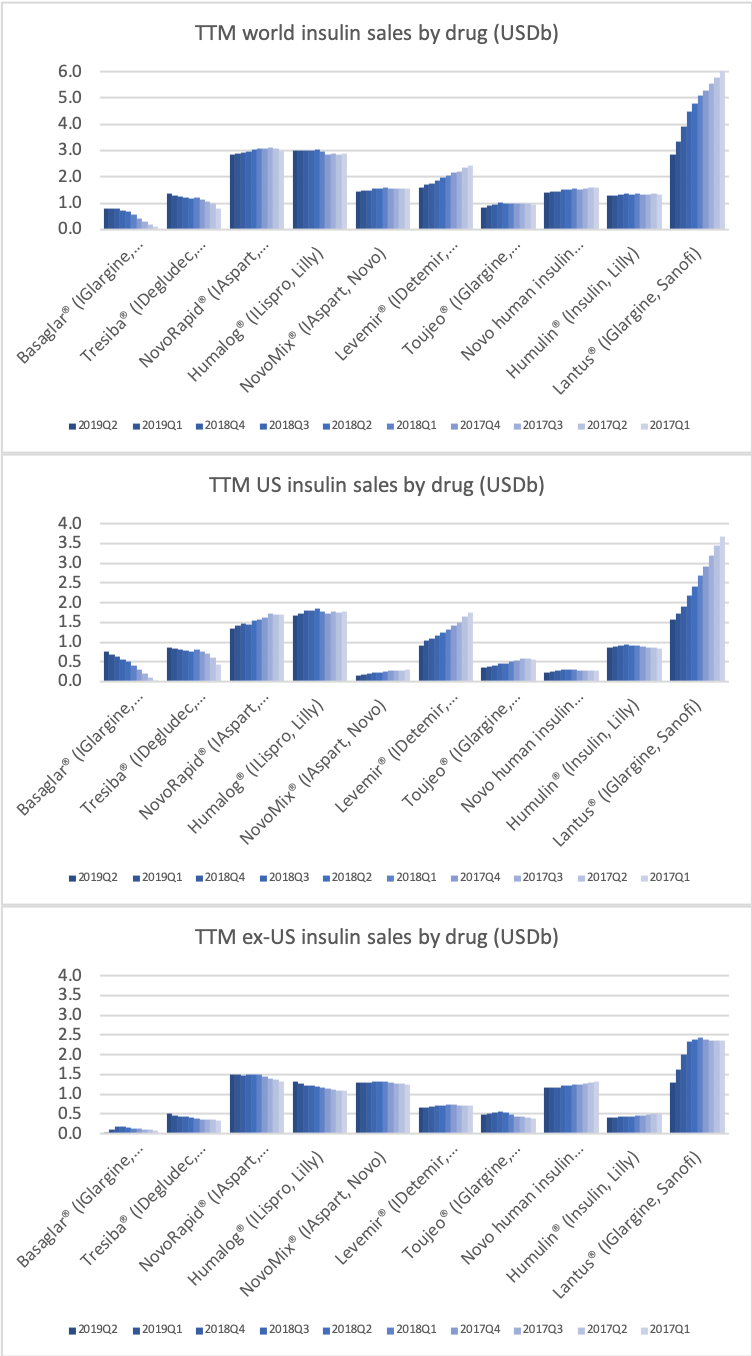

Worldwide sale of insulin continues to deteriorate, whereas the GLP1 class of drugs (e.g. Trulicity® from Eli Lilly and Ozempic® from Novo Nordisk) continues to grow within and outside the US.

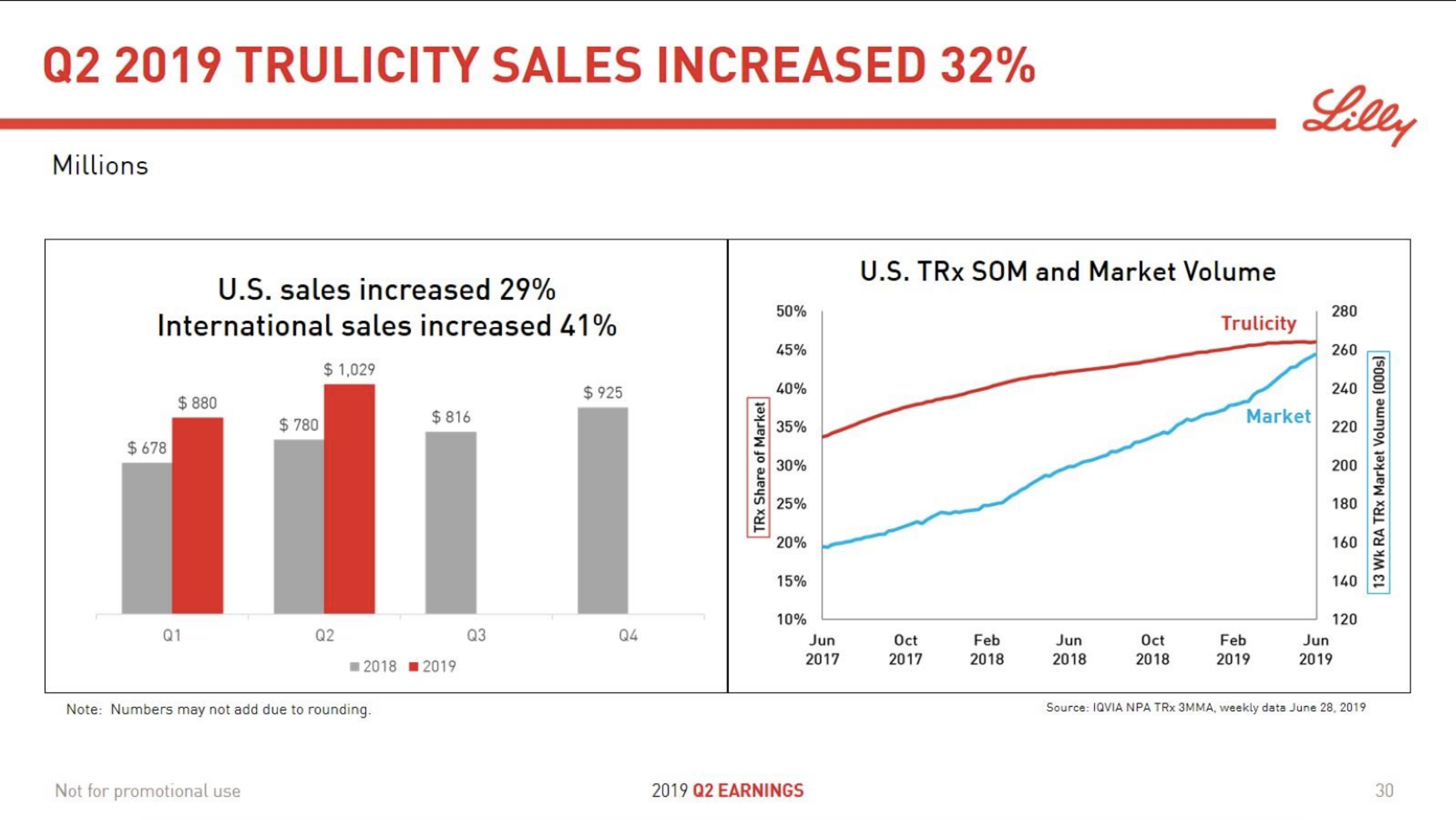

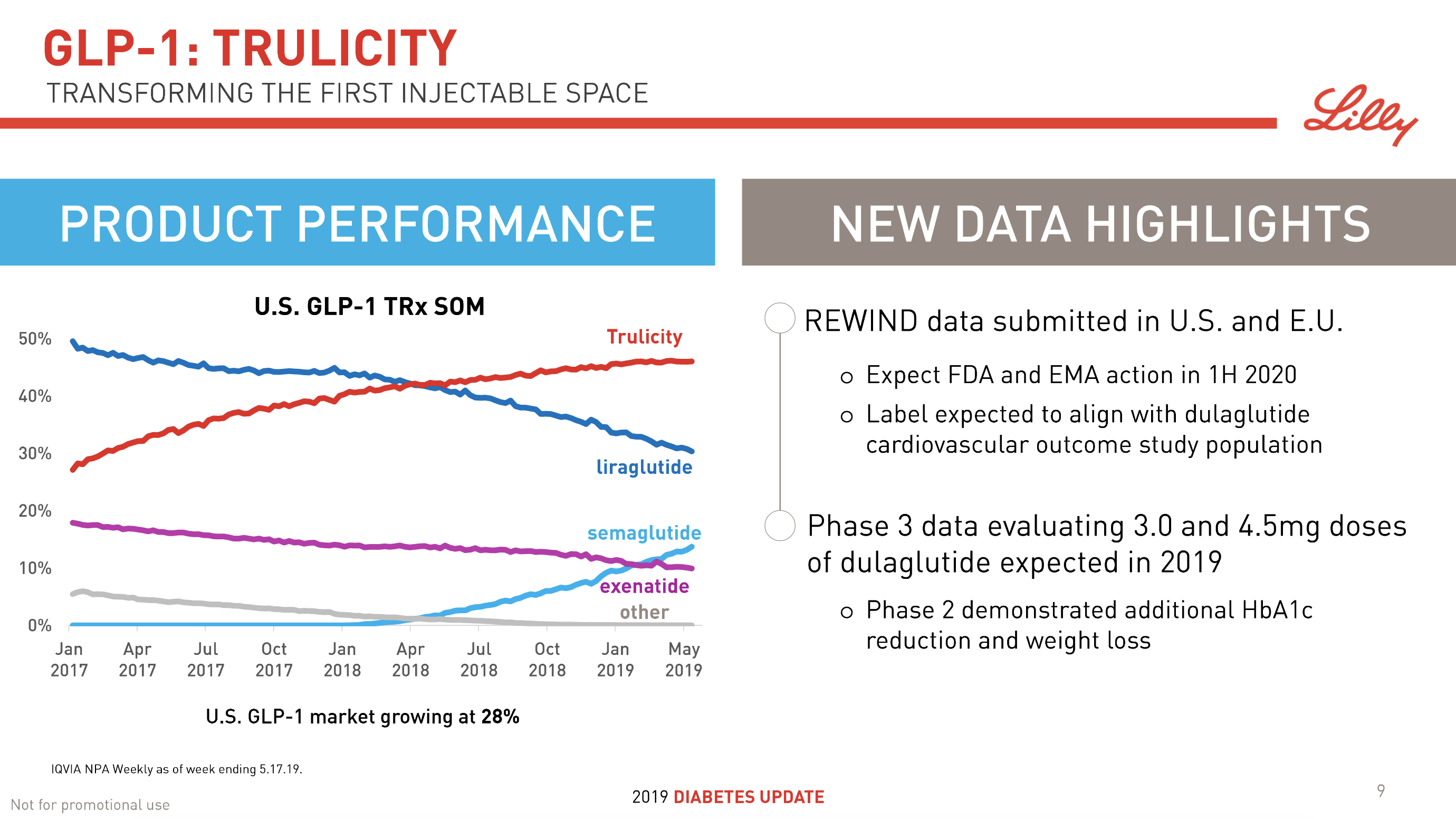

The majority of the growth in the US is spearheaded by Lilly and the GLP1 drug Trulicity®, whereas Sanofi and their insulin Lantus® continues to descend lower.

GLP1

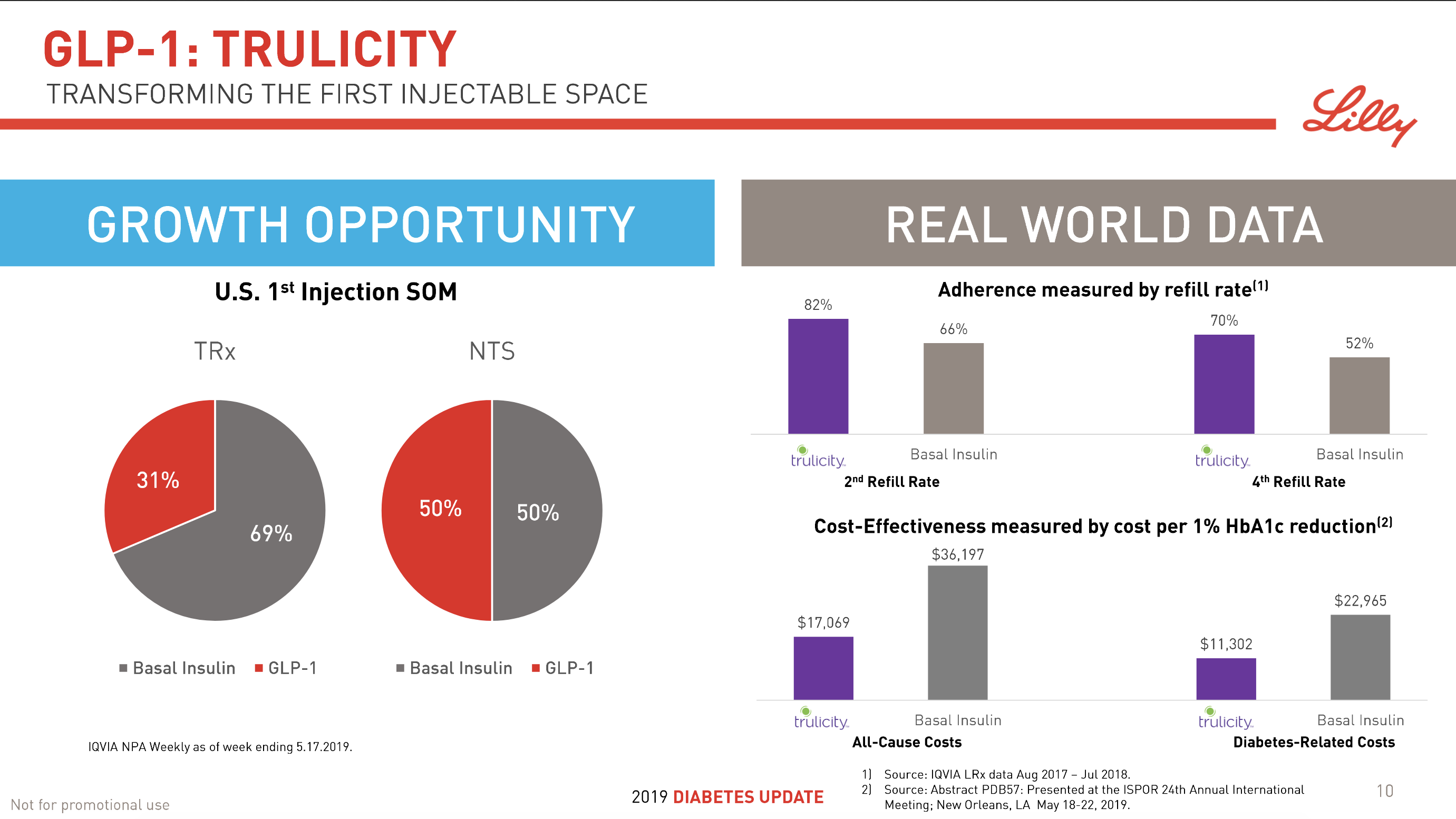

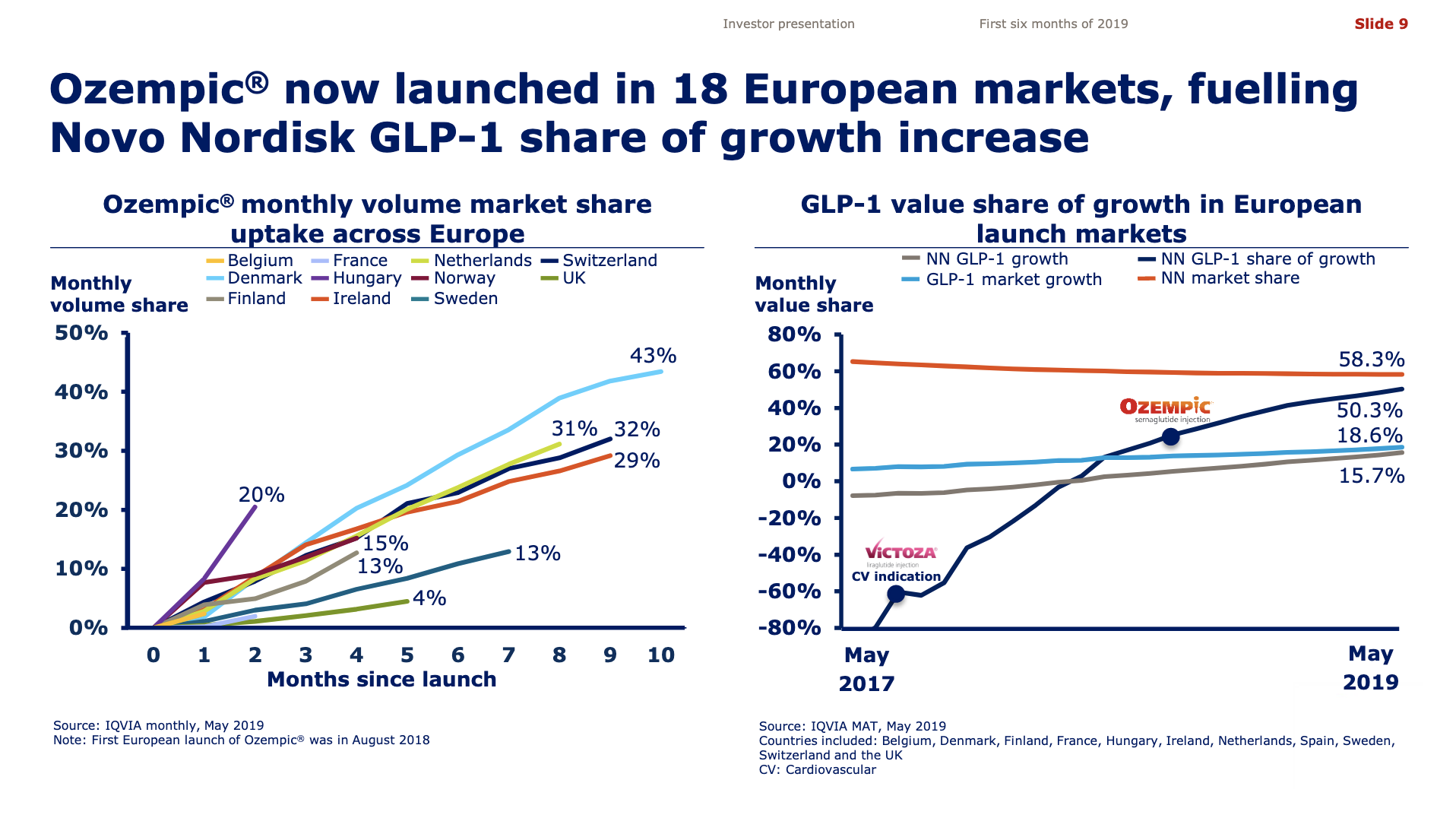

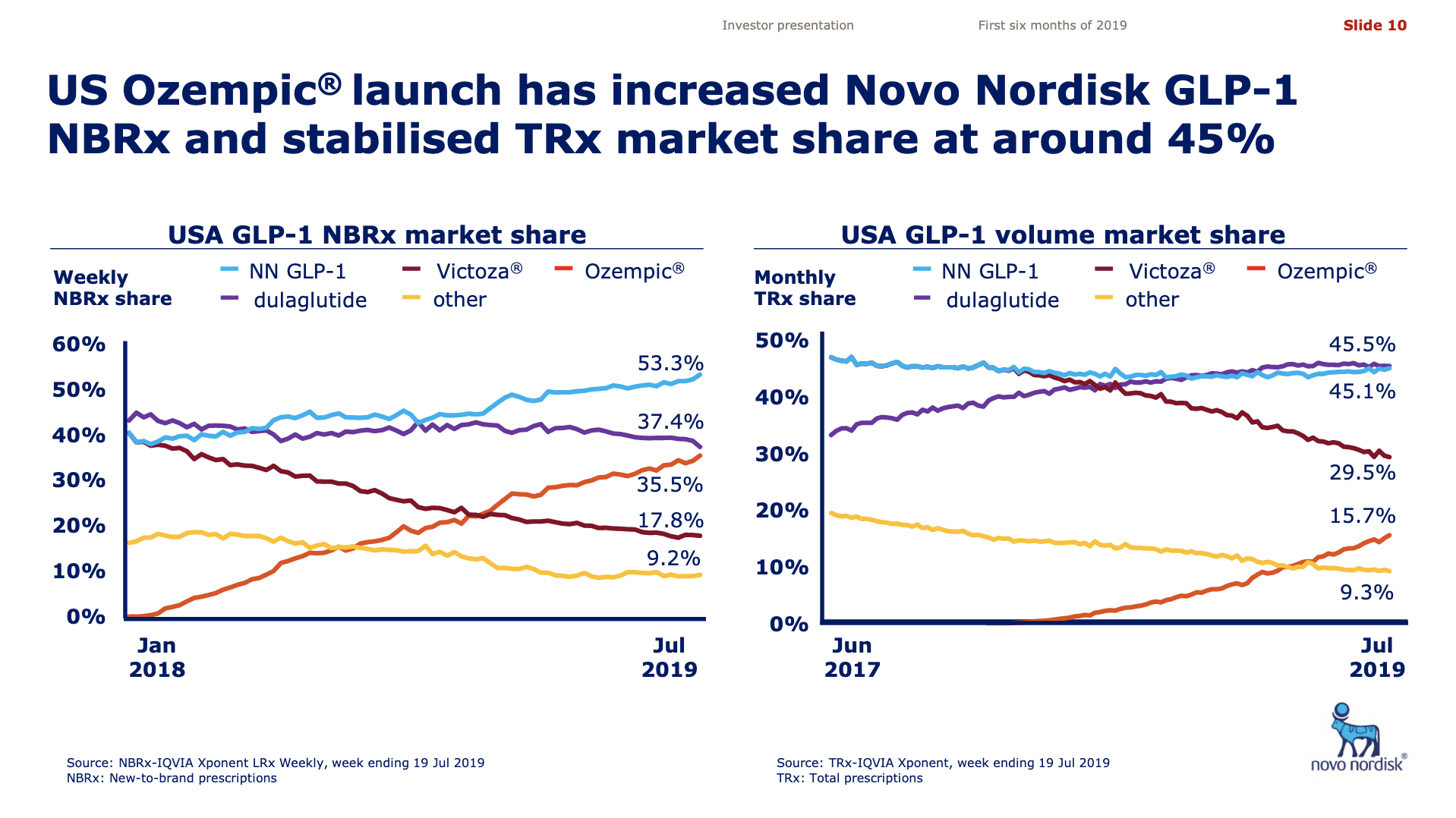

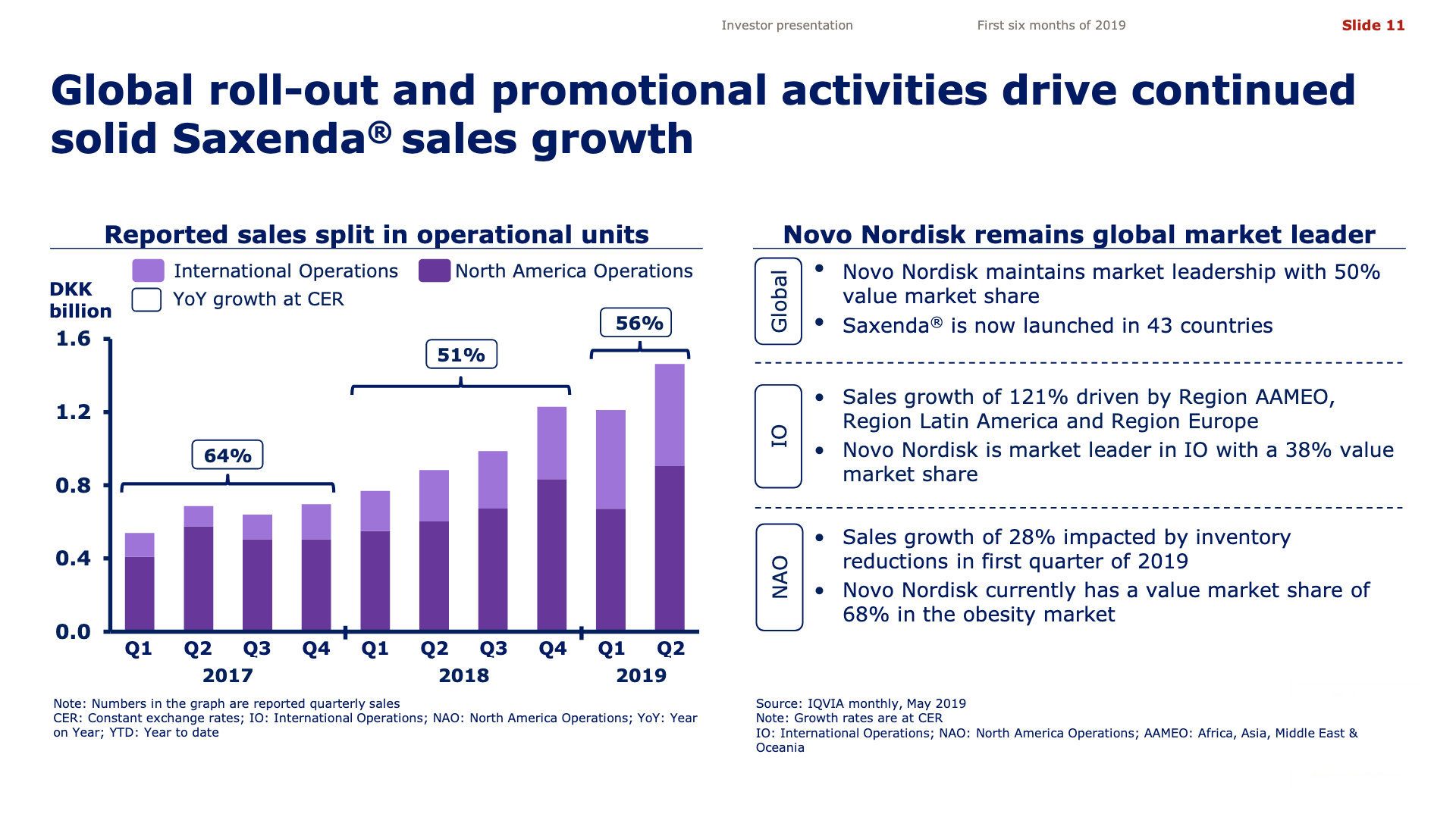

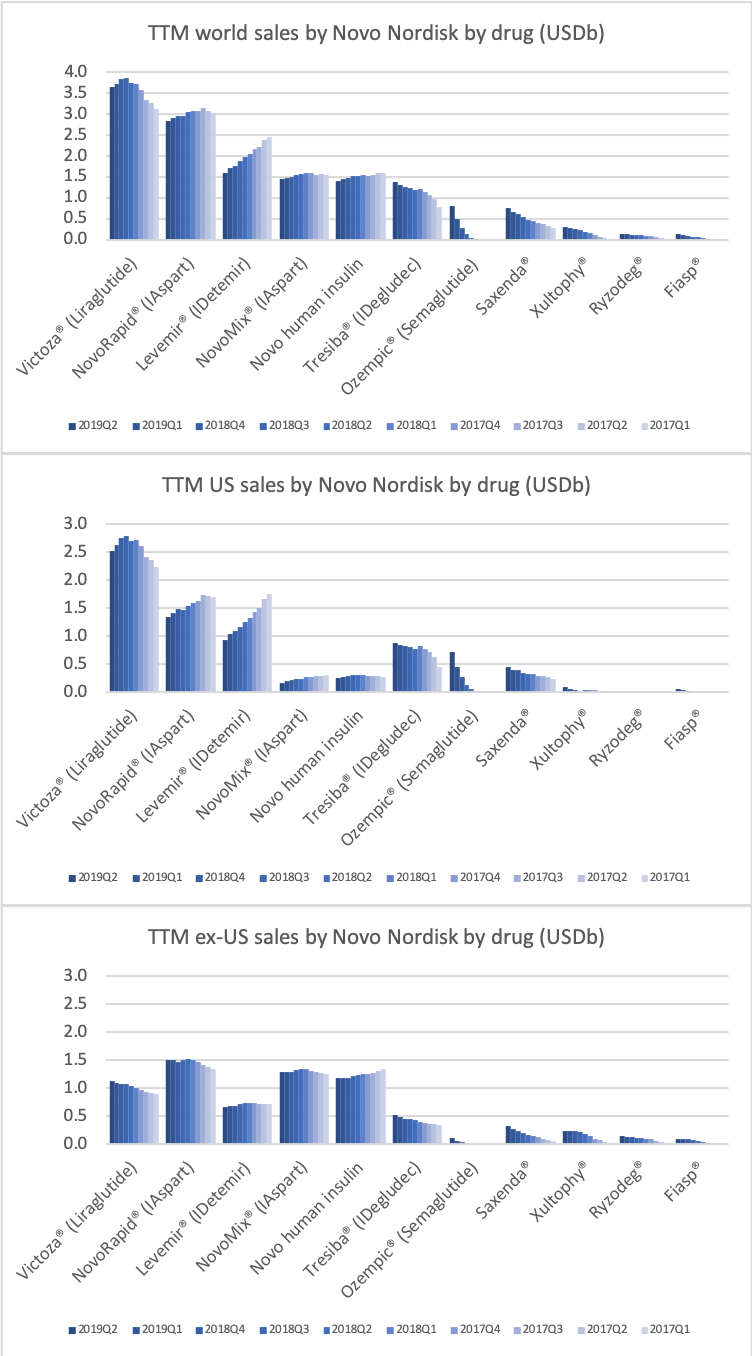

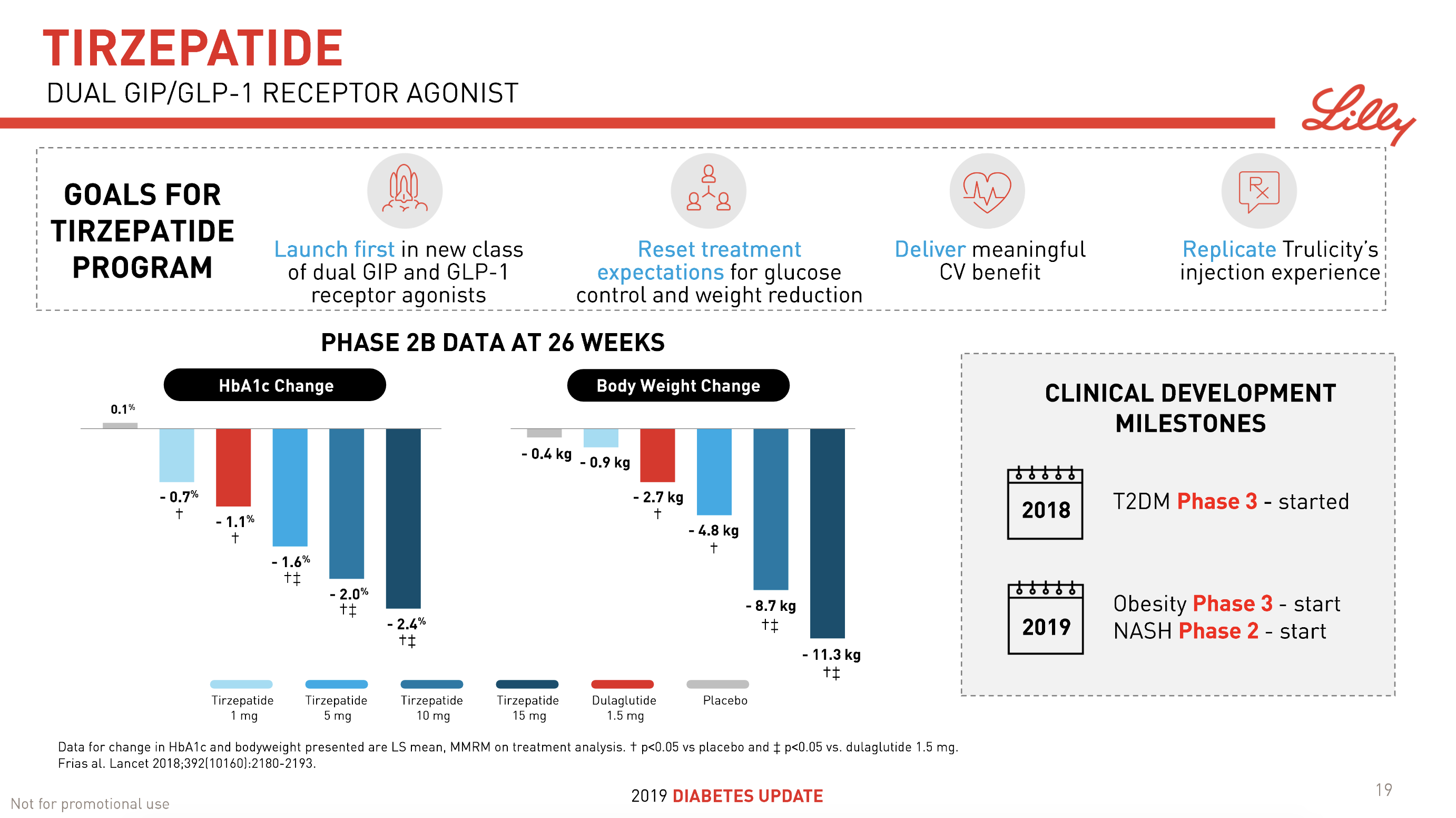

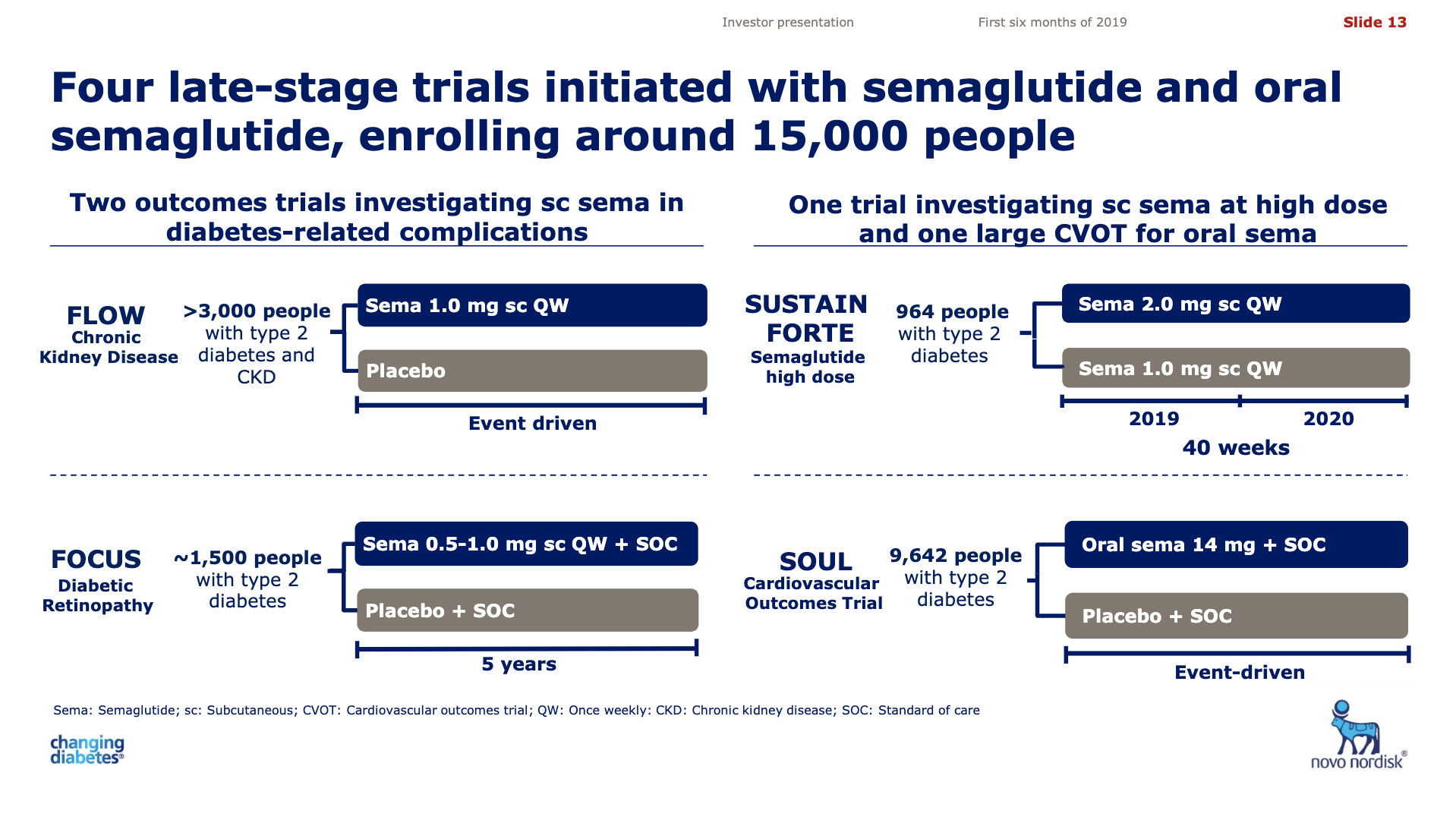

The previous GLP1 bestseller Victoza® is descending from its peak sales, whereas Trulicity® is now the best selling GLP1 drug and Ozempic® the fastest growing. Interestingly semaglutide against obesity (Saxenda®) is turning into a blockbuster drug for Novo Nordisk. The GLP1 sale at Novo Nordisk could further accelerate, if oral semaglutide is approved by the FDA on 20th of September. Other noteworthy GLP1 news are summarised below. One of them regarding benefits of the phase III dual agonist tirzepatide from Eli Lilly. Another regarding the filing of oral semaglutide for FDA approval six months ago.

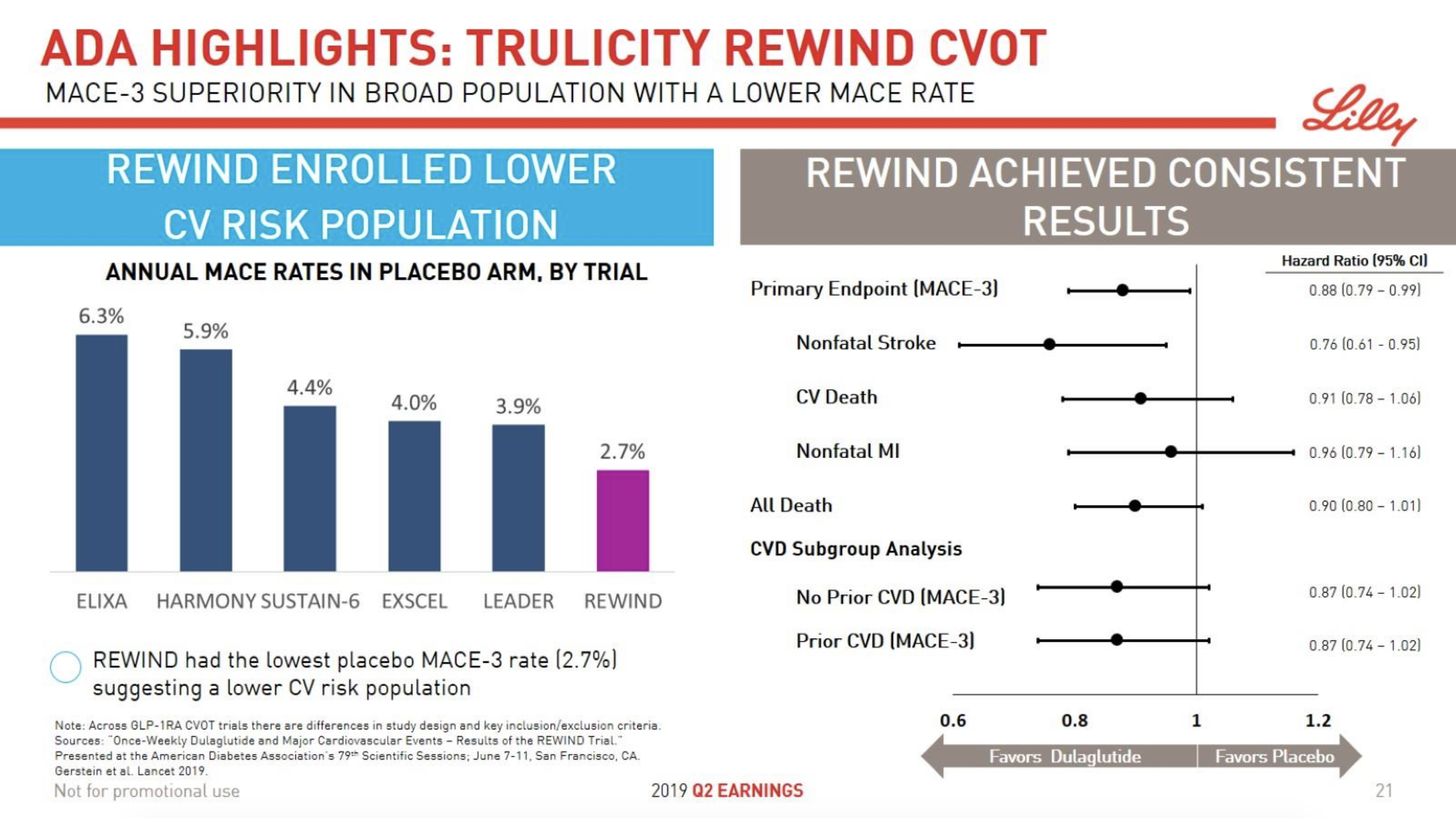

- 26Jun Lilly’s AWARD-11 trial studying higher investigational doses of Trulicity® (dulaglutide) demonstrated superiority in A1C reduction in people with type 2 diabetes

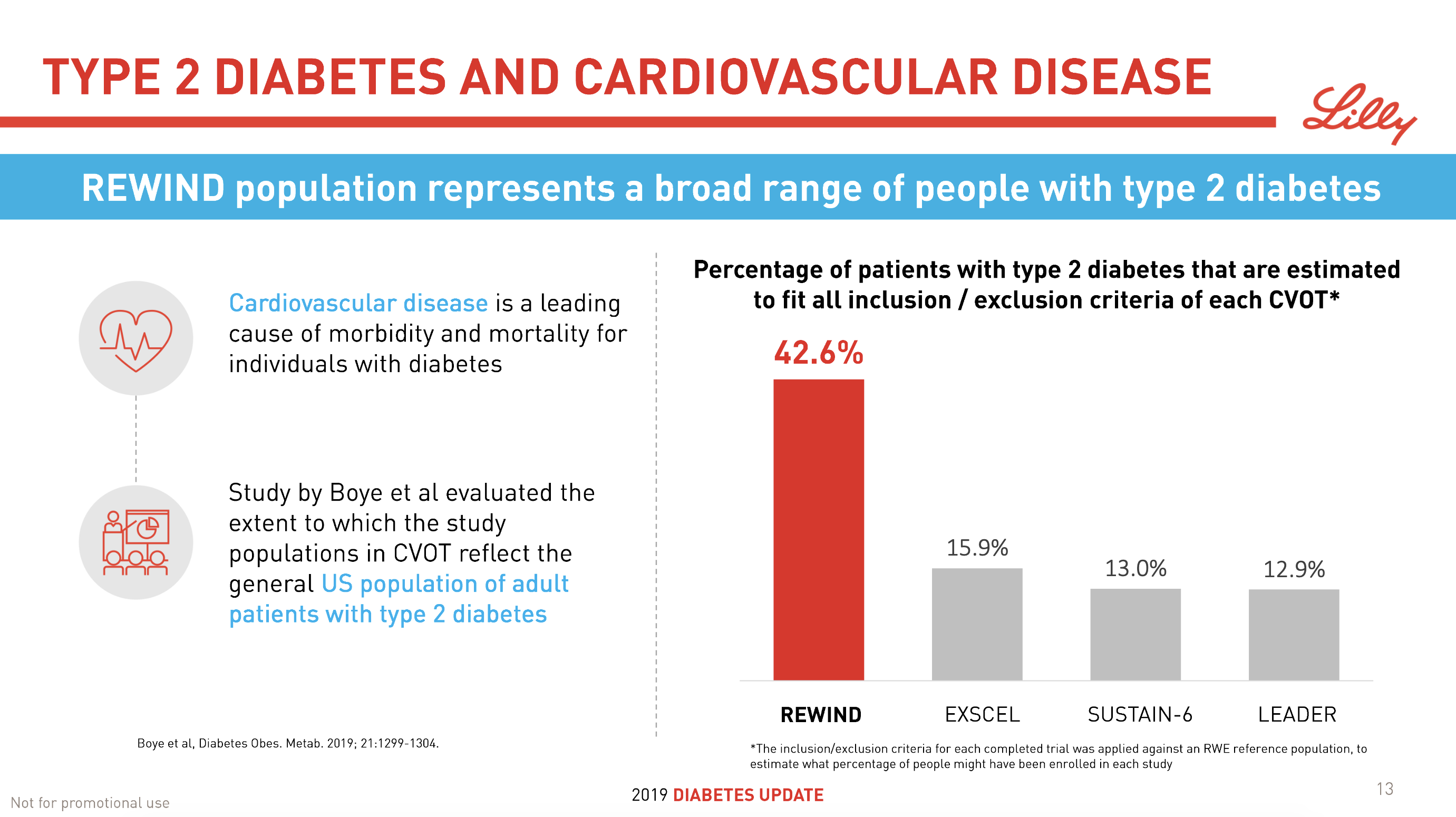

- 09Jun Trulicity® (dulaglutide) significantly reduced major cardiovascular events for broad range of people with type 2 diabetes

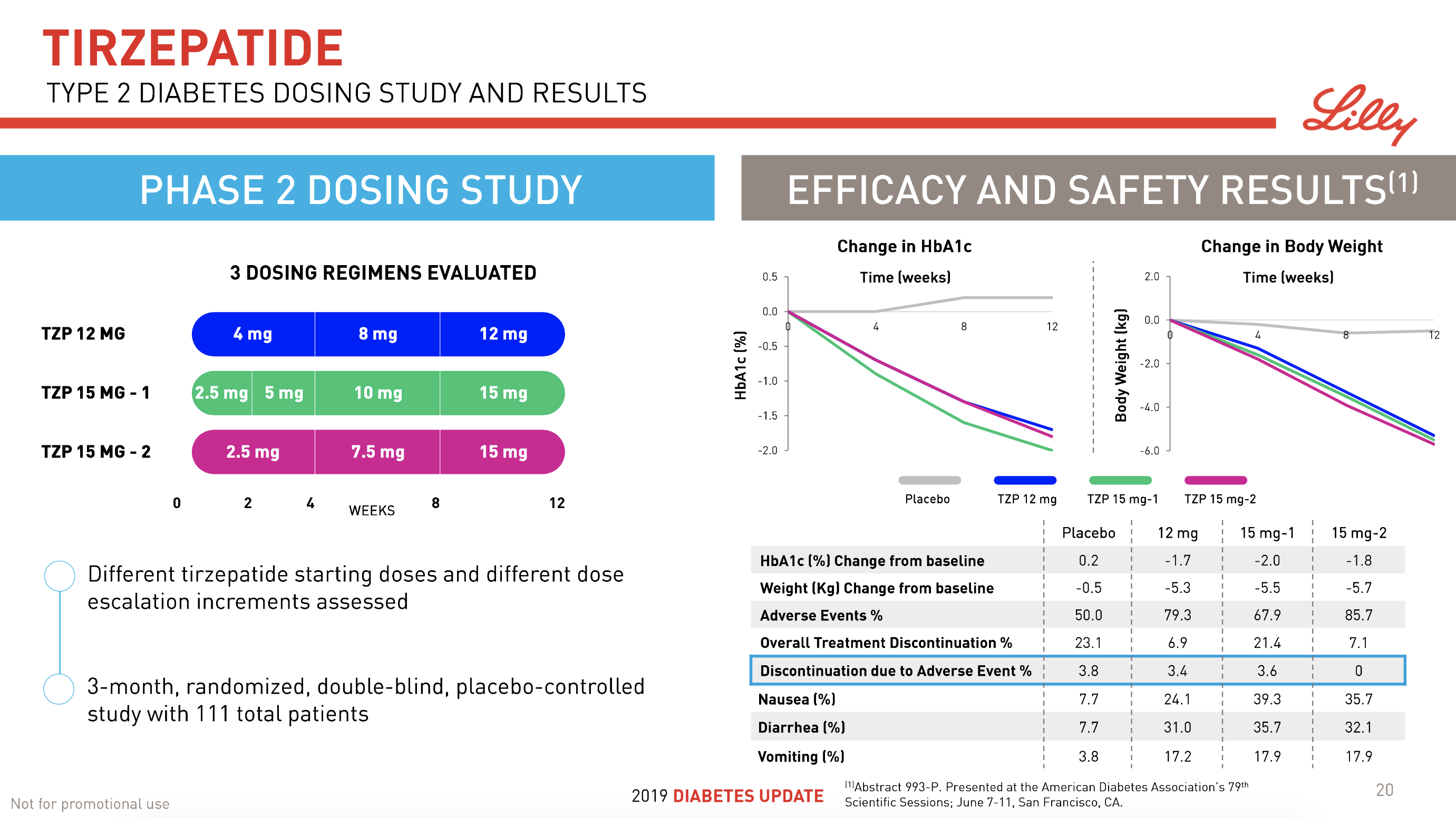

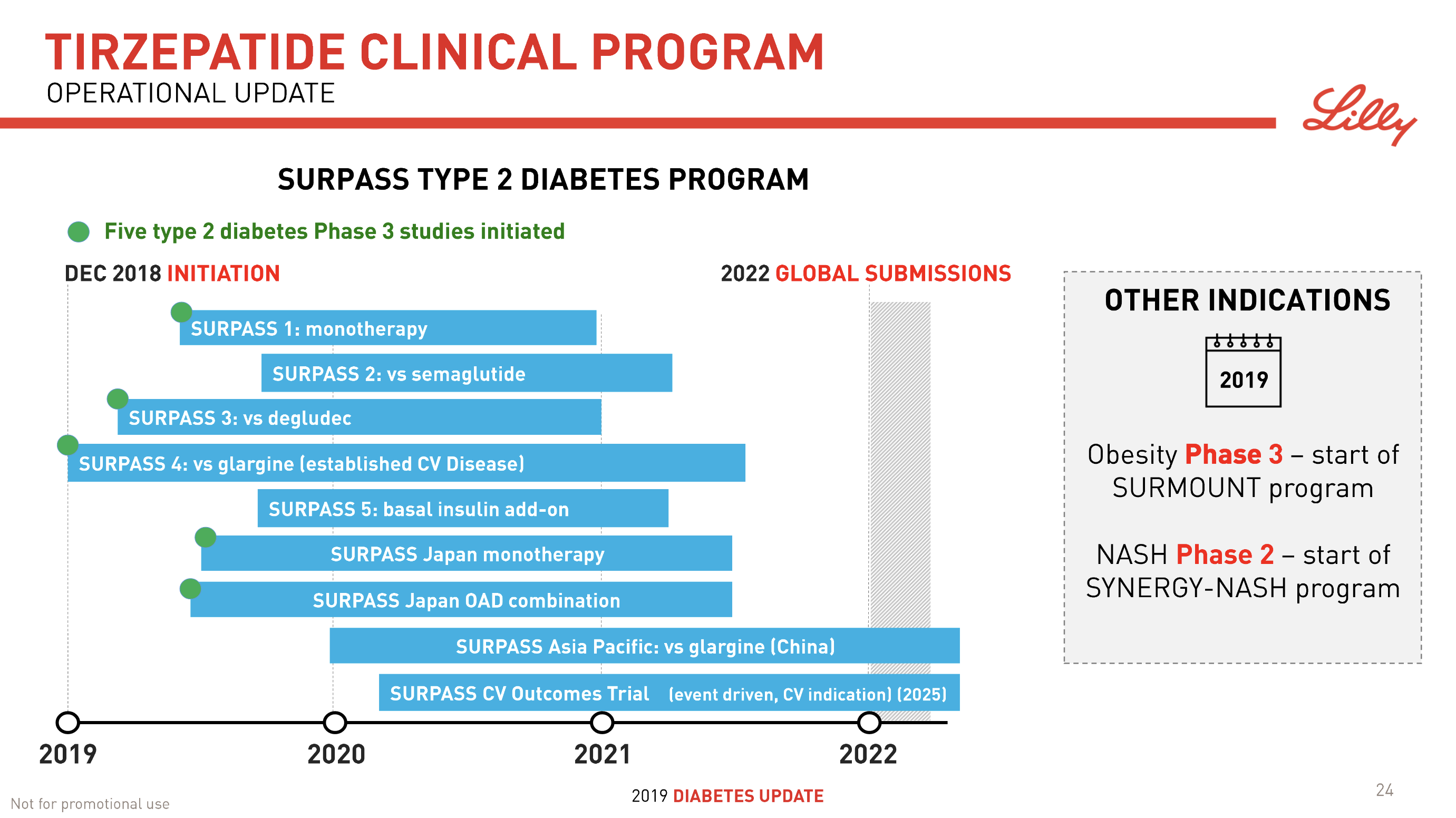

- 08Jun Lilly’s tirzepatide demonstrates benefits in data presented at the American Diabetes Association’s® 79ᵗʰ Scientific Sessions®

- 20Mar Novo Nordisk files oral semaglutide for US regulatory approval of glycaemic control, as well as for CV risk reduction for oral semaglutide and Ozempic®

Insulin

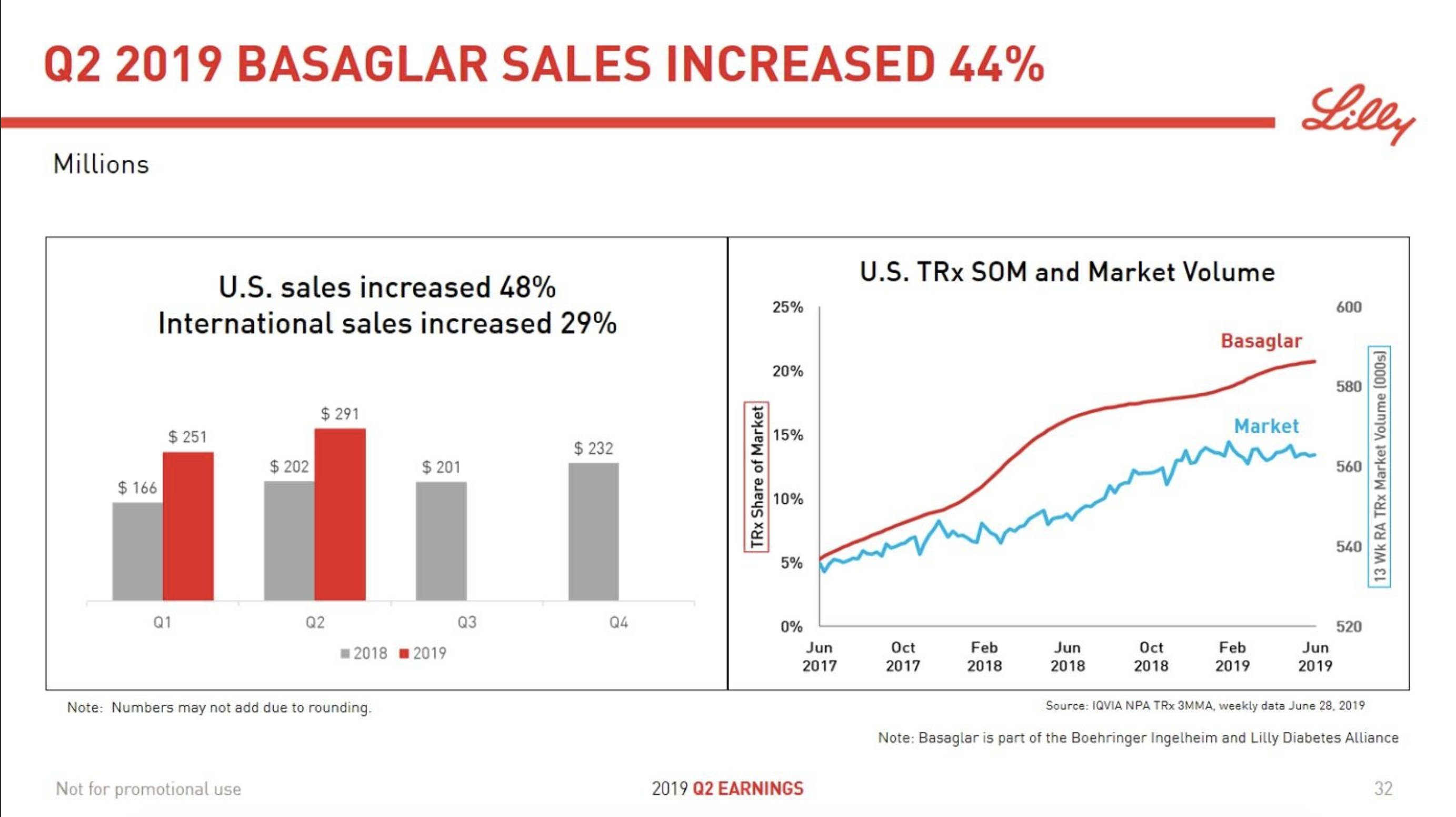

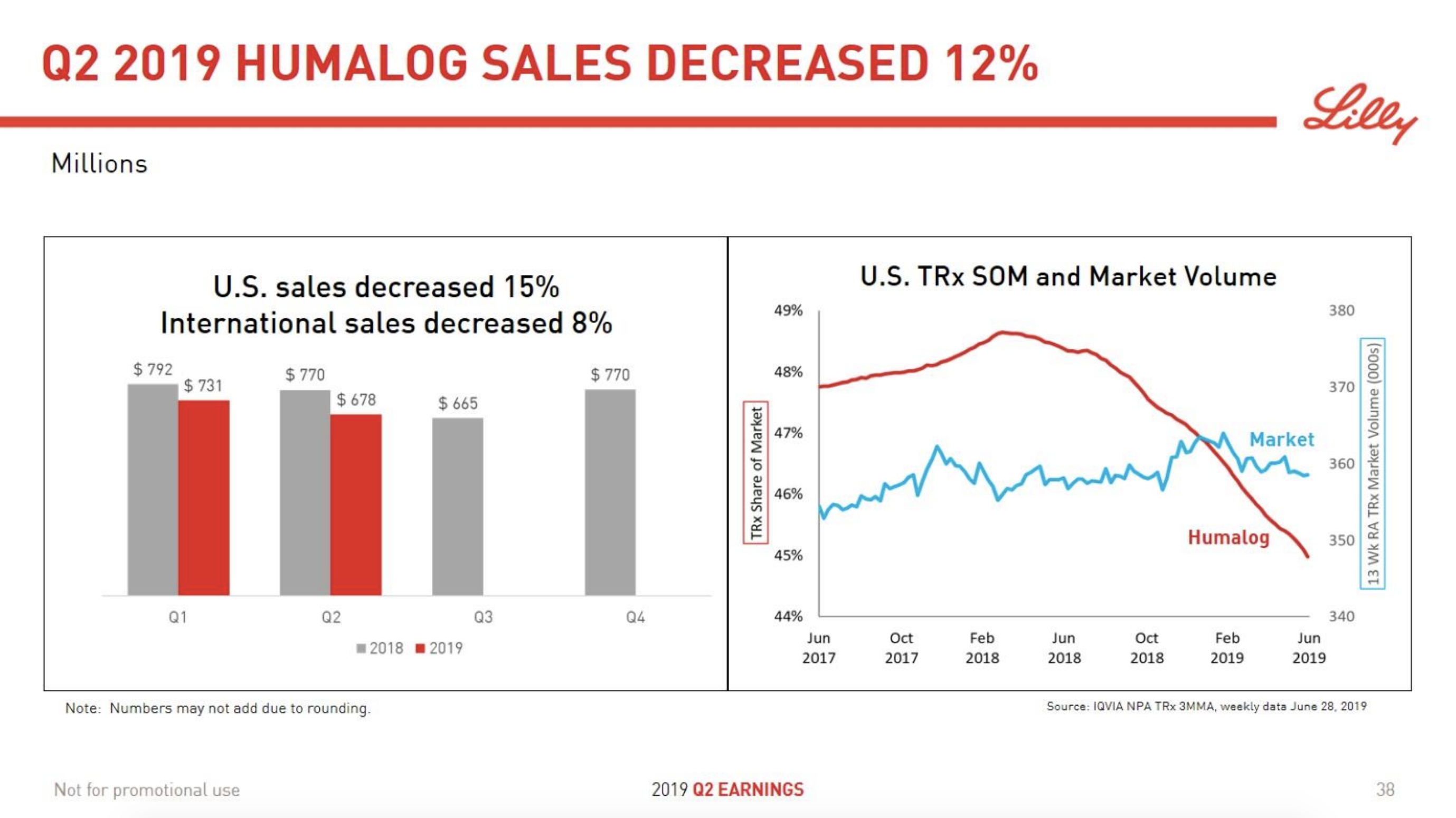

In terms of insulin, Lantus® from Sanofi is slowly bleeding to death in the US caused by the patent expiration and the launch of the analog Basaglar® by Eli Lilly. Levemir® from Novo Nordisk is also deteriorating in the US and this is not offset by growing sales of the newer Tresiba®. Similarly Humalog® from Eli Lilly will suffer in the coming quarters from the launch of a generic insulin Lispro by Eli Lilly itself and the analog Admelog® by Sanofi. Today and tomorrow belongs to the GLP1 class of drugs and not to insulin.

- Jun09 Lilly’s ultra rapid lispro provided similar A1C reductions compared to Humalog® (insulin lispro), with superior post-meal blood glucose reductions

- May22 Lilly’s Lower-Priced Insulin Now Available

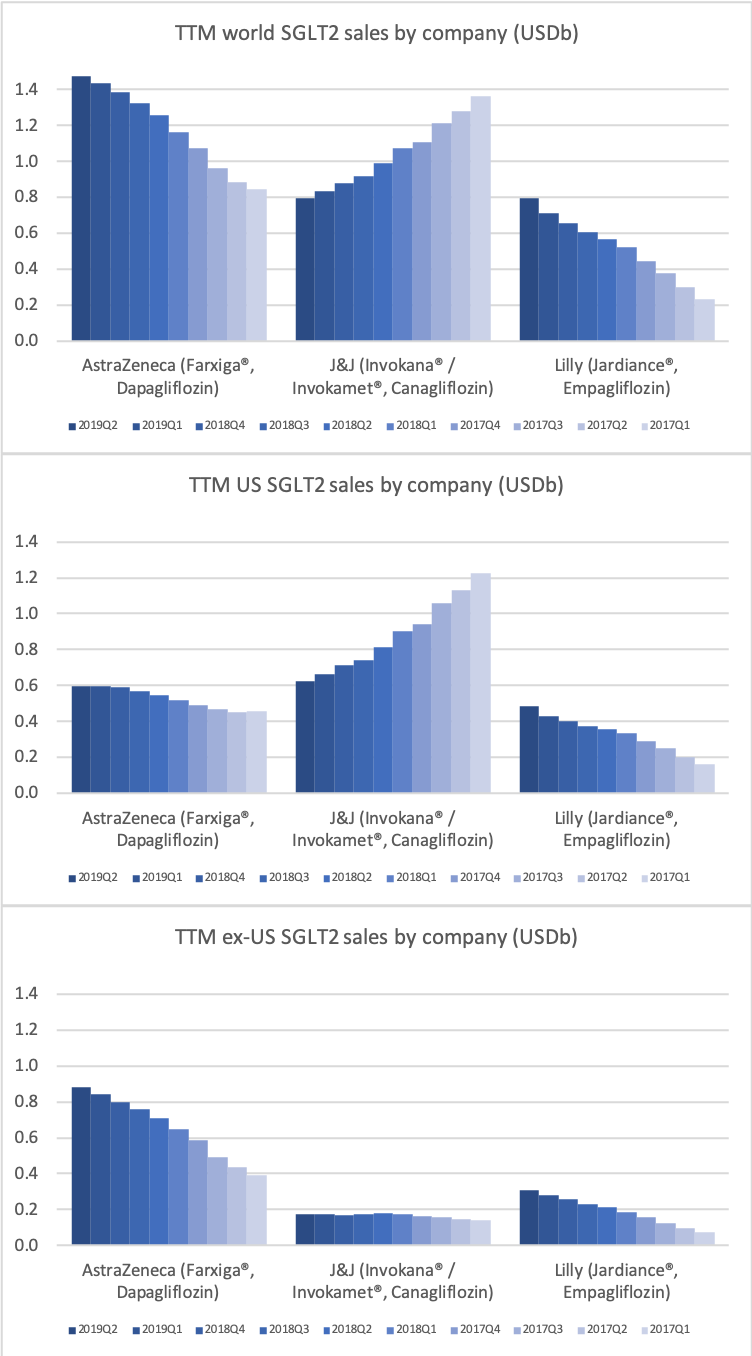

SGLT2

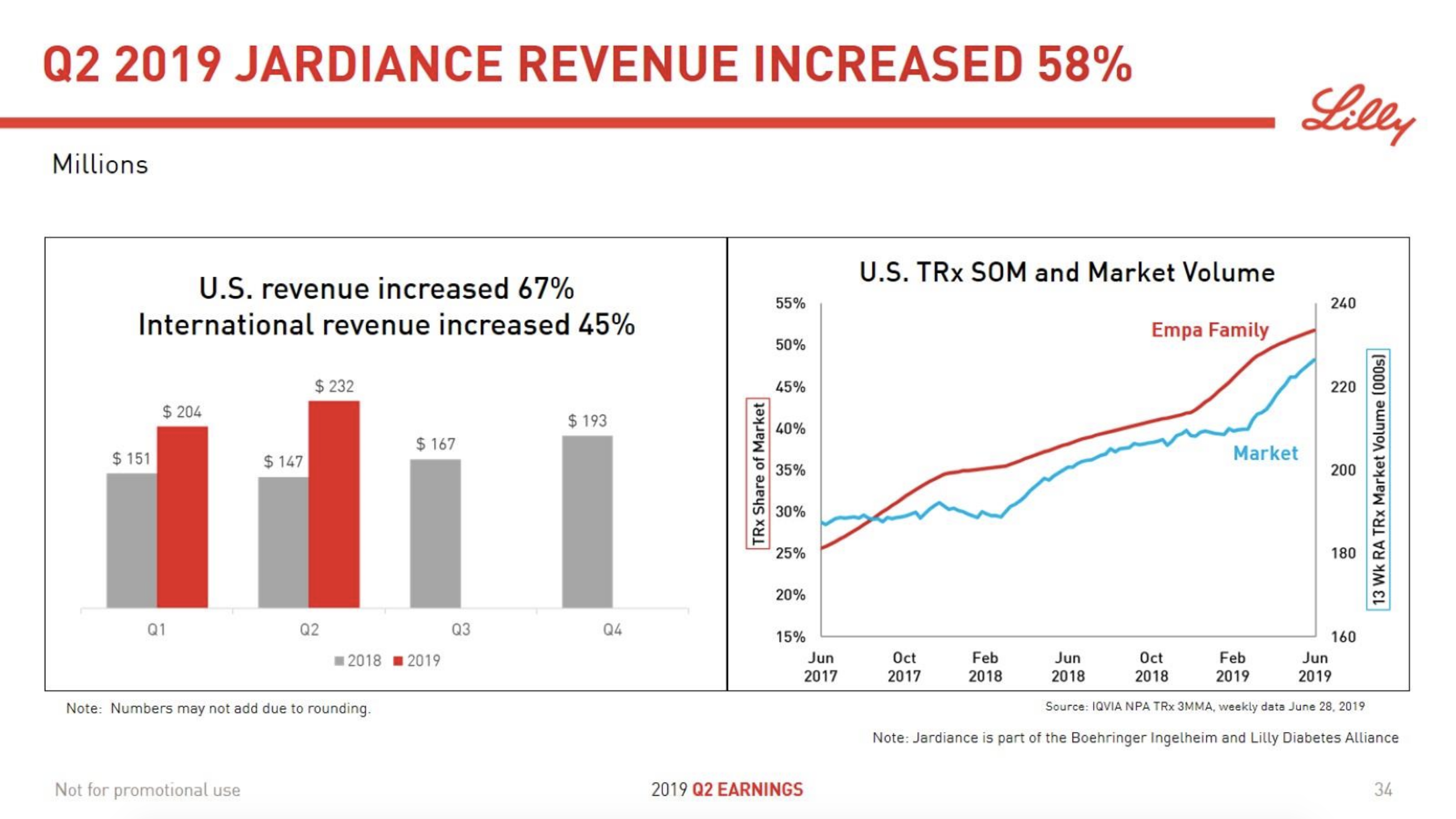

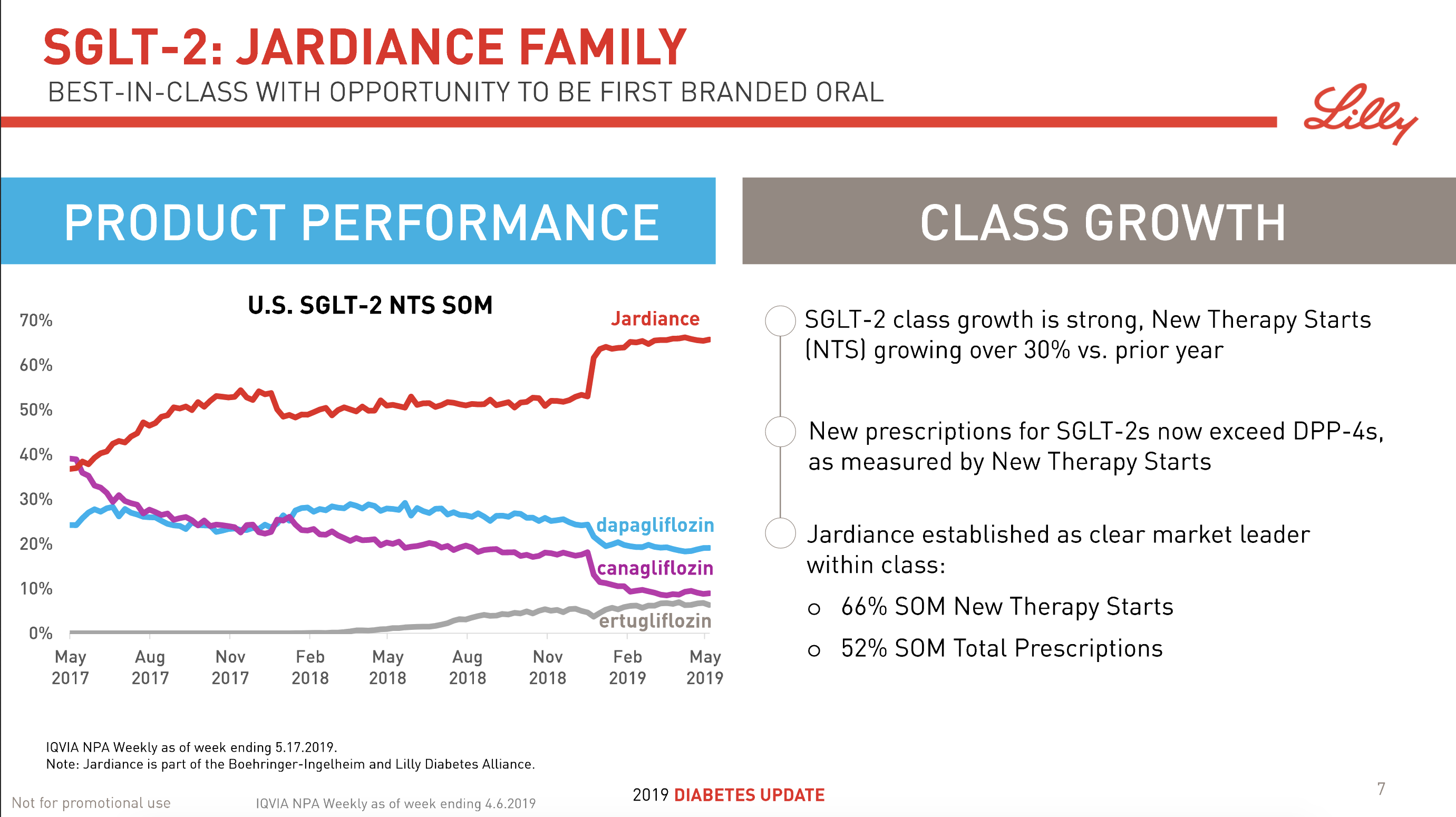

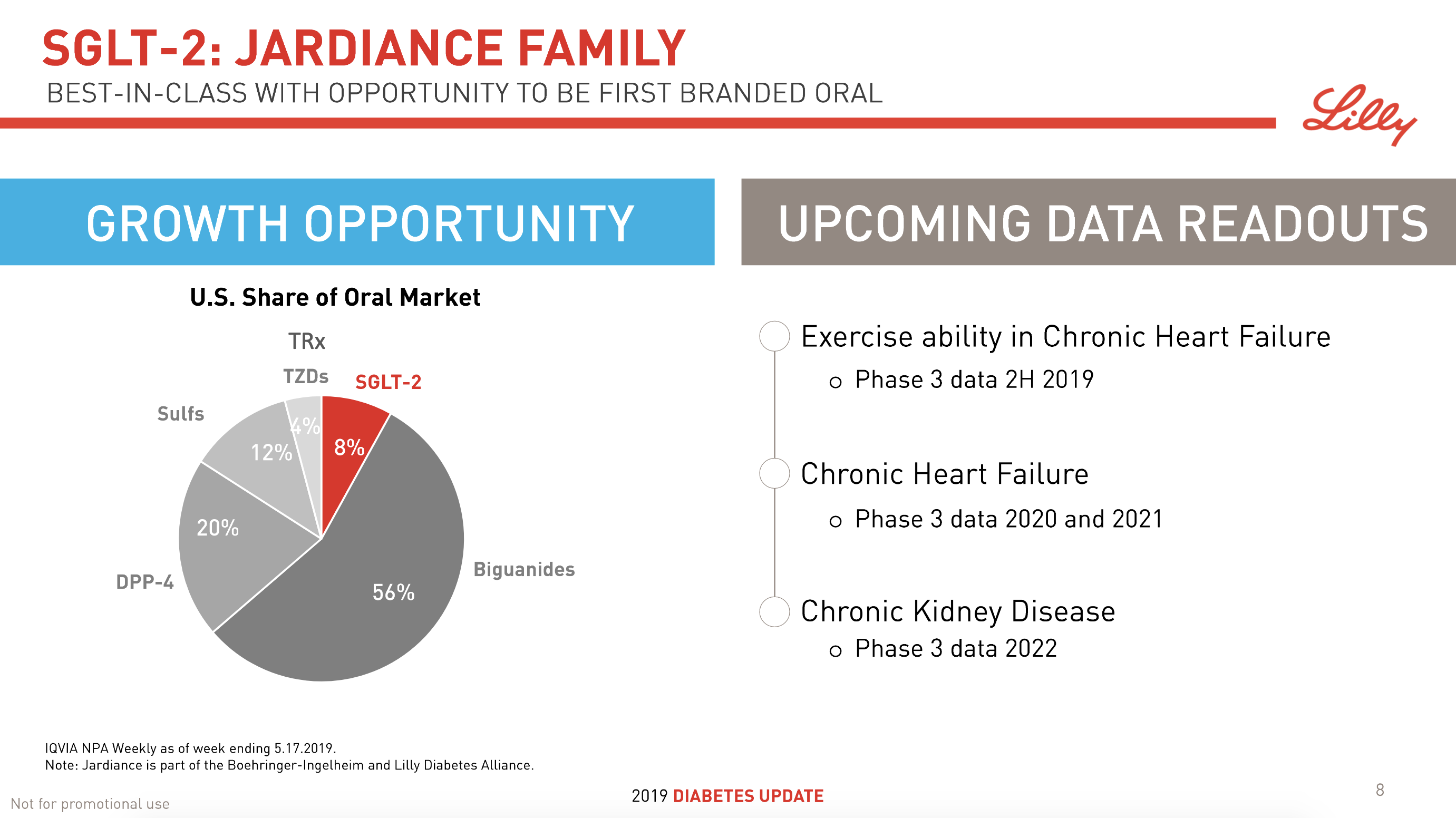

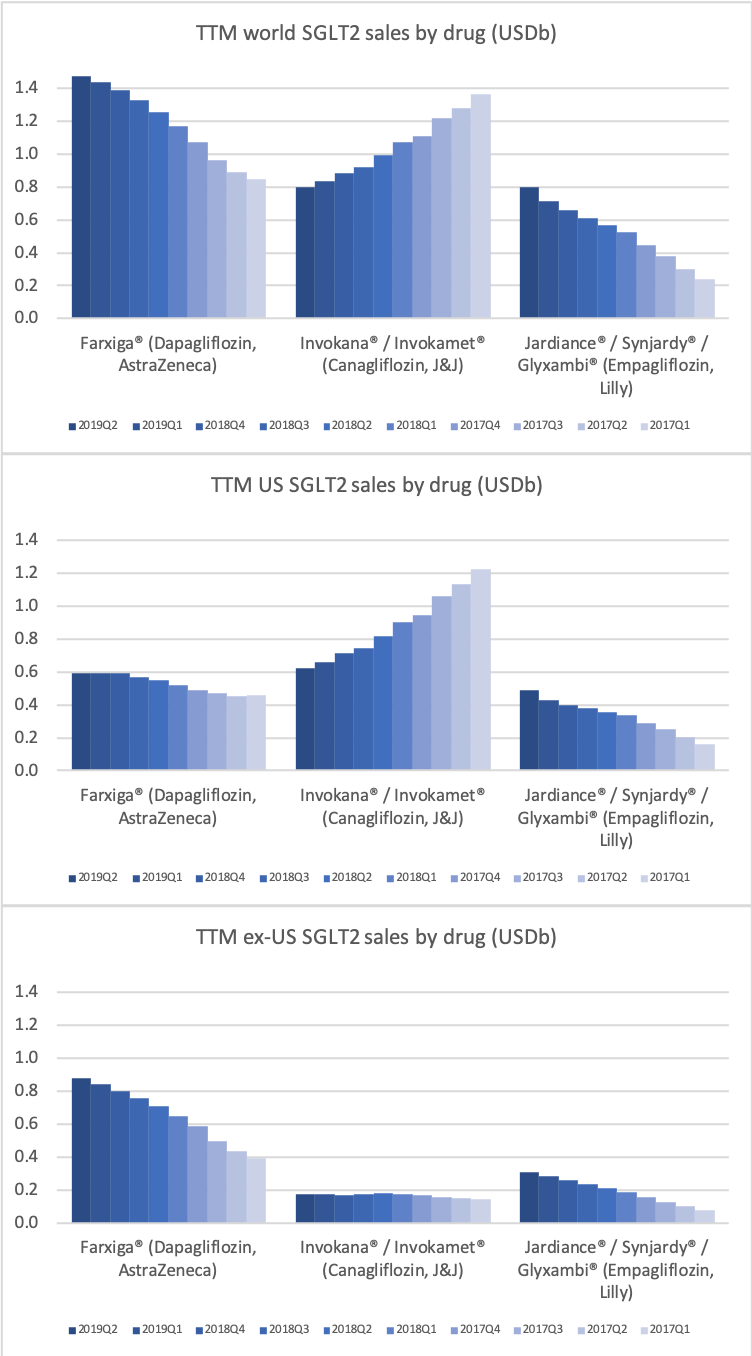

The SGLT2 drugs Farxiga® from AstraZeneca and Jardiance® from Eli Lilly continue to show positive growth in the US, whereas Invokana® from Merck displays negative growth. In the case of AstraZeneca SGLT2 is their fastest growing antidiabetic drug class. Recent news regarding the SGLT2 class of drugs are mentioned below.

- Sep01 Detailed results from Phase III DAPA-HF trial showed Farxiga significantly reduced both the incidence of cardiovascular death and the worsening of heart failure

- Aug20 Farxiga met primary endpoint in landmark Phase III DAPA-HF trial for the treatment of patients with heart failure

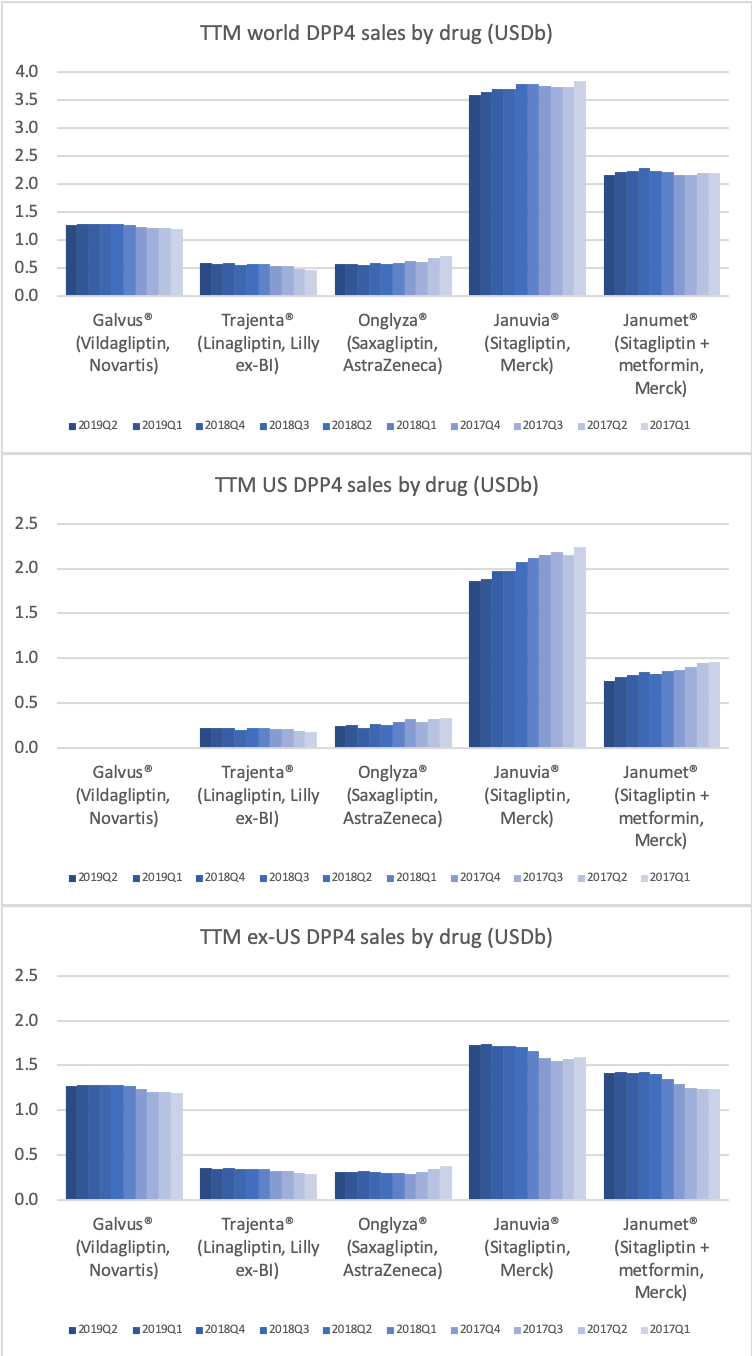

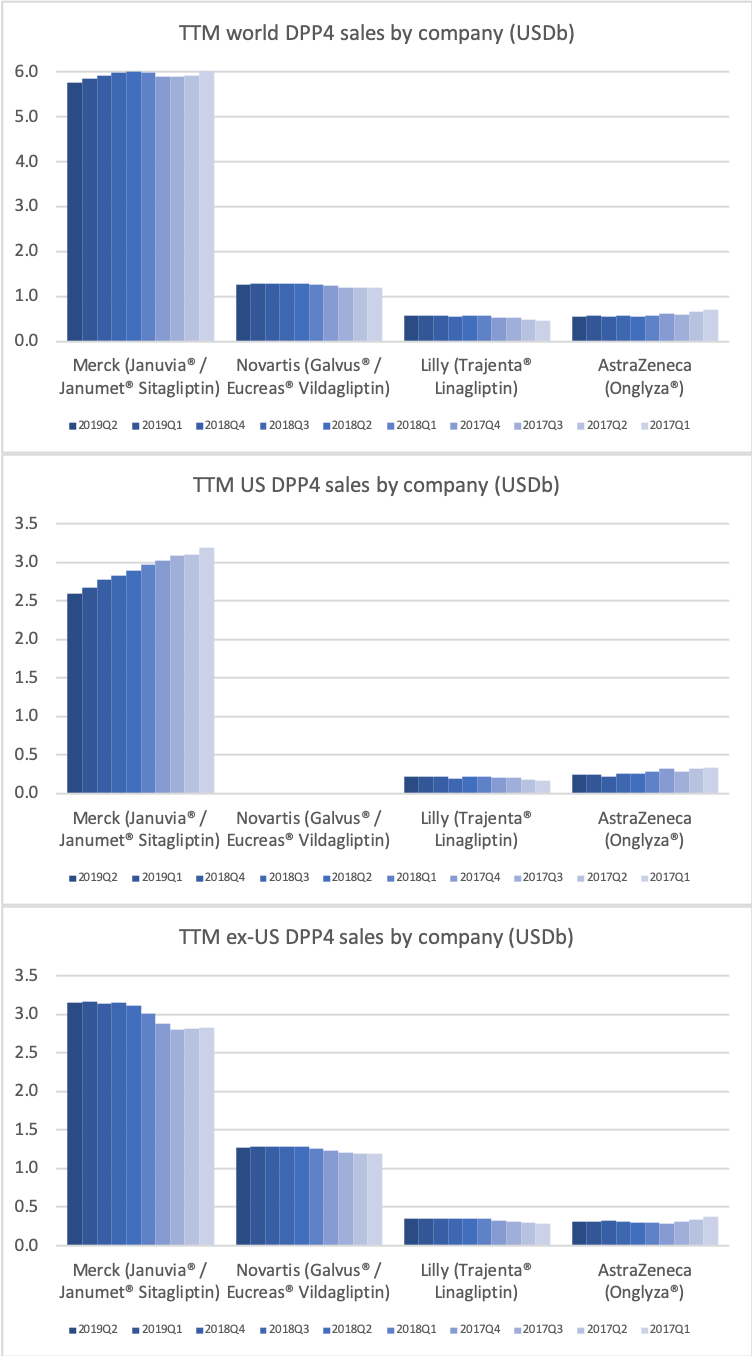

DPP4

Along with insulin the DPP4 class of drugs will probably be a loser going forward. Oral semaglutide, injected GLP1 and SGLT2 will continue to take market share from DPP4 going forward. The big loser will continue to be Januvia®/Janumet® from Merck, which is currently the best selling antidiabetic drug in the world with combined TTM sales just shy of USD 6B. Eli Lilly is planning to launch a combined SGLT2/DPP4 tablet according to the June press release below.

04jun U.S. FDA Accepts New Drug Application for Triple Combination Tablet for Adults with Type 2 Diabetes

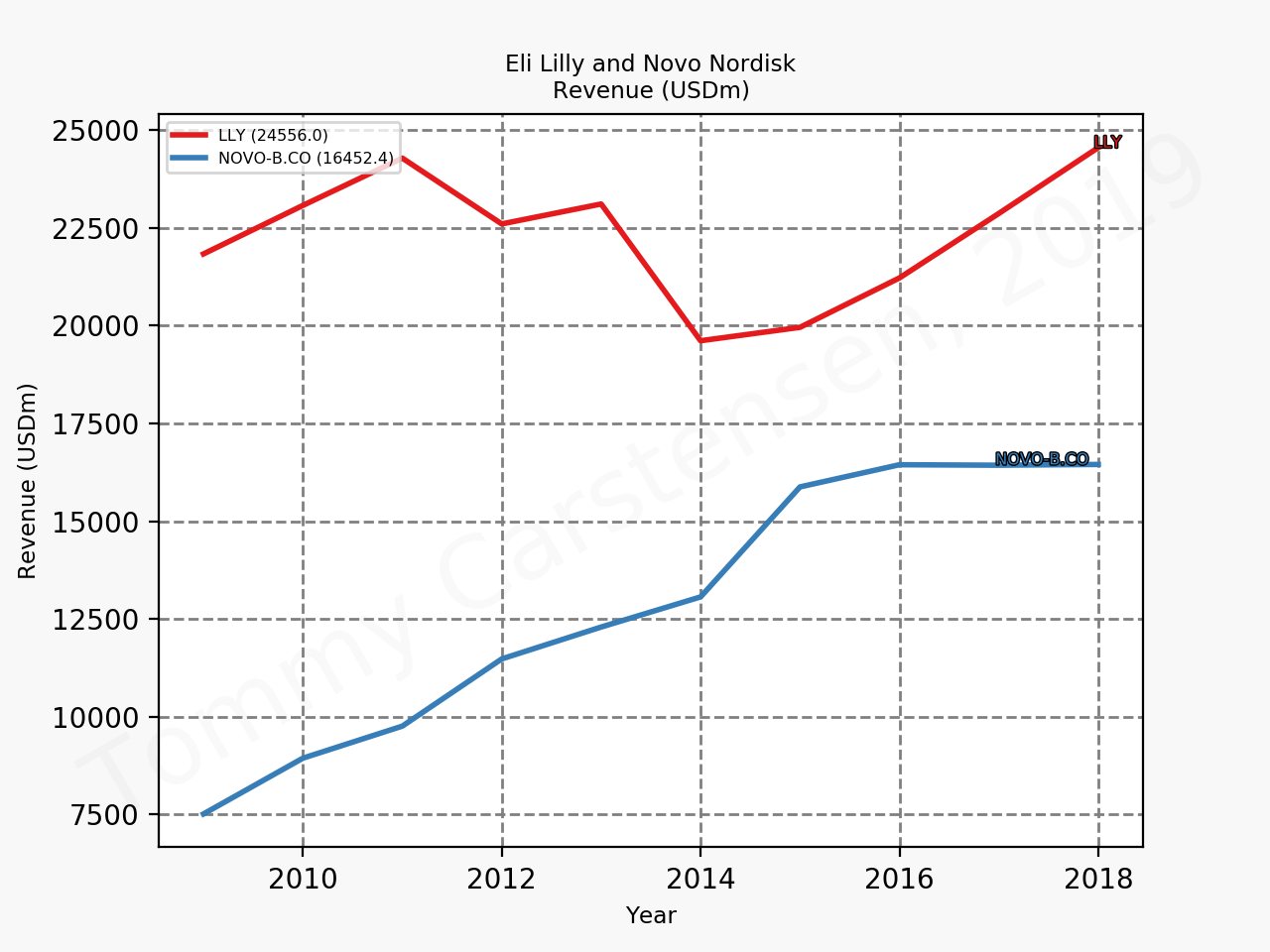

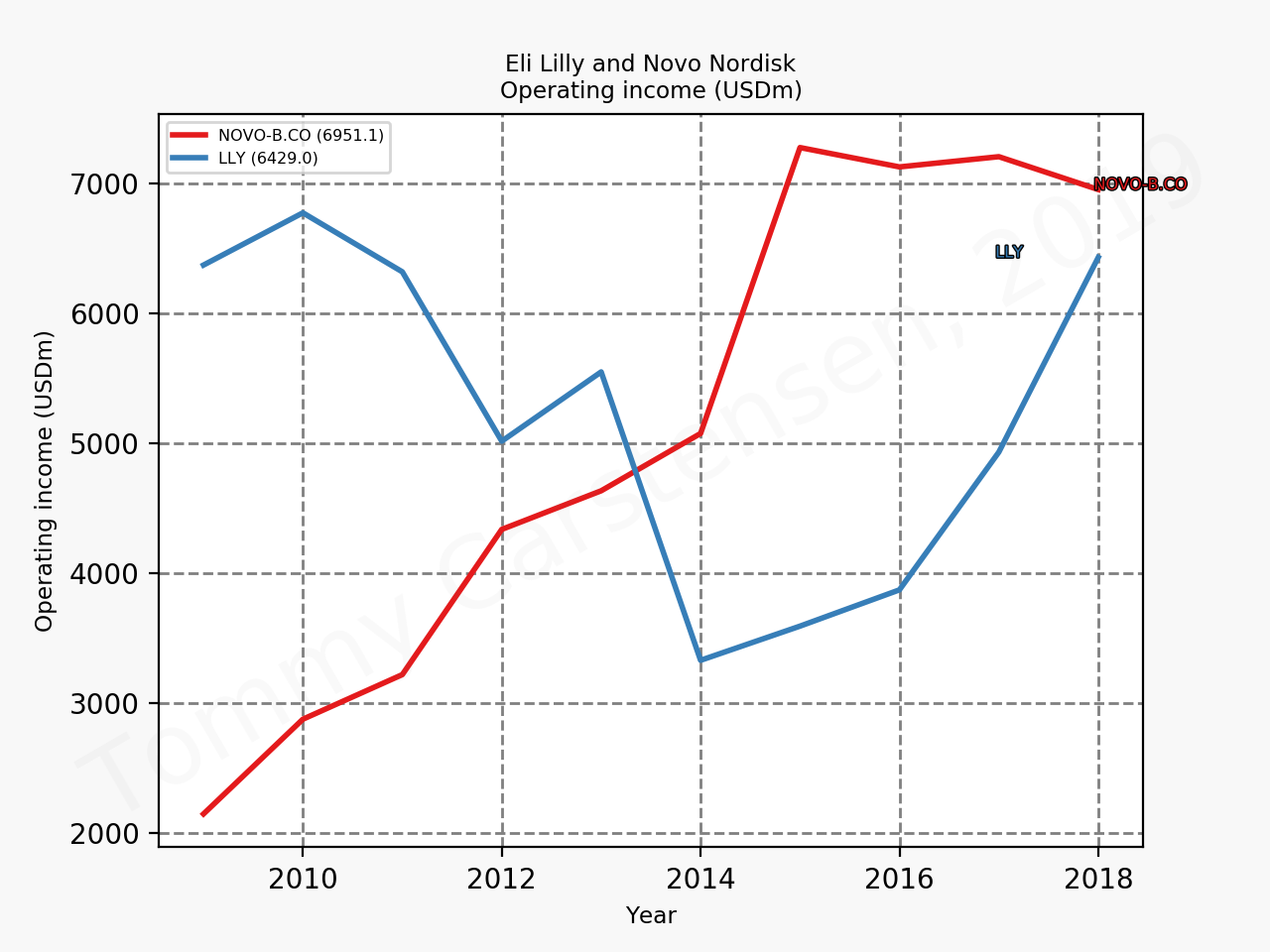

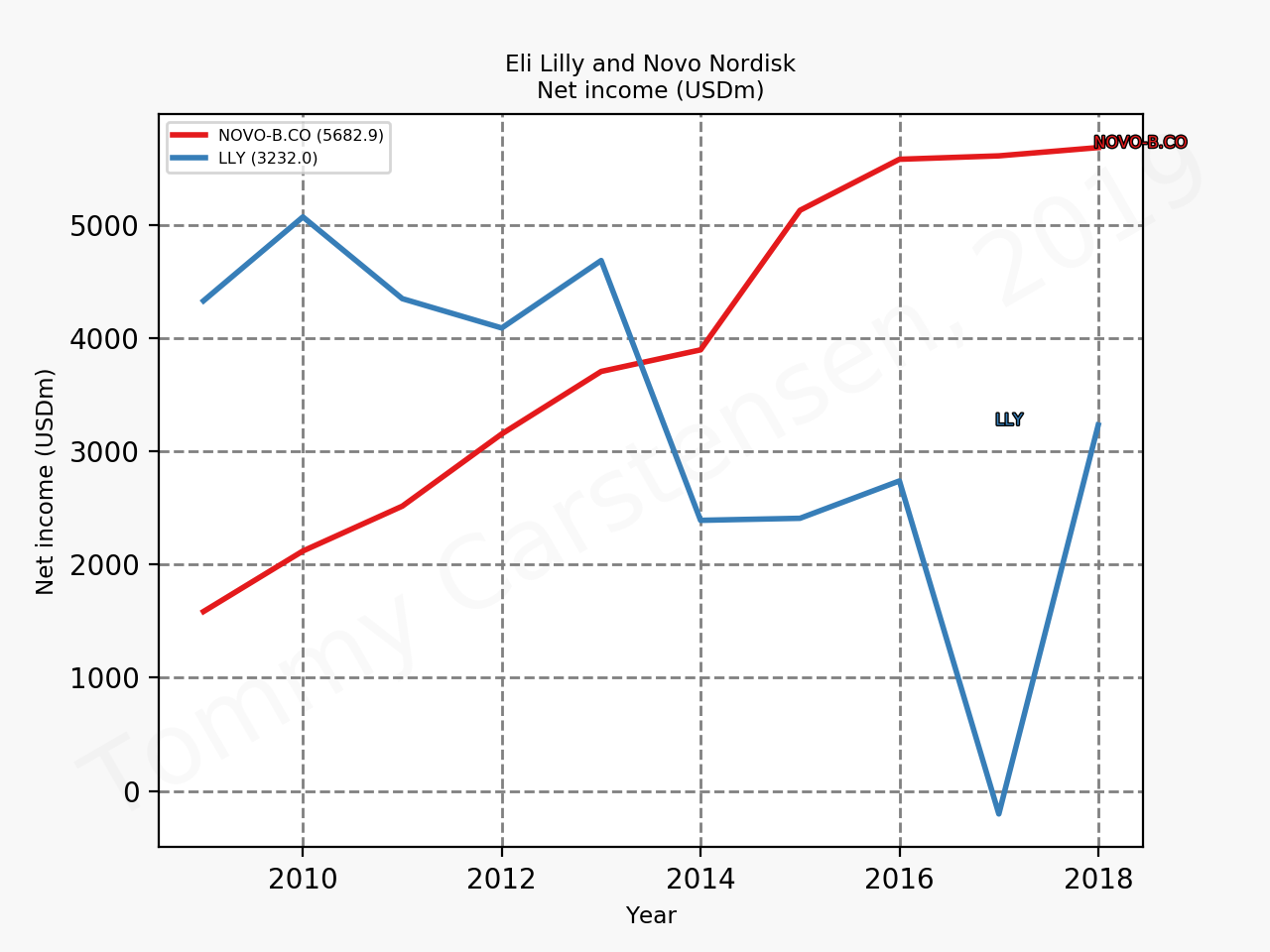

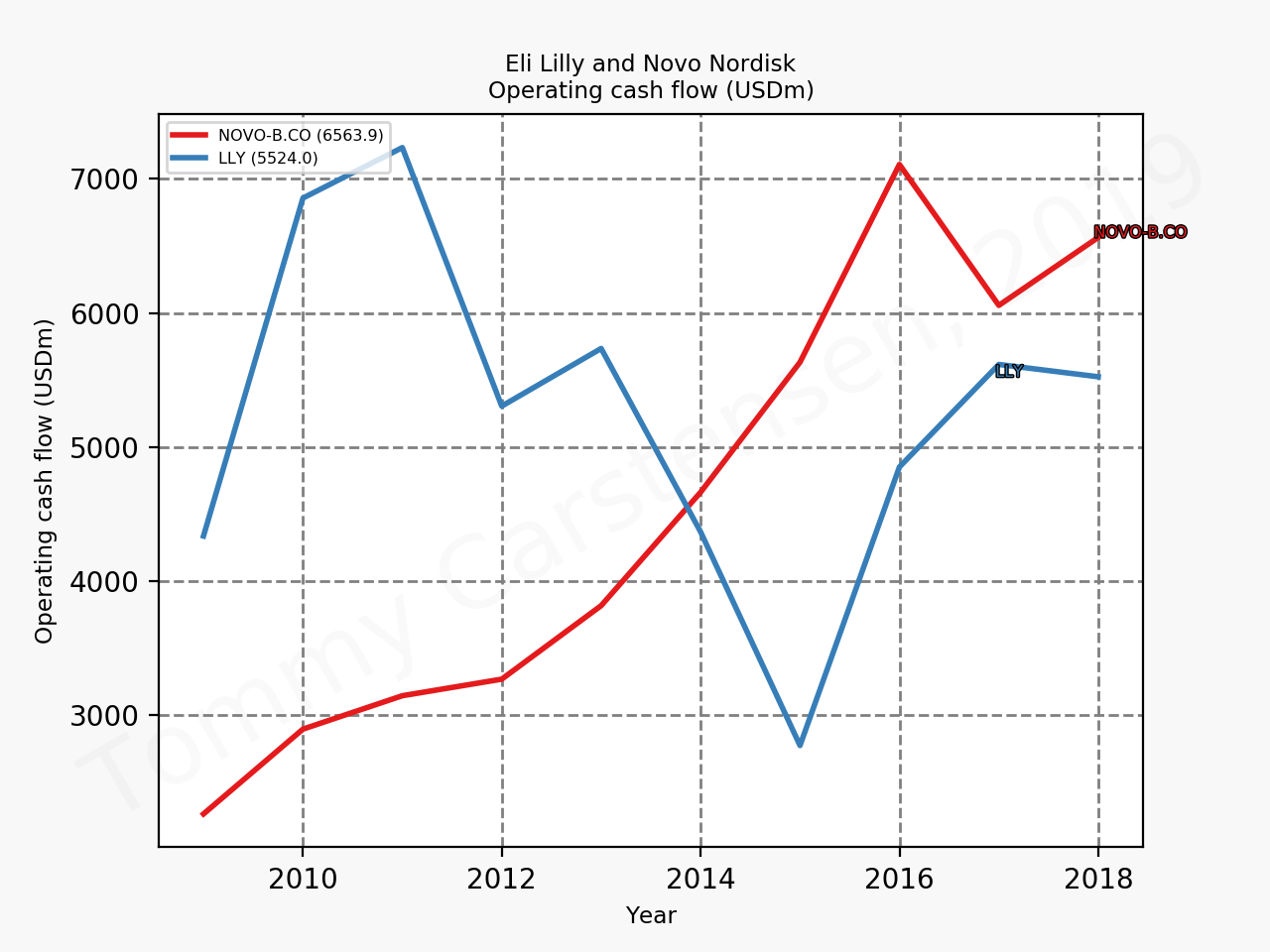

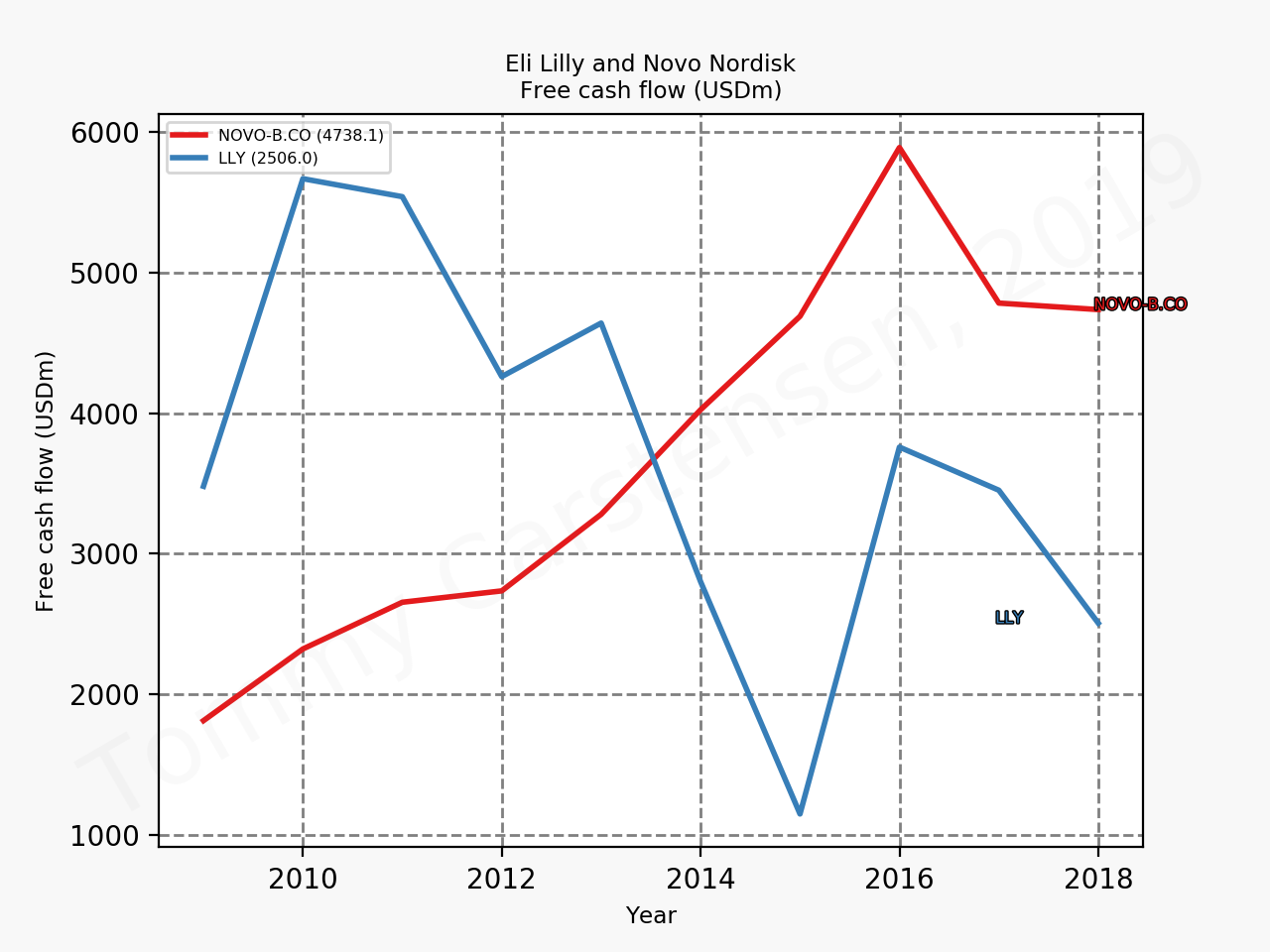

Novo Nordisk and Eli Lilly

|  |

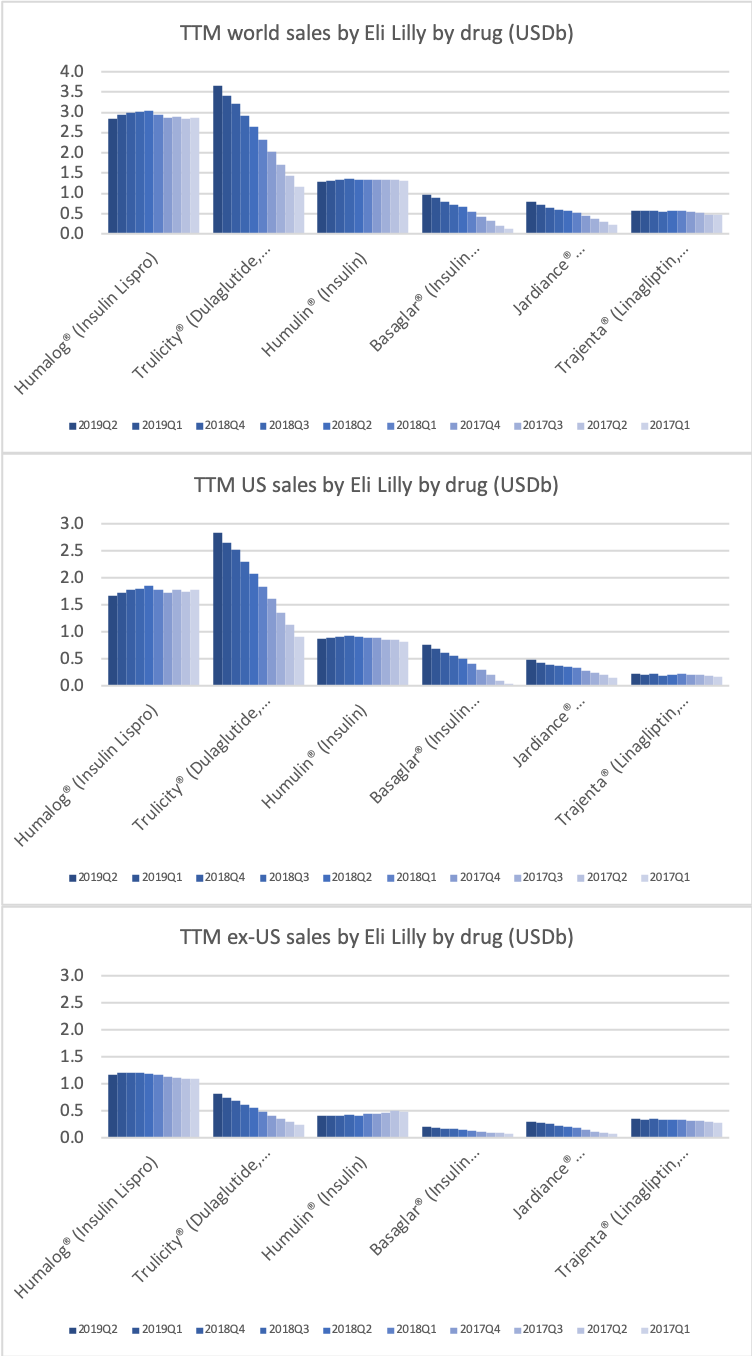

The figures below summarise the sales for Novo Nordisk and Eli Lilly for individual drugs. For Novo Nordisk the losers are Levemir® and Victoza® and the future and current winner is oral and injected semaglutide (Ozempic®), respectively. Tresiba® is only partially offsetting the revenue loss by Levemir®. The big winner for Eli Lilly is Trulicity®. A future winner might be their phase III dual agonist, which is discussed elsewhere in this article. The insulin Basaglar® is cannibalising Lantus® and the SGLT2 drug Jardiance® is also doing well within and outside the US.

Studies

The table below summarises some of the ongoing or recently finished GLP1 studies from Sanofi, Eli Lilly and Novo Nordisk.

| Company | Study ID | Trial ID | Drug | Study |

| Lilly | AWARD-11 | NCT03495102 | Dulaglutide | |

| Sanofi | AMPLITUDE-D | NCT03684642 | Efpeglenatide | Dulaglutide |

| Sanofi | AMPLITUDE-L | NCT03713684 | Efpeglenatide | Glargine |

| Sanofi | AMPLITUDE-M | NCT03353350 | Efpeglenatide | Placebo |

| Sanofi | AMPLITUDE-S | NCT03770728 | Efpeglenatide | Sulfonylurea |

| Sanofi | AMPLITUDE-O | NCT03496298 | Efpeglenatide | MACE |

| Lilly | SURPASS J-mono | NCT03861052 | Tirzepatide | Dulaglutide |

| Lilly | SURPASS-1 | NCT03954834 | Tirzepatide | – |

| Lilly | SURPASS-2 | NCT03987919 | Tirzepatide | Semaglutide |

| Lilly | SURPASS-3 | NCT03882970 | Tirzepatide | Degludec |

| Lilly | SURPASS-4 | NCT03730662 | Tirzepatide | I Glargine |

| Lilly | SURPASS-5 | NCT04039503 | Tirzepatide | I Glargine |

| Novo | SOUL | NCT03914326 | Semaglutide | MACE |

| Novo | PIONEER 12 | NCT04017832 | O Semaglutide | Sitagliptin |

Valuation

Eli Lilly is more than just Trulicity® and diabetes (e.g. Taltz®), but it is very richly valued despite terzepatide and other interesting drugs in the pipeline. Levemir® will continue to deteriorate for Novo Nordisk and Ozempic® will continue to cannibalise Victoza®, but a positive catalyst is the expected approval of oral semaglutide on September 20th; oral semaglutide could take market share from injected GLP1 (USD9B), SGLT2 (USD3B), DPP4 (USD8B) and insulin (USD18B). There is a lot of potential upside. Neither company is particularly attractive at current prices.

Good information i am big fan this website please more send

Thanks for the feedback. I’ll write about Novo Nordisk each quarter.