PepsiCo issued a press release regarding its quarterly results before the market opened.

CEO comments

The financial results were accompanied by the following comments by CEO Ramon Laguarta.

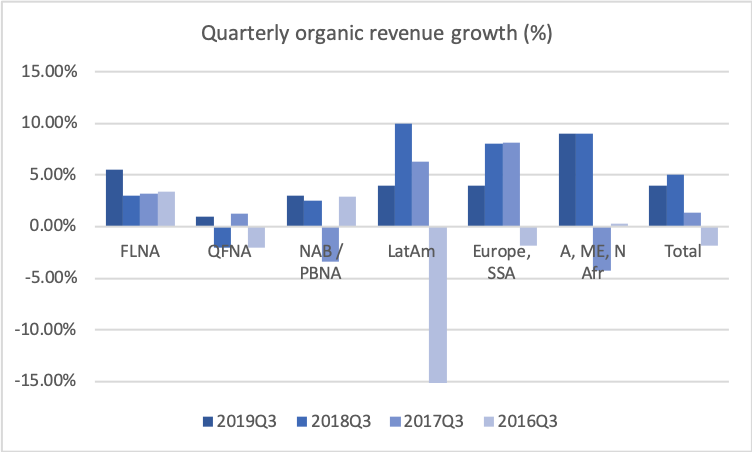

“We are pleased with our results for the third quarter. While adverse foreign exchange translation negatively impacted reported net revenue performance, organic revenue growth was 4.3% in the quarter. We are making good progress against our strategic priorities and our businesses are performing well as we continue to make the necessary investments in our capabilities, brands, manufacturing and go-to-market capacity to propel our future growth. Given our performance year-to-date, we now expect to meet or exceed our full-year organic revenue growth target of 4%.”

Diving into the financial results

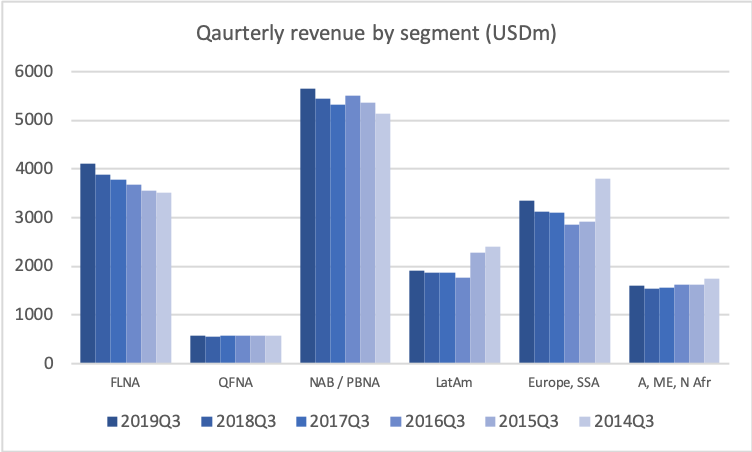

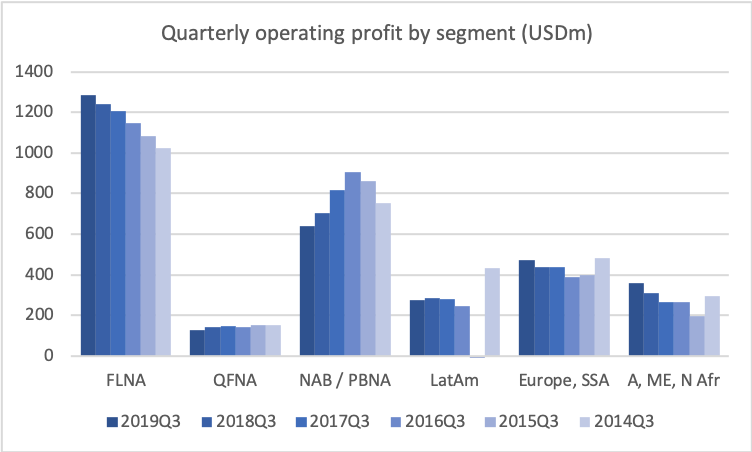

All segments except for Frito Lay North America (FLNA) and Asia/Middle East/North Africa suffered from decreasing volume, but this was offset by an increase in price and all segments experienced organic revenue growth.

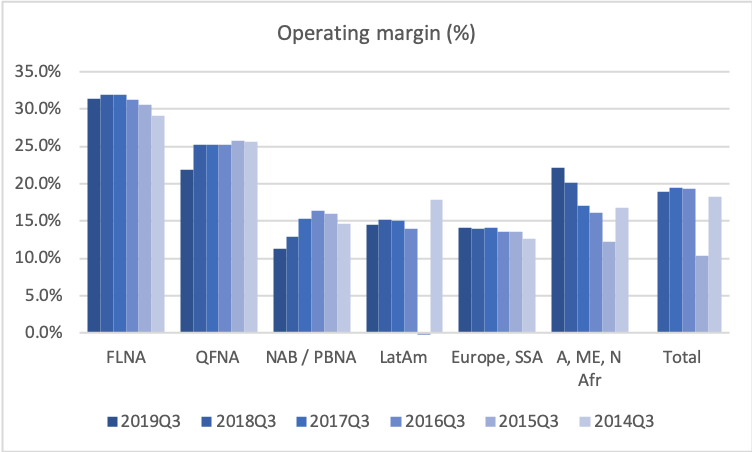

The operating margin margin for Quaker Foods North America contracted from 25.2% to 21.9%.

[expand title=”A question regarding the permanency of the contraction of the margins of the Quaker Foods North America segment was asked, and the decreasing margins were explained as being due to increased COGS as a consequence of an improved formulation that eliminates artificials.”]

[/expand]A question on Quaker. Quaker’s trend seems to be getting better, second quarter in a row that — of organic growth at Quaker, something not seen since 2015, if I’m correct. So could you please give us more granularity in those results, especially, and it’s not necessarily what we are seeing in

Nielsen data? And how sustainable this trend is in your view? And also, I mean, this growth seems to be coming at the expense of operating income, which seems to be a change of strategy this year versus the last few years. Should we think about operating margins to continue to compress to sustain the growth here?Good question, Laurent. Of course, we want each one of our businesses to be a positive growth business, so Quaker, no different. We will continue to invest to make sure that business continues to grow, maybe not at the levels that we have Frito-Lay, but just good levels.

We’ve done several things with that business. One is we invested a bit more, both in CapEx and on cost of goods. Cost of goods, specifically in the area of improving the formulation of our Quaker products. So we’ve eliminated all the artificials, now it’s only natural and I think that will do well for the brand going forward. Although it’s quite an important investment in terms of cost of goods. So that’s why you’re seeing the operating —

the gross margin reducing a little bit in Quaker.

2019 Expectations

PepsiCo maintains its expectations in terms of operating cash flow $9B and cash returns to shareholders of approximately $8B.

- Approximately $9 billion in cash from operating activities and free cash flow of approximately $5 billion, which assumes net capital spending of approximately $4.5 billion.

- Total cash returns to shareholders of approximately $8 billion, comprised of dividends of approximately $5 billion and share repurchases of approximately $3 billion.

This expectation is in line with previous years. The free cash flow in recent years have suffered a bit from increased net capital spending and in particular from a reduced operating cash flow. Given the increased share price and the reduced free cash flow it makes that share repurchases have been decreasing since 2015. As a consequence of the reduced buybacks and the increasing share price PepsiCo currently has one of the lower buyback ratios compared to other US consumer staples.

Valuation

PepsiCo is not cheap in absolute terms and neither relative to its peers nor its past. It’s probably not a time to buy, but given organic growth of four percent it’s probably not the time to sell either. Better consumer staples alternatives to buy might be Kraft Heinz [KHC], Unilever [UN, UNA.AS] or AB InBev [BUD, ABI.BR].

References

Reuters – Advertising blitz, sugar-free Gatorade drive PepsiCo profit beat

Bloomberg – Pepsi Says Consumer Chugging Along Even With Higher Prices

CNBC – Pepsi’s stock jumps as higher advertising spending fuels sales growth and earnings beat