Constellation Brands issued a press release on its third quarter earnings before the opening bell with the following highlights.

- Generates reported basis EPS of $1.85 and comparable basis EPS of $2.14, including Canopy Growth equity losses of $0.25; excluding Canopy Growth equity losses, achieved comparable basis EPS of $2.39

- Generates $2.1 billion of operating cash flow and $1.5 billion of free cash flow, an increase of 5% and 14%, respectively

- Increases fiscal 2020 reported basis EPS outlook to $0.95 – $1.05; increases comparable basis EPS outlook to $9.45 – $9.55

- Increases fiscal 2020 operating cash flow target to approximately $2.3 billion and free cash flow projection to $1.5 – $1.6 billion

- Agrees to revise original Wine & Spirits agreement with Gallo in connection with Federal Trade Commission review; expected to close by the end of fiscal 2020

- In a separate, but related, transaction, agrees to divest Nobilo Wine brand to Gallo for $130 million; expected to close in first half fiscal 2021

- Signs agreement with Kings & Convicts Brewing to divest the Ballast Point brand and certain related facilities; expected to close by the end of fiscal 2020

- Promotes Garth Hankinson to Constellation’s CFO replacing David Klein who will assume the Canopy Growth CEO role

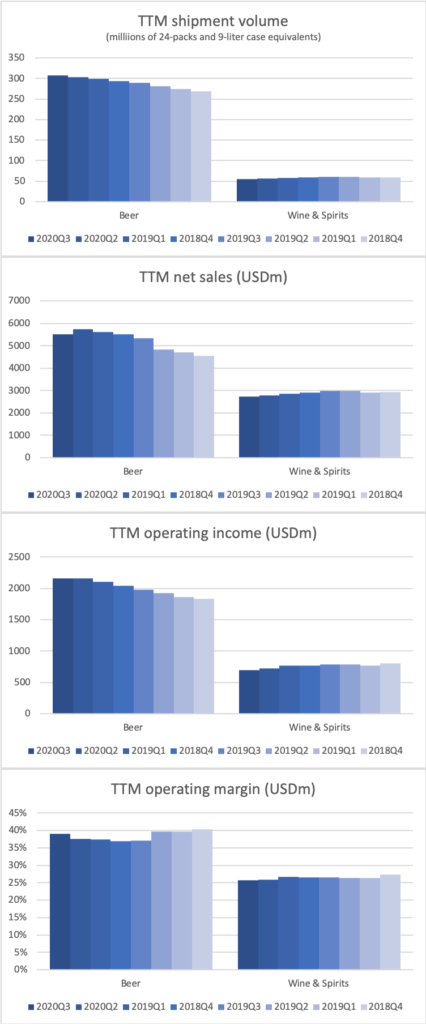

Volume, net sales, operating income and margins for wines and spirits (W&S) was down YoY for the quarter.

| Vol (%) | Sales (%) | Income (%) | |

|---|---|---|---|

| Beer | 6.8 | -14.2 | 0.0 |

| W&S | -13.5 | -9.7 | -12.4 |

The poor performance in terms of EPS was attributable to further impairment losses of $534 million related to Canopy Growth.

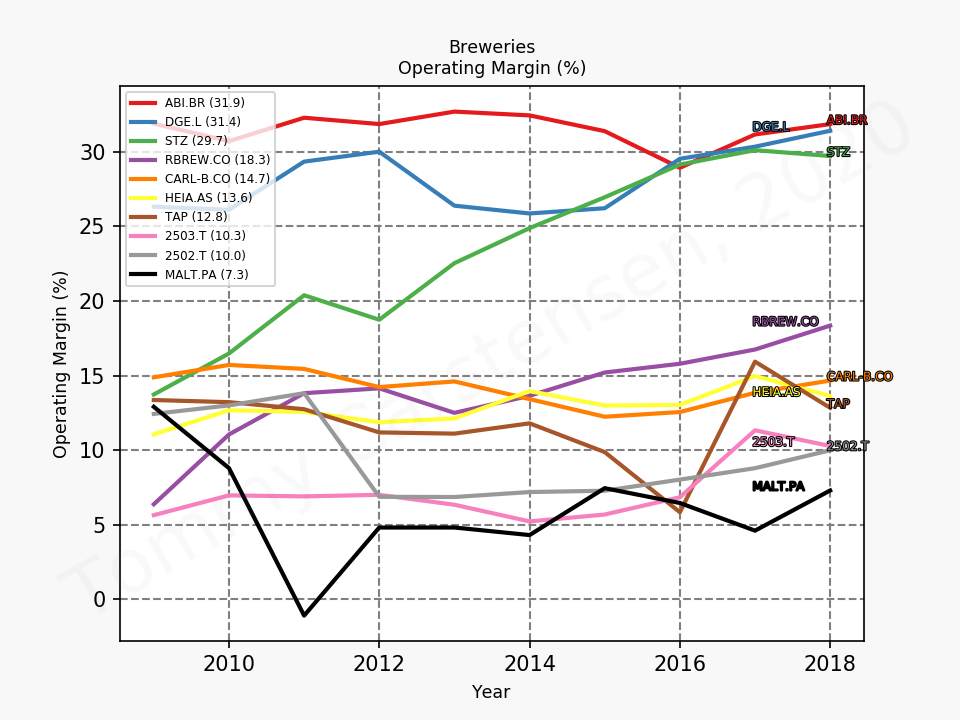

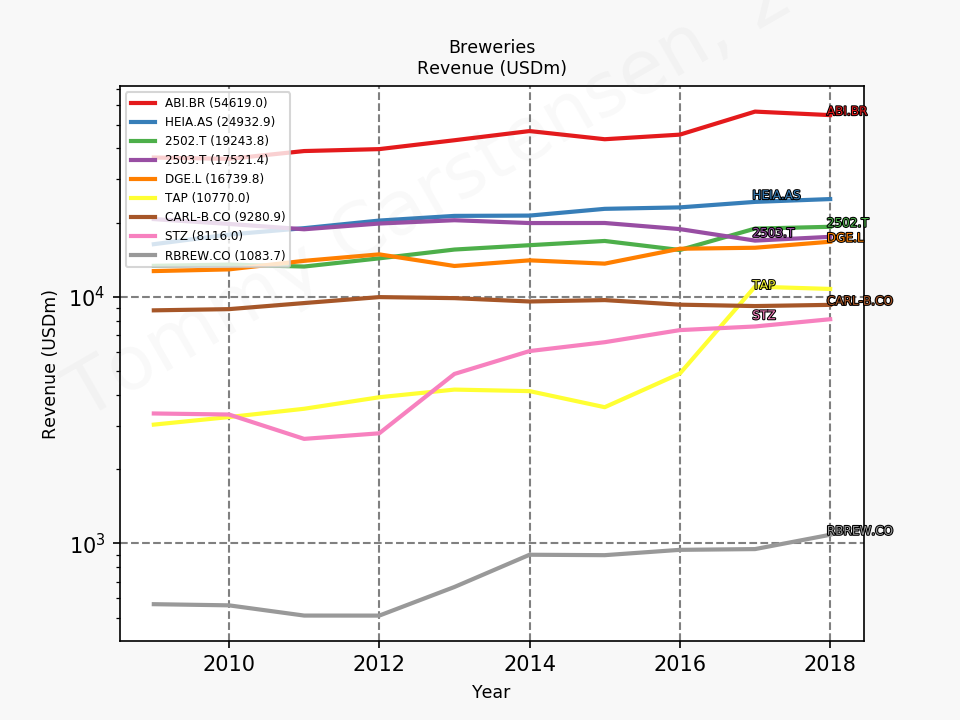

Given the headwinds caused by Canopy Growth it might be a while before Constellation Brands once more trades at its all time high of $234.22 from April 2018 despite some of the best operating margins in the industry.

Reuters – Constellation raises profit forecast after beer-driven quarter

Bloomberg – Constellation Brands Jumps After Boosting Profit Forecast