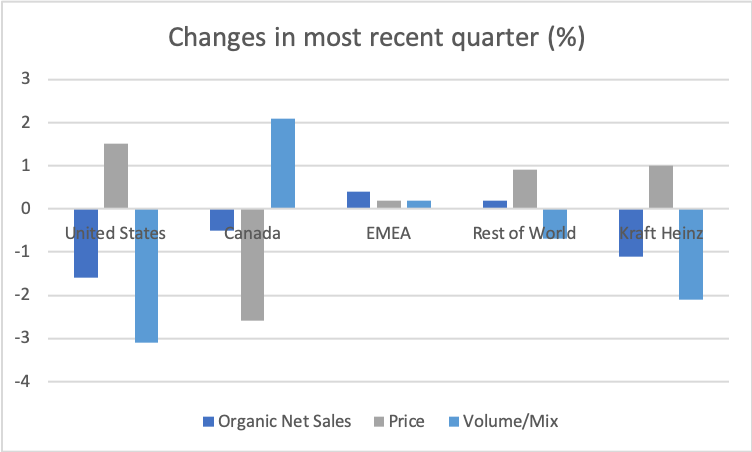

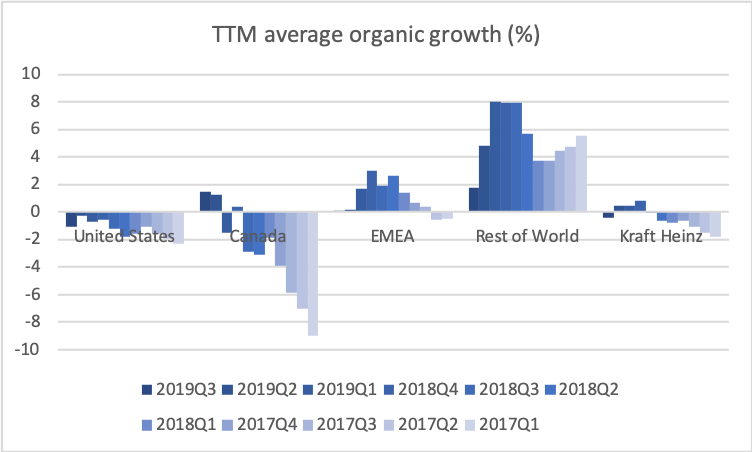

Kraft Heinz issued a press release on its third quarter results before the market opened. Organic growth was -1.6% in the US and -1.1% for the whole business.

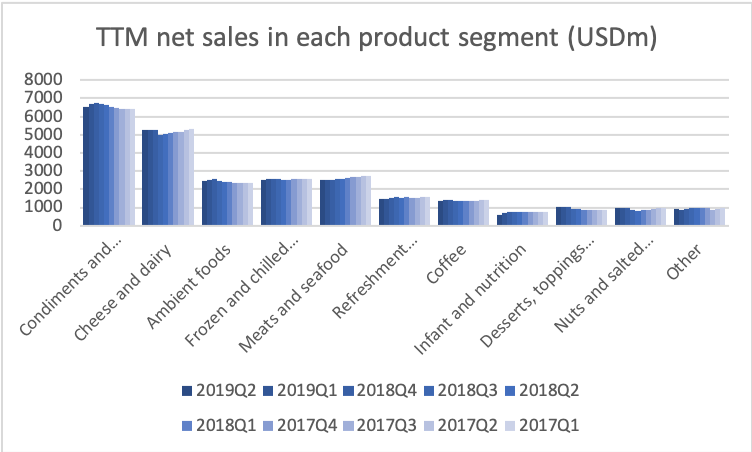

Revenue and income by geographic and product segment

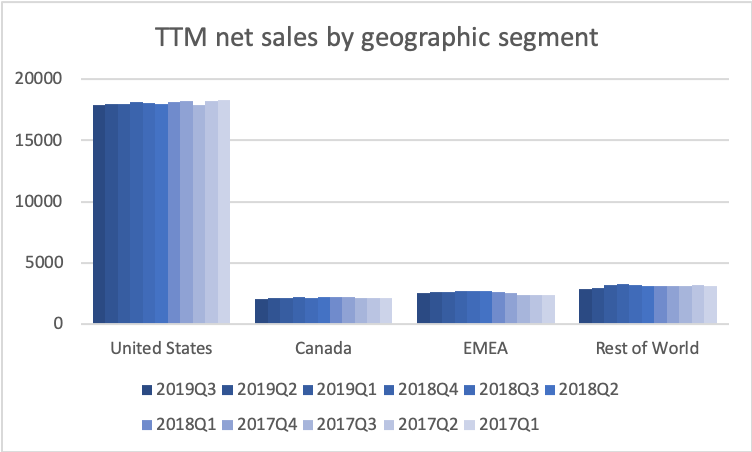

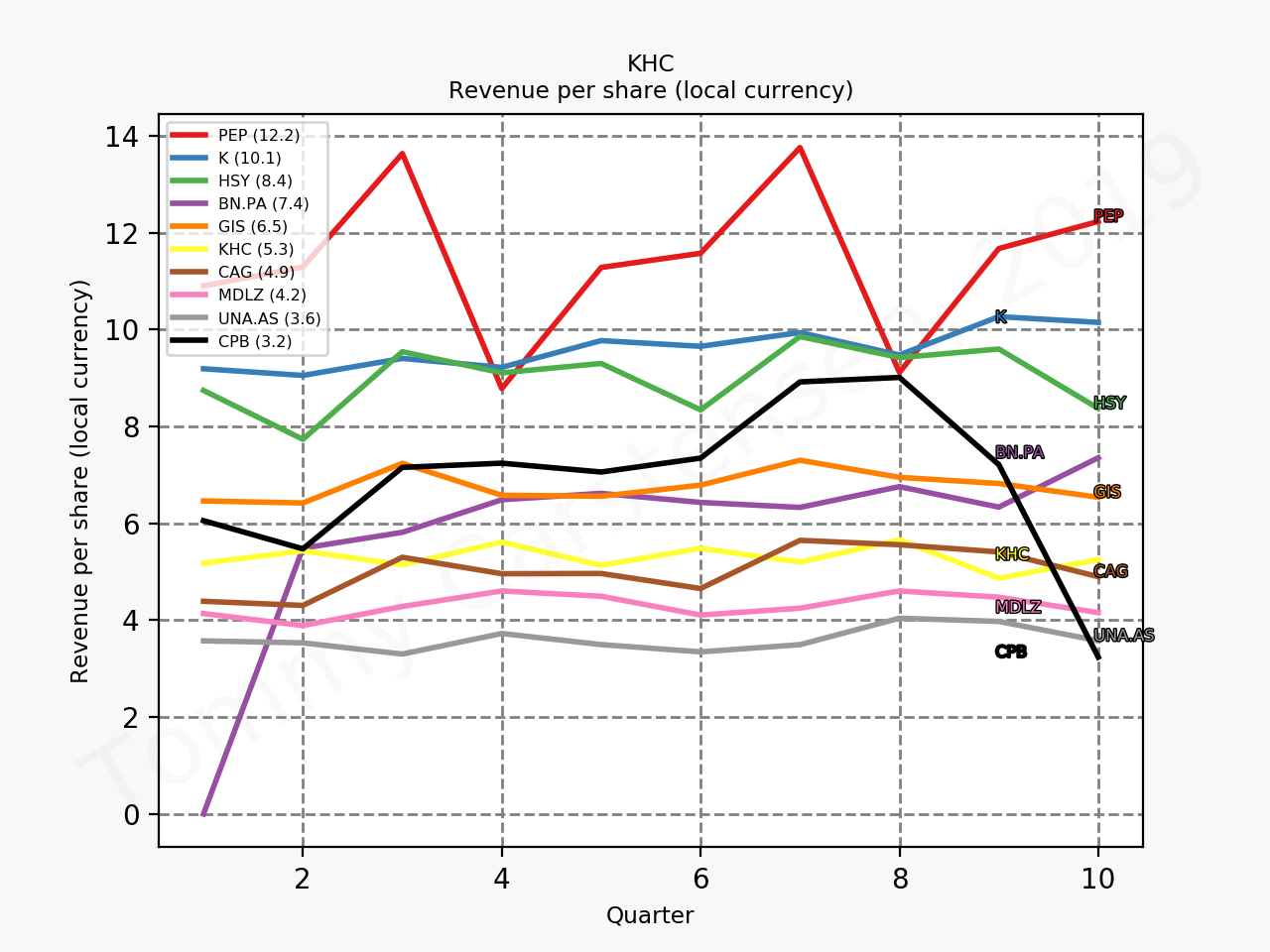

Revenue growth was impacted negatively by negative organic growth, currency headwinds and divestitures.

The natural cheese business being sold contributed approximately $560 million CAD (approximately $427 million USD at current FX rates) to Kraft Heinz’s net sales in 2017.

Press release from November 2018 announcing sale of Canadian natural cheese business to Parmalat.

The Kraft Heinz Company announced today the closing of the previously announced sale of its Canadian natural cheese business to Parmalat for a purchase price of $1.62 billion CAD (approximately $1.24 billion USD at current FX rates). The agreement includes Cracker Barrel, P’tit Québec, and aMOOza! brands in the Canadian market.

Press release from July 2nd announcing closing of the sale.

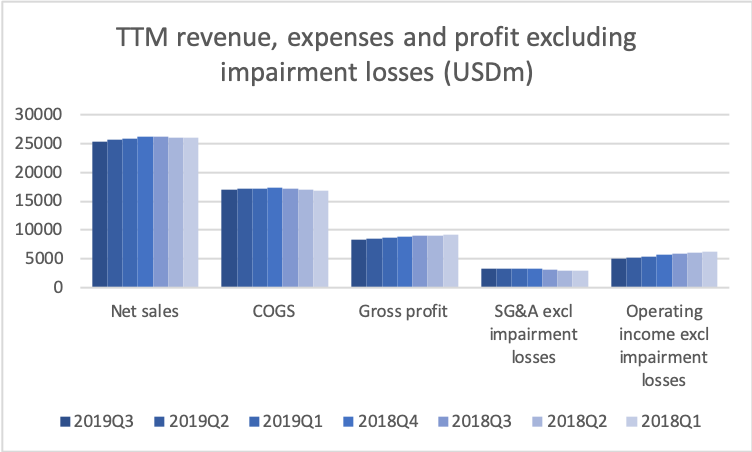

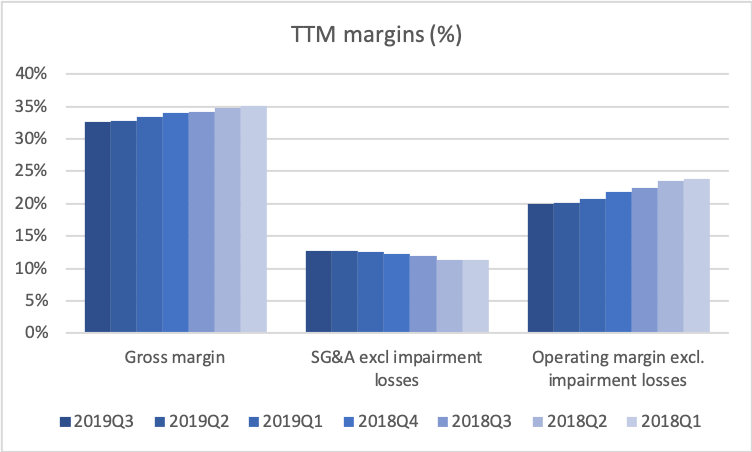

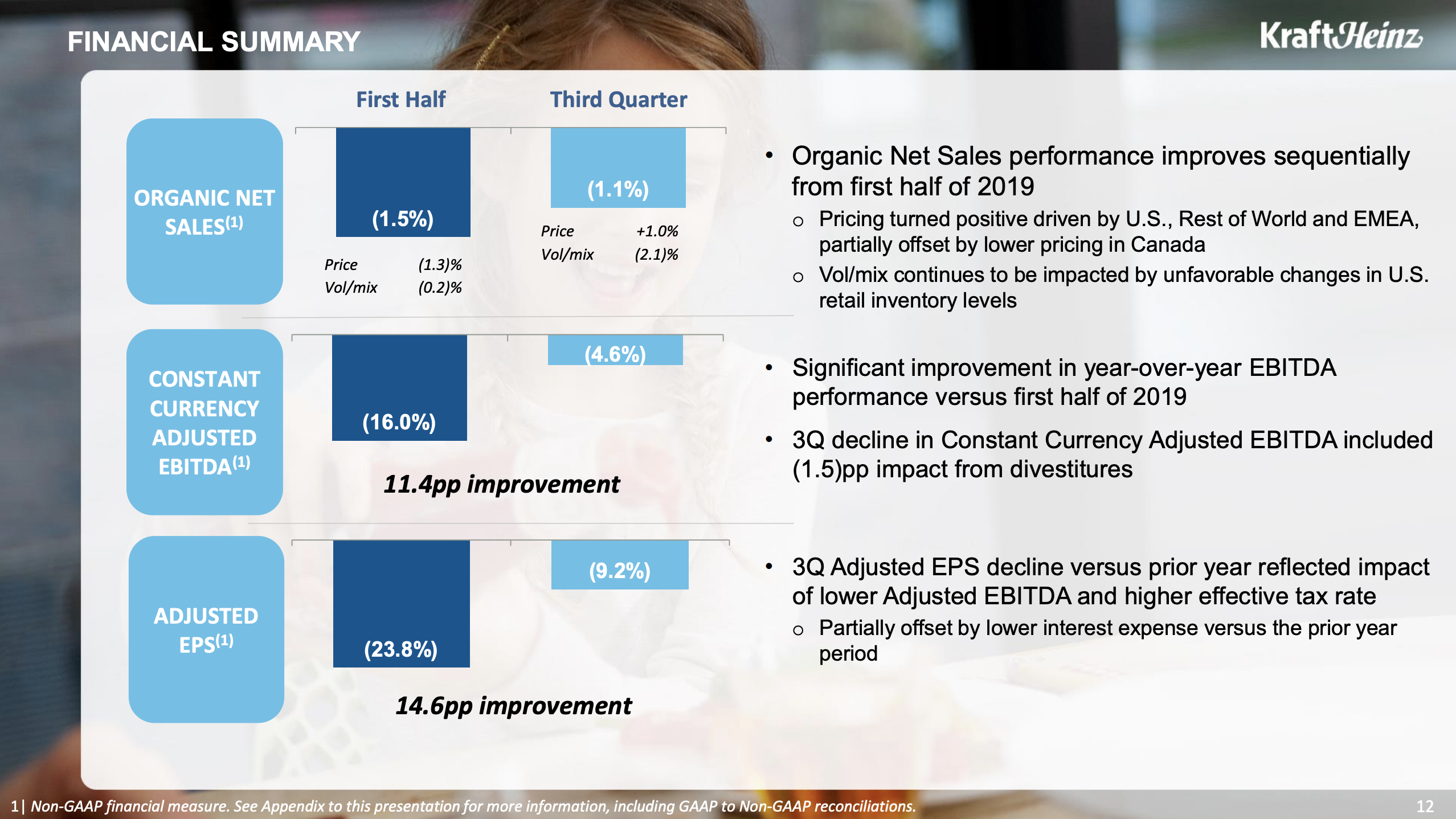

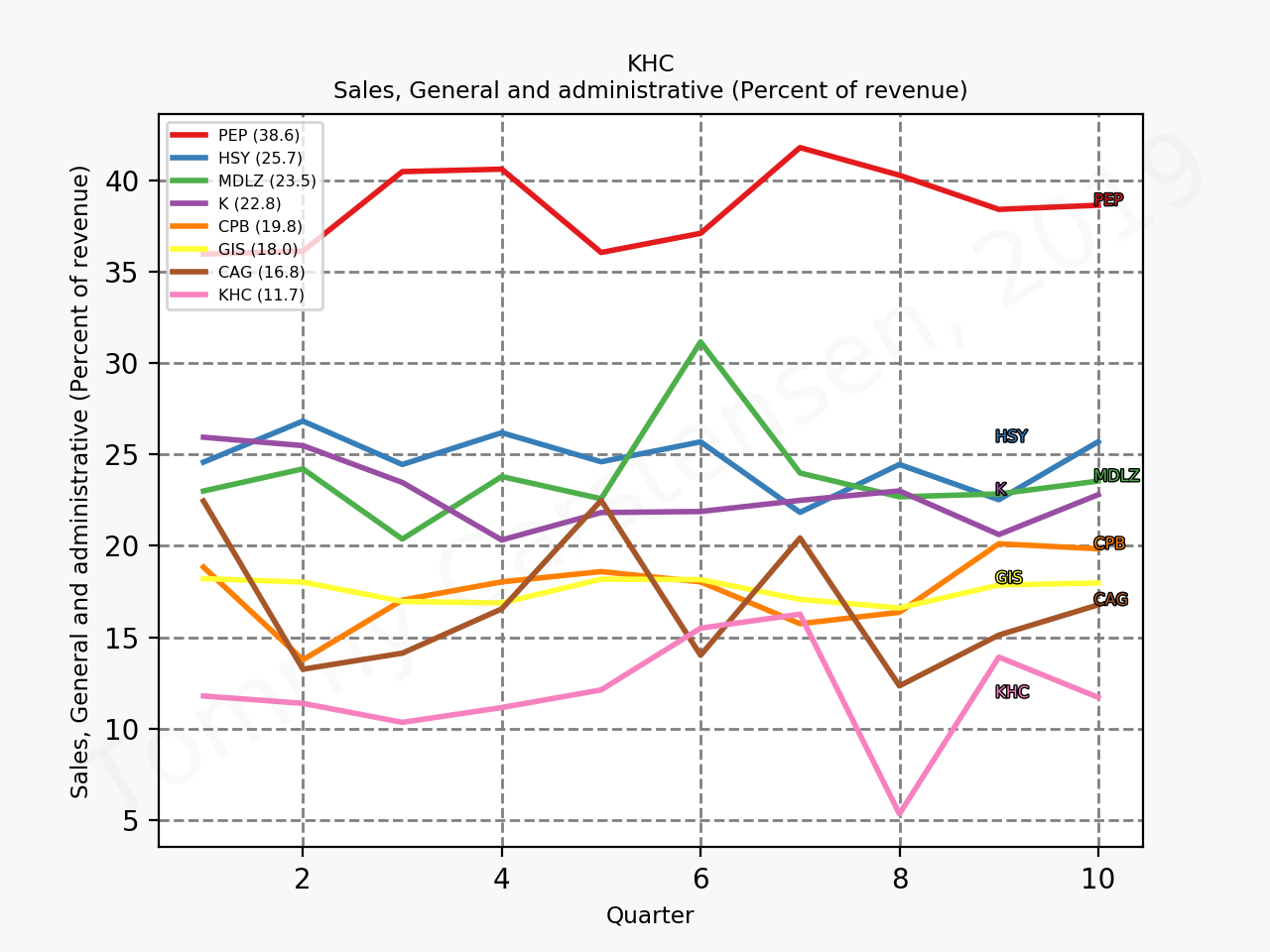

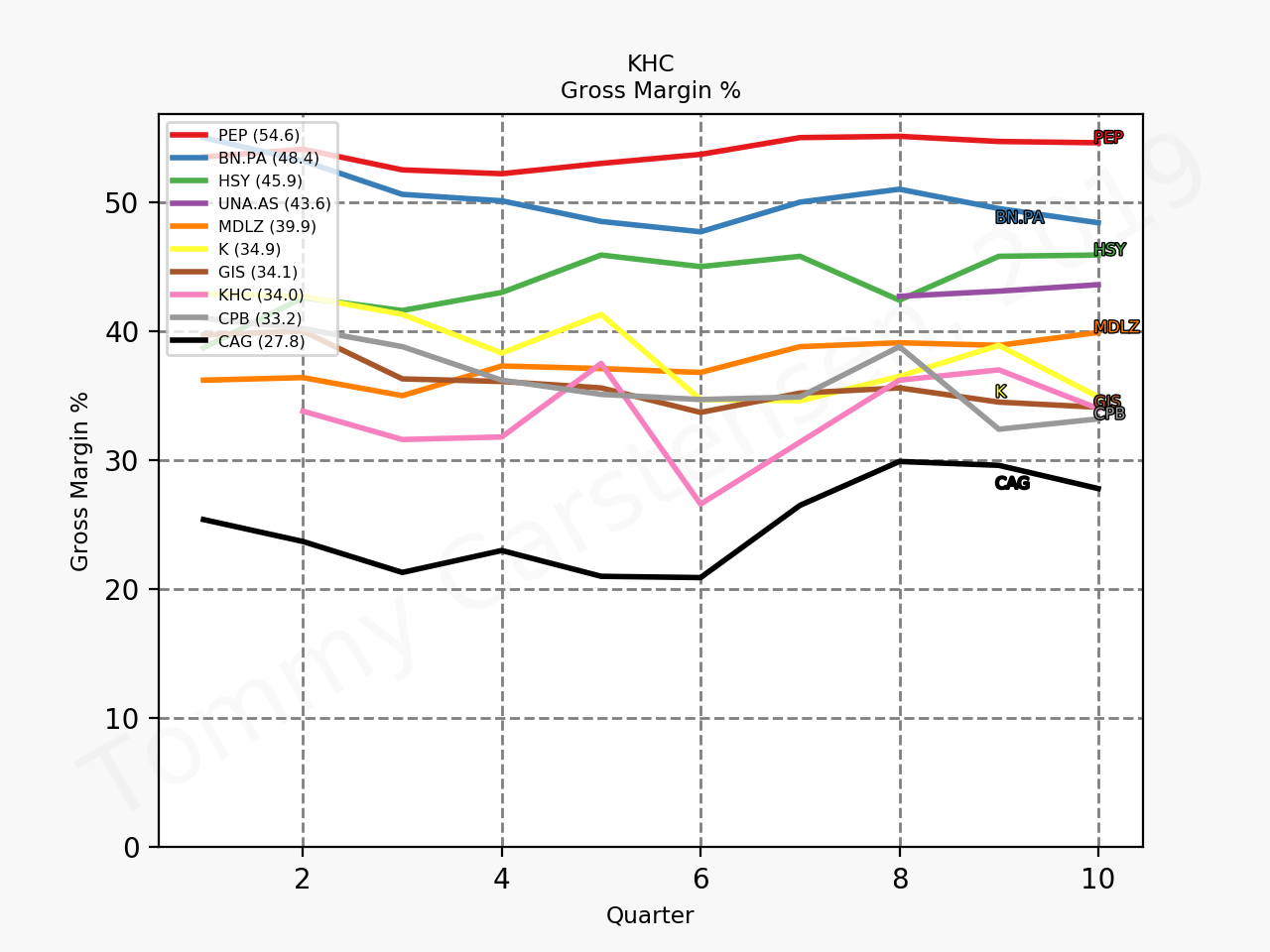

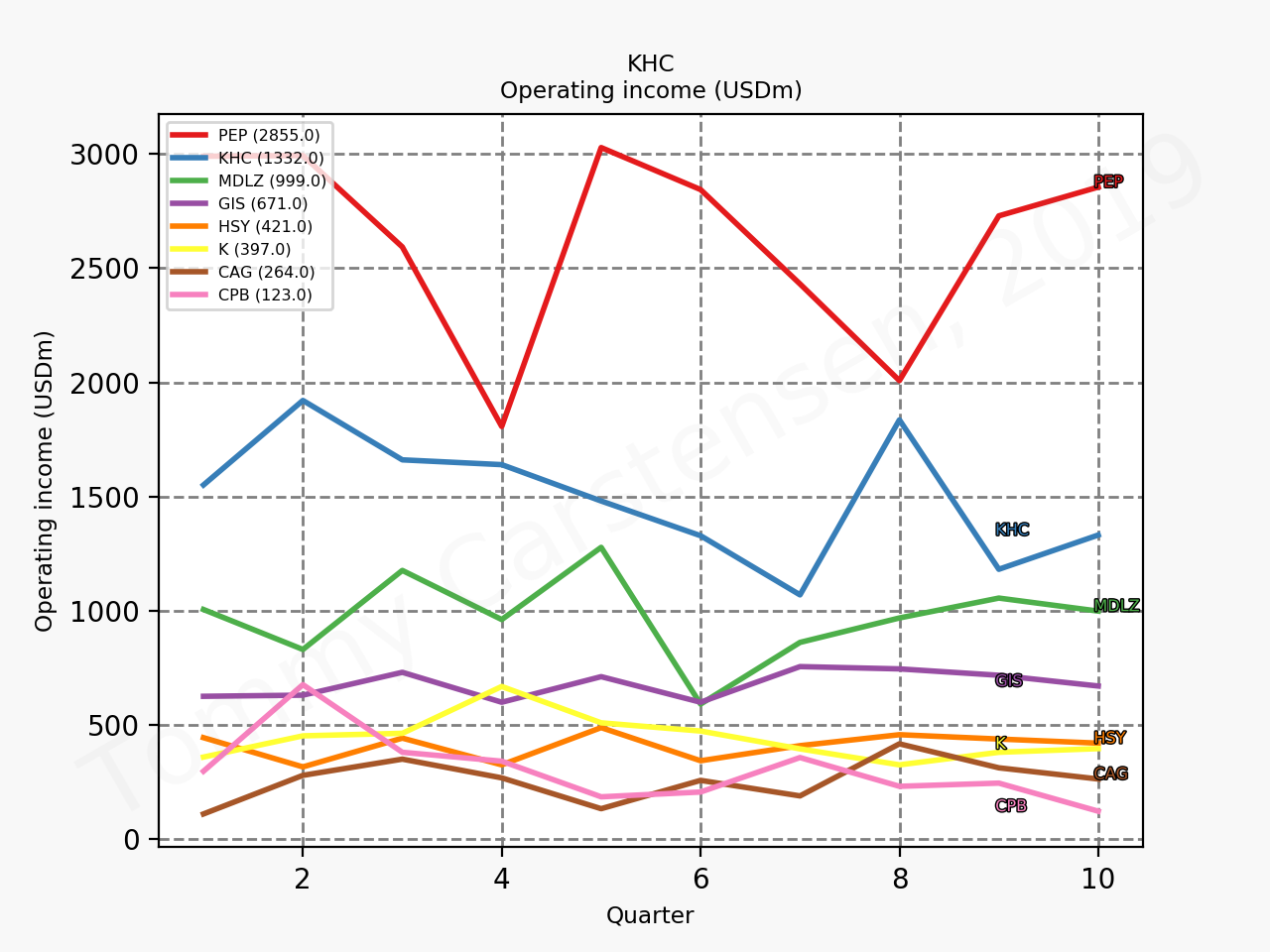

Gross margins and operating margins reached lows of 32.0% and 19.5% respectively, whereas SG&A excluding impairment losses was down from $803M to $762M.

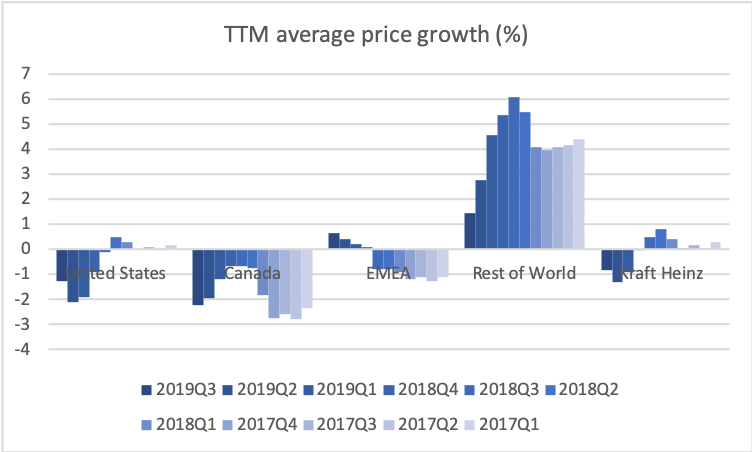

The US experienced negative organic growth of -1.6% despite price growth of 1.5% and revenue in the US for the quarter was $4,361M.

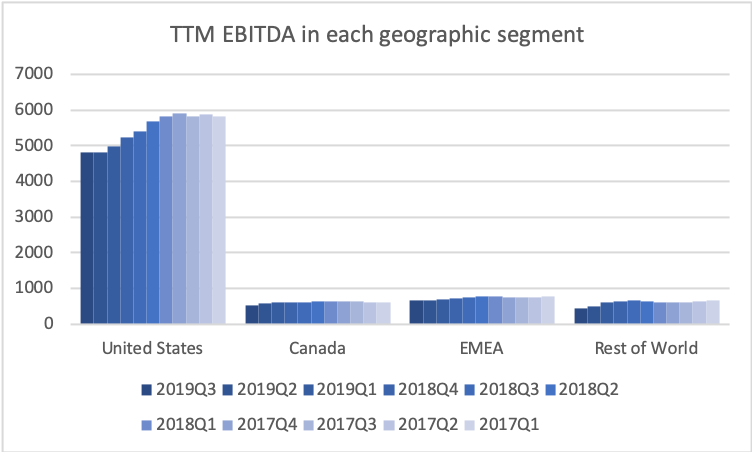

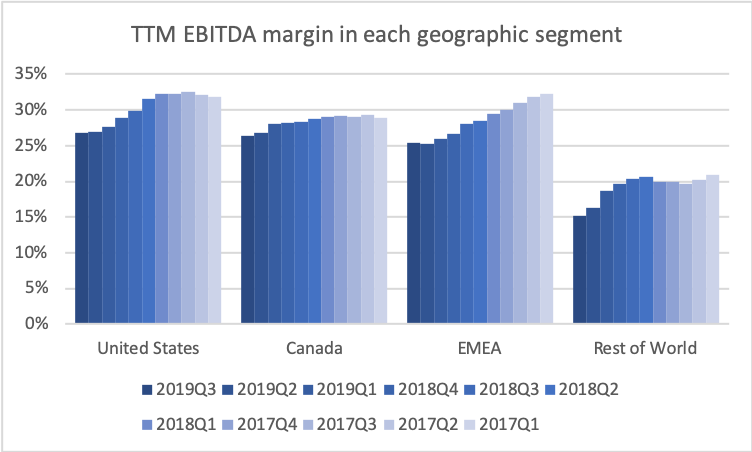

EBITDA was down in all geographic segments, but EBITDA and EBITDA margins seem to have stabilised. Except in the Rest of the World segment, where increasing supply chain costs are causing damage to the EBITDA margin.

The product segment condiments and sauces as well as infant and nutrition both saw some of the biggest declines in the quarter.

CEO Miguel Patricio had the following comment regarding the segments.

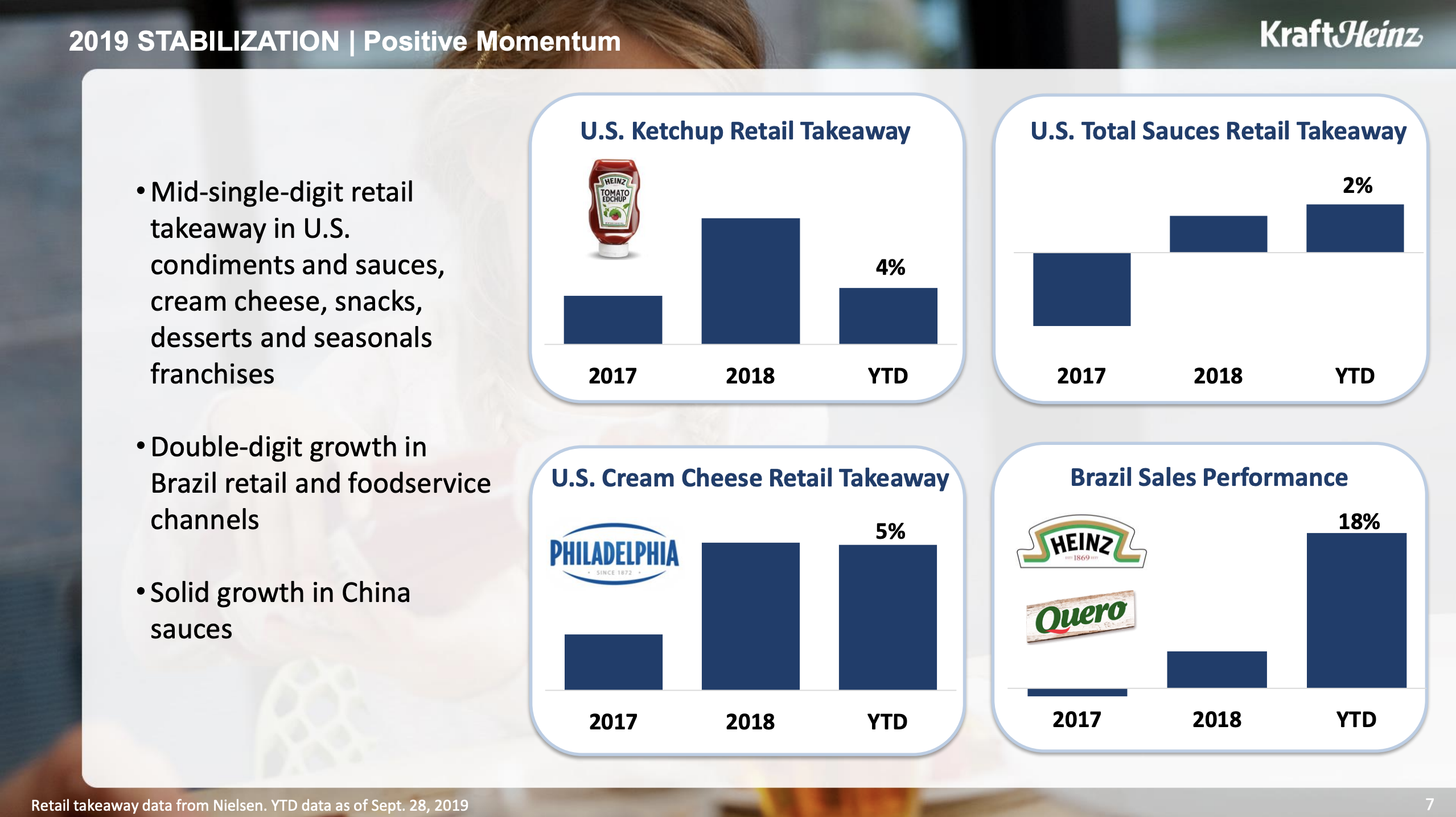

While overall performance is improving, our numbers are still negative versus the prior year, and our performance remains uneven across categories and across geographies. This includes ongoing share and distribution losses within our natural cheese, cold cuts and coffee business in the United States, lower-than-anticipated promotional lifts in Canada, ongoing infant nutrition declines in both EMEA and China as well as increasing supply chain costs in our Rest of the World segment.

Kraft Heinz CEO Miguel Patricio on the 2019 third quarter earnings call.

Growth

Organic growth was -1.1% and -1.6% in the US despite growth in price of 1.5% in the US.

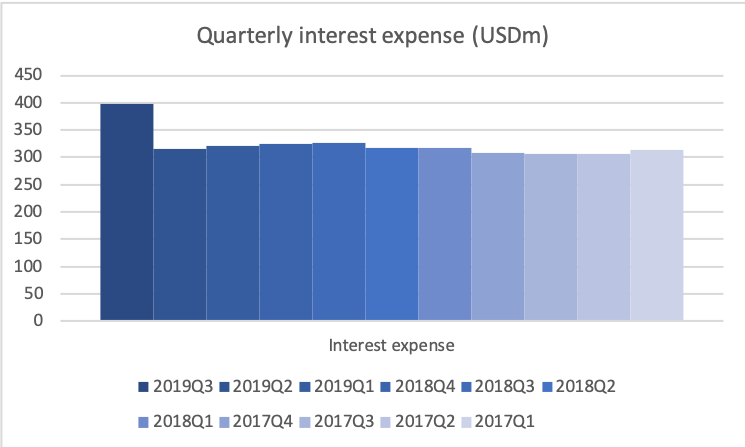

Debt and interest expenses

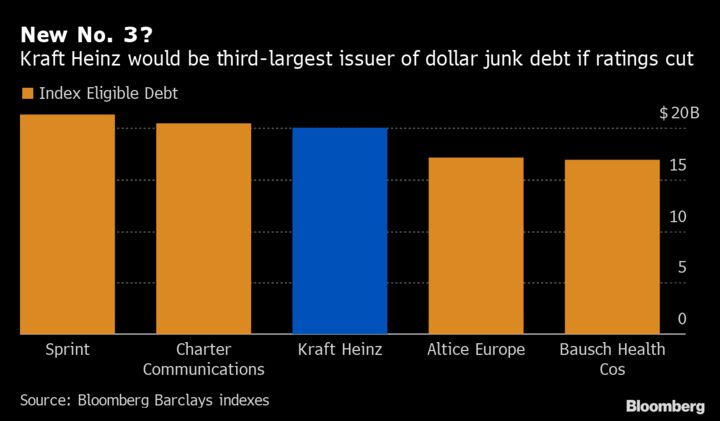

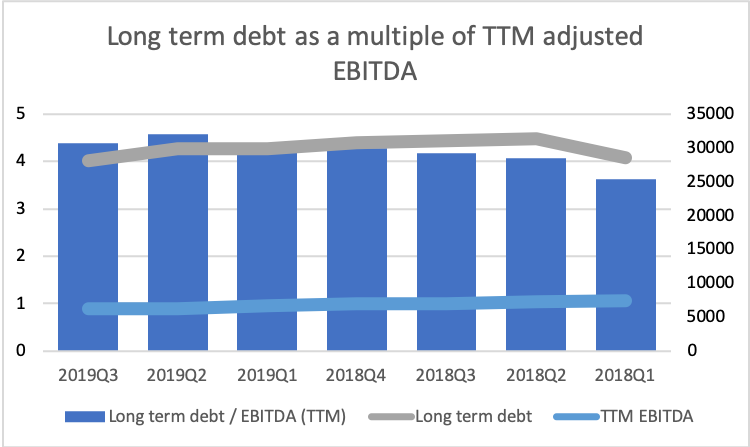

S&P in August affirmed the credit rating but revised the outlook from stable to negative. This followed the downgrade in June. S&P commented on adjusted leverage.

The negative outlook reflects the potential for a downgrade to speculative grade by mid-2021 if we believe Kraft Heinz cannot reduce adjusted leverage to below 4x. This could result if operating performance weakens further and we come to believe the strategic plan to be announced by the new CEO in early 2020 will be unsuccessful, including a failure to stabilize and reverse EBITDA declines, or an inability or unwillingness to reduce or eliminate the dividend or conduct meaningful deleveraging asset sales.

S&P press release from August

The adjusted leverage is still above 4x, but there are small signs of improvement following the deleveraging asset sale of the Canadian natural cheese business for approximately USD1.24B.

Interest expenses were up, which further stresses the need to deleverage.

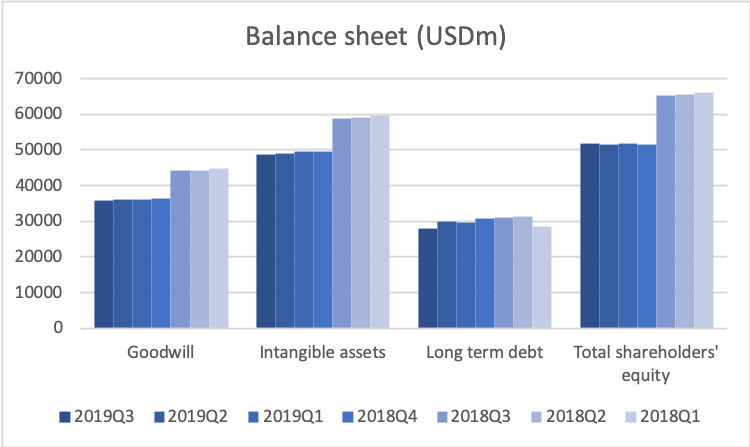

Impairment charges and the balance sheet

Unlike the previous three quarters and the disastrous fourth quarter of 2018 there were no significant impairment charges and long term debt was reduced to $28,112M following the deleveraging asset sale in Canada.

Why is the share price up in the pre-market?

That the share price is up in the pre-market is probably a combination of valuation, the return of the CFO, the absence of impairment charges. Especially the valuation was attractive following the share price collapse.

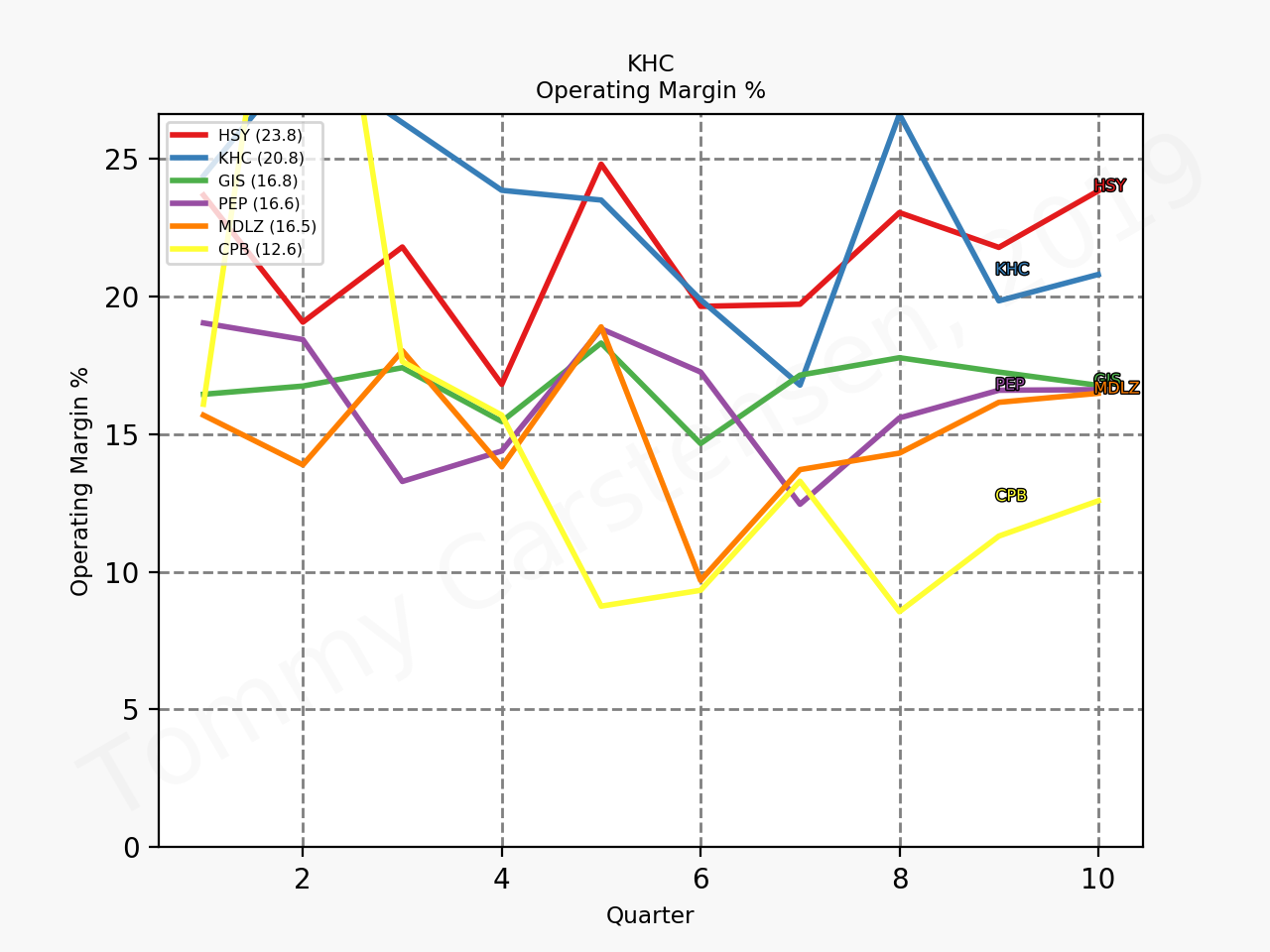

And despite all of the bad news that landed in February it still remains a fact, that Kraft Heinz has some of the lowest costs and best margins in the industry.

And unlike the share price neither the sales nor the operating income have imploded. The business is intact despite the headwinds and the mountain of debt.

Media coverage

Reuters – Kraft Heinz investors cheer profit beat, plans to boost marketing

Bloomberg – Kraft Heinz Shares Rise as Delayed Comeback Materializes at Last

CNBC – Kraft Heinz stock jumps on earnings beat

Financial Times – Kraft Heinz still struggling with changing consumer tastes as sales dip

Previous media coverage

2019-10-23 Reuters – Kraft Heinz sees potential in baby food, will keep Plasmon

2019-09-12 Reuters – Where’s the fake beef? Not at Kraft Heinz, investors worry

2019-08-26 Reuters – Kraft Heinz brings back former CFO after accounting missteps