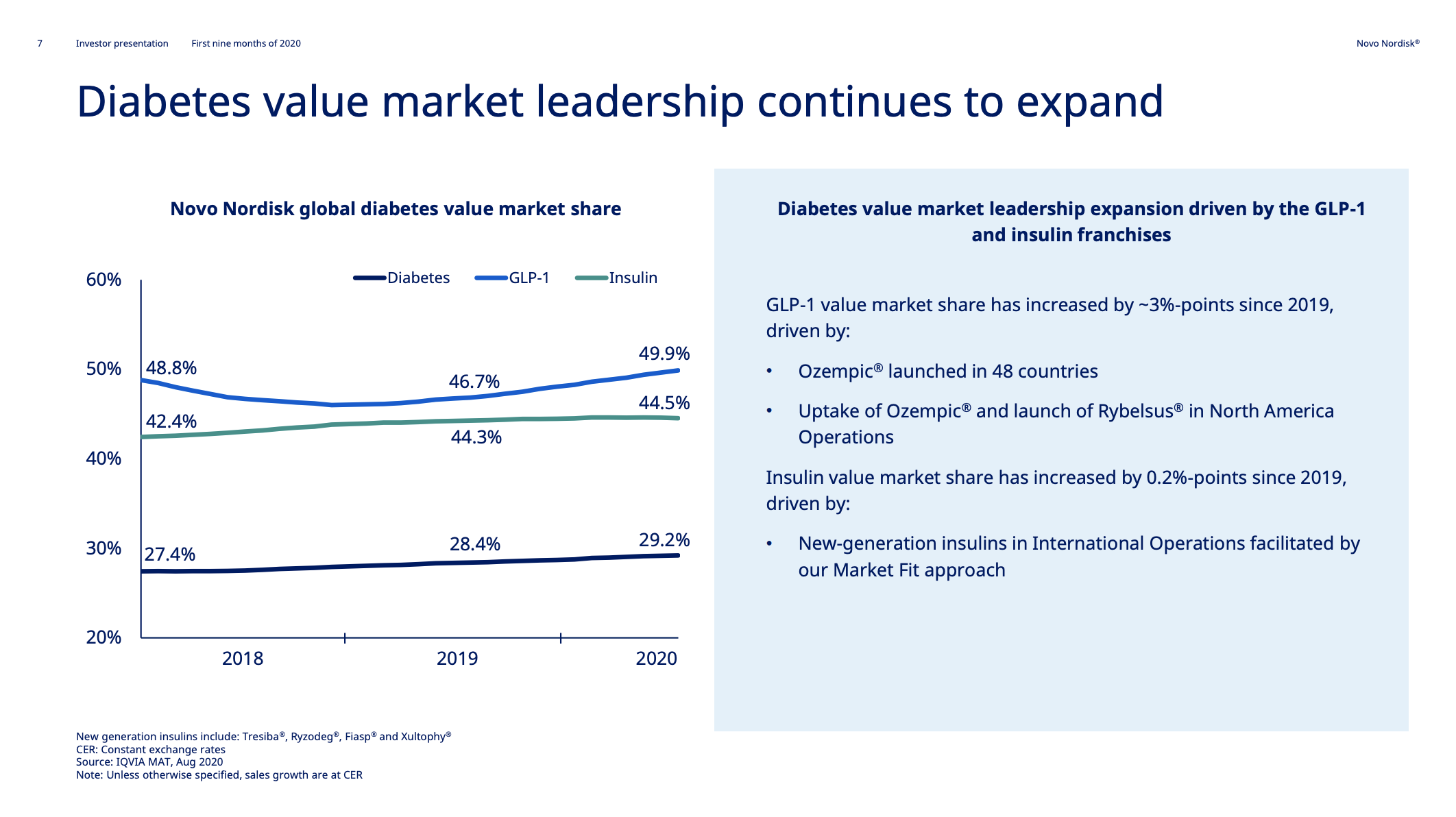

Novo Nordisk has gained market share in diabetes (29.2%), GLP-1 (49.9%) and insulin (44.5%).

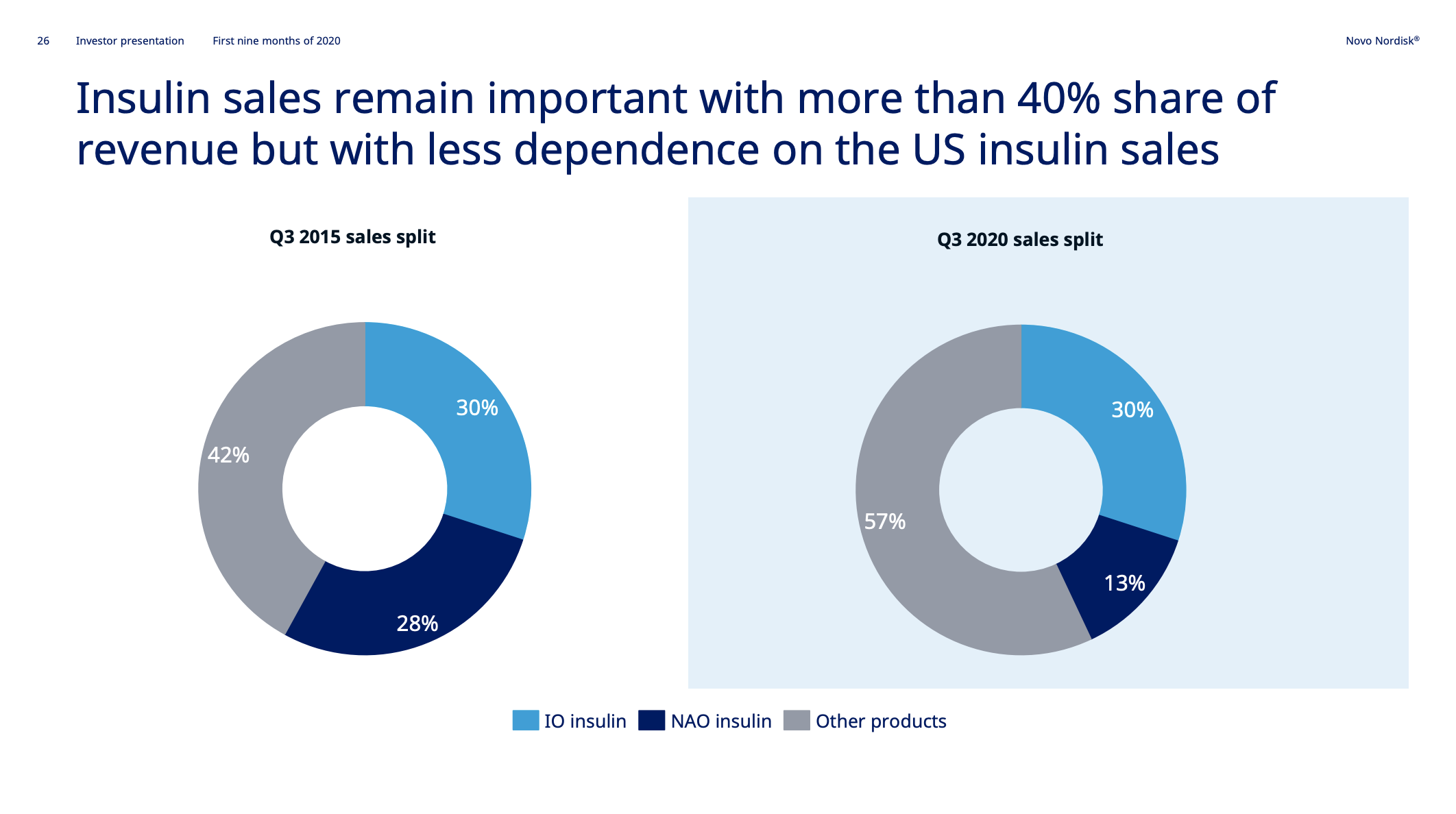

The gain in market share has happened with a change in market value in the US as a backdrop; i.e. GLP-1 up and insulin down. As a consequence approximately 70% of sales in the US did not exist 5 years ago.

Diabetes and GLP-1

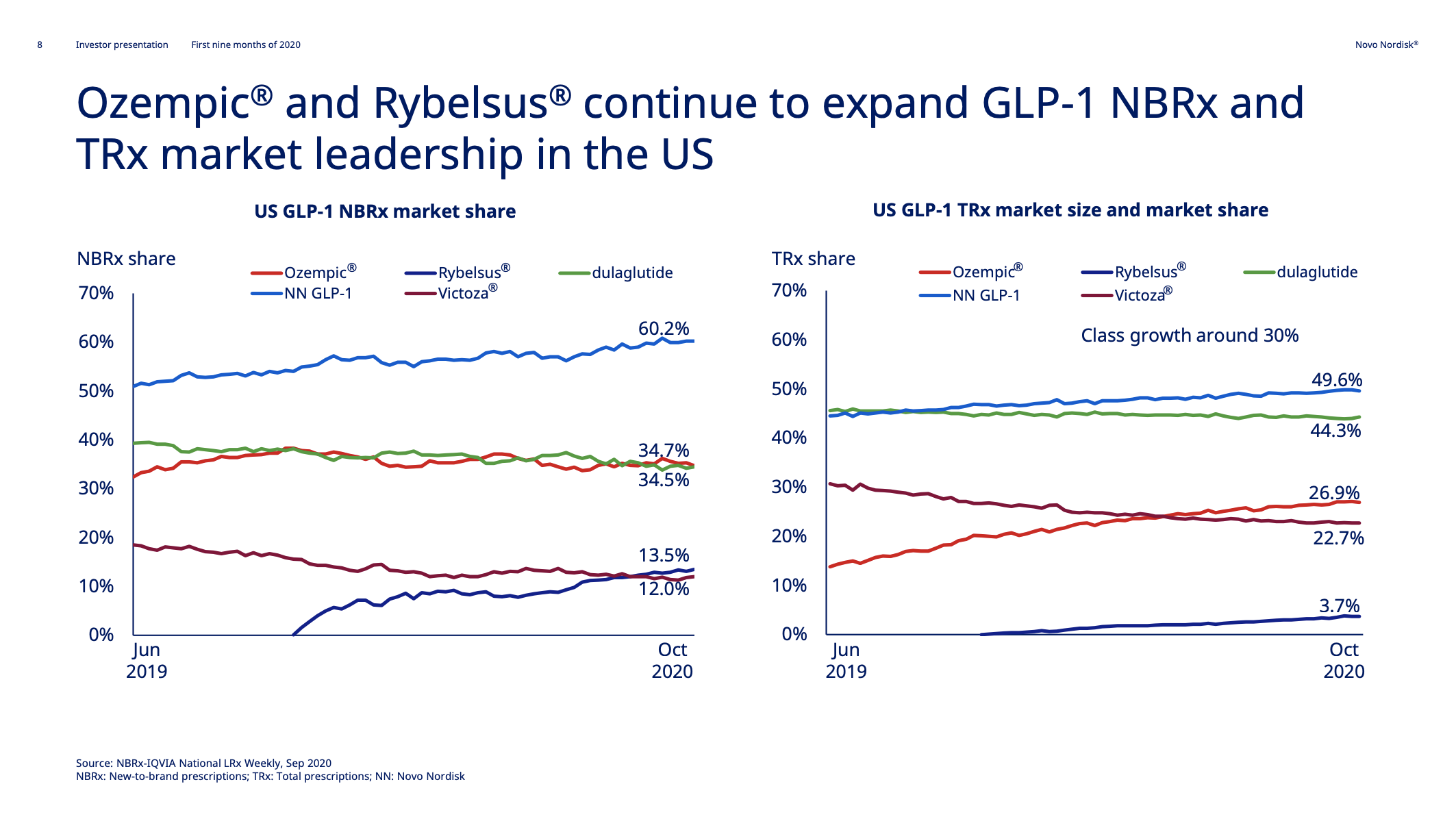

In the US Novo Nordisk GLP1s command a 60.2% NBRx and 49.6% TRx market share, which is driven by Ozempic® (once weekly injected semaglutide) and Rybelsus® (oral semaglutide).

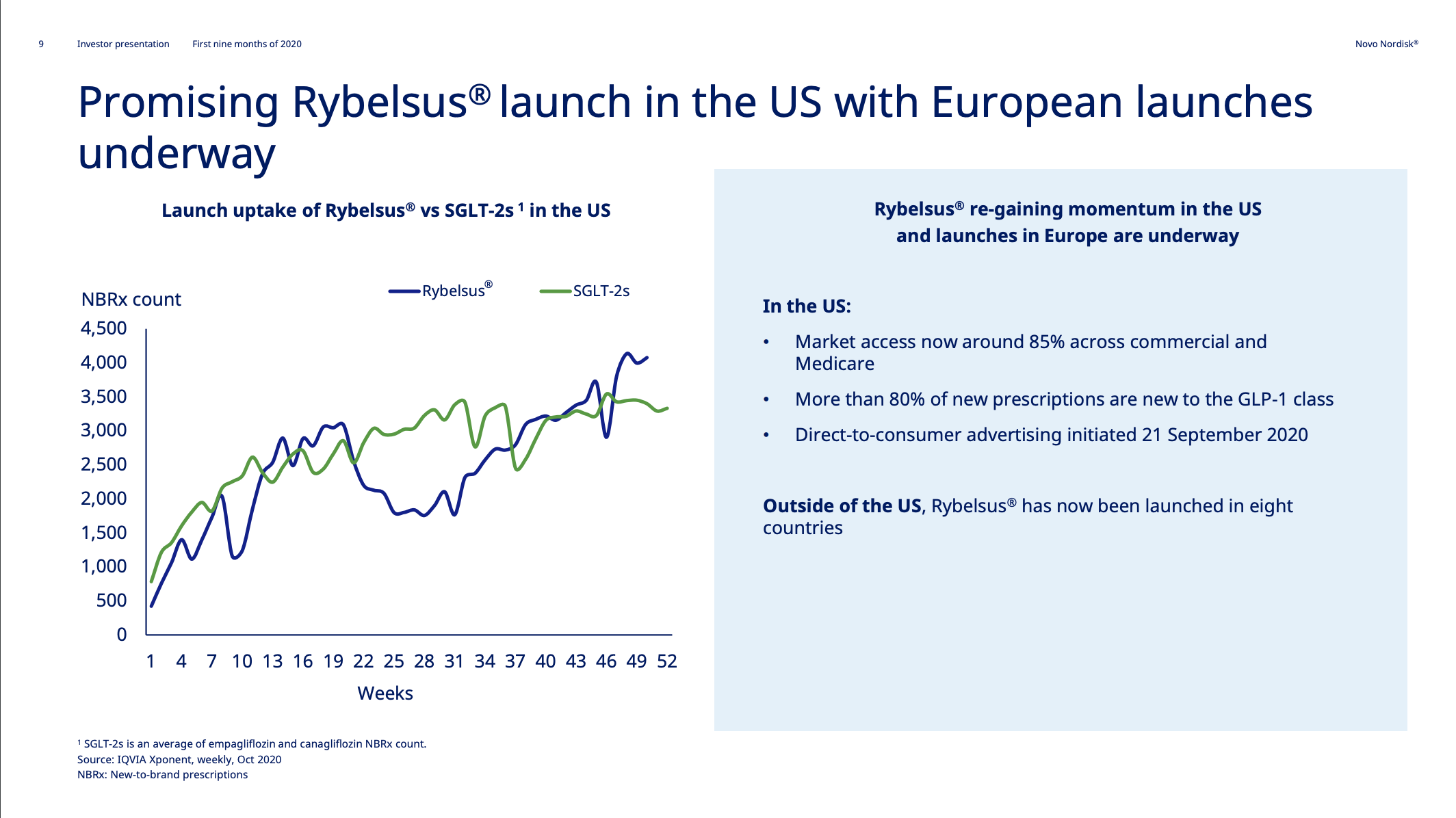

The uptake of Rybelsus® has however been curbed by COVID-19, but market access in the US is now approximately 85%.

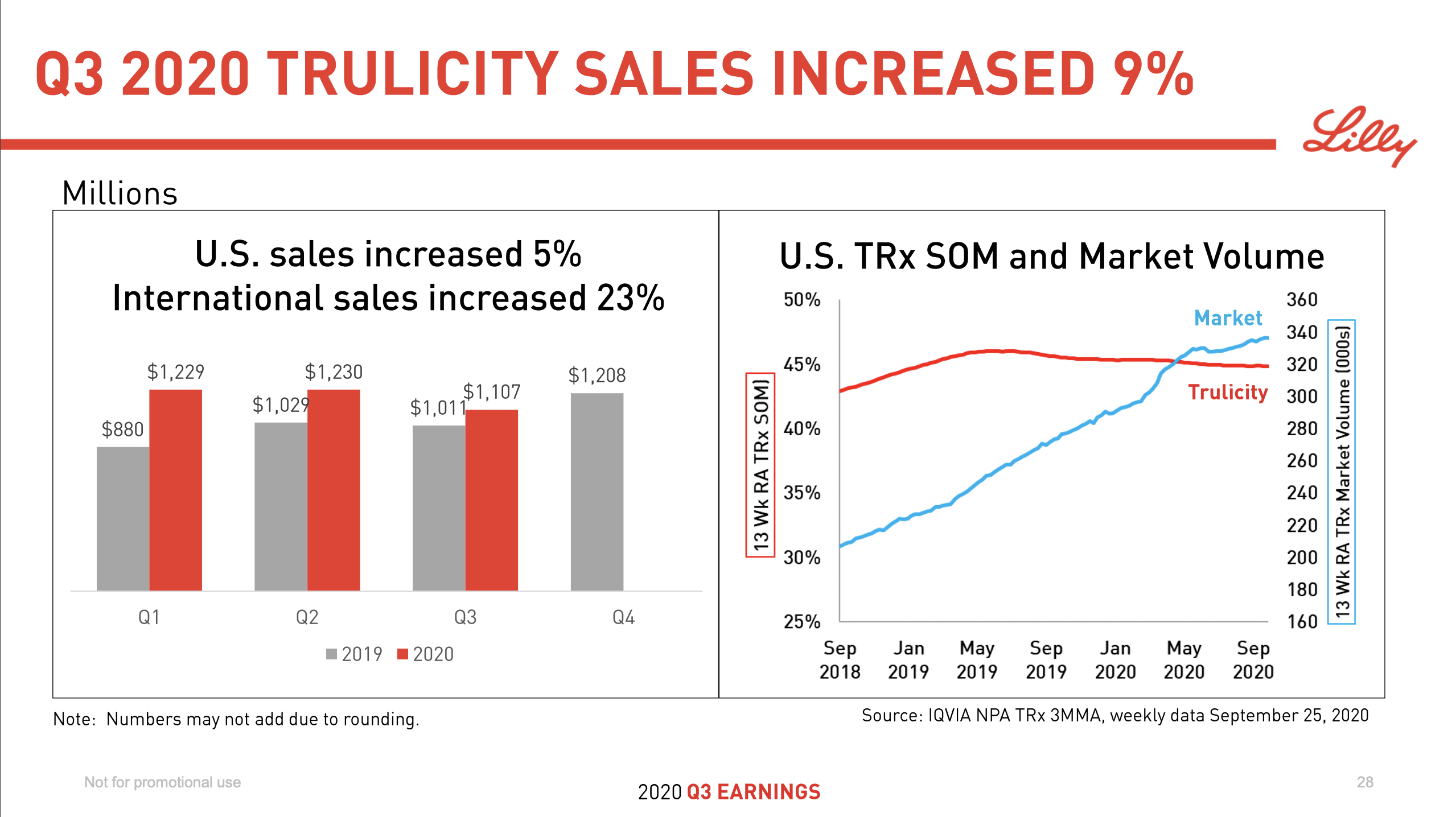

In a similar fashion sales of Trulicity® have increased by 9% but it has lost market share as a proportion of both prescriptions and market value.

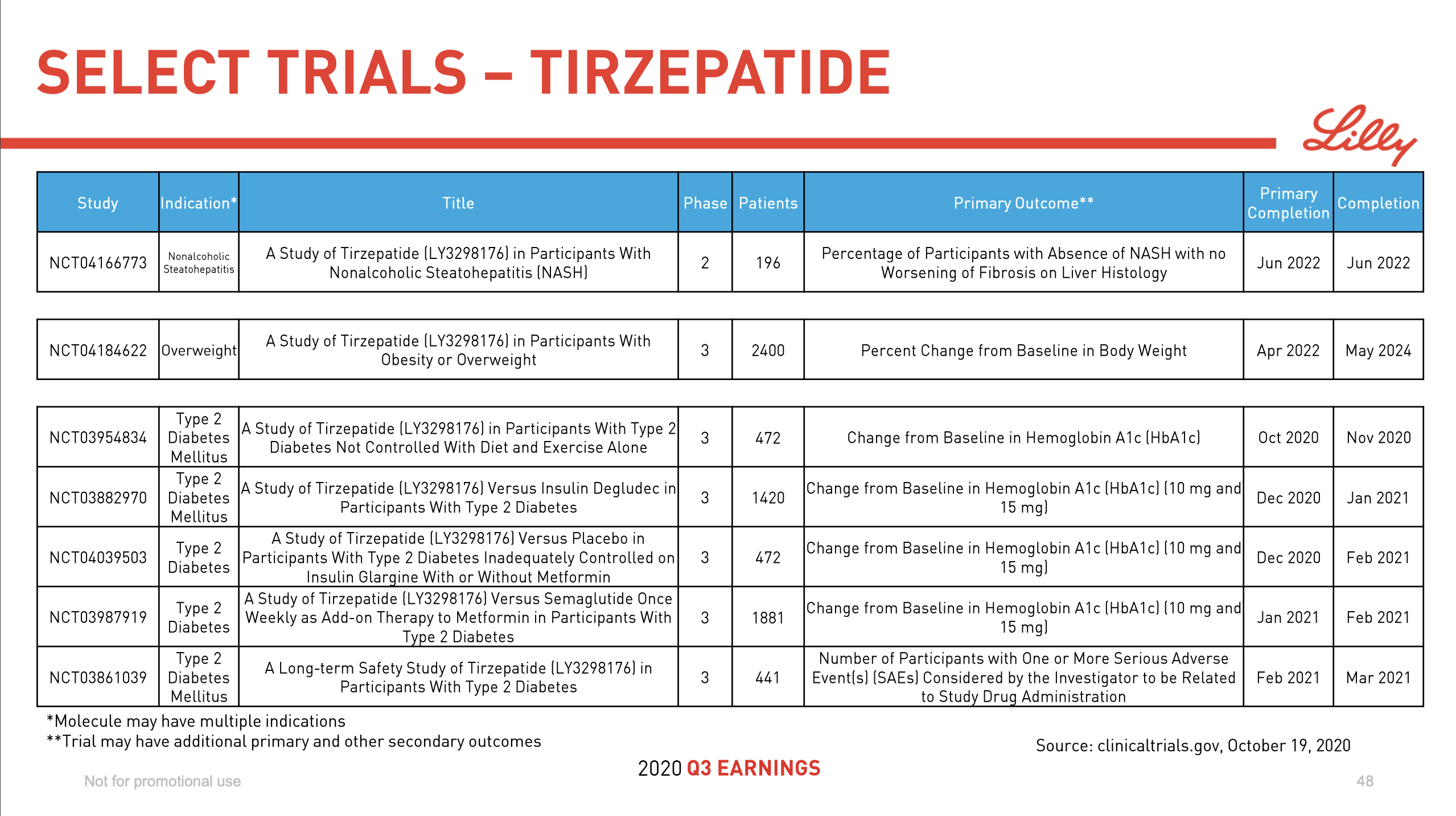

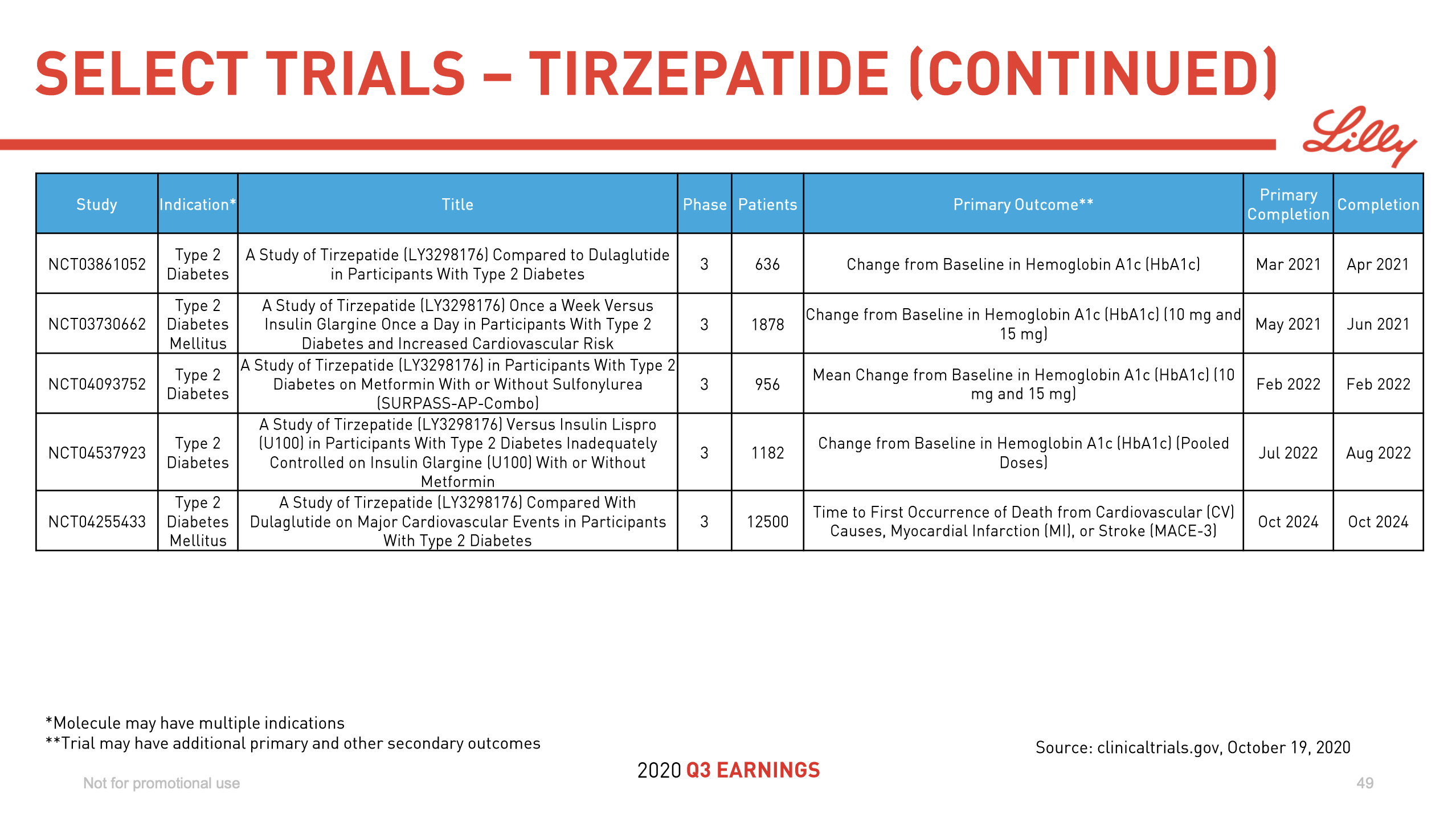

Ozempic® might face competition from Tirzepatide in the future.

Diabetes and insulin

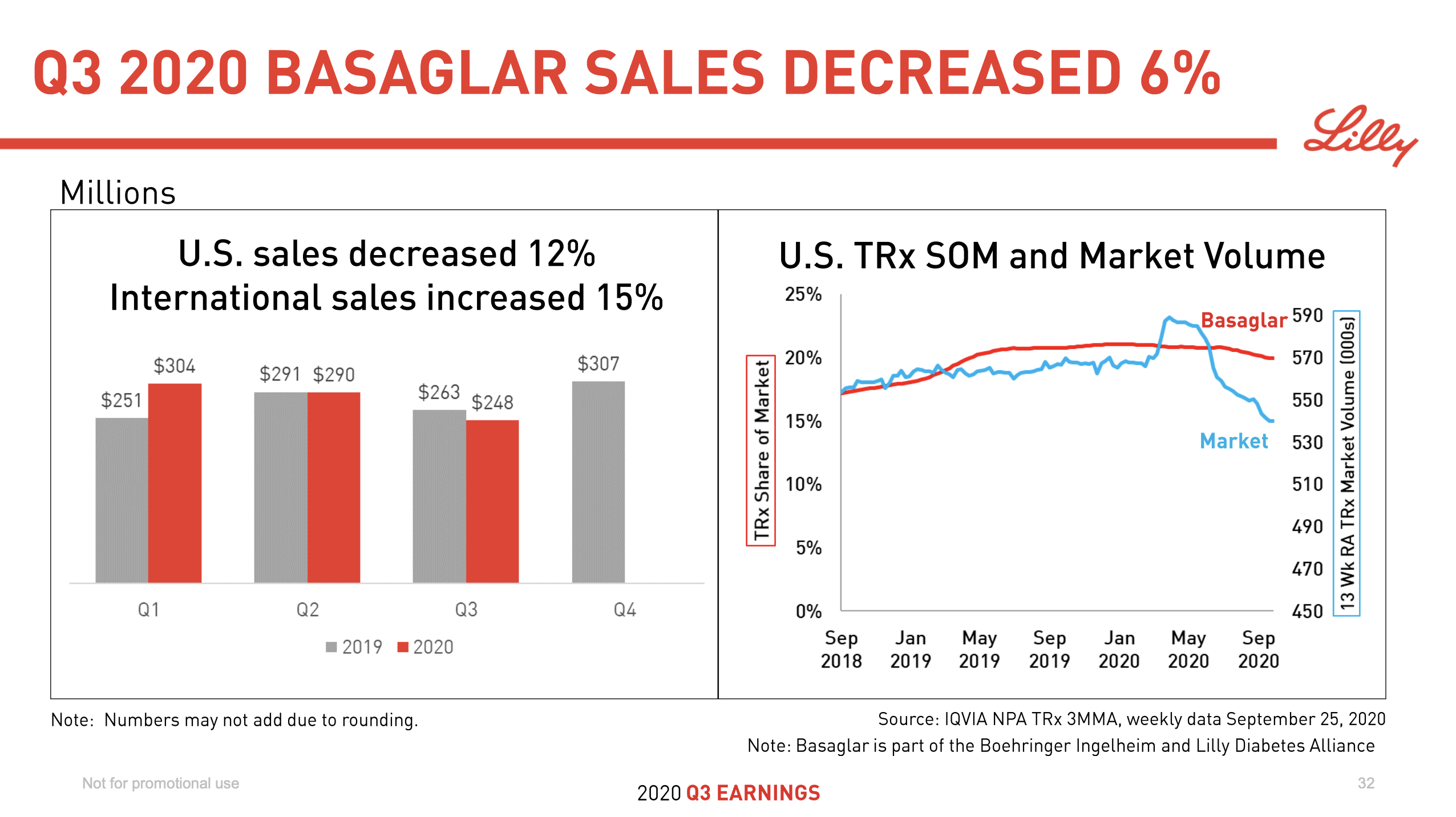

As already mentioned insulin is deteriorating rapidly in the US, which is thanks to biosimilars such as Basaglar® and Admelog®.

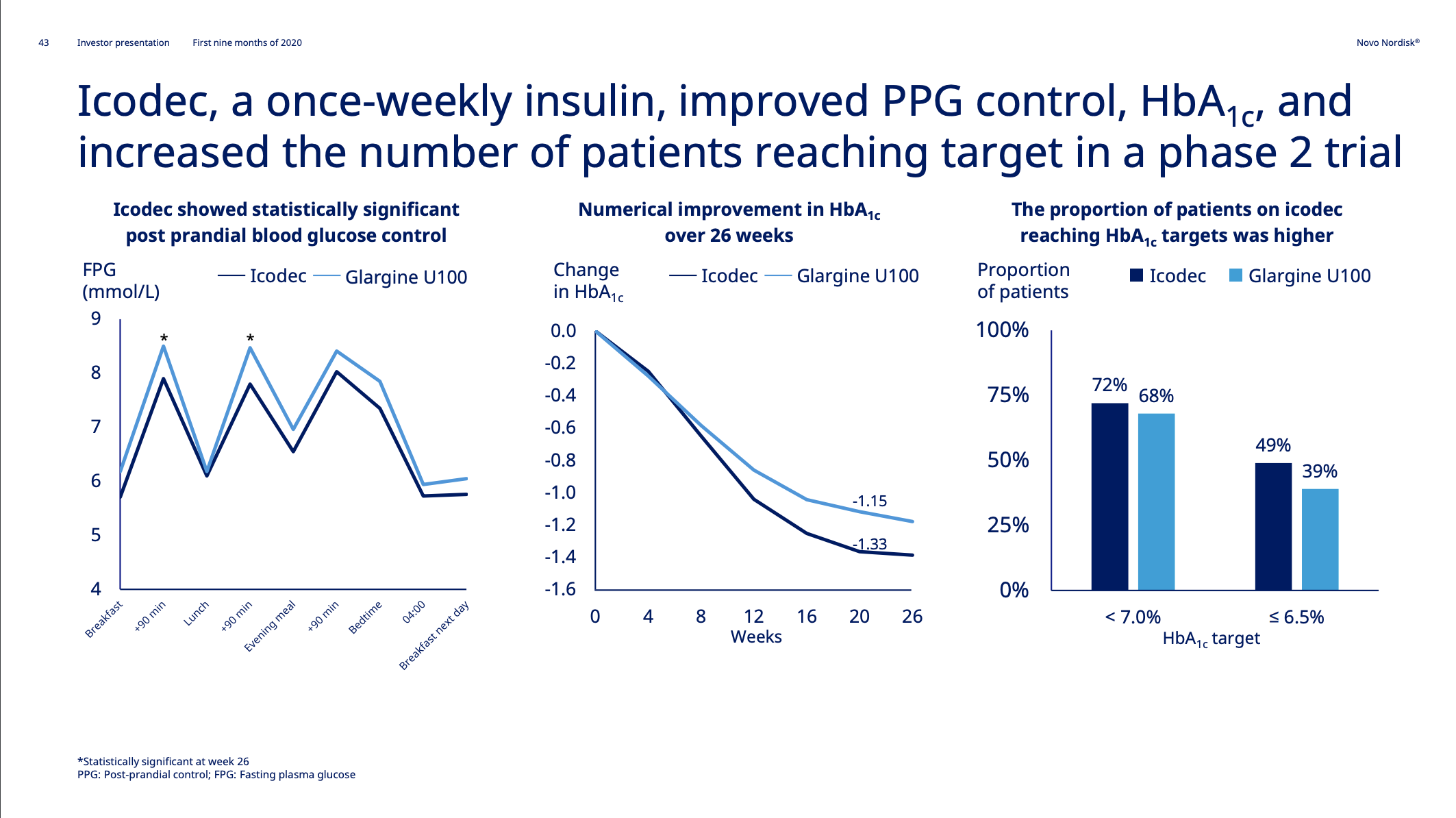

Insulin icodec phase 3 clinical trial results might be available in the second half of 2021.

The glucose sensitive insulin NN1845 has been added to phase 1.

Obesity

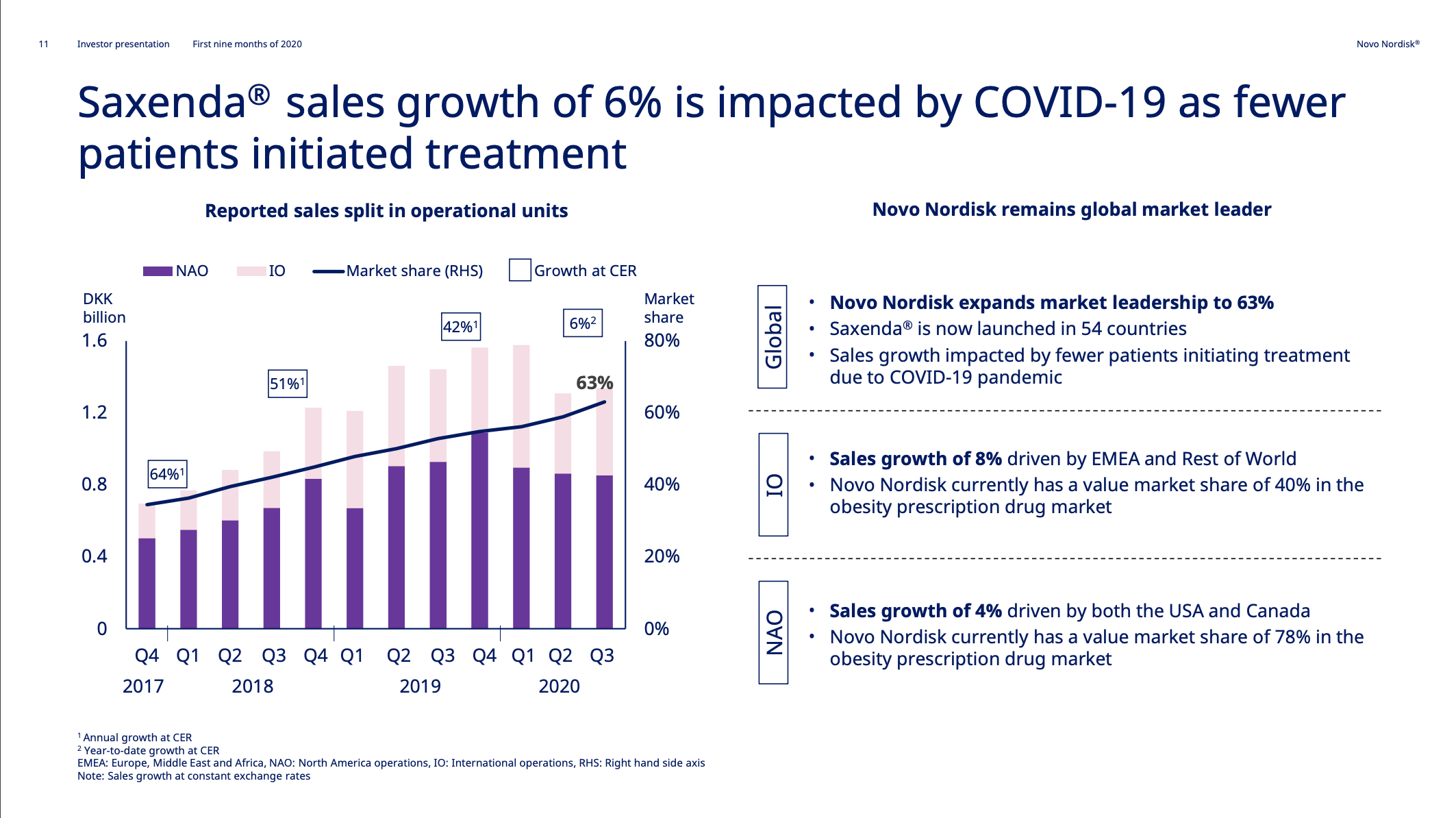

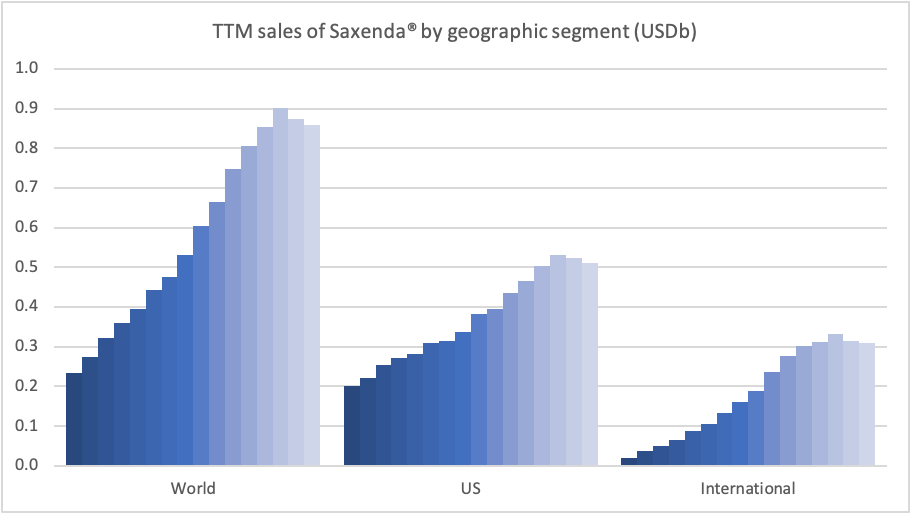

The uptake of Saxenda® has been put on hold by COVID-19 as demonstrated by the reduction in new prescriptions and sales.

A decision on injected semaglutide for obesity is expected in Q4 or Q1. Getting oral semaglutide approved for obesity would be the next logical step. Eli Lilly is expecting their phase 3 primary endpoint results on Tirzepatide for obesity in June 2022.

It will be interesting to see if Novo will keep gaining market shares in the US market in the coming years with increasing awareness about health and diet.