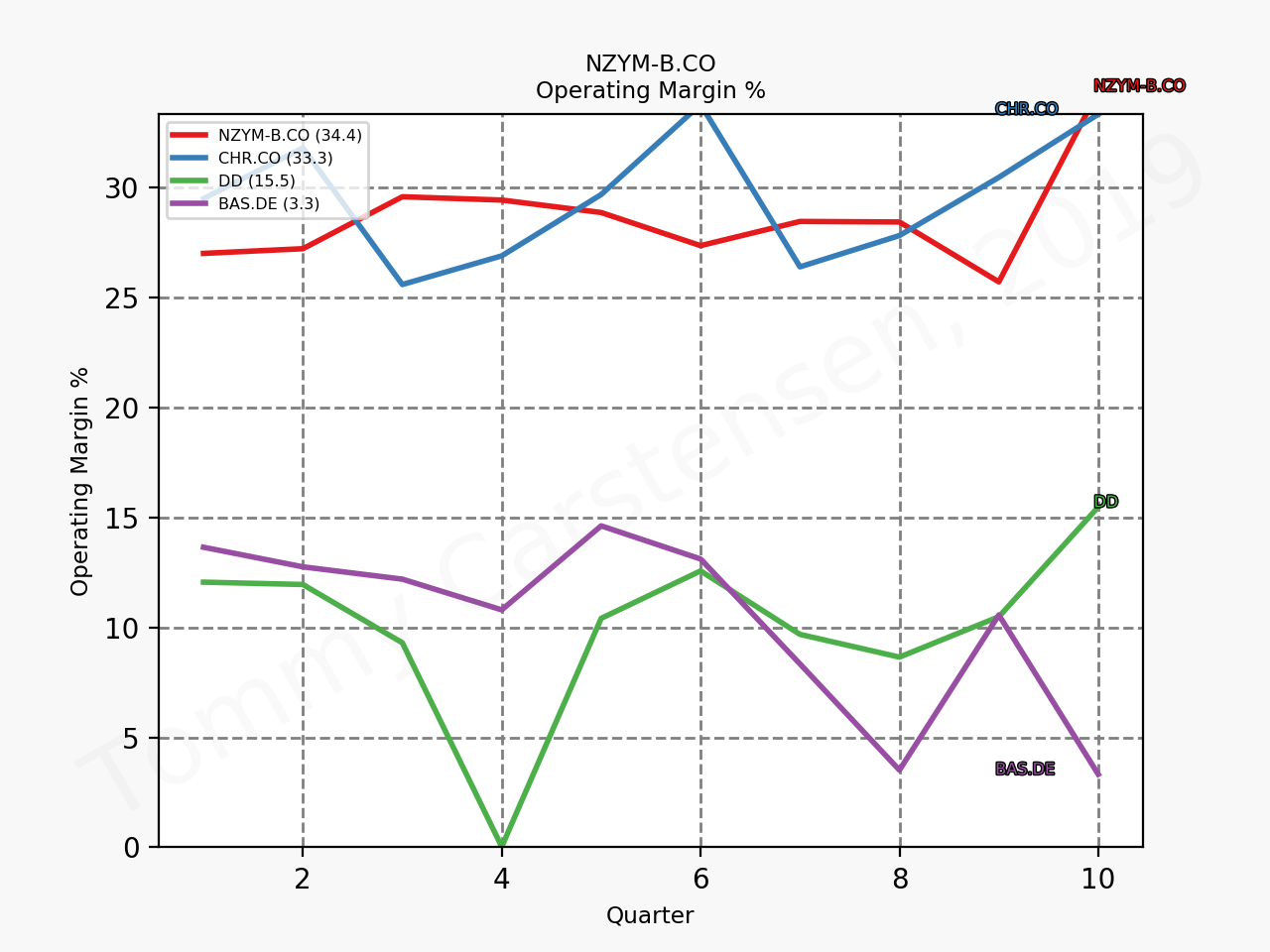

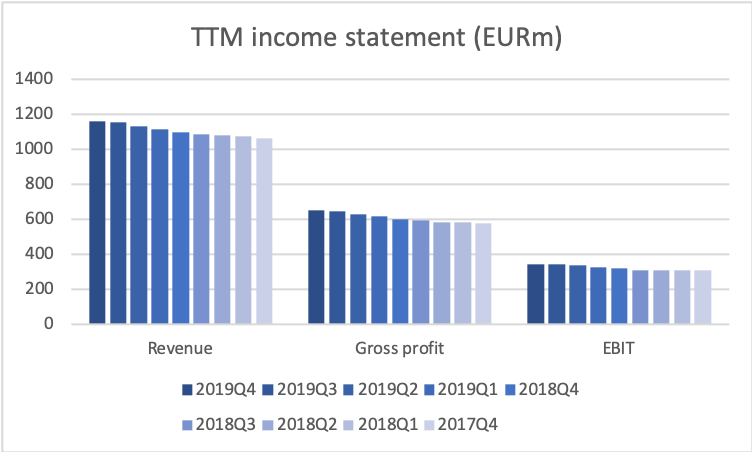

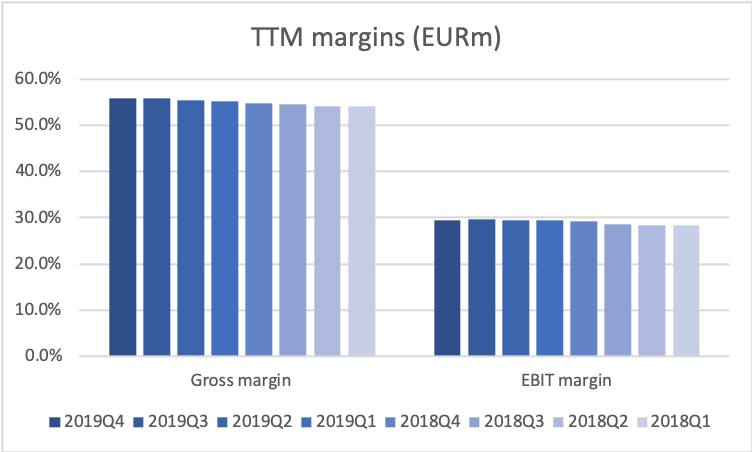

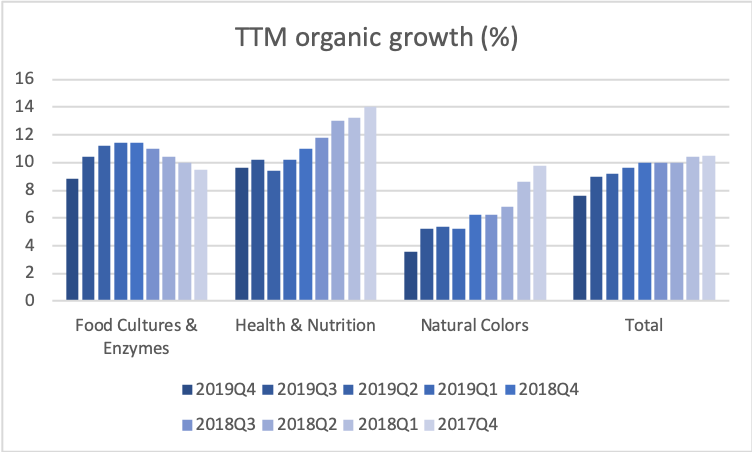

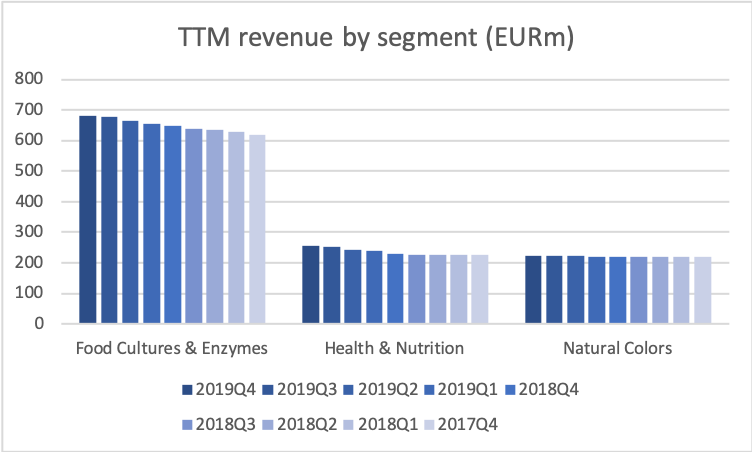

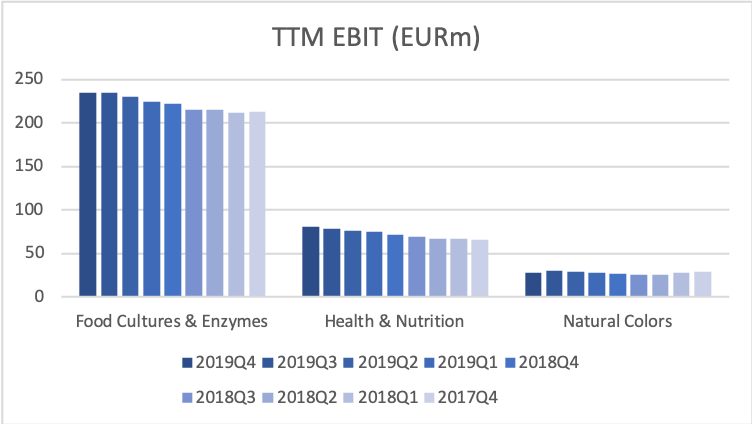

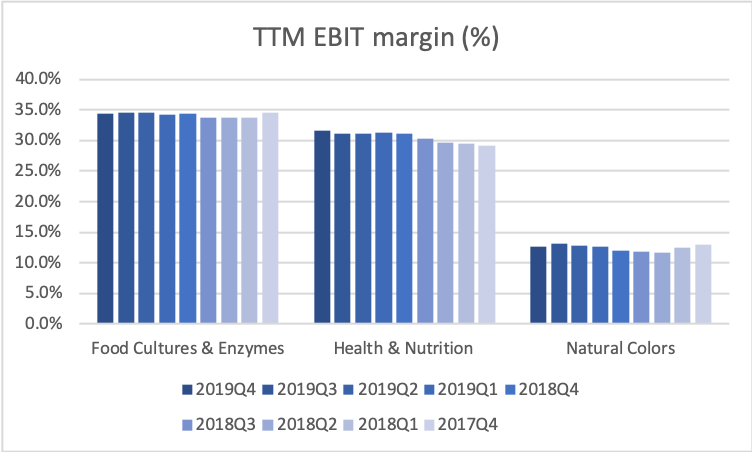

The two Danish enzyme manufacturers Chr. Hansen and Novozymes both saw their share price tumble following third quarter earnings. Chr. Hansen released earnings on October 10th and Novozymes released earnings on October 23nd. This followed the October 9th profit warning from Novozymes. Chr. Hansen, which traded and continues to trade at higher multiples, fell from DKK 579.20 to 525.80 (-9.2%) on October 10th, whereas Novozymes didn’t budge. The figures below compare the expansion and contraction of multiples and operating margins of the two companies.

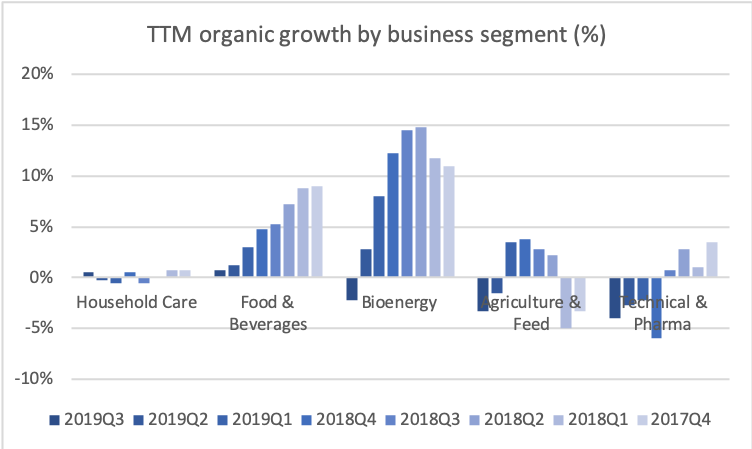

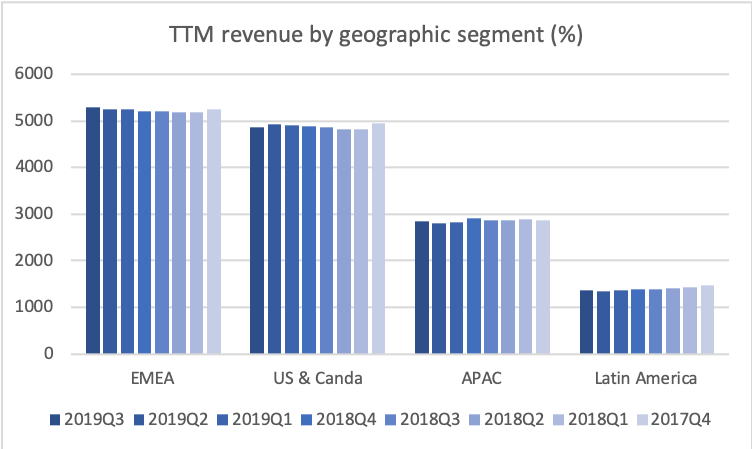

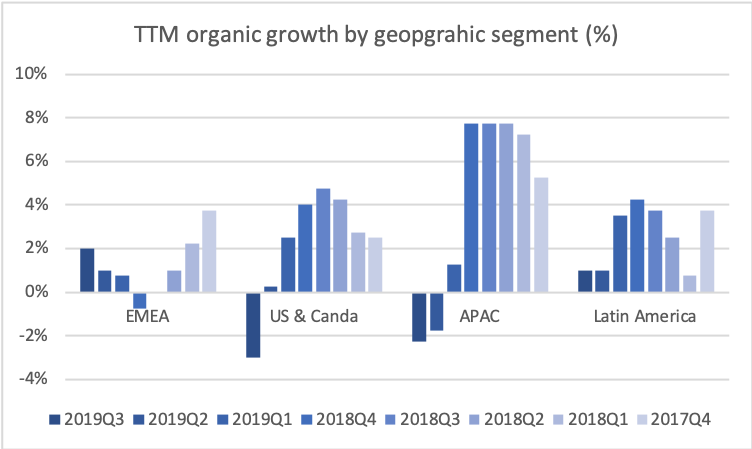

Chr. Hansen is still richly valued and might present itself as a short candidate. AQR Capital Management is one company with a short position in Chr. Hansen. Neither company seems attractively priced at current levels. Both companies suffer in similar segments and both are experiencing declining growth rates.

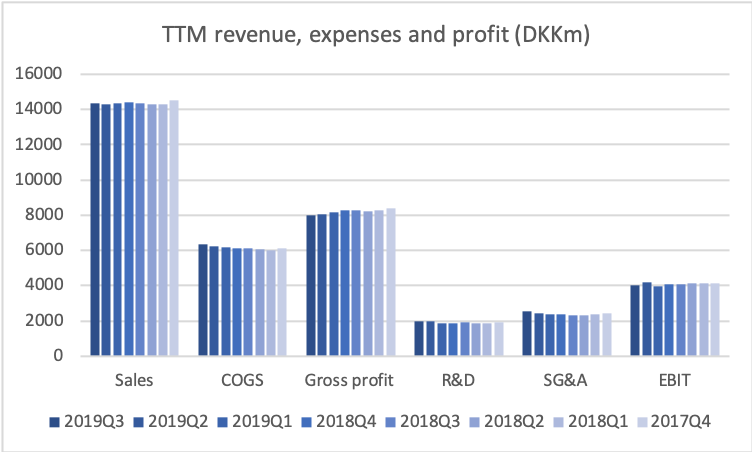

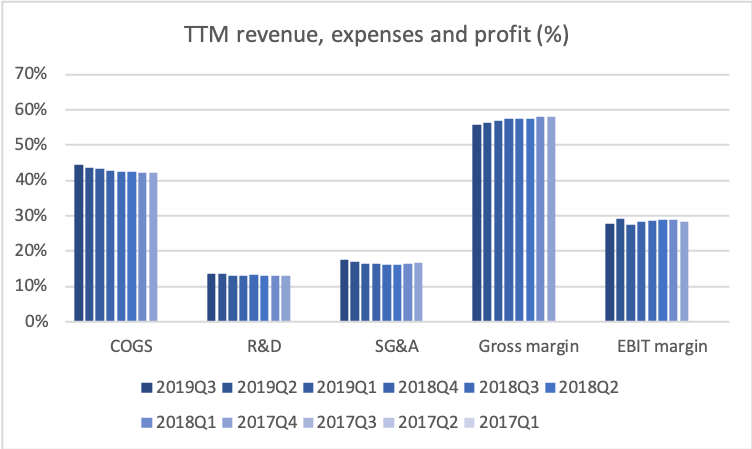

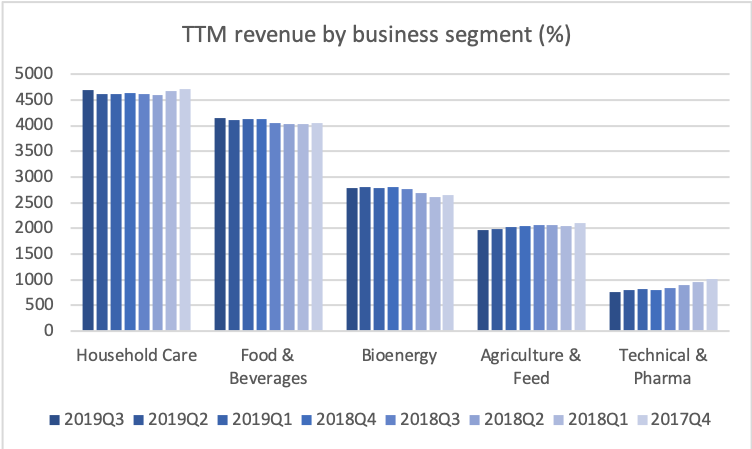

Novozymes

Chr. Hansen

Media coverage

Oct10 Reuters – Shares in Denmark’s Chr. Hansen slump on lower sales outlook, weak demand

Oct23 JP Finans – Novozymes fastholder forventningerne til året efter nedjustering

Oct23 Børsen – Novozymes i stort kurshop: “Ansættelse af ny topchef er meget meget tæt på”

Oct15 Reuters – Novozymes’ CEO to step down as company looks to rejuvenate sales

Oct10 Bloomberg – `Credibility Problem’ at Novozymes Has CEO Explaining Next Steps