Today Ely Lilly (LLY) announced the positive results on a phase 2 diabetes drug of theirs (LY3298176) via a publication in The Lancet, a presentation at the annual meeting of the European Association for the Study of Diabetes (EASD) and the press release below:

Lilly’s Investigational Dual GIP and GLP-1 Receptor Agonist Shows Significant Reduction in HbA1c and Body Weight in People With Type 2 Diabetes

The press release created a few headlines:

Bloomberg: Diabetes Drug’s Results Push Lilly to Look at Obesity Too

Reuters: Lilly’s diabetes drug data impresses, hurts rival Novo’s shares

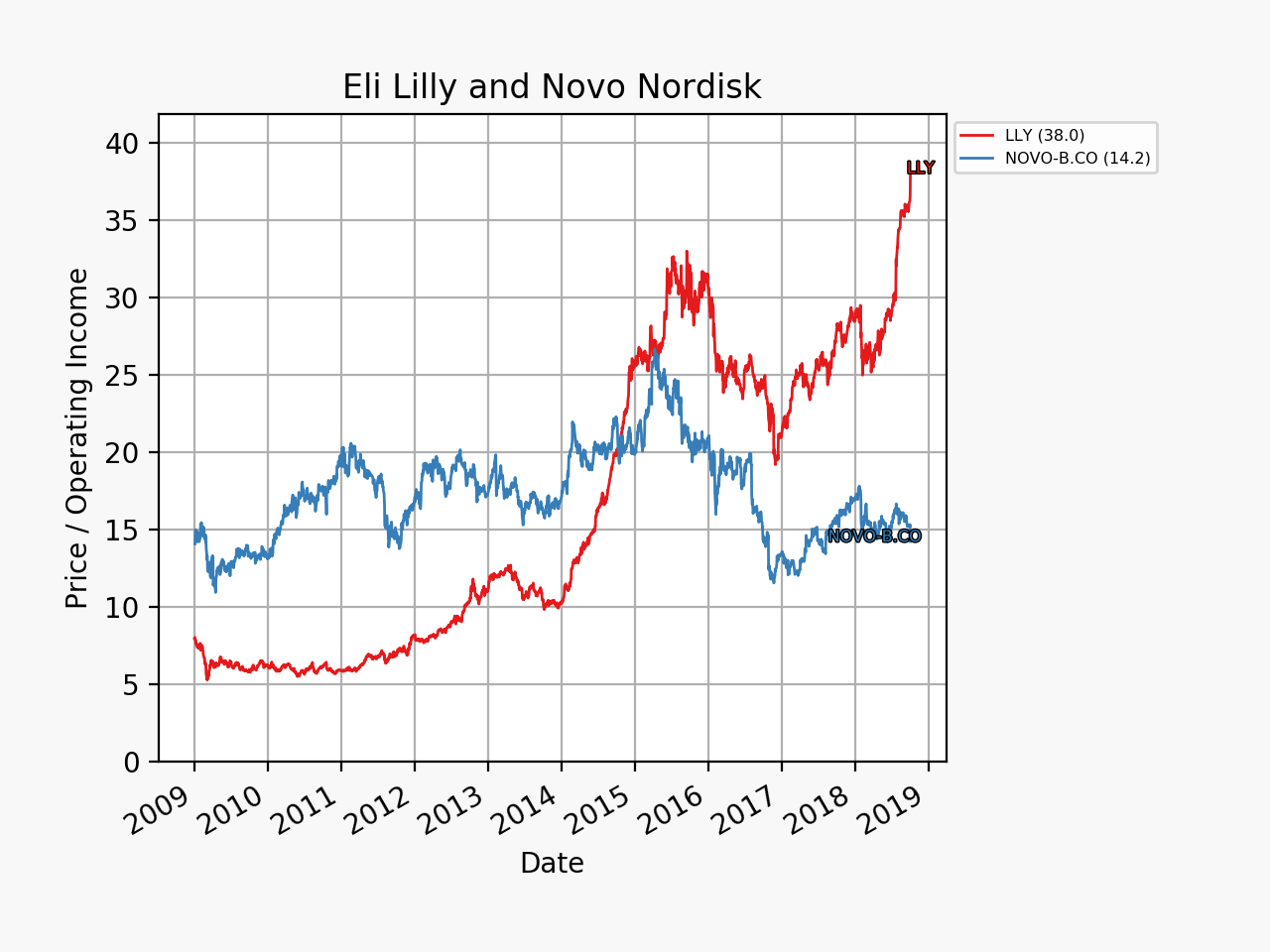

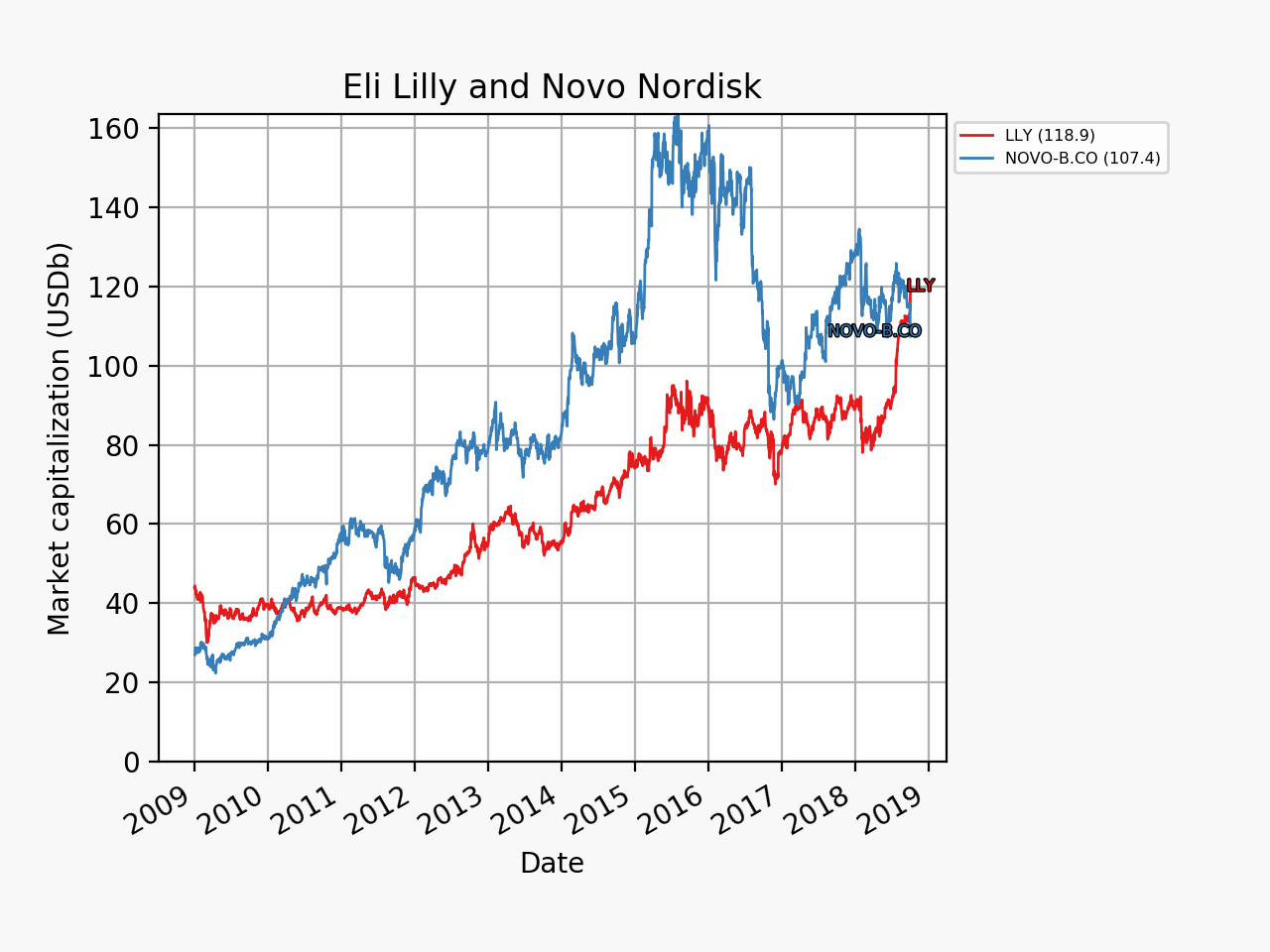

The share price of Eli Lilly went up by 4% in an otherwise sour market and that of Danish rival Novo Nordisk (NOVO-B.CO) plummeted some 7-8%. The multiples and market capitalizations of the two companies were sent further in opposite directions.

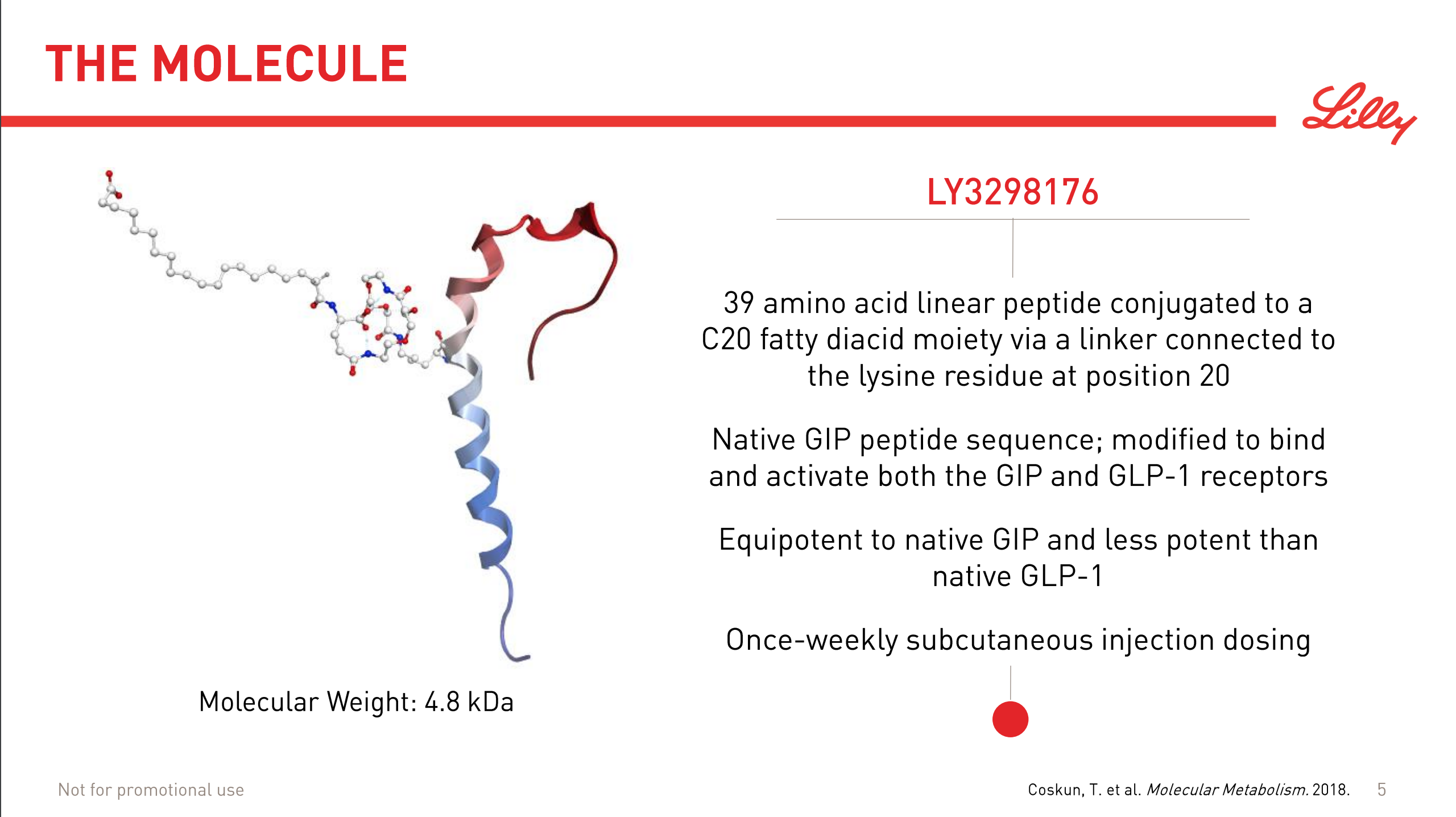

The market movements were caused by the positive results on the phase 2 drug candidate LY3298176. It is a peptide and an incretin and a dual GIP/GLP1 receptor agonist.

Incretins such as GLP1 receptor agonists work by stimulating insulin and inhibiting glucagon release.

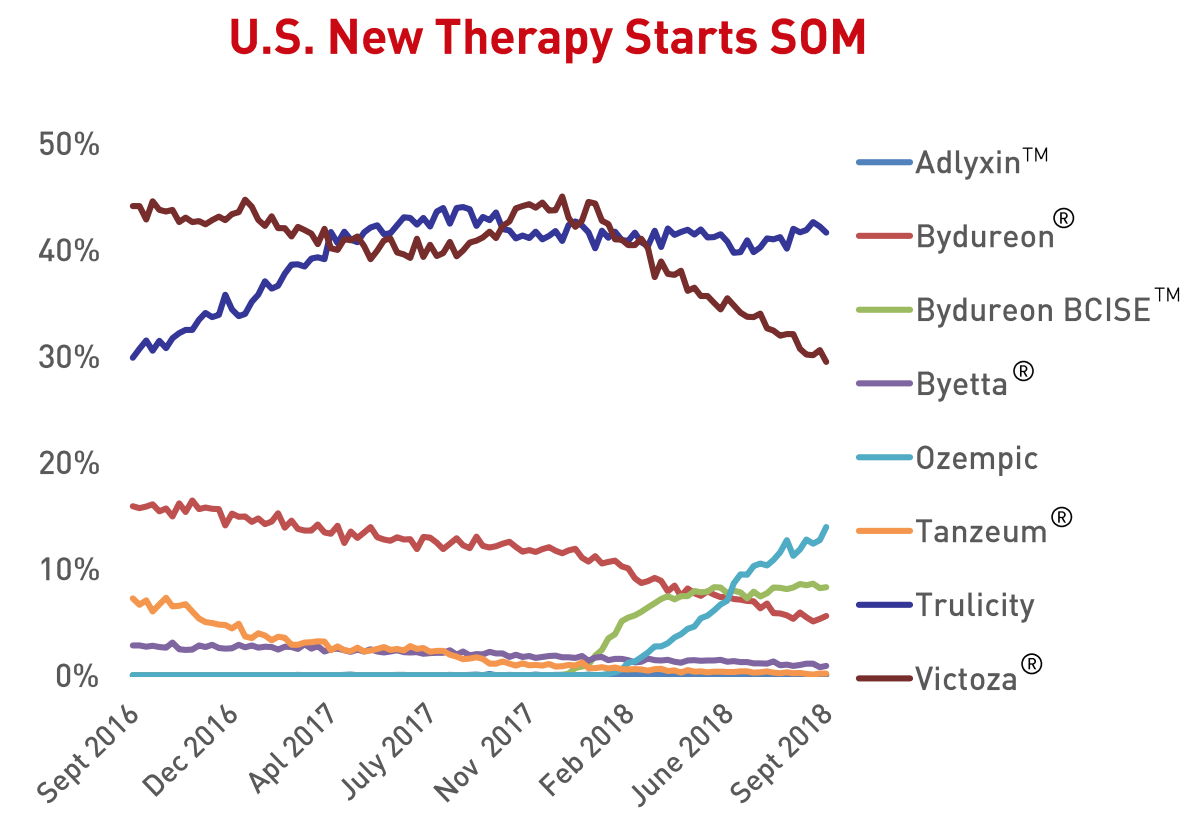

The GLP1 class of antidiabetic drugs is growing at a fast pace (green line in the figure below).

And Lilly and Novo have the vast majority of the market share as evidenced by the Q2 sales figures and Q3 prescription numbers below.

It is never appropriate to compare across studies due to different doses, different study designs, different patient groups and other confounding factors, but in the table and figures below are comparisons of the dual agonist LY3298176, Trulicity® (dulaglutide), Ozempic® (semaglutide) and oral semaglutide.

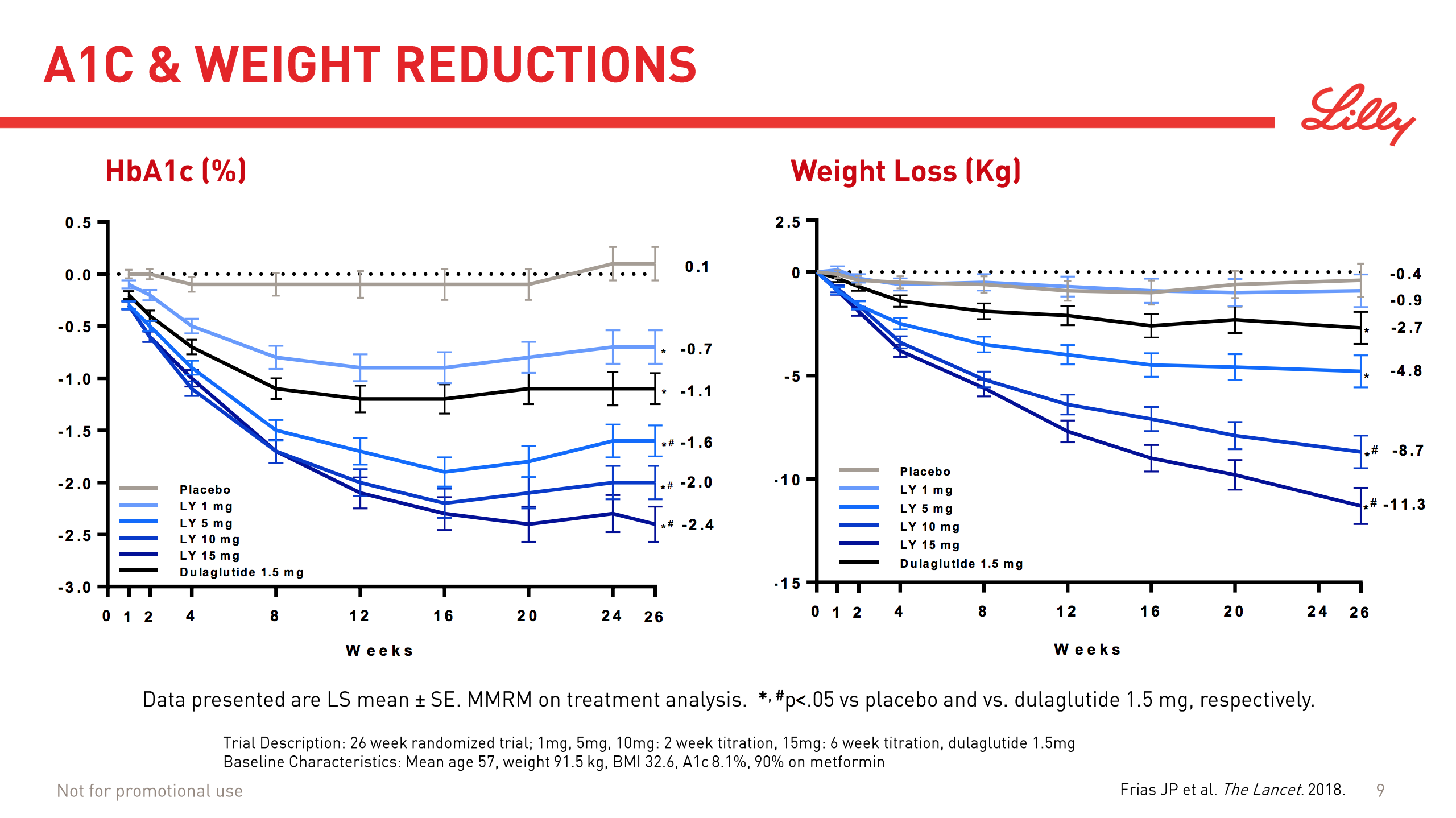

Today Lilly presented their results from a 26 week trial and showed their phase 2 drug at doses of 5mg and higher to be superior to their own Trulicity® (dulaglutide) at a 1.5mg dose in terms of HbA1c reduction and weight loss.

The SUSTAIN 7 study by Novo showed semaglutide (0.5mg and 1.0mg) to be superior to dulaglutide (0.75mg and 1.5mg) in terms of HbA1c reduction and weight loss after 40 weeks. The figure below is from Pratley2018.

The figure below summarises all of the SUSTAIN studies and it is from Overgaard2018.

The phase 2 obesity trial on semaglutide showed an even greater weight loss than that observed with the new dual agonist from Lilly, but the trial ran for 52 weeks as opposed to the 26 week Lilly trial.

| Study/Trial | Drug | Dosis | HbA1c reduction (%) | Weight loss (kg) |

|---|---|---|---|---|

| NCT03131687 | Dulaglutide | 1.5mg | 1.1% | 2.7kg |

| NCT03131687 | LY3298176 | 1mg | 0.7% | 0.9kg |

| NCT03131687 | LY3298176 | 5mg | 1.6% | 4.8kg |

| NCT03131687 | LY3298176 | 10mg | 2.0% | 8.7kg |

| NCT03131687 | LY3298176 | 15mg | 2.4% | 11.3kg |

| NCT02648204 (SUSTAIN 7) | Dulaglutide | 0.75mg | 1.1% | 2.3kg |

| NCT02648204 | Dulaglutide | 1.5mg | 1.4% | 3.0kg |

| NCT02648204 | Semaglutide | 0.5mg | 1.5% | 4.6kg |

| NCT02648204 | Semaglutide | 1.0mg | 1.8% | 6.5kg |

| NCT02863419 (PIONEER 4) | Oral semaglutide | 14mg | 1.2% | 5.0kg |

| NCT02863419 | Victoza® (liraglutide) injection | 1.8mg | 0.9% | 3.1kg |

The dosis is important, since the dual agonist is inferior to dulaglutide at lower doses. As written in the press release “the most commonly reported side effects were gastrointestinal-related, and dose-dependent. These events included nausea, diarrhea and vomiting.” An analyst asked on the Lilly conference call today, whether the higher doses are workable. The answer was that it remains to be seen during phase 3.

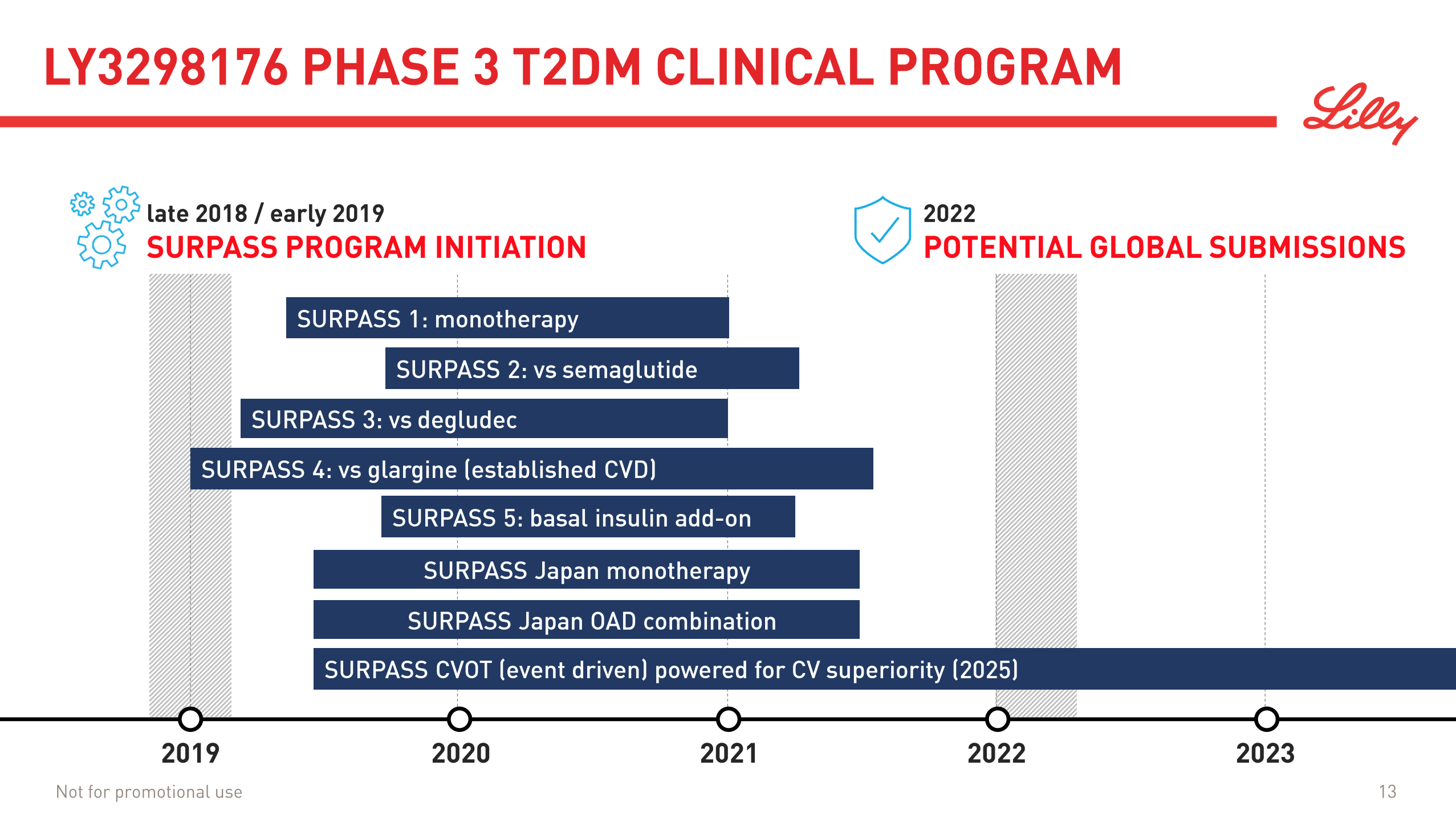

Phase 3 will also involve the SURPASS 2 study, which will be a comparison with semaglutide (Ozempic®), and it is expected to finish before 2022.

Eli Lilly conquered some ground today, but neither the battle nor the nearly century old war has been won, and there are interesting drug candidates in both the pipeline of Novo Nordisk and the pipeline of Eli Lilly. Selected drug candidates from each of the two pipelines are mentioned below.

| Company | Phase | Therapy | Name | Type |

|---|---|---|---|---|

| Novo | 3 | Diabetes | Oral semaglutide | GLP1 receptor agonist semaglutide |

| Novo | 3 | Obesity | Semaglutide Obesity | GLP1 receptor agonist semaglutide |

| Novo | 1 | Obesity | AM833 | Amylin analogue |

| Novo | 1 | Obesity | PYY1562 | Peptide YY analogue |

| Novo | 1 | Obesity | GG-co-agonist 1177 | Novel Glucagon–GLP1 co-agonist |

| Novo | 1 | Obesity | Tri-agonist 1706 | Triple GLP1-GIP-GCG agonist |

| Lilly | 2 | Diabetes | LY3298176 | GIP/GLP-1 Co-agonist Peptide |

| Lilly | 2 | Diabetes | DACRA-042 | Dual Amylin Calcitonin Receptor Agonist |

| Lilly | 1 | Diabetes | DACRA-089 | Dual Amylin Calcitonin Receptor Agonist |

| Lilly | 1 | Diabetes | “Oxyntomodulin” | Oxyntomodulin |

It is also worth noting, that Novo Nordisk on August 17th announced the acquisition of Bristol based Ziylo in an effort to develope glucose responsive insulin, which would reduce the risk of patients overdosing with insulin.

In conclusion it is probably much too premature to call it game, set and match. It is however quite certain, that the innovation of drugs and devices will continue and the best days for diabetes patients around the world are still ahead.