The jewelry company Pandora has issued a press release regarding their quarterly results with the comments below from the new CEO and the CFO.

Alexander Lacik, CEO:

“I’m very excited to join Pandora. We have some very strong fundamentals in terms of a world-class supply chain, a strong product proposition as well as a deep reaching distribution network that gives consumers all around the globe quality access to Pandora. The brand as well as the company has reached a point of maturity and it is not without some serious challenges. The recently announced transformation programme NOW, which I fully support, is a great transition into the future.“

Anders Boyer, CFO:

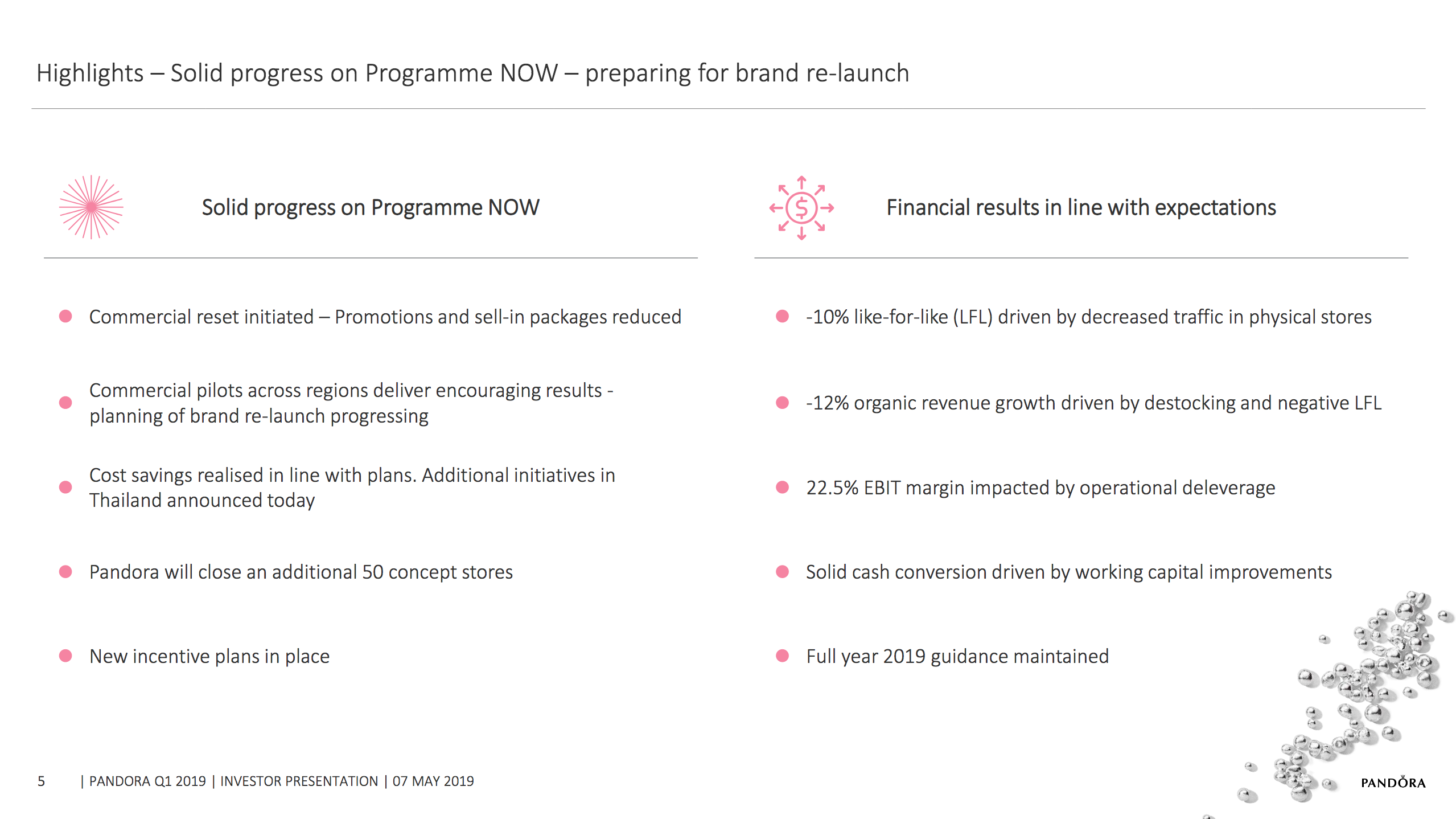

“Programme NOW is progressing rapidly and is creating a real transformation of our business, culture and organisation. As expected, the first quarter was characterised by continued weak like-for-like further burdened by our deliberate commercial reset. While the first quarter emphasises the need for our planned brand re-launch, it is encouraging to see that our initial commercial pilots and marketing tests to Reignite a Passion for Pandora show good results.”

A transcript of the earnings call is available from Yahoo Finance.

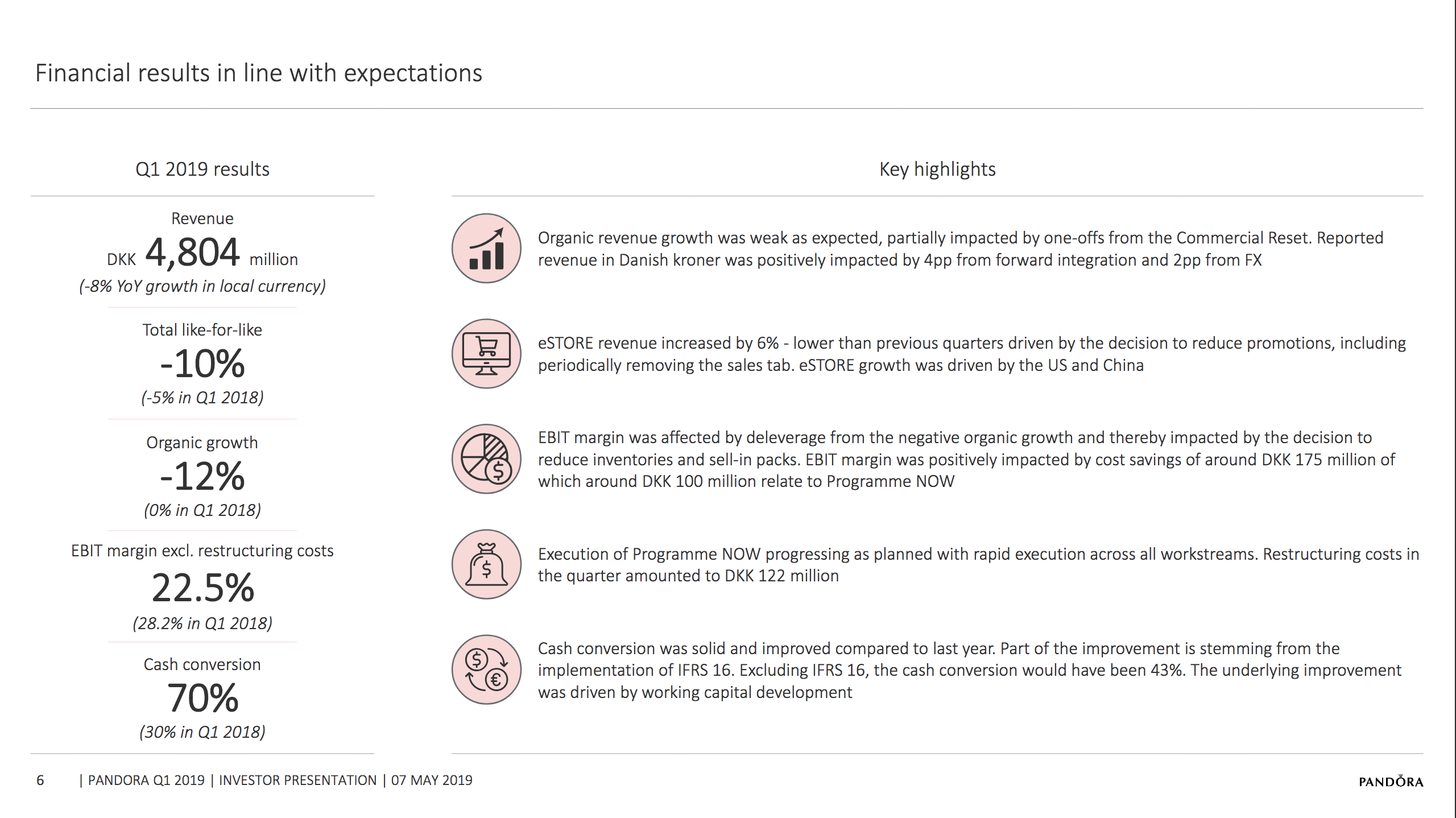

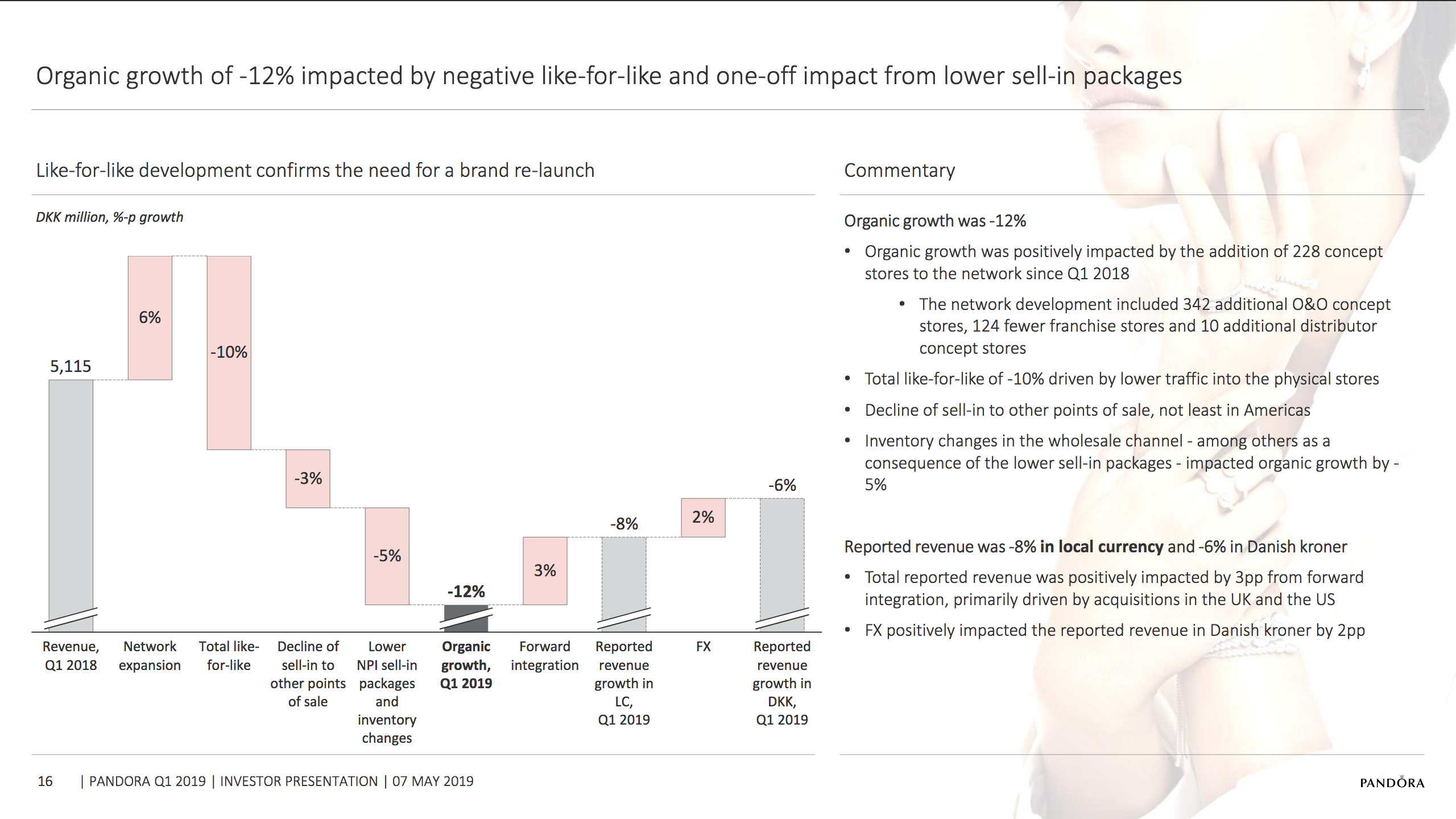

Below are two slides from the earnings call with the highlights of the quarter and two slides with waterfall charts visualising the organic growth and the EBIT margin for the quarter.

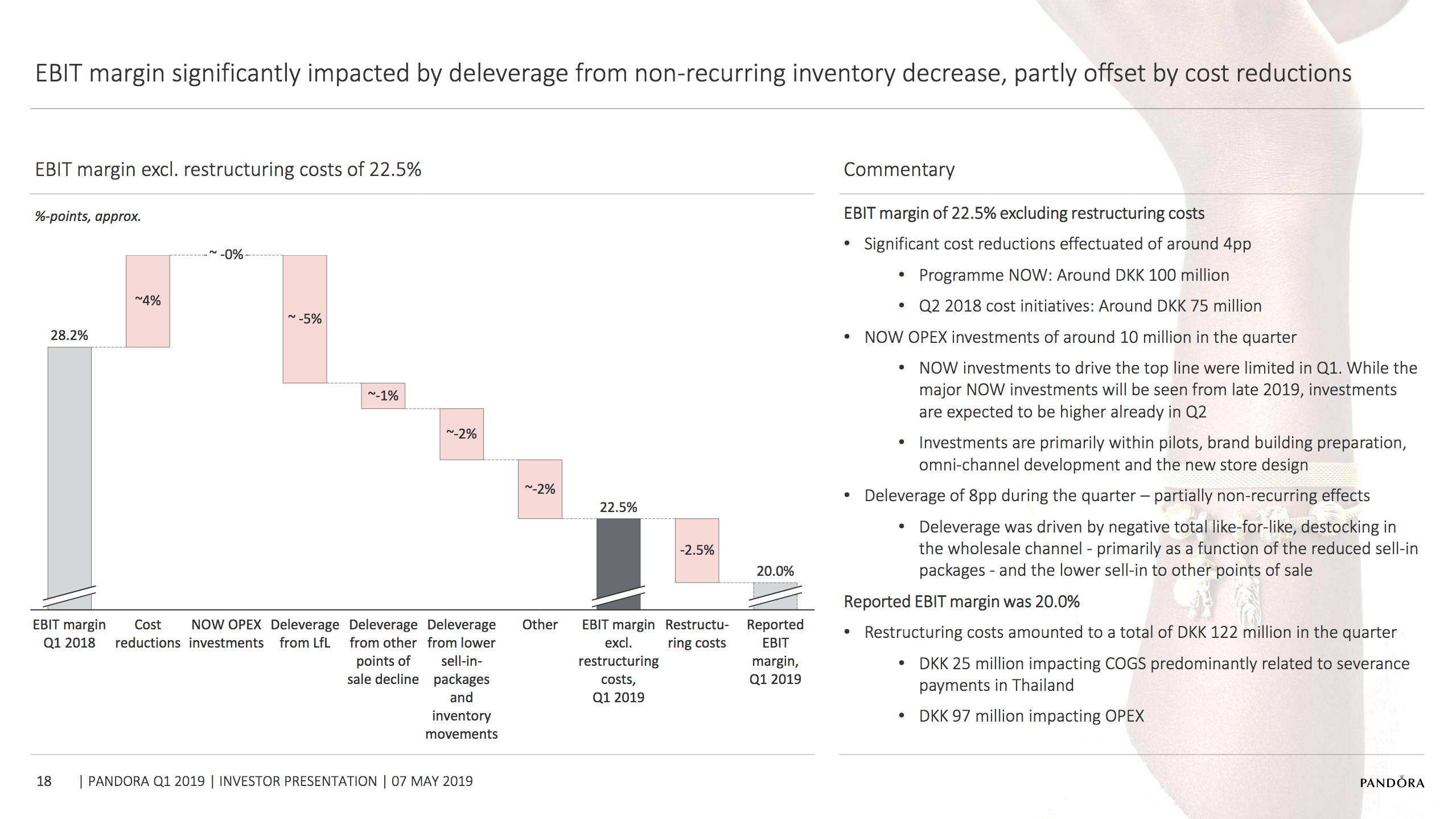

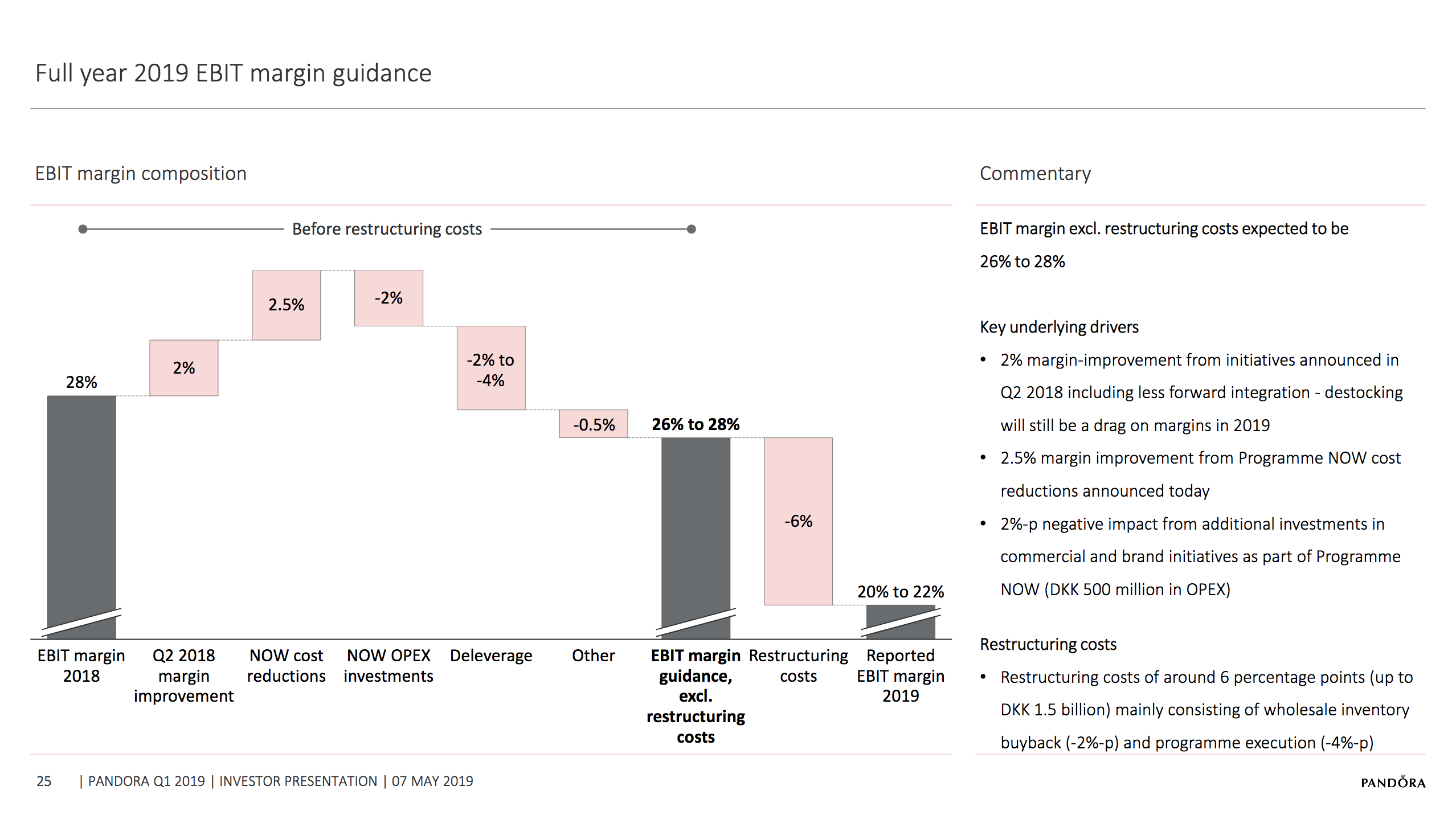

Various financial metrics are summarised below. Revenue is shrinking (-6%), gross profit is decreasing (-6%) despite COGS being reduced (-6%) and operating profit is down (-25% excluding restructuring costs) in part due to SG&A being up (+5%); administrative expenses are down (-8%), but sales and distribution is up (+13%). The gross margin is relatively unchanged at 75.9%, but the EBITDA margin is down from 32.6% to 30.7% and the EBIT margin is down from 28.2% to 22.5% (excluding restructuring costs).

ROIC hit another all time low of 47.6%. Because of a switch from the IAS17 to the IFRS16 accounting standard it was further reduced to 35.2%.

Product segments

Revenue from charms was down from DKK2,854m to DKK2,434m (17.3% YoY). Charms will quite possibly make up less than half of the total revenue at the end of 2019. This diversification of product categories is not necessarily a bad thing, as it can be seen as a natural maturation process of the brand and as a reduction of risk.

Geographic segments

China is still growing double digit in terms of store openings (+29%) and revenue (+15%), whereas other mature markets seem to be saturated. The same-store-sales growth is negative (-10%). All of the main markets are experiencing negative like-for-like growth; including China (-4%).

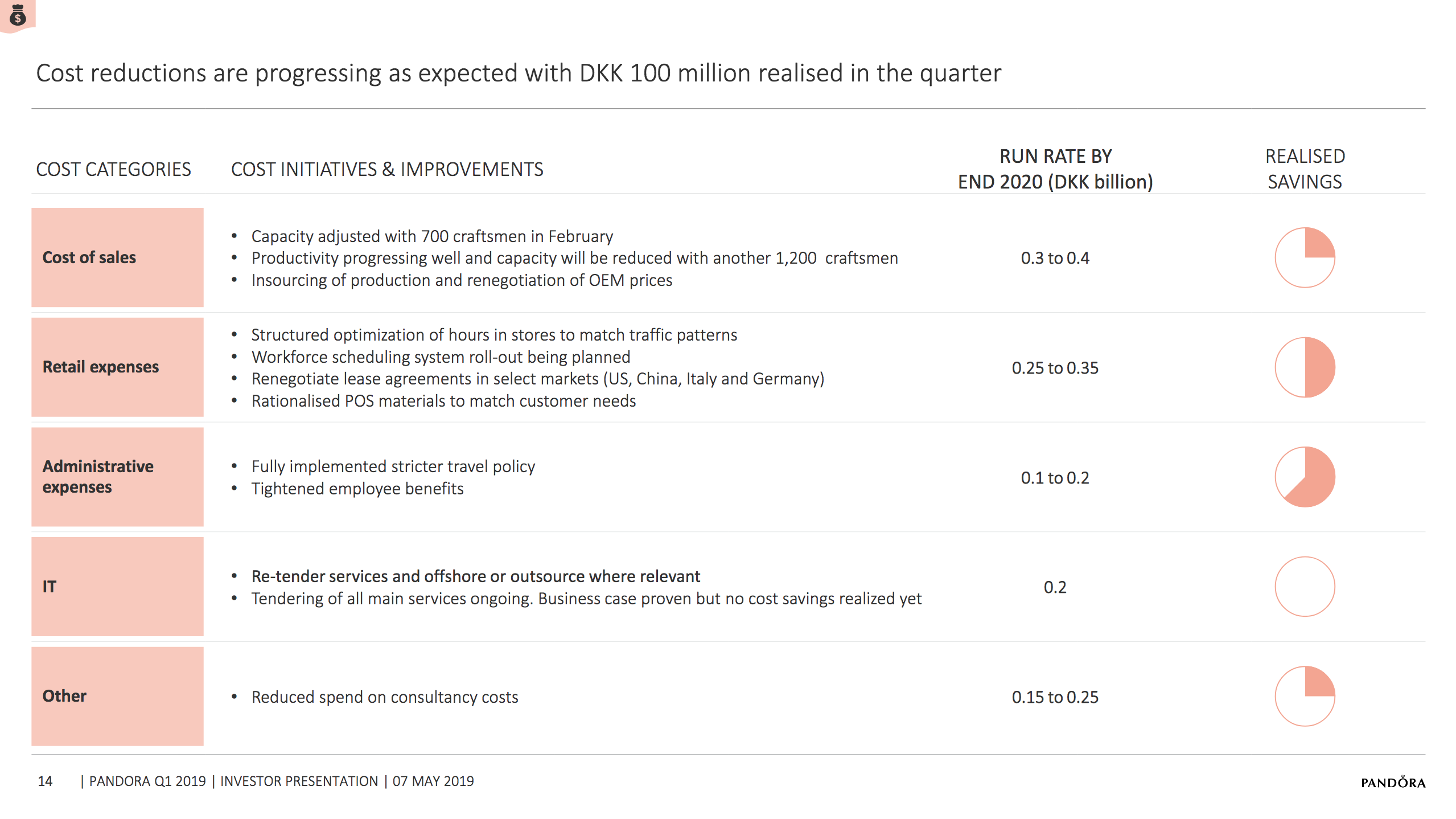

Cost reductions are progressing as expected with DKK100m realised in the quarter. The CFO had the following comment regarding the cost reduction:

As you know, the cost reduction opportunity is quite big. And we target a run rate saving DKK1.2 billion by the end of next year, by the end of 2020. And for ’19 specifically, we expect to realize cost reductions of around DKK600 million. And that comes, as you know, on top of the DKK350 million cost reductions that was announced back in August last year and in connection with the Q2 announcement.

The CFO had the following comment about the restructuring costs, which will include channel buyback

So that’s — we are keeping the DKK1.5 billion — up to DKK1.5 billion in restructuring cost unchanged for that same reason.

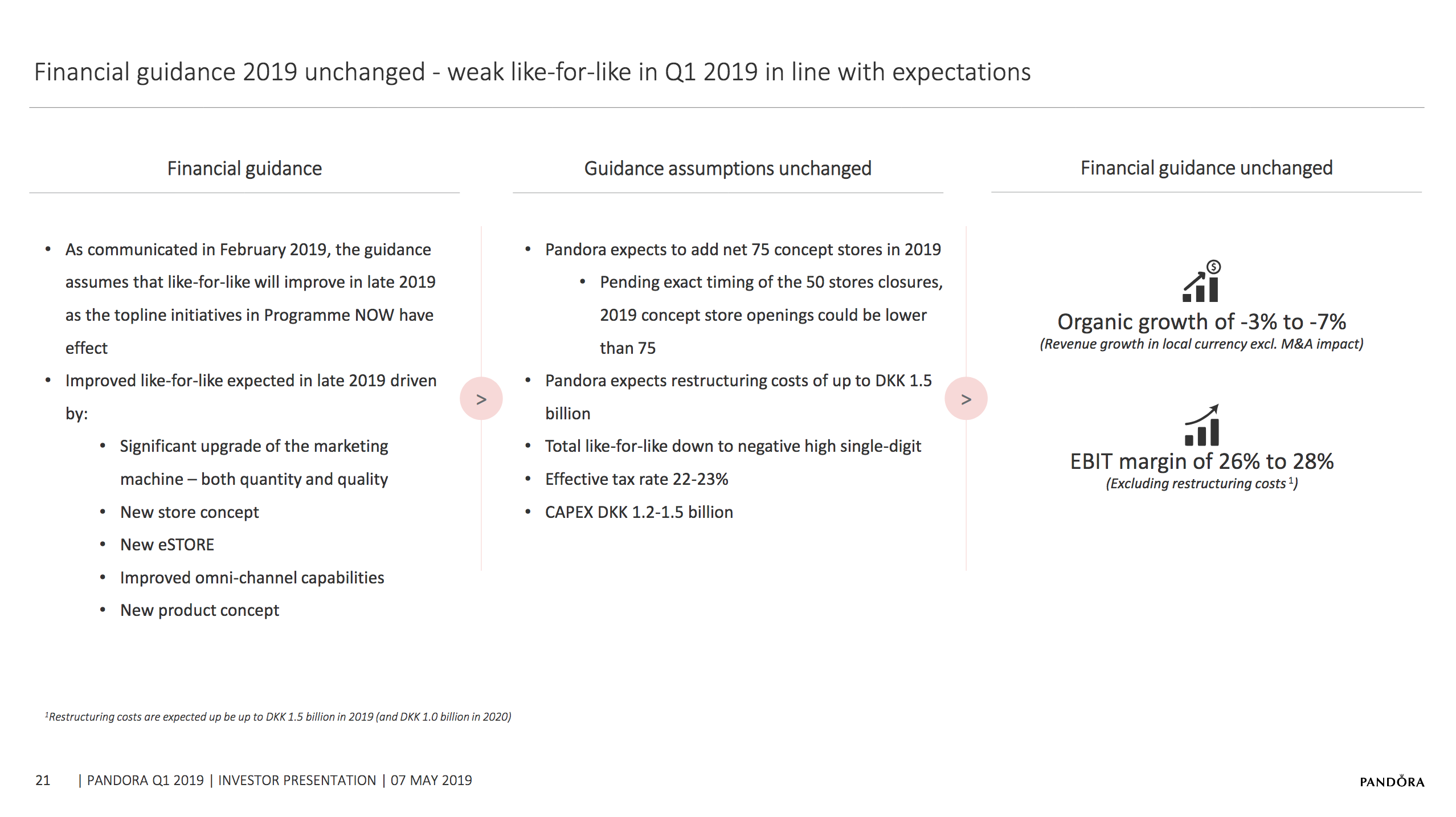

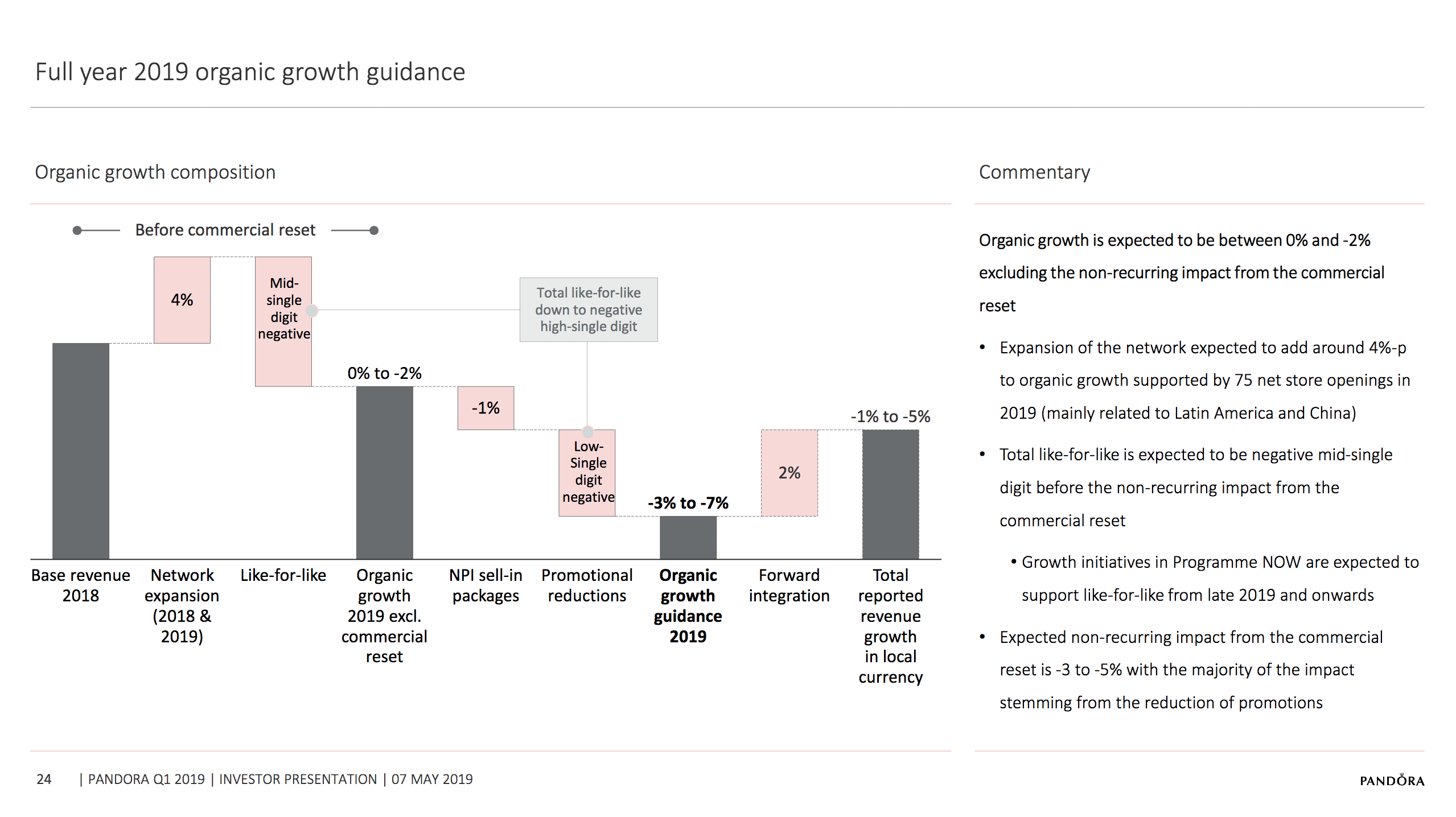

Pandora guides with negative growth of -3% to -7% and a lowered EBIT margin of 26% to 28% excluding restructuring costs.

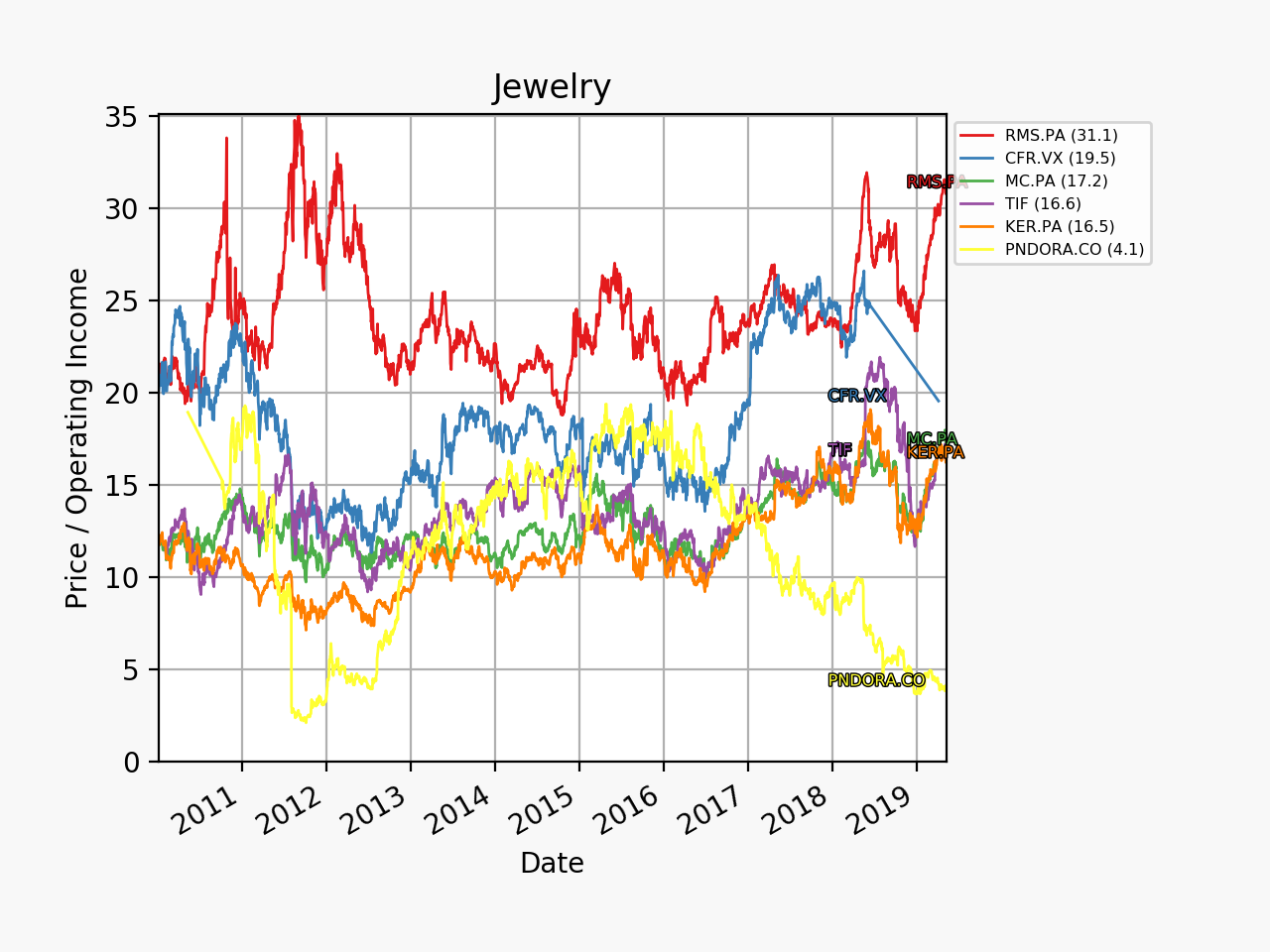

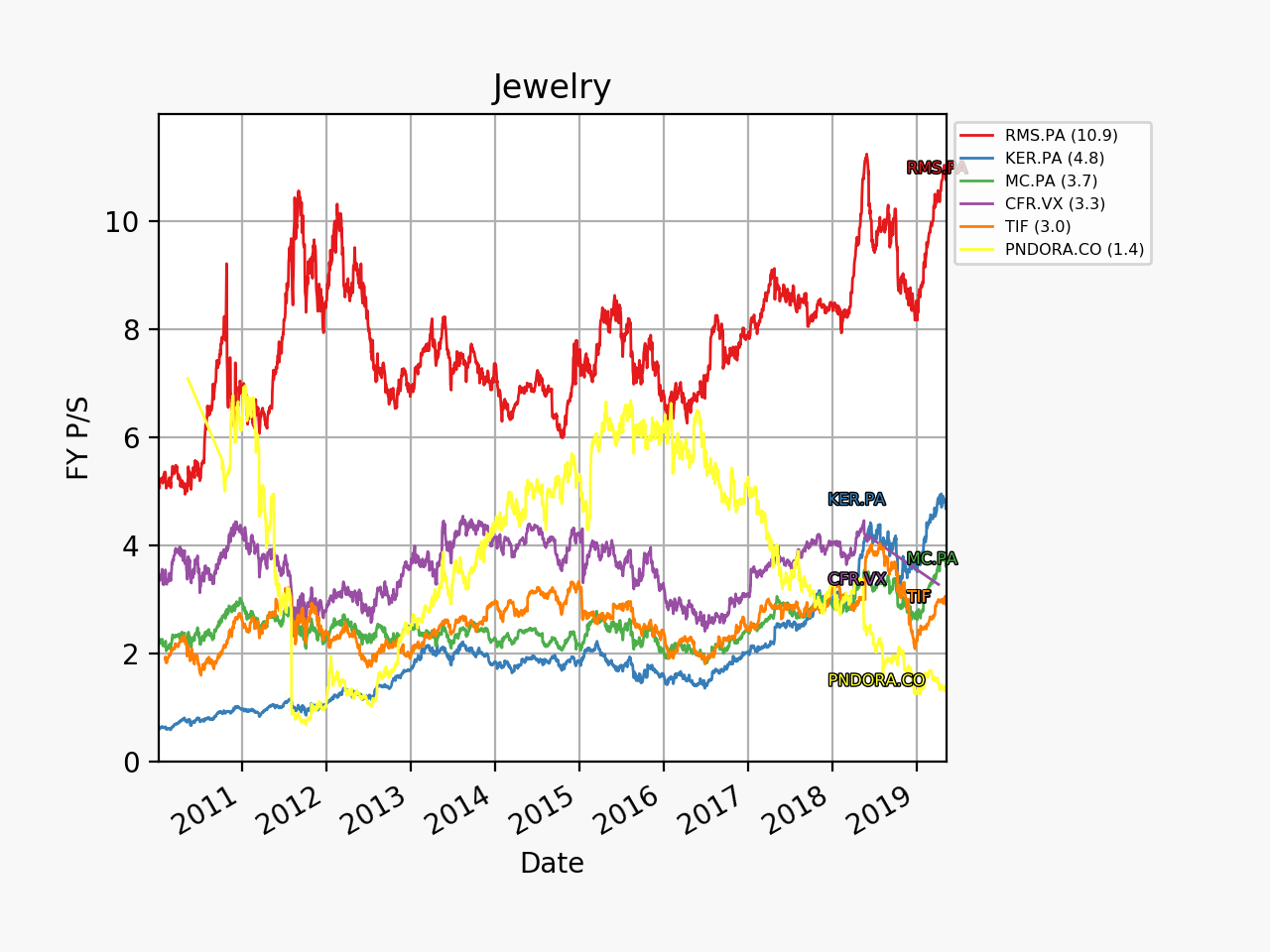

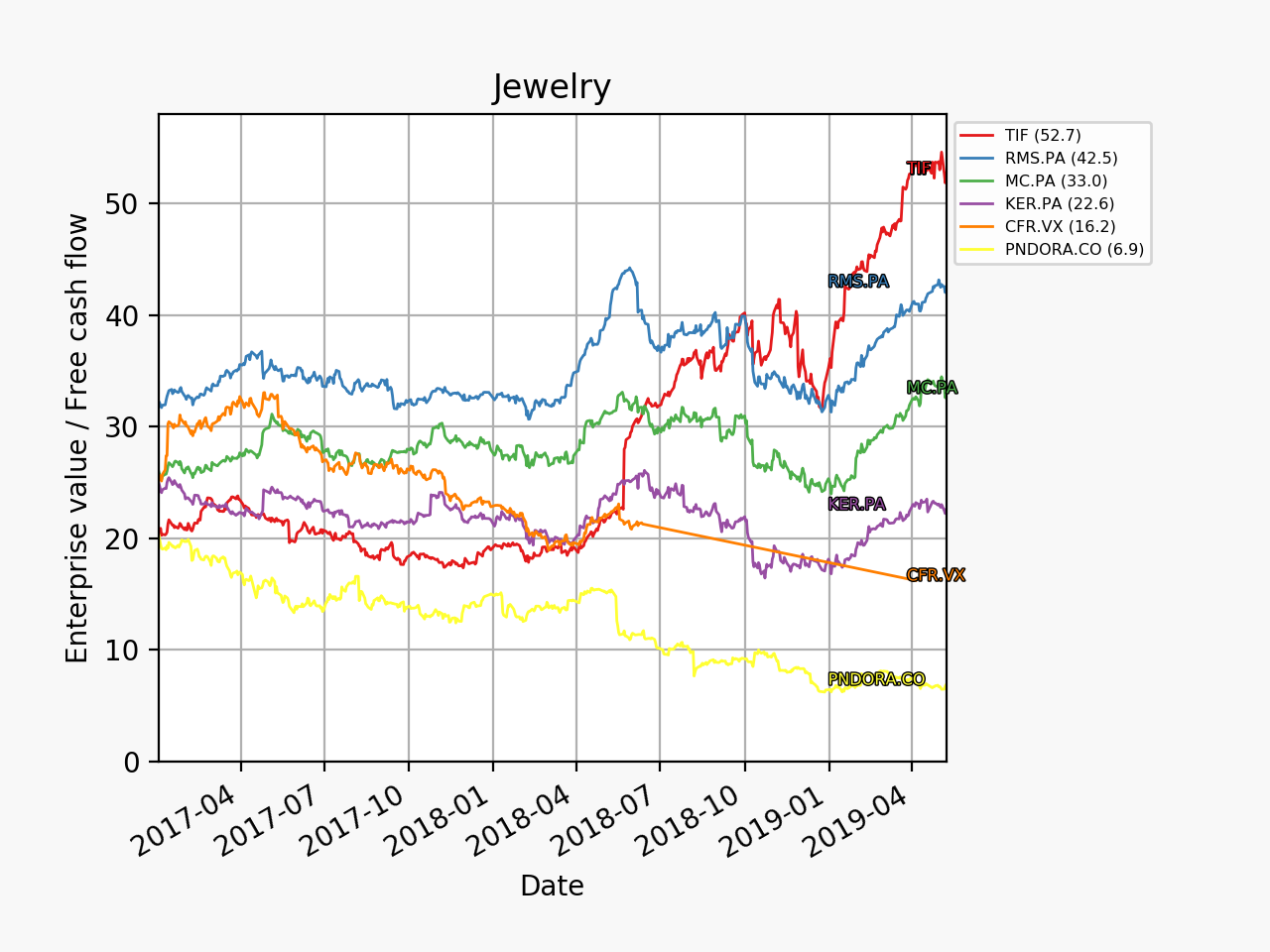

Despite guiding with a lower EBIT margin of 26% to 28% Pandora still has some of the best margins in the jewelry/luxury industry.

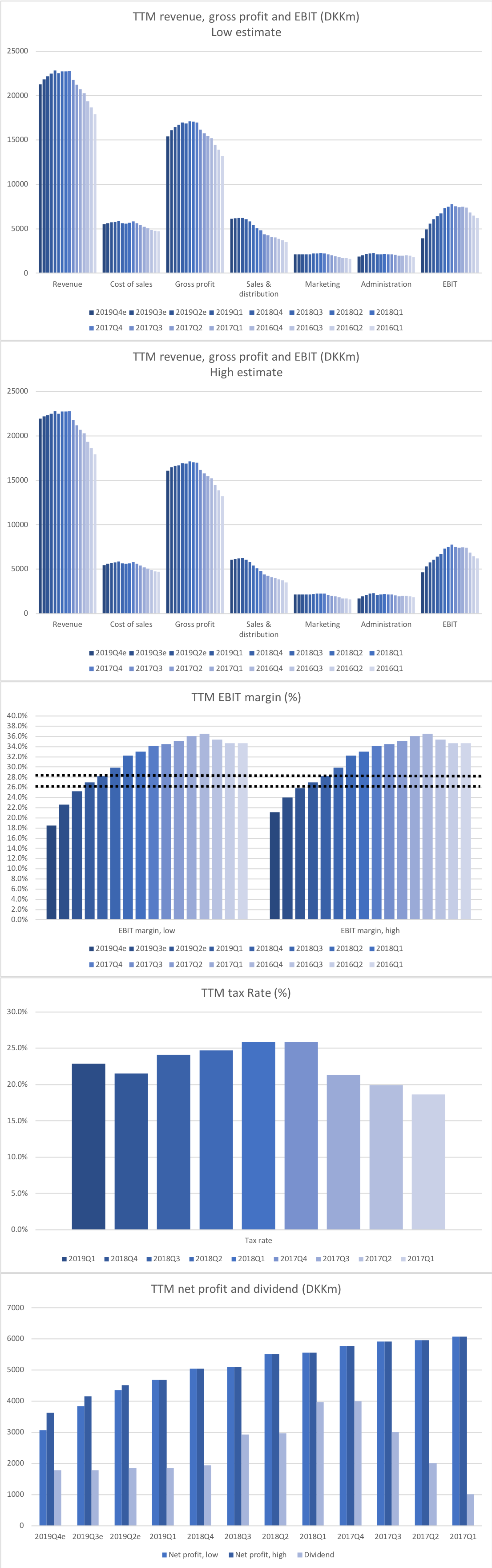

An attempt can be made to estimate the 2019 FY earnings. Pandora is guiding with organic growth in the range -7% to -3% and an EBIT margin in the range 26-28%. Below are some more pessimistic expectations regarding earnings and margins prior to restructuring costs based on the lower and higher end of estimates regarding organic growth and cost savings.

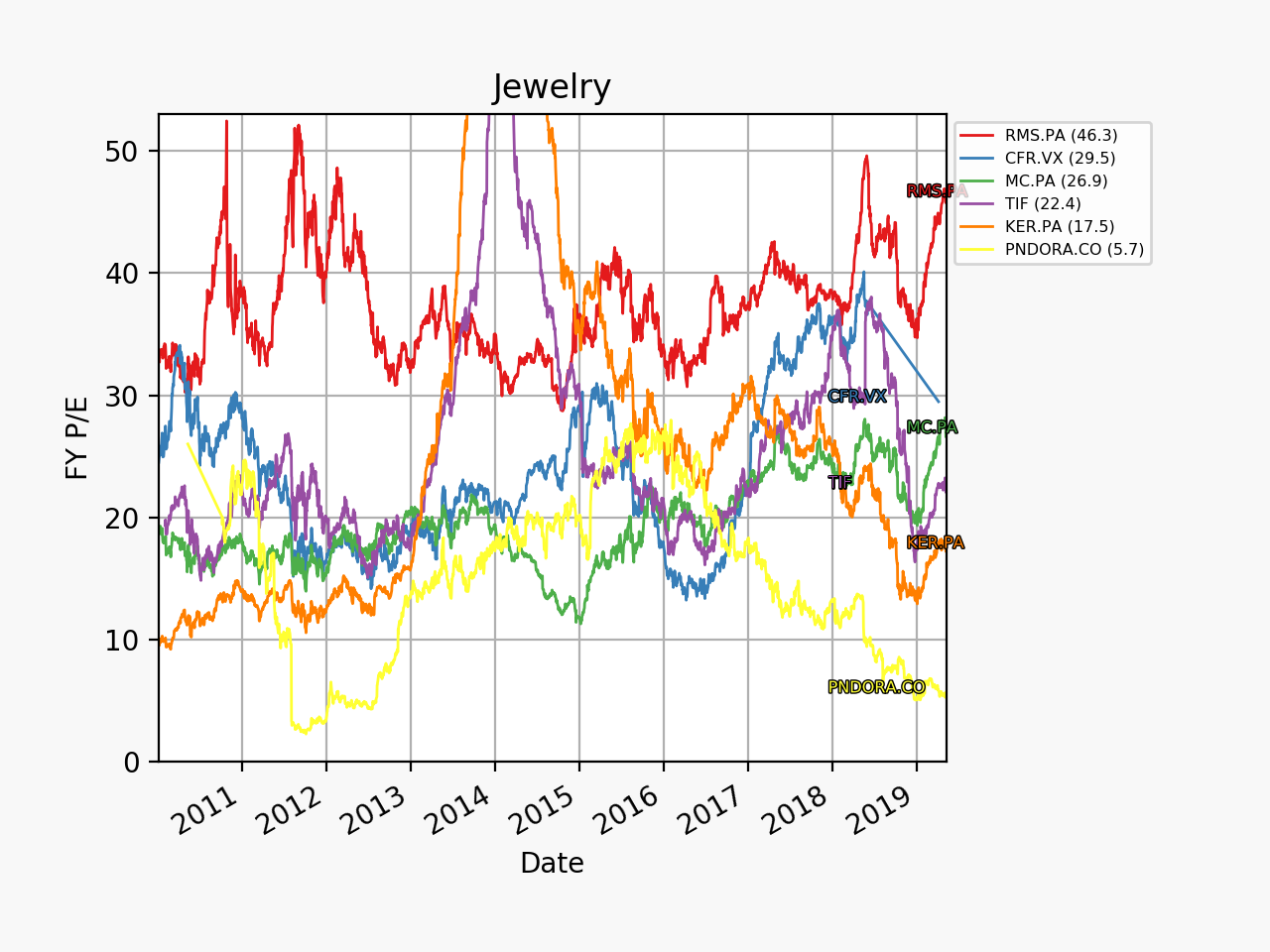

By any measure Pandora currently trades at an attractive price; even when factoring in, that net profit could very well be 30% lower in 2019 compared to 2018. Below various multiples such as trailing annual P/E (5.7) are shown.