Teva Pharmaceuticals issued a press release on their Q2 earnings on August 7th.

Below are excerpts from the earnings call with CEO Kåre Schultz and outgoing CFO Michael McClellan and relevant figures and slides. Further below the CGRP migraine drugs Ajovy® from Teva, Aimovig® from Amgen and Emgality® from Lilly are discussed. The legacy litigations regarding opioids and pricing are not discussed here, but Teva has a $646 million provision for legal settlements following their $85M opioid settlement, which is further described in the earnings transcript and in this Bloomberg article.

Earnings call

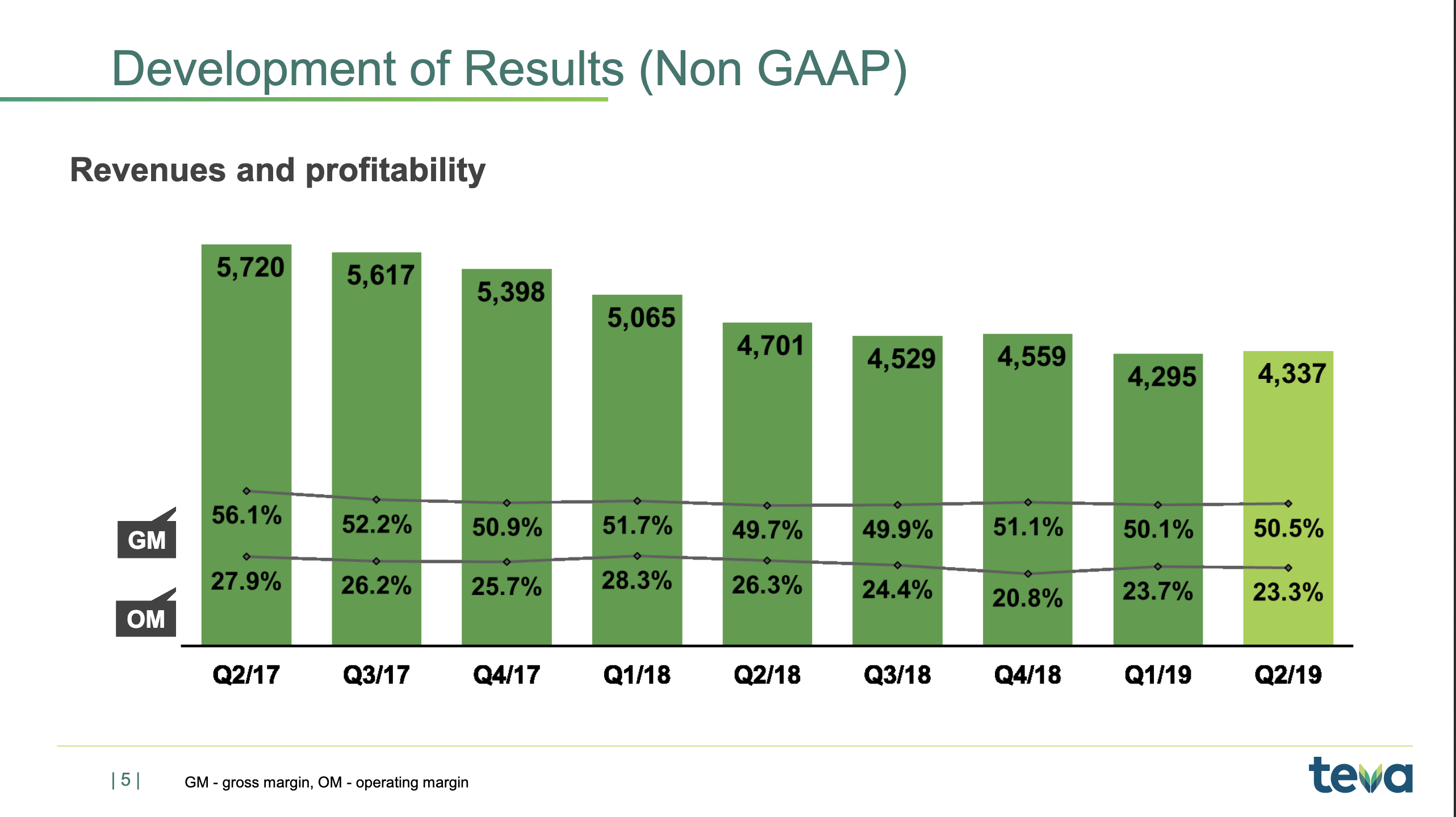

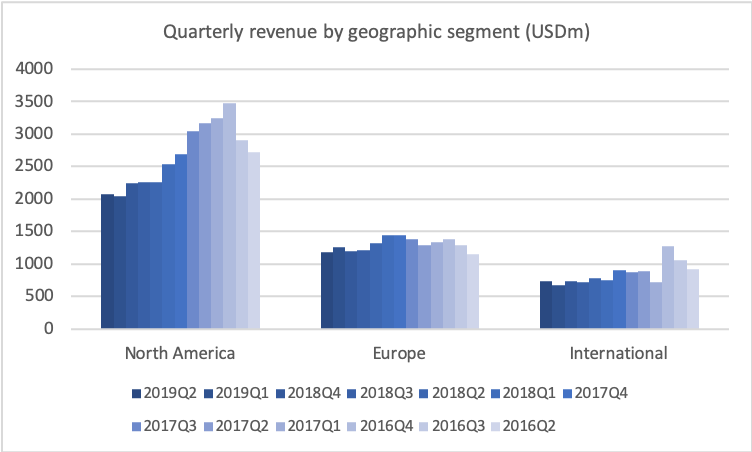

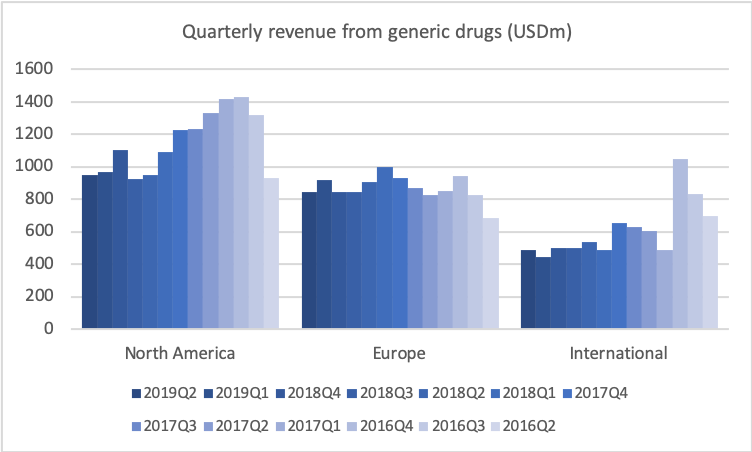

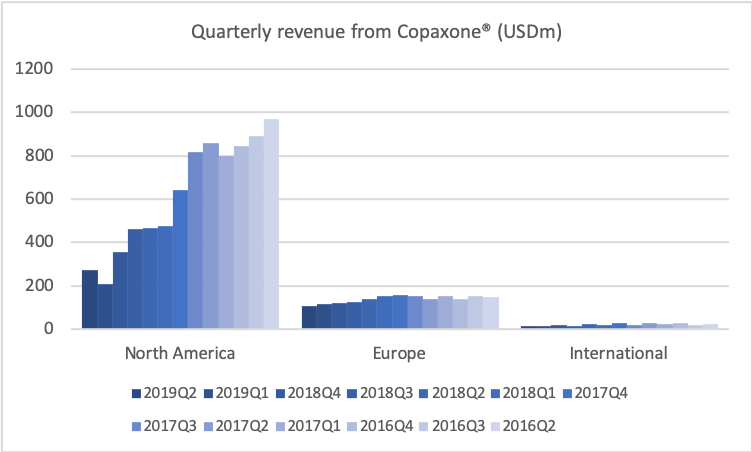

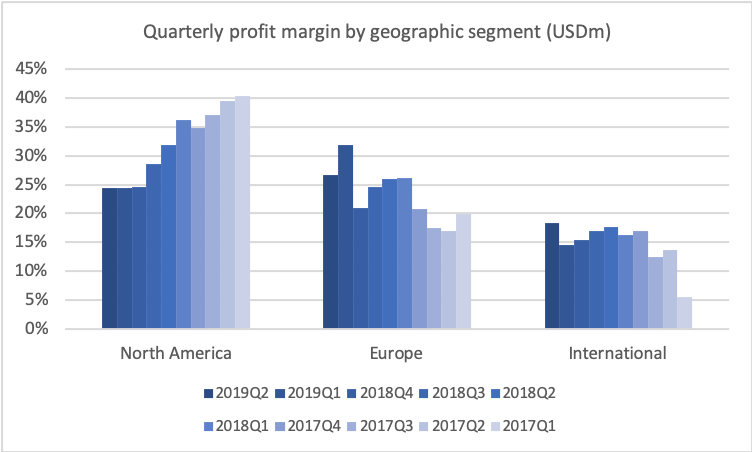

If we go to historical development of revenue and profitability, I’d just like to remind you of the situation in late-2017 when I joined, where we saw generic competition coming in on COPAXONE, and we basically knew that revenues were going to fall roughly $4 billion on a yearly basis. That’s also what you see. You see the quarterly revenue coming down from some $5.3 billion to $4.3 billion.

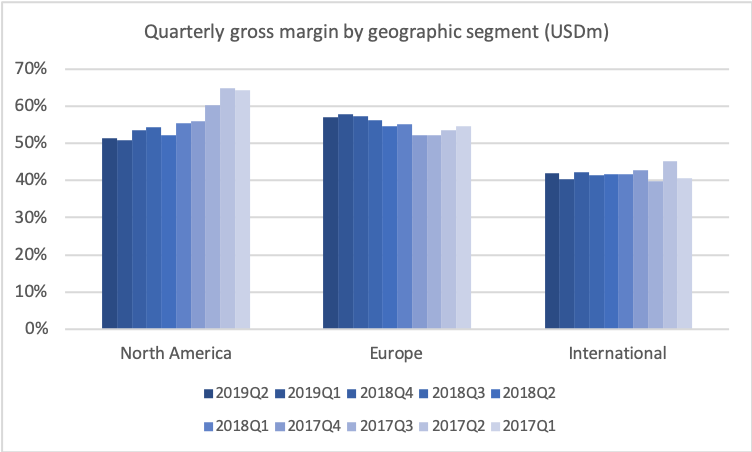

But you also see now the beginning of the trough, as I’ve been calling it, the trough of 2019, which is basically where the revenue stabilises. You also see that the gross margin that was coming down is also stabilising now just above 50%, and the operating margin stabilising now around 23%, which is of course not our long-term target. Our long-term target, as I’ll get back to, is 27%, so we still need to see improvement there.

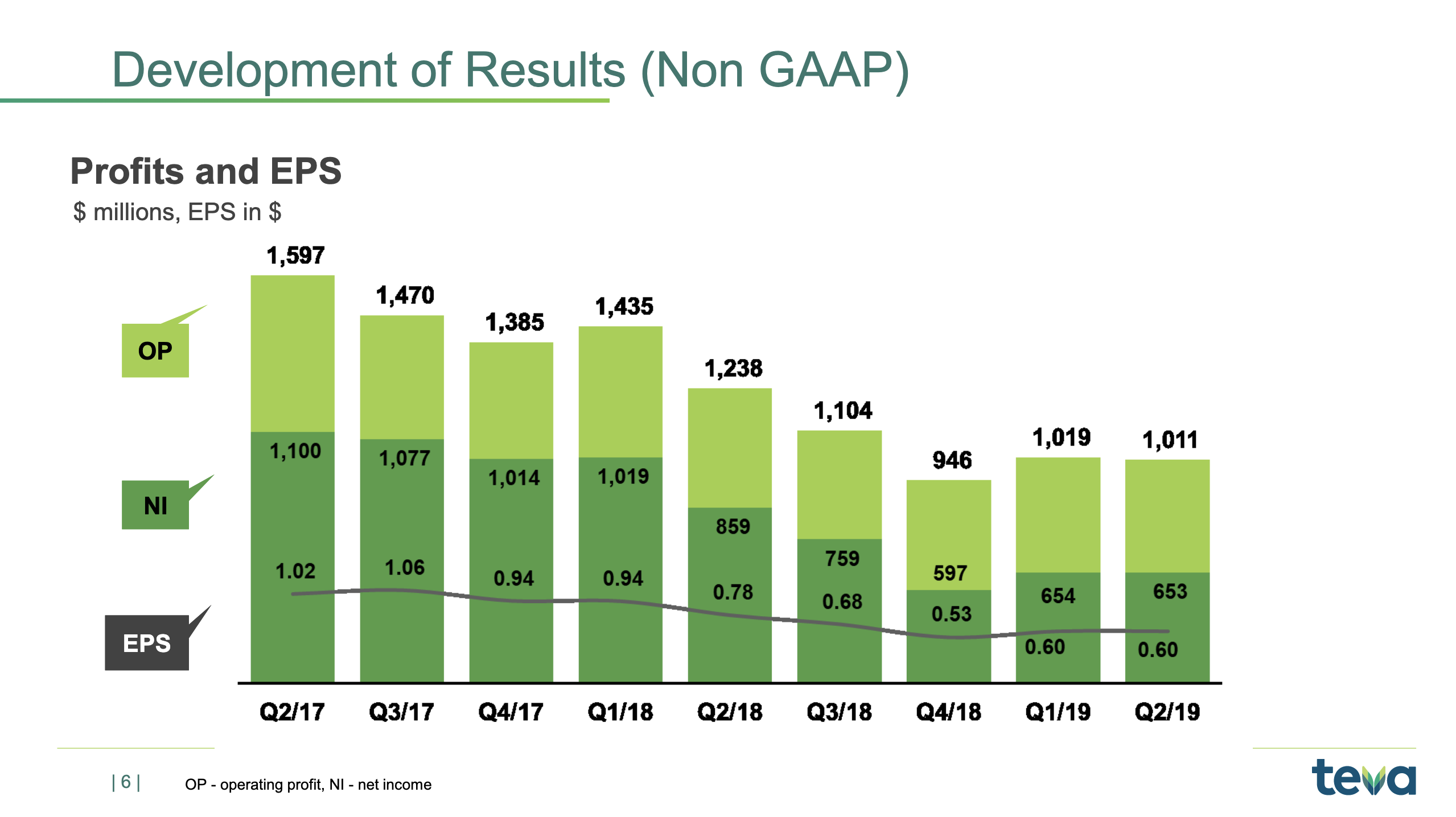

Talking about the trough, let’s look at the operating profit. If we look at that in the same historical period, then you’ll also see the very big effect of the revenues declining, and us only being able to take down the cost quarter-by-quarter, but still the effect now is that we are stabilising the operating profit at around roughly $1 billion per quarter, and you see that the net income is around $650 million right now. And that results, of course, in the earnings per share stabilising right now around $0.60.

Now this is – as I’ve said before, this is what we expect to be the trough year. It’s not that there will be a dramatic turnaround in the coming years, but the trend lines will slowly change and we’ll start to see a moderate increase in revenues and moderate increases in EPS going forward. But, just to remind everybody, this year will be the lowest year in terms of operating profit and also in terms of average earnings per share

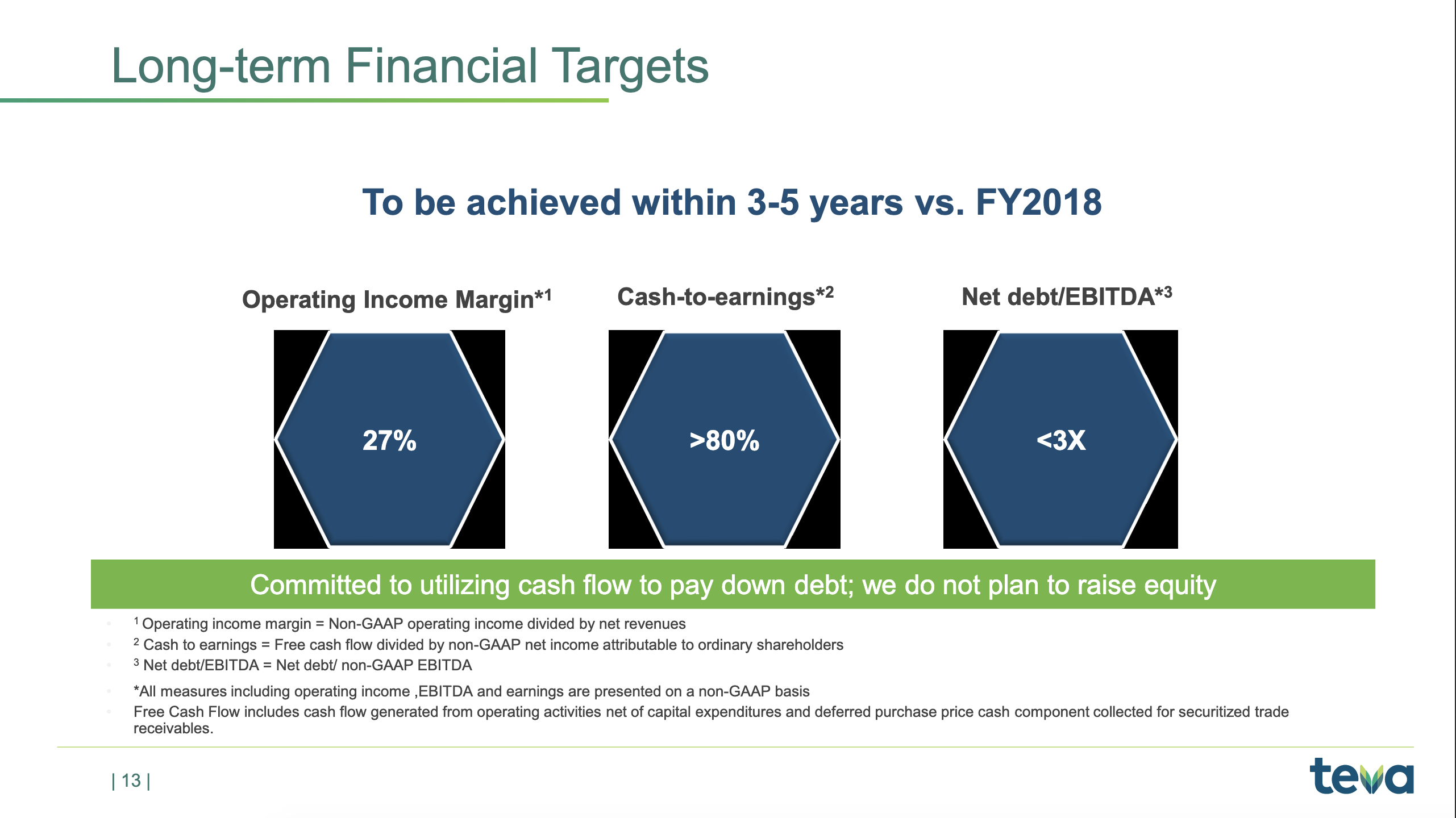

Now, if we look at the business going forward and our financial targets for the business going forward, then I’d just like to repeat these. We have talked about them before, but just so that everybody knows what our long-term plan is. And one key element is, as I said in the beginning, to improve the operating margin. Now, that happens by a lot of elements.

One element is, of course, that you optimise your product portfolio, the gross margin on the products you’re selling. You optimise the manufacturing cost of the products you sell. And you make sure that you have a good and strong overall market development. As I showed you earlier, we are at the level of 23% right now, and we want to improve that up to the level of 27%.

The cash-to-earnings is quite simple because we need the cash in order to reduce our debt. And of course, we have a long-term plan to keep on reducing our debt. The simple math is that, right now, we probably have a net earnings of some $650 million per quarter. That’s 2.6 billion a year. 80% of that, that’s roughly just around $2 billion. So, as you see, we’re also guiding $1.6 billion to $2 billion on the cash flow, so we’re really aiming at getting to that level where we, on a consistent basis, generate most of the result as cash.

There will always be quarterly fluctuations with a big balance sheet as ours. Of course, there are quarterly

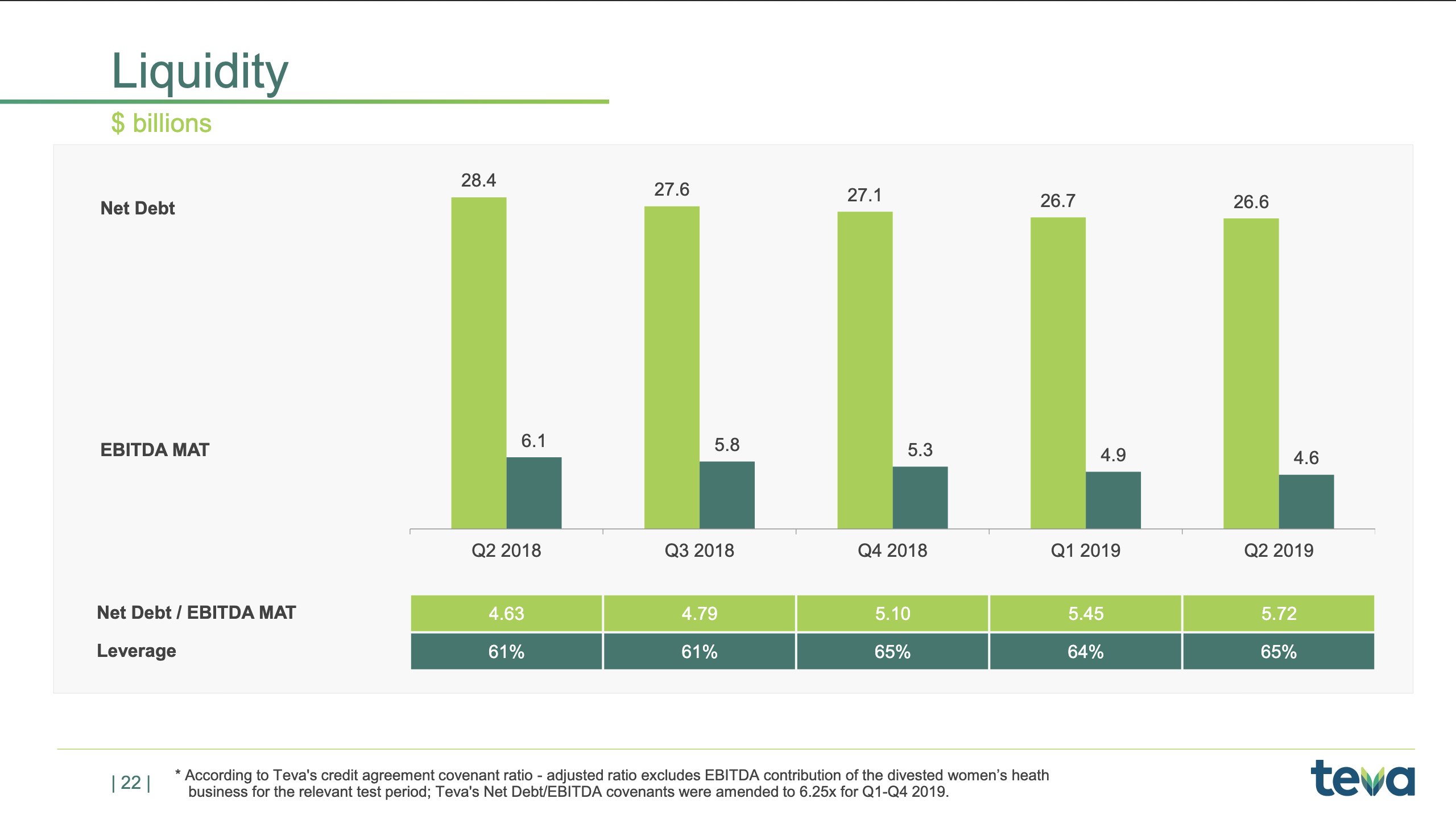

fluctuations. But, on a yearly basis, it’s very important that we meet this target of the 80% cash-to-earnings. And that is important because we need to reduce the debt.As you know, our net debt-to-EBITDA ratio right now is about 5x, and we really want to get it below 3x, and the only way to do that is to generate cash and pay back the debt. So we will continue to use all our cash flows to really pay down debt. And as I stated many times, we do not plan to raise equity. We plan to continue to use cash to reduce the outstanding debt, and we think that’s the best way to create value for our long-term shareholders.

We ended the second quarter with a net debt of $26.6 billion and a net debt-to-EBITDA ratio of 5.72x. As you may recall, during April, we also entered into a $2.3 billion unsecured syndicated revolving credit facility, which replaced the previous $3 billion revolving credit facility that we had. This new RCF can be used for general corporate purposes, including repaying existing debt. As of June 30, 2019, no amounts were outstanding under the RCF. And as of today, we have $500 million outstanding under the RCF.

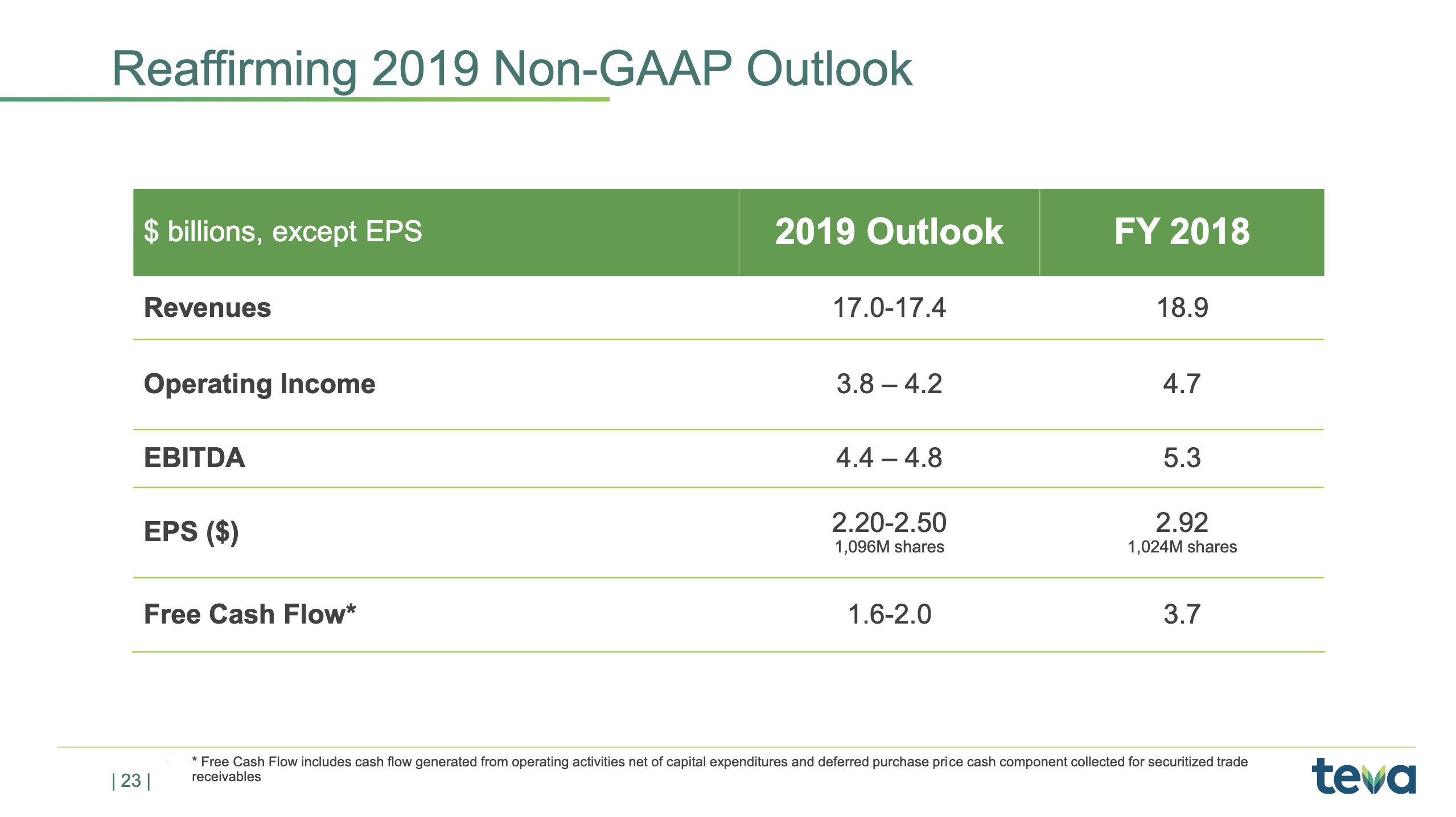

Today, we are reaffirming all aspects of our annual guidance that were first presented in February and reaffirmed in May, including earnings per share in the range of $2.20 to $2.50 and free cash flow from $1.6 billion to $2 billion for the year. Where we end up in the ranges of the full year will depend on the performance of the branded products, especially COPAXONE and AJOVY, the timing of generic launches, foreign exchange rates, especially the euro, and our expense management.

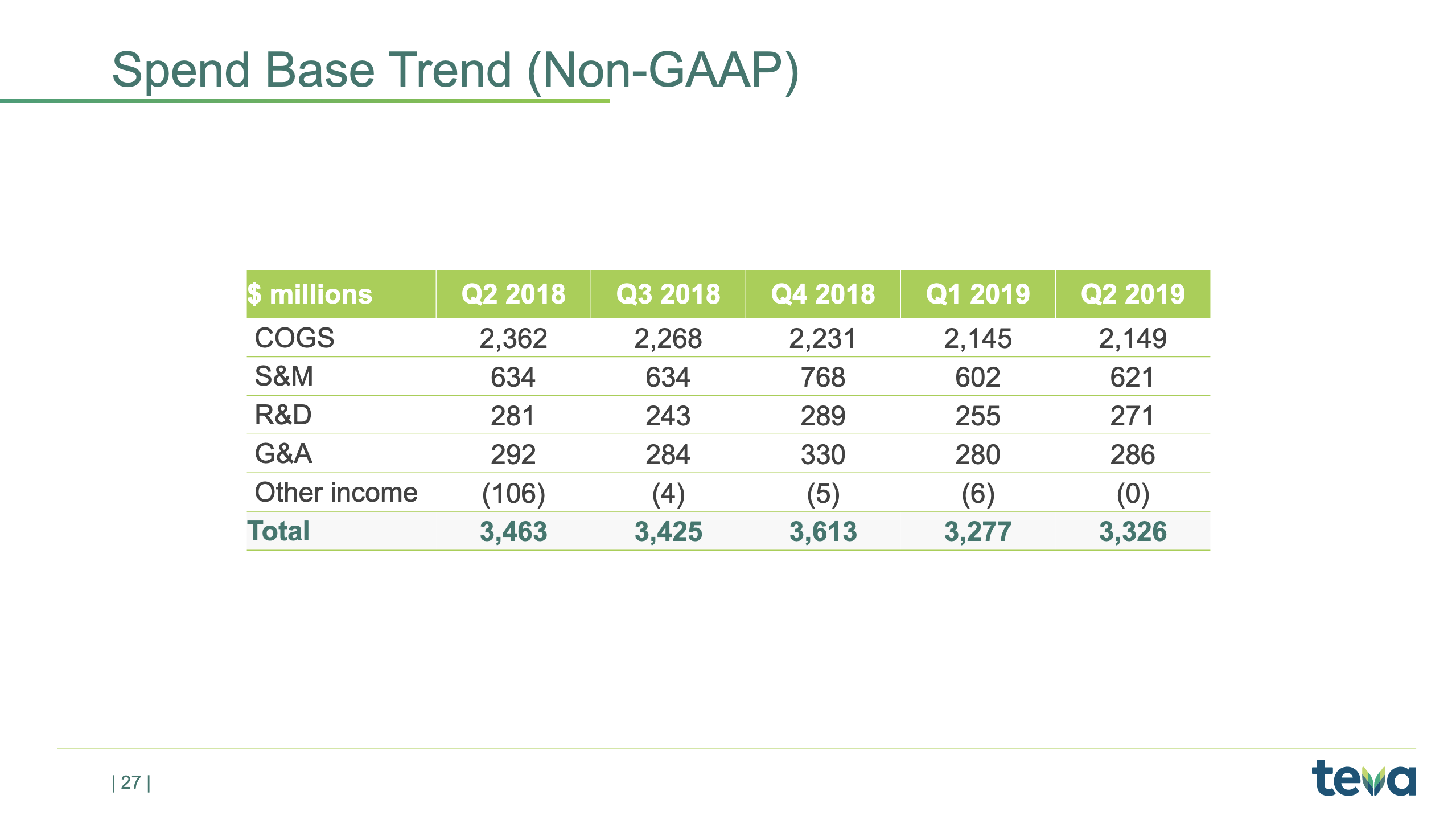

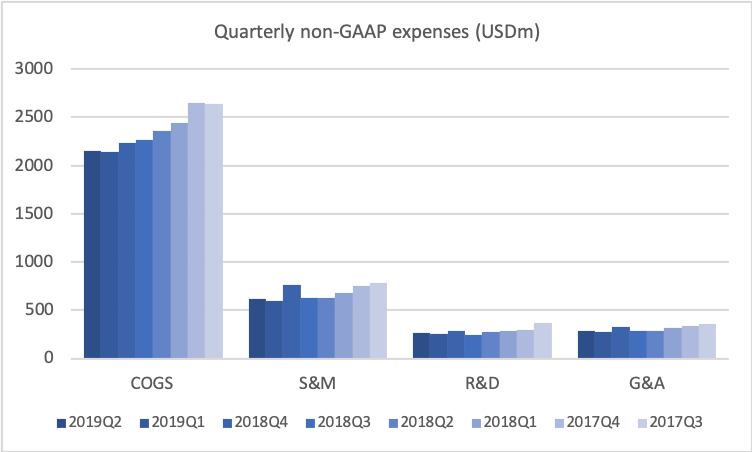

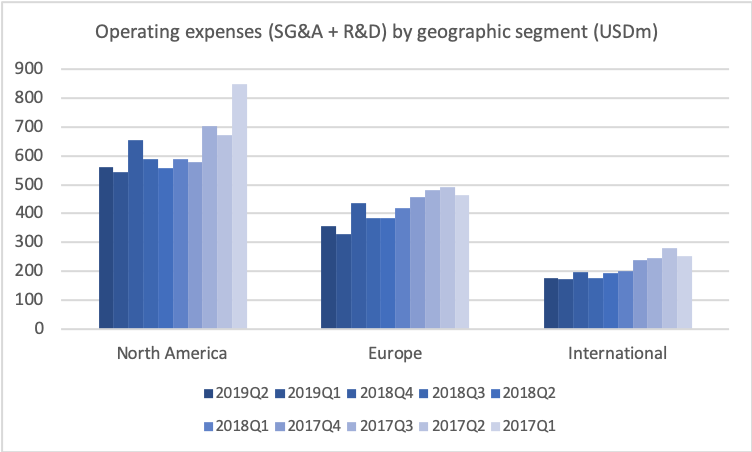

Spend base

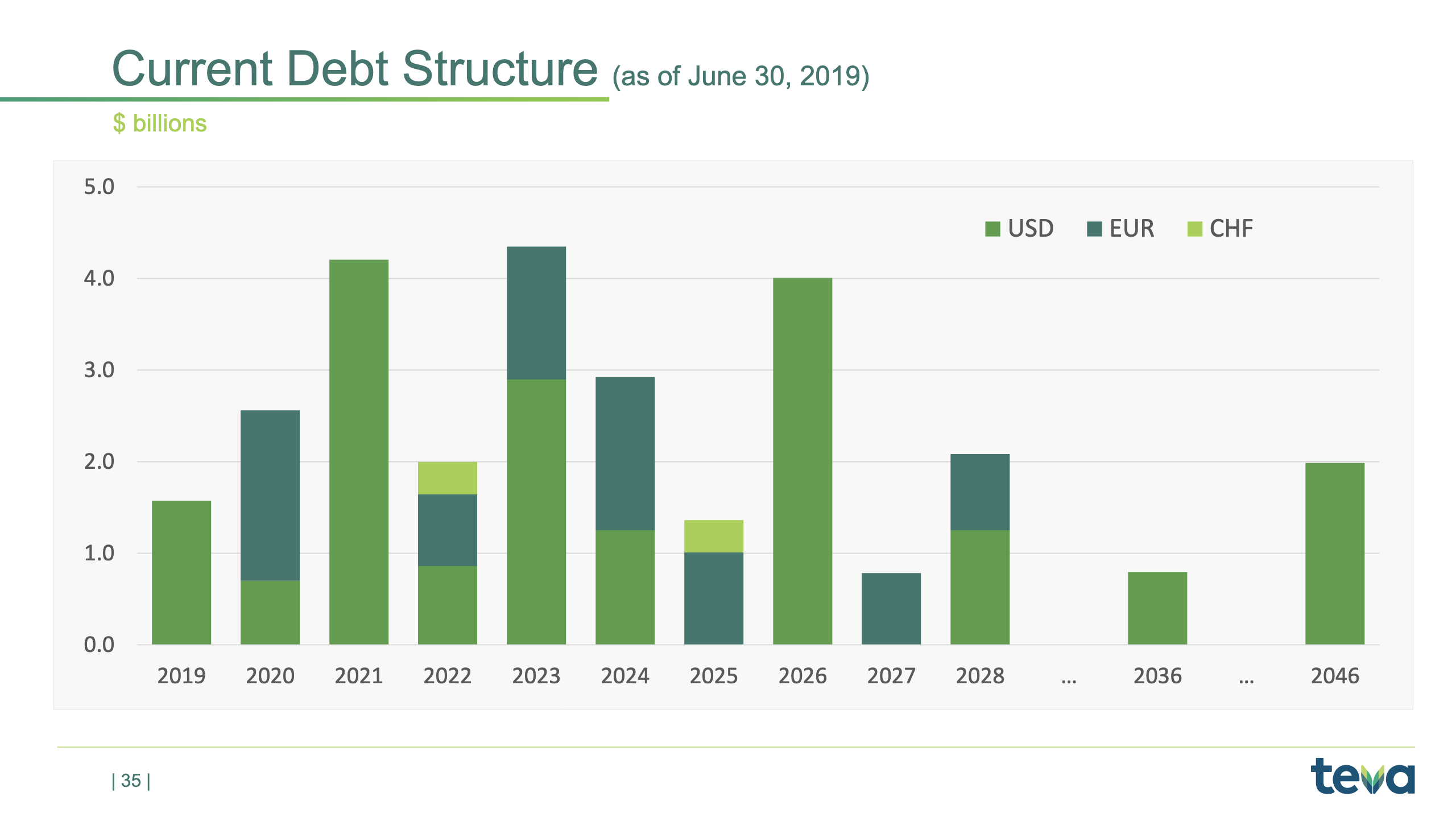

Debt Structure

CGRP migraine drugs

The quarterly sale of CGRP migraine drugs were:

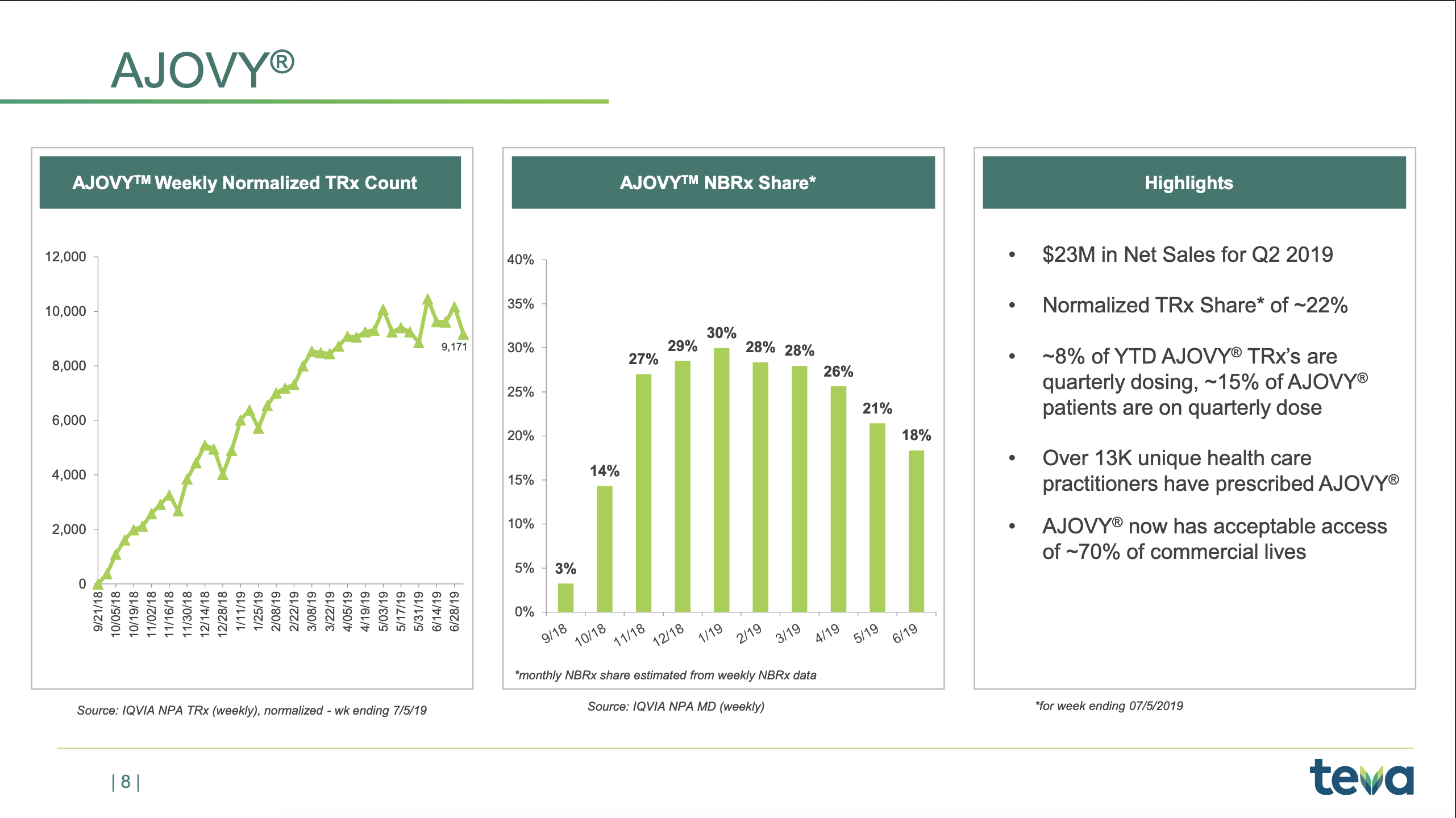

- $23M Teva Ajovy® (Fremanezumab)

AJOVY revenues in our North America segment in the second quarter of 2019 were $23 million. AJOVY was approved by the FDA and launched in the United States in September 2018 for the preventive treatment of migraine in adults.

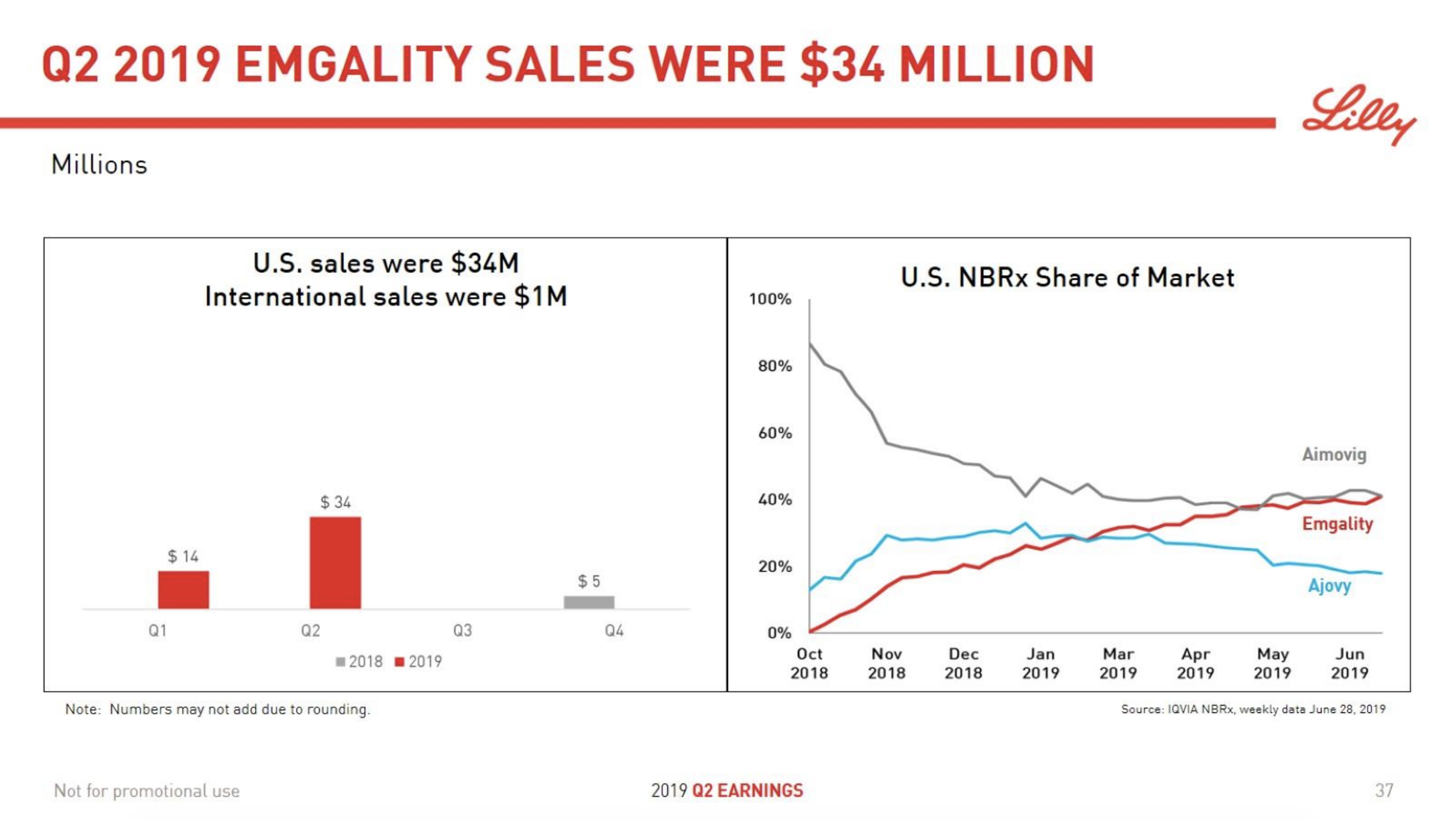

- $34M Lilly Emgality® (Galcanezumab)

For the second quarter of 2019, Emgality generated worldwide revenue of $34.3 million, an increase of $20.1 million compared with the first quarter of 2019. U.S. revenue was $33.8 million, an increase of $21.7

million compared with the first quarter of 2019. Emgality launched in certain international markets in the first quarter of 2019 and generated revenue outside of the U.S. of $0.5 million in the second quarter of 2019.

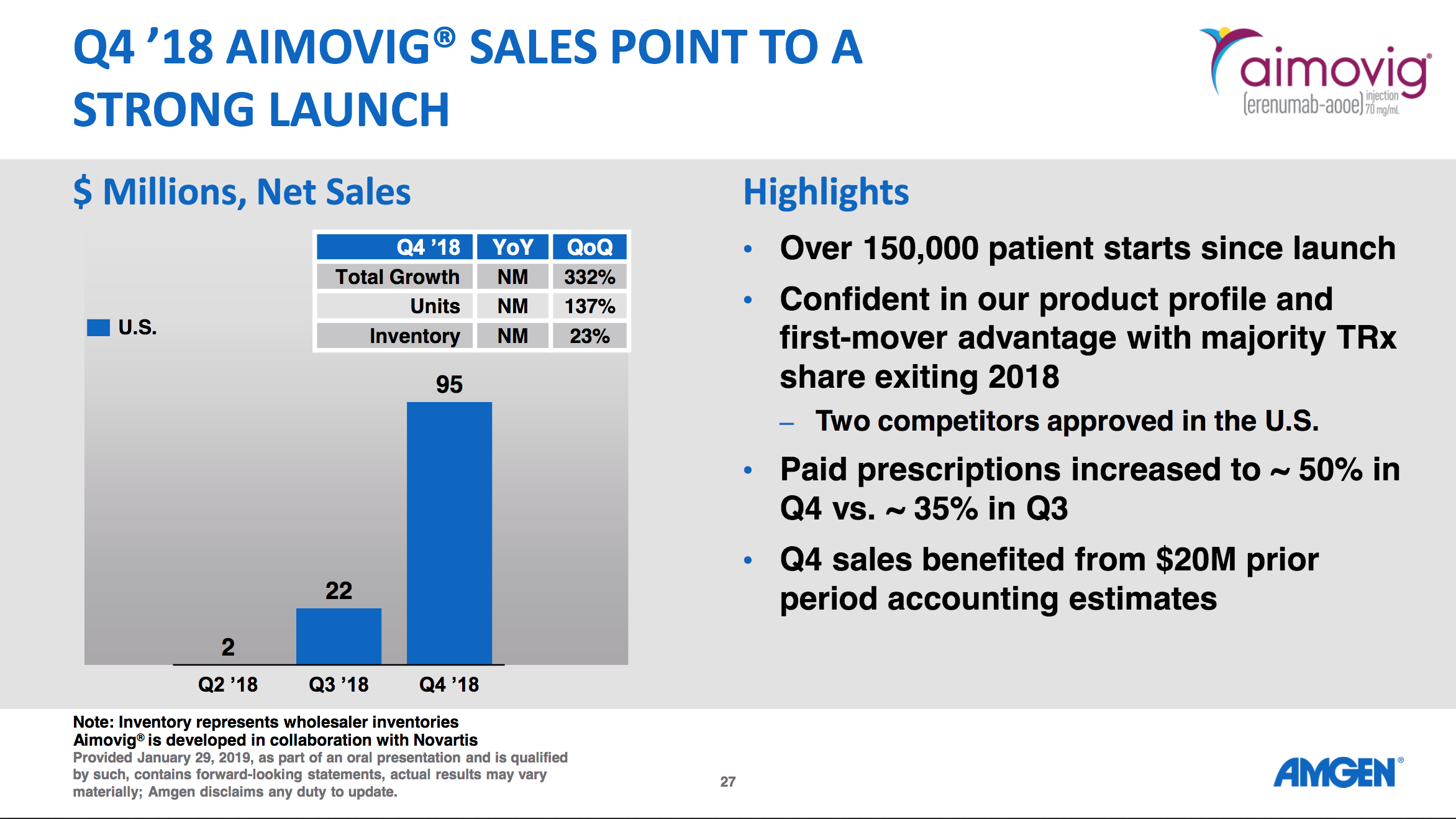

$83M Amgen Aimovig® (Erenumab)

Aimovig was launched in the U.S. in the second quarter of 2018 and generated $83 million in sales in the second quarter of 2019.

Below are important announcements regarding clinical studies and links to these studies.

- Erenumab (ARISE study)

- Erenumab (STRIVE study)

- Fremanezumab (FOCUS study)

- Galcanezumab (EVOLVE-1 study)

- Galcanezumab (EVOLVE-2 study)

On August 21st Teva announced that Fremanezumab data in The Lancet demonstrate clinically meaningful reduction in monthly migraine days versus placebo for patients with difficult-to-treat migraine.

On August 5th Lilly announced positive results for Emgality® (galcanezumab) from the CONQUER study in patients who failed previous migraine preventive treatments.

On May 2nd Amgen announced it would highlight extensive long-term safety and efficacy data of Aimovig® (erenumab) across the spectrum of migraine at the American Academy of Neurology annual meeting.

Below are slides and excerpts from earnings call transcripts.

We are very happy about the strong launch we’ve had of AJOVY. We still have above 20% TRx share in U.S., and we have just started the launches in Europe. We’ve seen a moderate decline in the NBRx share. We think it’s related to a couple of factors. One being the fact that we’ve stopped the full pay-down on all scripts, which means that some scripts where we are not covered actually do get declined at the pharmacy level. And we also see that, in some cases, the patients do prefer an auto-injector, and therefore, of course, we are very eagerly awaiting the approval and the launch of our own auto-injector for AJOVY.

And of course, we’re anxiously awaiting the approval of our auto-injection device and the launch of that device which we expect in the next six months. That will be a second stimulus, really, a second phase of our launch, and we expect a significant boost to our new-to-brand and our TRx share as a result of that.