Brexit is being decided by the members of parliament in the House of Commons tomorrow. Westminster could decide to go ahead with the deal negotiated by prime minister Theresa May, but “no deal” as opposed to a people’s vote (or general election or extension of article 50) cannot be ruled out completely.

Below the PM giving her final statement at 16:21:39 the day before the vote:

What will the consequences of withdrawal from the EU on WTO terms be for UK businesses? One would expect just-in-time manufacturing to be most severely affected by the UK leaving with no deal. Here I look at a) the exports of the UK and b) the risk assessment and the exports for a selected set of UK companies.

The UK economy

Below some interesting figures and articles regarding British exports and imports and GDP growth for the UK.

What would Brexit mean for the global balance of power? via weforum.org

Net exports:

This is how Brexit would affect British trade via weforum.org

Exports of goods between Britain and EU, 2014, % of national totals:

bankofengland.co.uk: EU withdrawal scenarios and monetary and financial stability

At Last, Something About Brexit Everyone Can Agree On via bloomberg.com

UK and EU goods and services trade volume relative to Remain:

GDP growth:

Brexit has already created more than 4,500 jobs in Ireland via finance.yahoo.com

Brexit has prompted 55 firms to invest in Republic, IDA Ireland says via irishtimes.com

The Economic Effects of the Government’s proposed Brexit Deal via niesr.ac.uk

Modelling assumptions underlying different Brexit scenarios:

UK exports and imports:

UK services trade volumes by sector:

GDP per capita:

Treemaps of UK gross imports and exports in 2016 from The Atlas of Economic Complexity at atlas.cid.harvard.edu:

Export by partner:

Import by partner:

Export by product:

Import by product:

The economy of an independent Scotland?

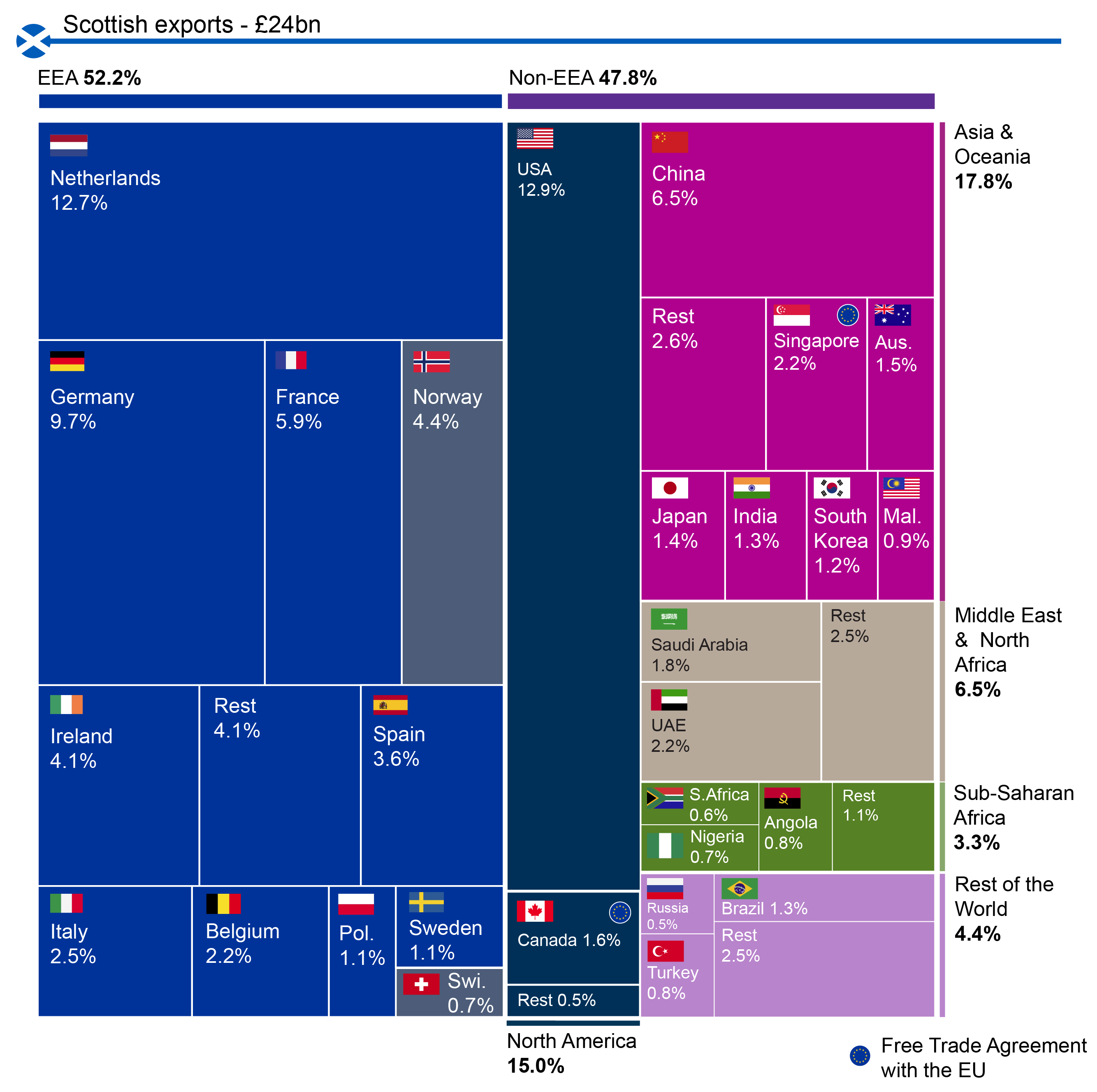

Export statistics of Scotland via gov.scot

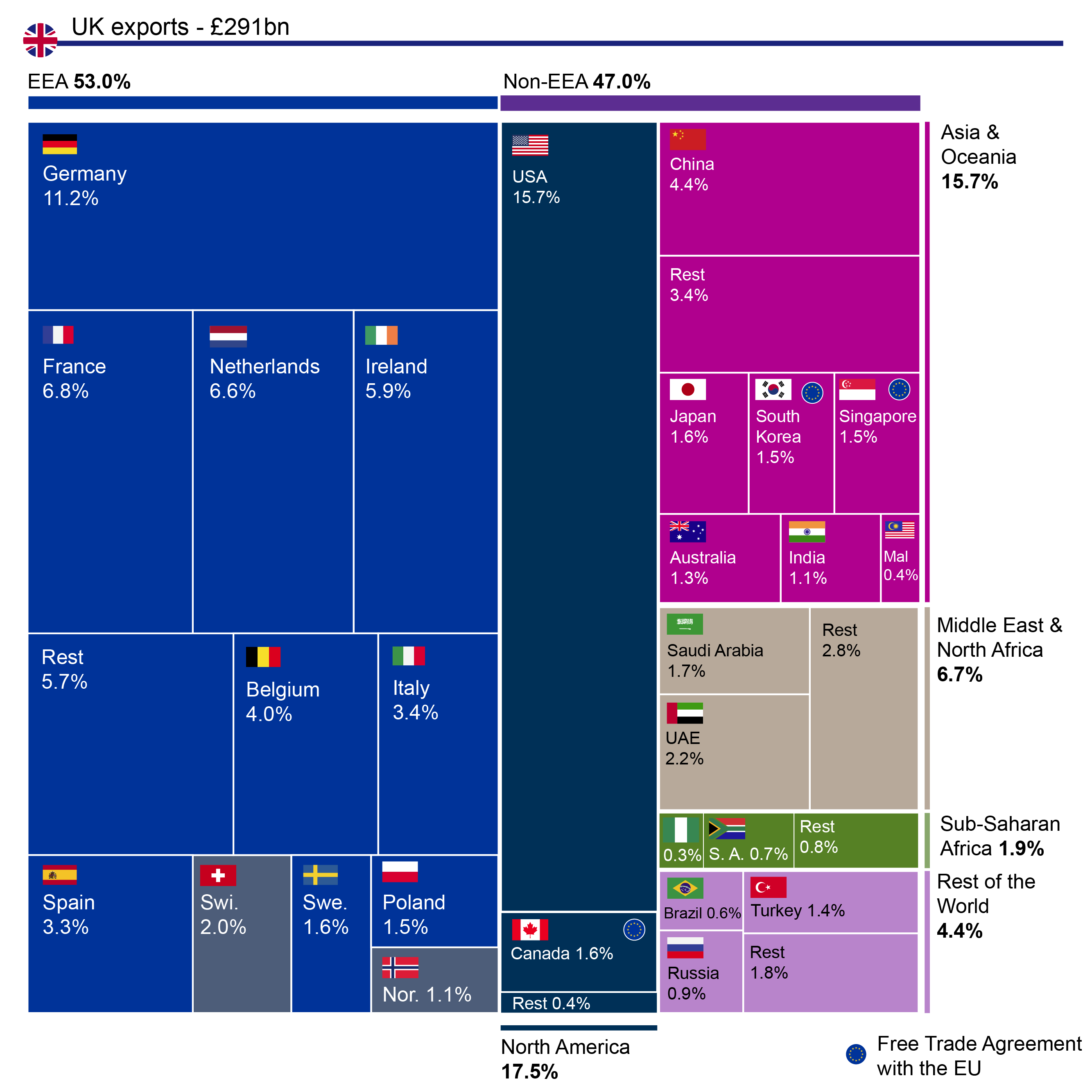

The UK and Scotland’s current international trade flows via parliament.scot

Scottish international exports (£24bn) by region:

UK international exports (£291bn) by region:

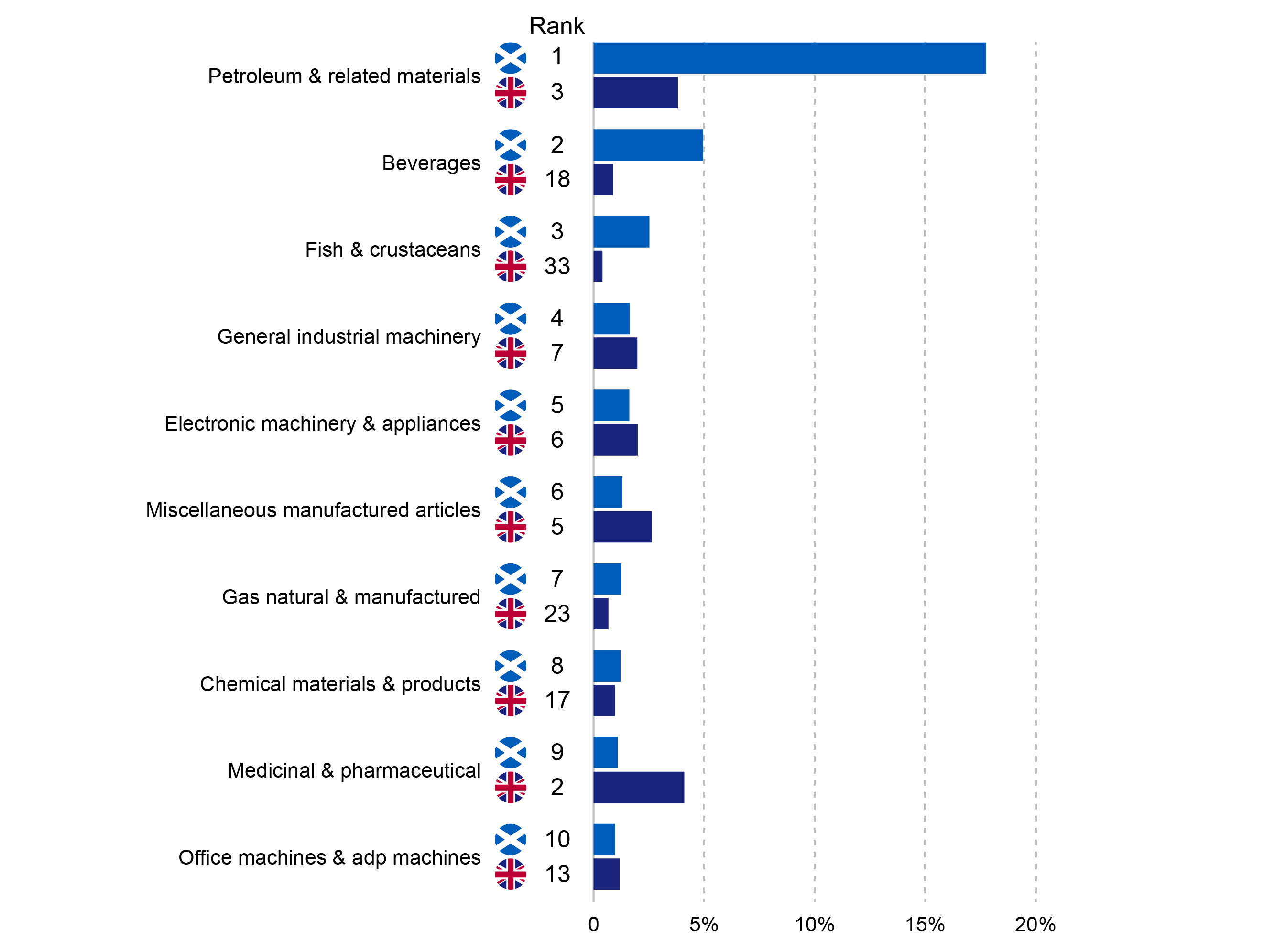

Relative importance of sectoral exports to the EU for both Scotland and the UK

UK companies

Below revenue and market capitalisation during the past 10 years for a selected set of UK companies.

Revenue:

Market cap:

Revenue for geographic segments of various UK companies:

| Company | UK | EU* | Neither | Total |

|---|---|---|---|---|

| Britvic | £891.3m (59.3%) | £443.2m (29.5%) | £1,503.6m | |

| Unilever | €3,022m (23.2%) | €13,050m | ||

| Ted Baker | £141.4m (32.0%) | £442.5 | ||

| AstraZeneca | £8,258m (36.8%) | £8,419m (37.5%) | £5,788 (25.8%) | £22,465m |

| GSK | £940m (5.3%) | £17,983 | ||

| Rolls Royce | £1,881 (11.5%) | £3,741 (22.9%) | £10,685m (65.5%) | £16,307m |

| Diageo | £1,630m (8.8%) | £3,355m (18.2%)* | £18,432 | |

| Smith & Nephew | £244m (5.1%) | £4,765m |

* In some cases “EU” also includes Turkey and the Middle East. The numbers are not always broken down by the – for this purpose – appropriate segments.

Below are the Brexit risk assessments by selected UK companies in part or in full:

[expand title=”AstraZeneca plc”]

On 23 June 2016, the UK held a referendum on the UK’s continuing membership of the EU, the outcome of which was a decision for the UK to leave the EU (Brexit). The progress of current negotiations between the UK Government and the EU will likely determine the future terms of the UK’s relationship with the EU, as well as to what extent the UK will be able to continue to benefit from the EU’s single market and other arrangements. Until the Brexit negotiation process is completed, it is difficult to anticipate the potential impact on AstraZeneca’s market share, sales, profitability and results of operations. The Group operates from a global footprint and retains flexibility to adapt to changing circumstances. The uncertainty during and after the period of negotiation is also expected to increase volatility and may have an economic impact, particularly in the UK and Eurozone. The Group has responded by engaging proactively with key external stakeholders and establishing a cross-functional internal steering committee to understand, assess, plan and implement operational actions that may be required. Some of these actions are being implemented based on assumptions rather than defined positions so that the Company is able to mitigate the risks arising from variable external outcomes. Currently, a number of areas for action have been identified including duplication of release testing and procedures for products based in the EU27 and the UK, transfer of regulatory licences, customs and duties set up for introduction or amendment of existing tariffs or processes and associated IT systems upgrades. The Board reviews the potential impact of Brexit as an integral part of its Principal Risks (as outlined overleaf) rather than as a stand-alone risk. As the process of Brexit evolves, the Board will continue to assess its impact.

[/expand]

[expand title=”Britvic plc”]

Unlike some other businesses, leaving the European Union of itself, does not present specific challenges to the company as we manufacture the vast majority of finished goods in the same market as our selling market. Nonetheless, Brexit could result in higher cost of goods for the company, as a result of the introduction of trade tariffs for imports to the UK from the EU which would impact the raw materials that we purchase from the EU. Additionally, in the event of a ‘no-deal’ Brexit, there is a risk of disruption at borders, which could impact the supply of some raw materials sourced from the EU. We are working closely with suppliers to understand their plans, reviewing all supply alternatives and increasing the level of raw materials that we hold in the run-up to 29 March 2019.

[/expand]

[expand title=”Diageo plc”]

We continue to prepare for all scenarios around the United Kingdom’s exit from the European Union in 2019 and are taking Brexit in our stride. We look forward to agreement on a final deal that will provide stability for our workforce and business operations in the United Kingdom and the European Union, as well as clarity on existing and future trade deals between countries. As one of the United Kingdom’s most important manufacturing export companies, we are working with the UK government to ensure our priorities are well understood.

Ongoing risk identification and mitigation planning to respond to the risks associated with Brexit and the potential impact of any trade wars. We have particular focus on identifying critical decision points to ensure potential operational disruption is effectively mitigated.

Diageo is headquartered in the United Kingdom and has significant production and investment in Scotland. In June 2016, the United Kingdom voted by referendum to withdraw from membership in the European Union (commonly referred to as “Brexit”). The prime minister of the United Kingdom formally invoked Article 50 of the Treaty of the European Union in March 2017, thus officially initiating the negotiation process for the departure of the United Kingdom from the European Union. Although the potential impact of Brexit on Diageo’s business cannot be fully assessed until the detailed terms of the United Kingdom’s withdrawal from the European Union are finalised and the United Kingdom negotiates, concludes and implements successor trading arrangements with other countries, it is likely that this withdrawal process will continue to result in a sustained period of economic and political uncertainty and complexity. The United Kingdom’s withdrawal from the European Union could also negatively impact economic conditions in Europe more generally and have adverse effects on Diageo’s business and financial results. For instance, the negotiating process surrounding the terms of the departure of the United Kingdom from the European Union may continue to contribute to significant volatility in exchange rates and risks to supply chains across the European Union and ultimately lead to changes in market access or trading terms, including to customs duties, tariffs and/or industry-specific requirements and regulations, restrictions on the mobility of employees and generally increased legal and regulatory complexity and costs.

The withdrawal of the United Kingdom from the European Union could also have further implications for the constitutional makeup of the United Kingdom as a result of renewed discussions surrounding independence for Scotland and/or further devolved governments in Scotland and Northern Ireland following the outcome of the Brexit referendum. This could result in a further period of political uncertainty in the United Kingdom and otherwise adversely affect Diageo’s business and financial results, particularly since Diageo has substantial operations and inventory located in Scotland.

[/expand]

[expand title=”GlaxoSmithKline plc”]

We have evaluated the impact of Brexit on our business operations, including our supply chain and quality oversight. Our priority is to maintain continuity of GSK’s supply of medicines, vaccines and health products to our patients and consumers in the UK and the EU.Uncertainty remains about the future relationship between the UK and the EU. As a result, we have agreed a risk-based approach to mitigation across the organisation. Implementation of our contingency plan has been underway since January 2018, with an immediate focus on our supply chains. This includes expanding our ability in the EU and the UK to conduct re-testing and certification of medicines; transferring Marketing Authorisations registered in the UK to an EU entity; updating packaging and packaging leaflets; amending manufacturing and importation licences, and securing additional warehousing.We currently anticipate that the cost to implement these and other necessary changes could be up to £70 million over the next two to three years, with subsequent ongoing additional costs of approximately £50 million per year, including additional customs duties and transaction or administration costs. These charges represent our estimates of the impact of Brexit based on the information currently available. As more information on the changes to our business that will be required after Brexit becomes available, the assumptions underlying these estimates could change, with consequent adjustments, either up or down, to the additional costs we expect to incur. We will continue to adjust our plans and their expected financial impact as negotiations and regulations develop.Delivering these necessary but complex changes by March 2019 will be ambitious and potentially disruptive in the short term and we support efforts to secure a status quo transition period to minimise disruption. Over the longer term, we continue to believe that Brexit will not have a material impact on our business.

[/expand]

[expand title=”Next plc”]

BREXIT PREPARATIONAND IMPACT ANALYSIS

Nature of risk and Risk level

Direct risks:

(i) Increases in tariffs and duty on goods imported into the UK from the EU and other countries – Medium

(ii) Administrative workload and costs in submitting necessary data on EU goods when they enter the UK from the EU – Low

(iii) Increases in tariffs and duty on goods exported to the EU – Low

(iv) Regulatory risks relating to the acceptability of product standards to UK and EU authorities – Very low

Indirect risks:

(i) Reduction in the value of Sterling along with associated increase in cost of goods from overseas – Medium

(ii) Queues and delays at UK and EU ports as a result of increased customs declarations for other companies – High

[/expand]

[expand title=”Rolls-Royce Holdings plc”]

Political risk

Our Brexit steering group has continued to assess potential impacts of leaving the EU, including uncertainties related to our principal risks. We have briefed the UK Government and other governments on our Brexit-related issues and have made representations through our trade association memberships. While we wait for political certainty from the Brexit negotiations and details of the final Brexit deal, we have assessed potential additional operational impacts to understand what action Rolls-Royce might need to take before Brexit occurs in 2019. We could be impacted through a number of routes. For example: our regulatory relationship with the EU (European Aviation Safety Agency; REACH chemical certification programme); our operational relationship (customs union and movement of people); our tax and treasury strategy; our EU R&T funding relationship and other interfaces. We are managing these risks through our operational assessment and applying our business continuity risk management process to Brexit.

[/expand]

[expand title=”Smith & Nephew plc”]

In June 2016 the UK voted to leave the European Union. The UK’s withdrawal will be effective from 29 March 2019 at 11pm GMT. As negotiations regarding the terms of the withdrawal continue, the nature of the trade agreements and the closeness of the economic ties between the UK and the EU beyond the withdrawal date remains uncertain. We continue to monitor the situation. Among the potential impacts of Brexit, the regulatory framework for medical devices could be affected, as it is unclear whether the UK will ascribe to the new Medical Devices Regulation which will become applicable in May 2020.

[/expand]

[expand title=”Ted Baker plc”]

Potential Impact: The UK’s decision to leave the European Union has increased the level of economic and consumer uncertainty.

Mitigation: The Group has established a Brexit Committee which, together with its external advisers, continues to carefully monitor the potential impact of Brexit. Scenario planning includes the impact of additional customs duties, VAT and customs duty declarations; and the restriction on the free movement of people.In addition to this ongoing monitoring and mitigation, our presence in a range of international markets helps mitigate the impact of this risk.

Treasury Risk Management: In June 2016, ahead of the UK referendum on Brexit, the Group extended its hedging arrangements for US Dollars to April 2018. At the balance sheet date, the Group has hedged its projected commitments in respect of the period ending 26 January 2019 as well as a proportion of its requirements for the following period.

[/expand]