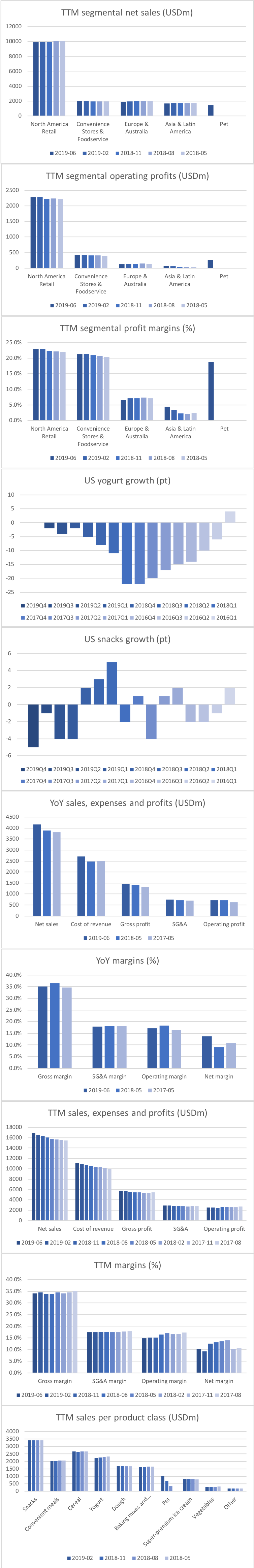

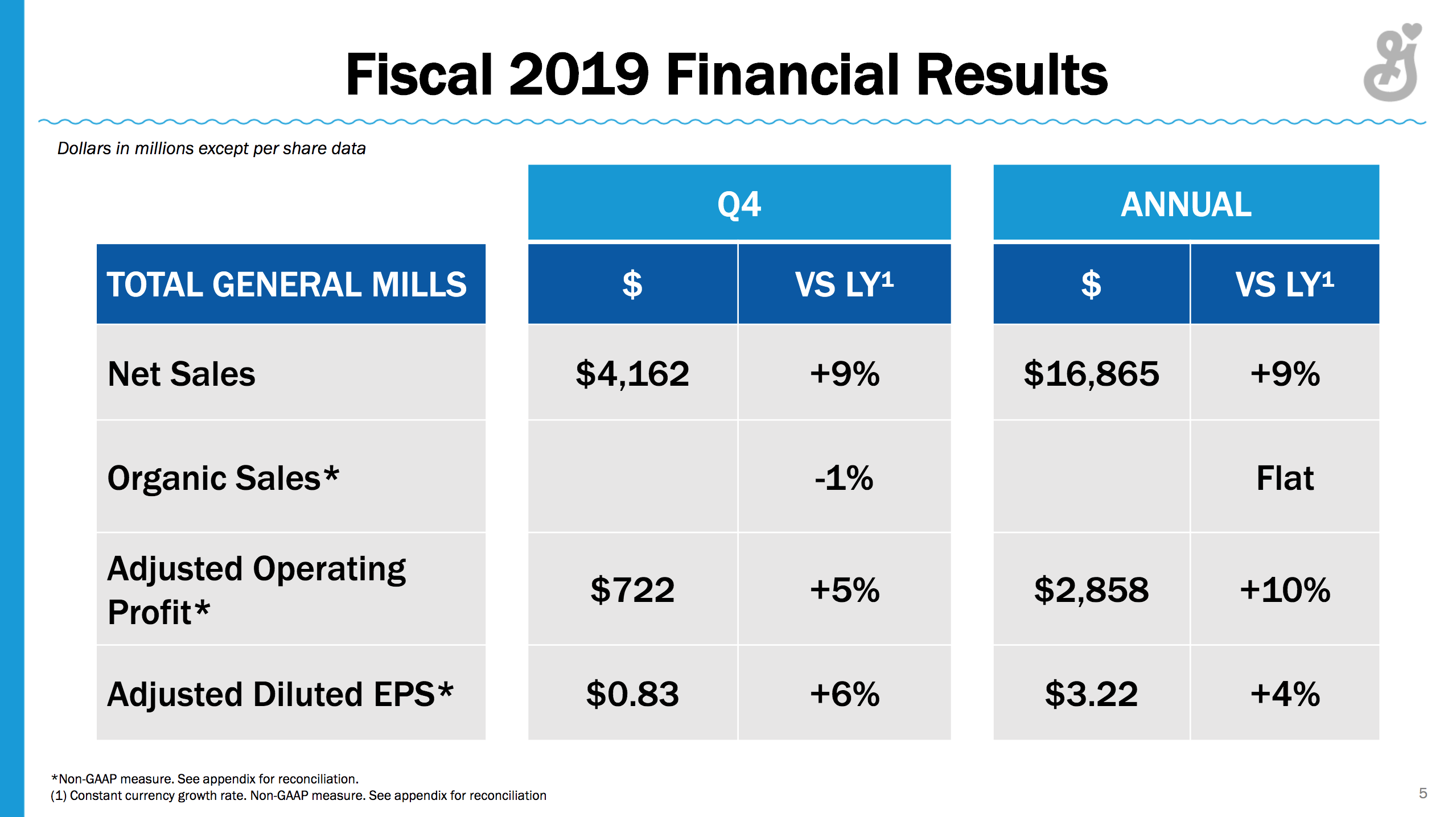

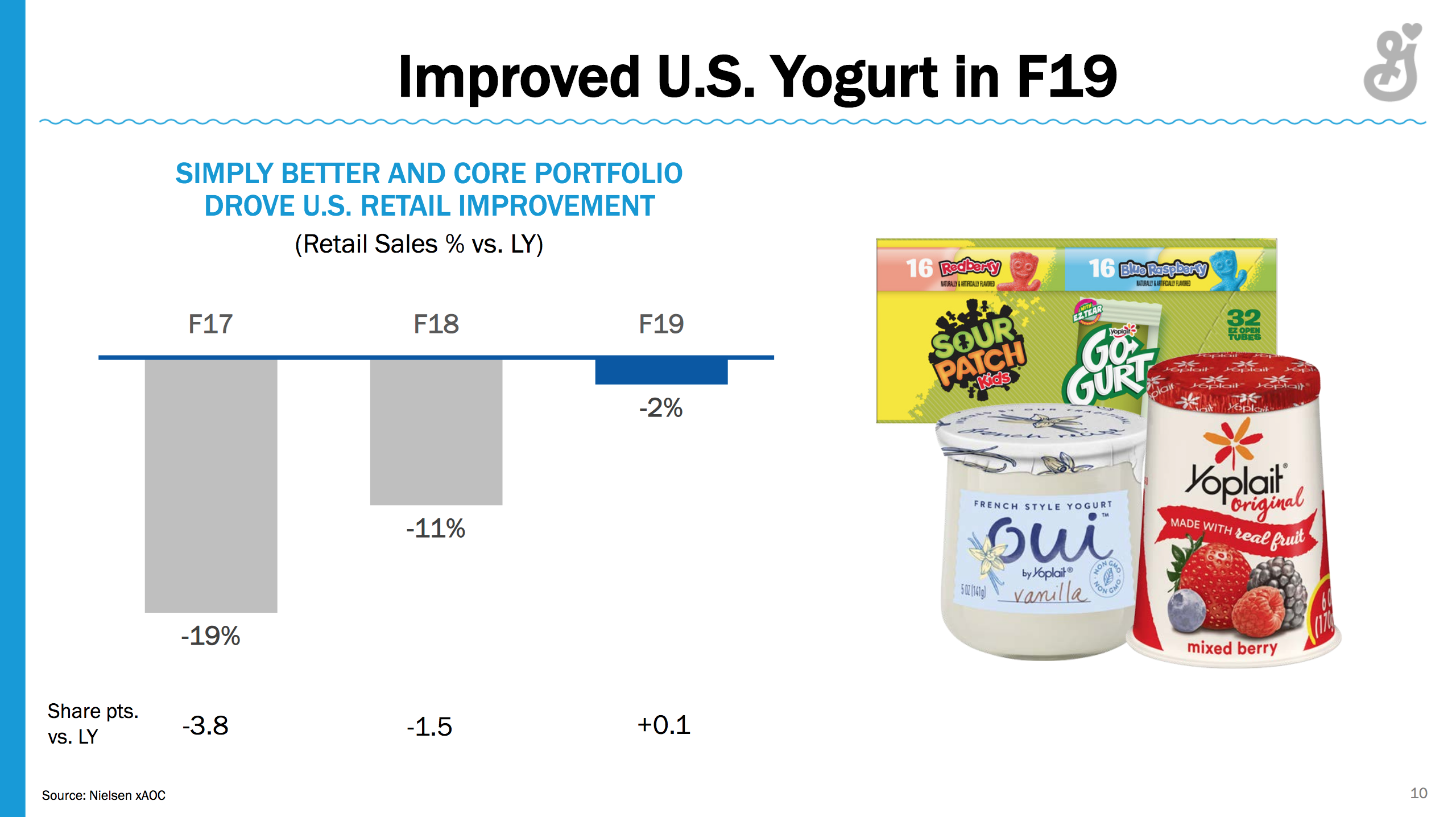

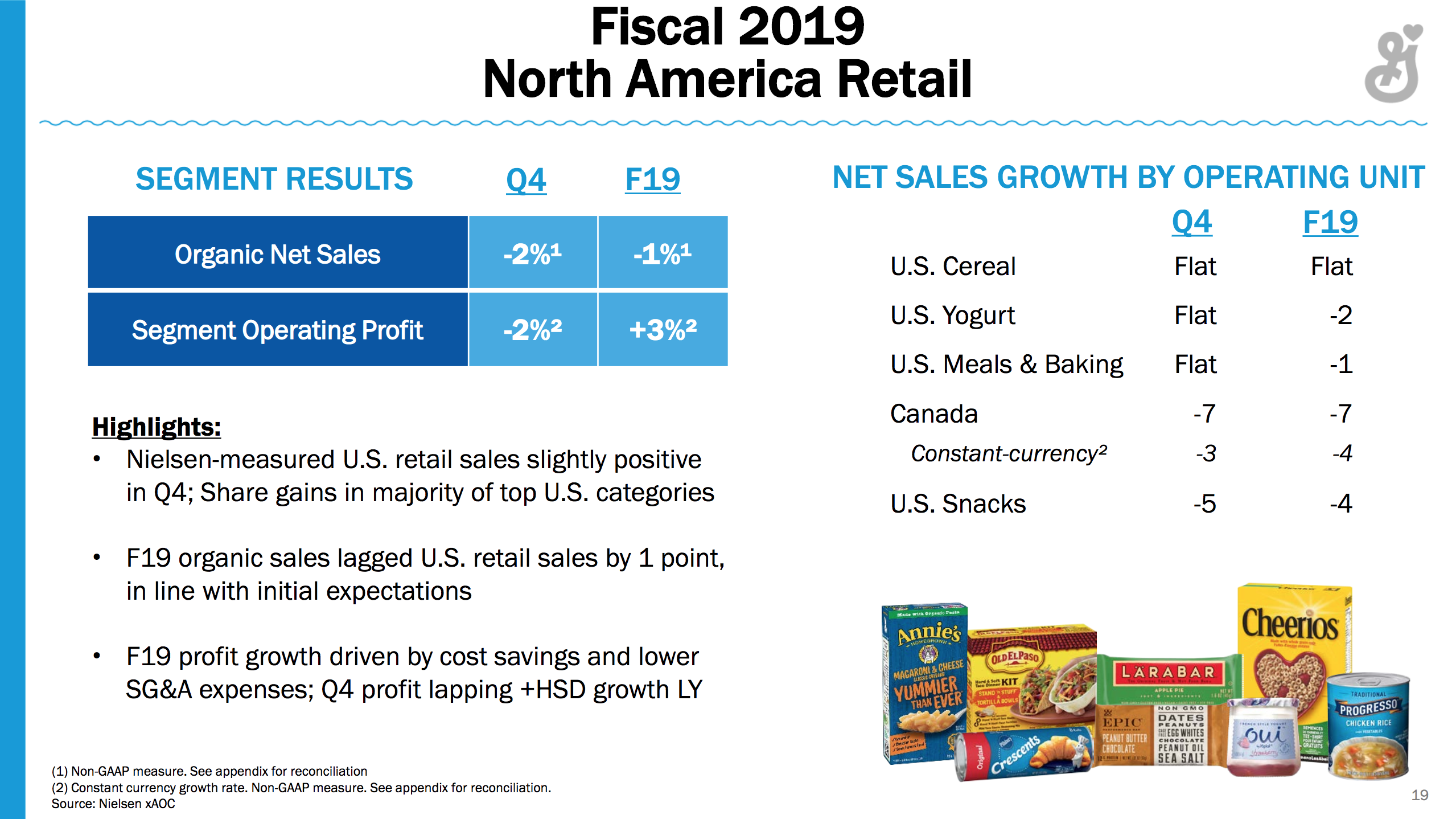

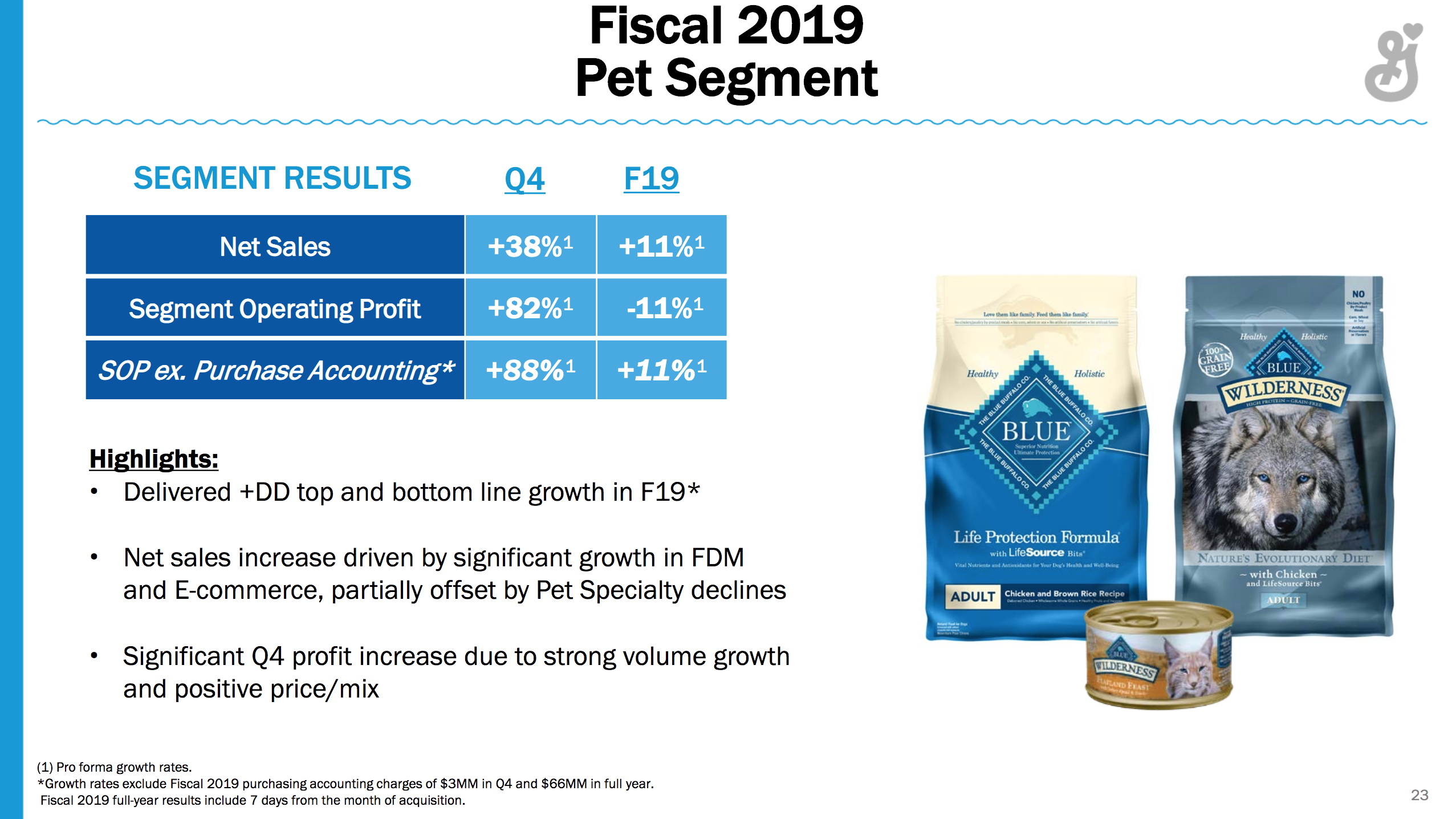

General Mills ($GIS) issued a press release on their quarterly earnings. Sale of yogurt in the US has stabilised after several consecutive quarters of market share losses to Chobani. Sales in the pet segment are up by 11% on an annual basis (and 38% on a quarterly YoY basis) following the acquisition of Blue Buffalo. Snacks however are down by 5%; hot snacks gaining market share and fruit snacks losing market share. That combined with the share price reaching fair valuation might have sent the stock price down by as much as 9.6% at one point during the day. The stock price closed down 4.4% at $51.31. The fair value is probably somewhere in the mid 50s.

The CEO Jeff Harmening had the following comments in the press release and during the earnings call:

“I’m pleased to say thatwe executed well, successfully transitioned Blue Buffalo into our portfolio, and delivered our financial commitmentsin fiscal 2019.”

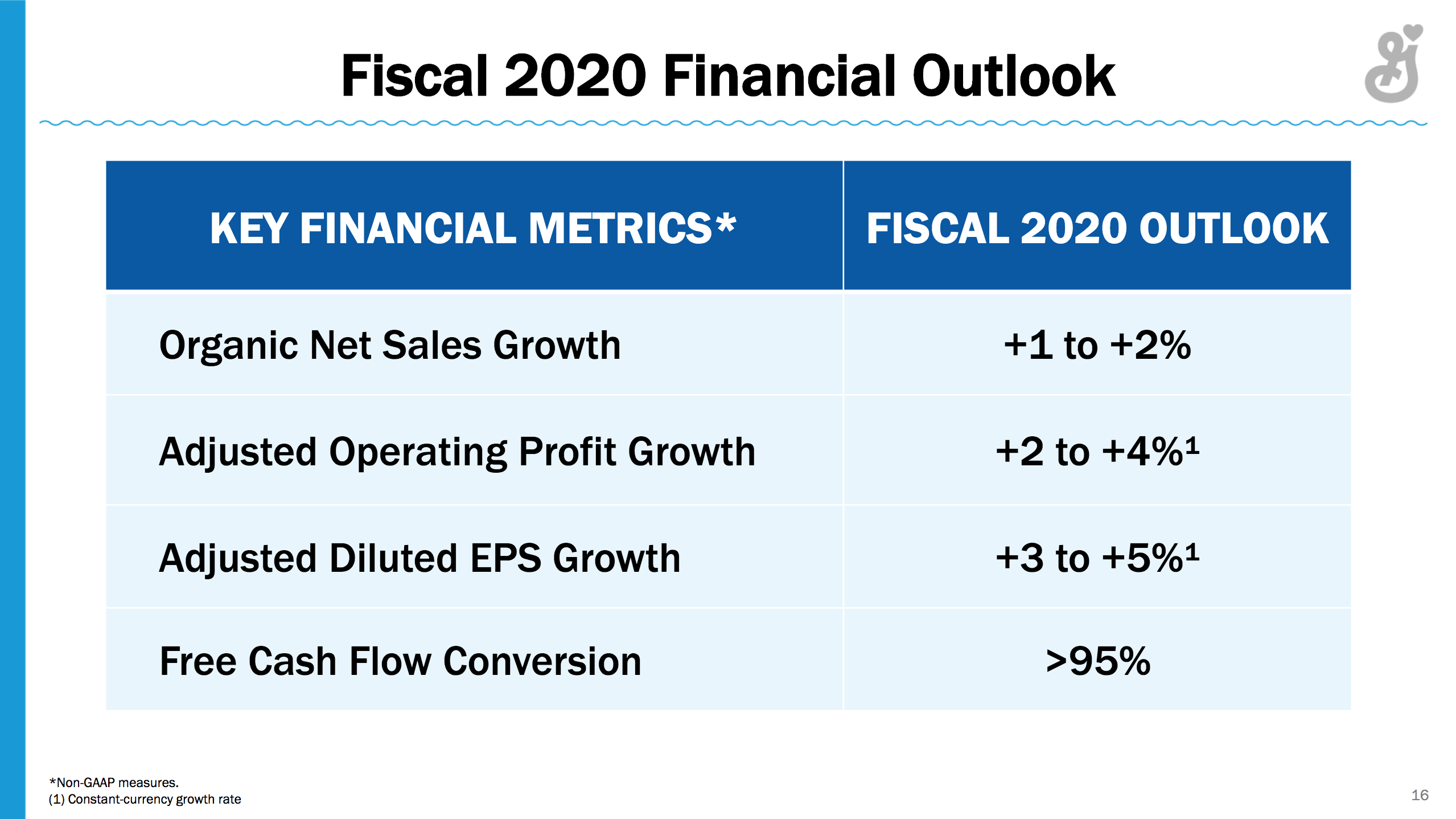

“We’ll look to improve our performance again in fiscal 2020, and we have plans in place to accelerate our organic sales growth while maintaining our strong marginsand cash discipline.”

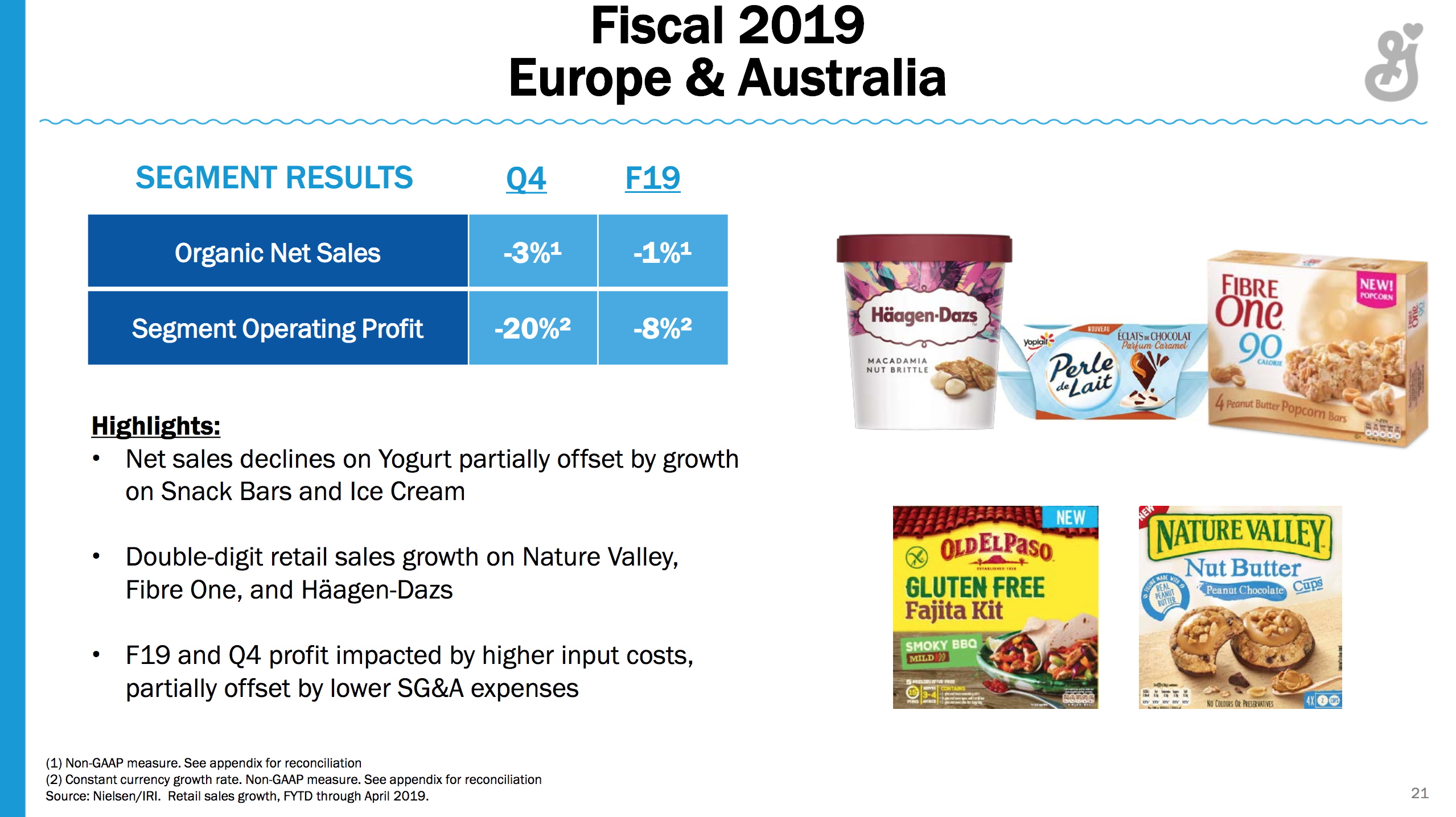

“We are very focused and frankly not satisfied with the performance on both Nature Valley and Fiber One, and that’s really what we need to turn around in the coming year.”

Reuters: General Mills sales hit by low demand for Nature Valley, Fiber One bars

Bloomberg: General Mills Slumps as Sales Fall Short of Market Expectations