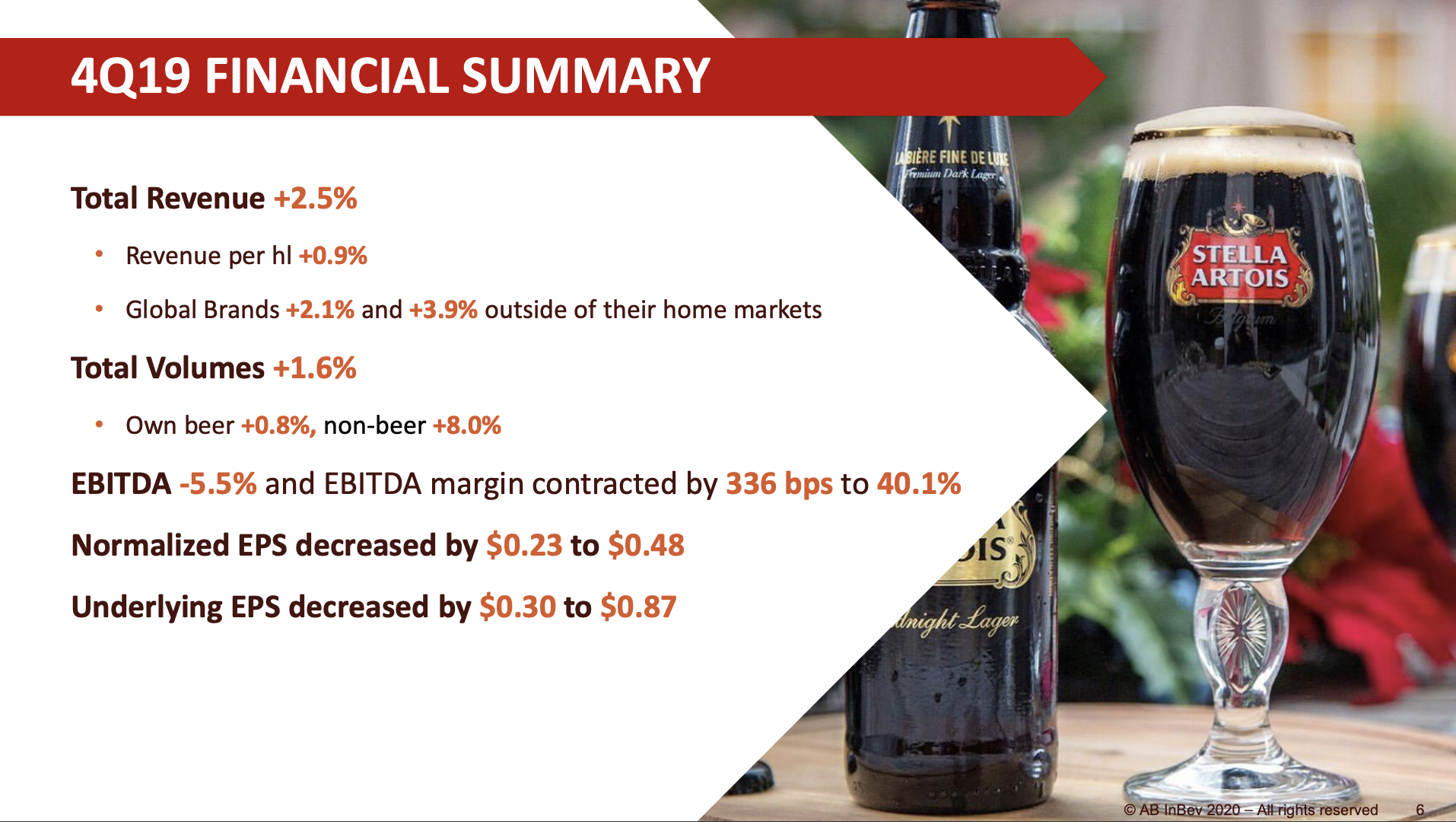

AB InBev ($BUD, $ABI.BR) issued a press release on their Q4 earnings on February 27th.

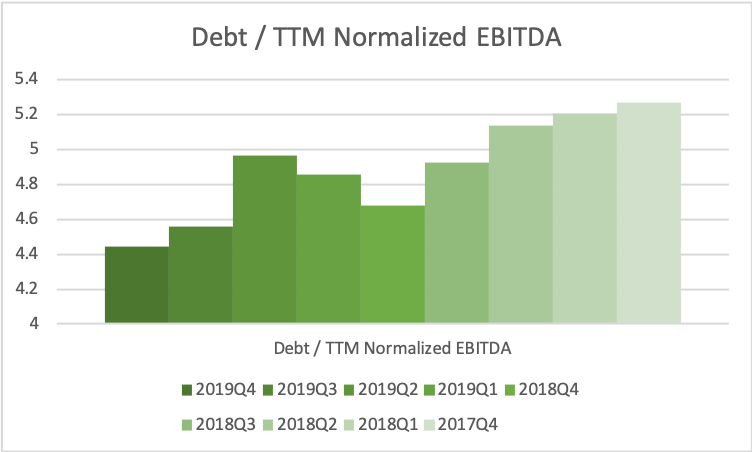

The company has maintained its dividend while continuing to deleverage.

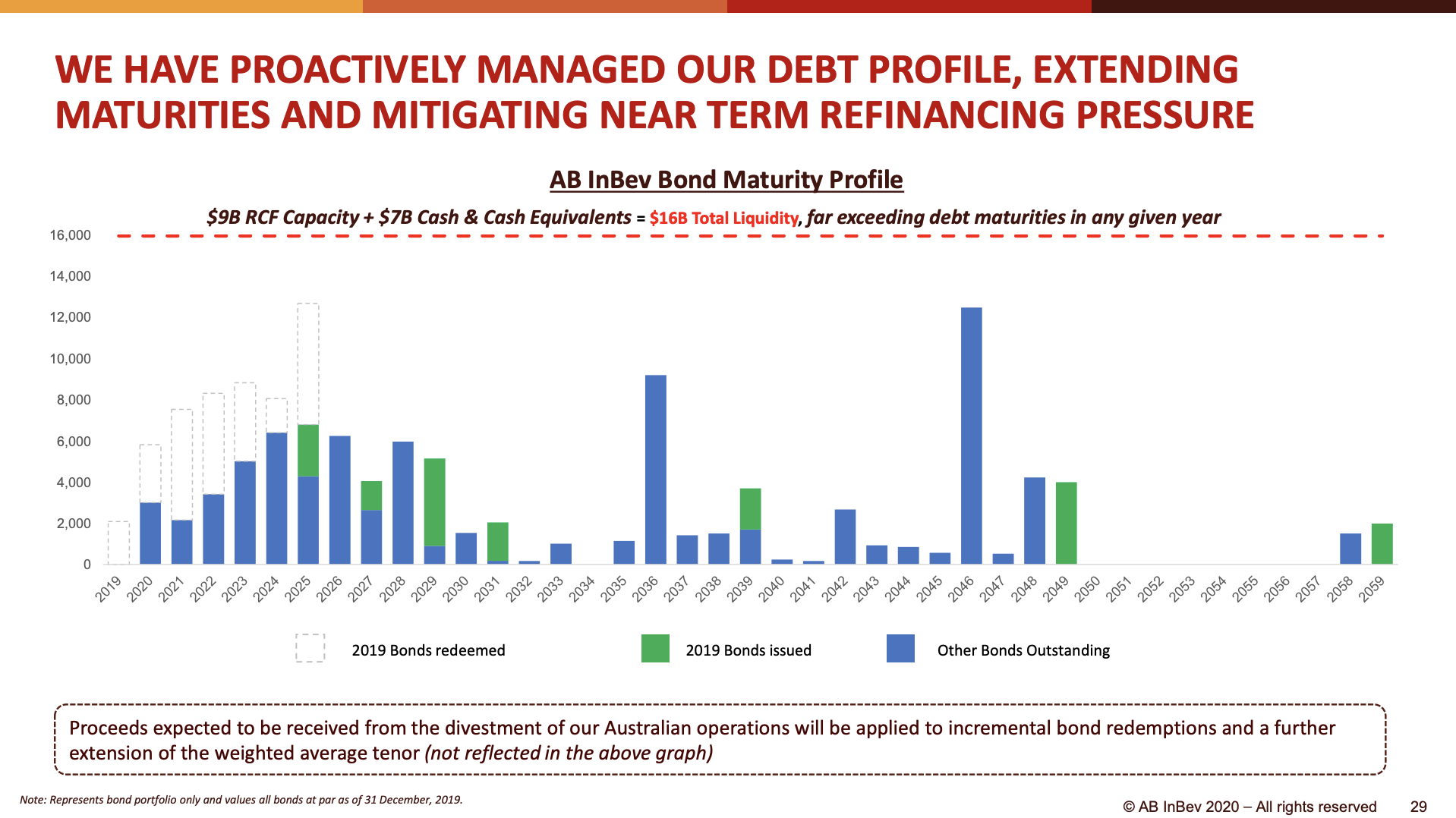

Accounting for the proceeds expected to be received from the divestment of the Australian operations (while excluding the last 12 months EBITDA from the Australian operations), the net debt to EBITDA ratio would be 4.0x for the 12-month period ending 31 December 2019.

Q4 press release

Since closing the SAB combination the debt has been reduced and maturities extended to eliminate near term refinancing risks.

AB InBev is by far the largest brewery in the world after the merger of Belgian Interbrew and Brazilian AmBev in 2004 and acquisitions of Anheuscher-Busch in 2008 and SABMiller in 2016.

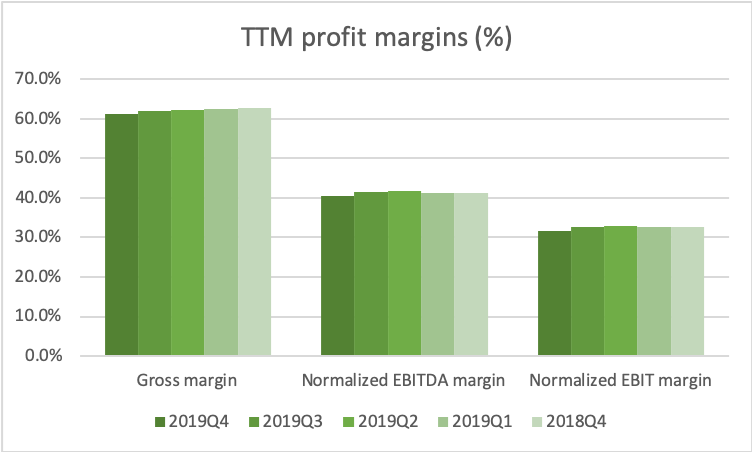

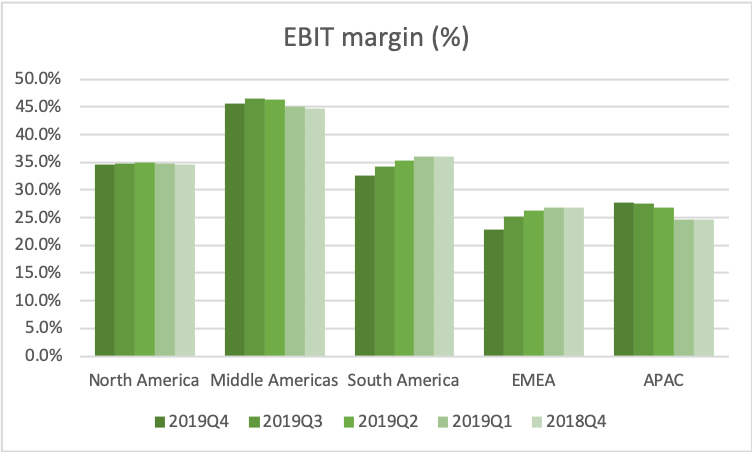

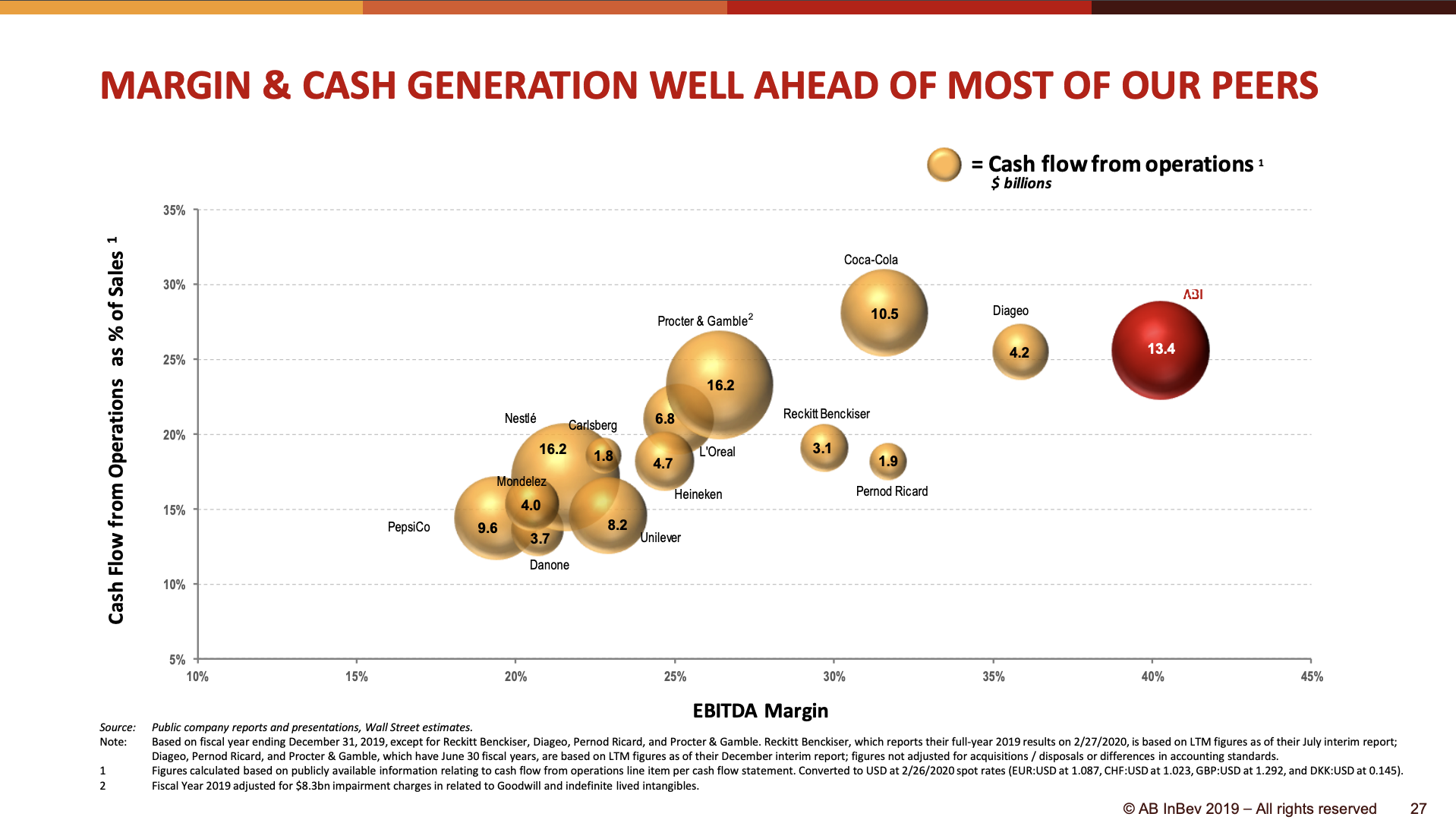

AB InBev continues to have the strongest margin in the industry. EBIT margins are greater than 30%, which is unrivaled in the industry.

Cash flow generation is also better than those of rivals Heineken ($HEIA.AS) and Carlsberg ($CARL-B.CO).

Likewise the return on capital and net tangible assets is unparalleled within the brewing industry.

The best-in-class margins and cash flow generation and return on assets is due their strong brands and their economies of scale.

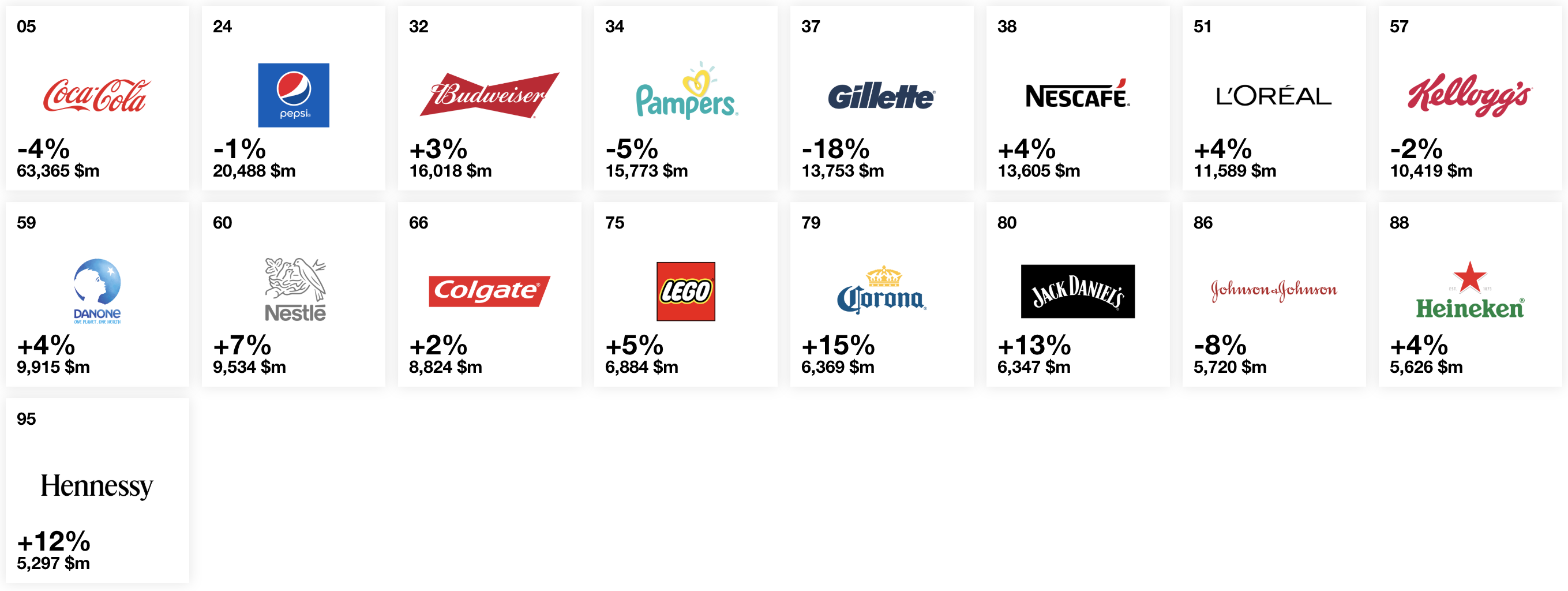

Interbrands released their report on the 100 top ranked brands in the world on the 17th of October. AB InBev is featured on the list with two of their brands; Budweiser (#32) and the rapidly growing Corona (#79).

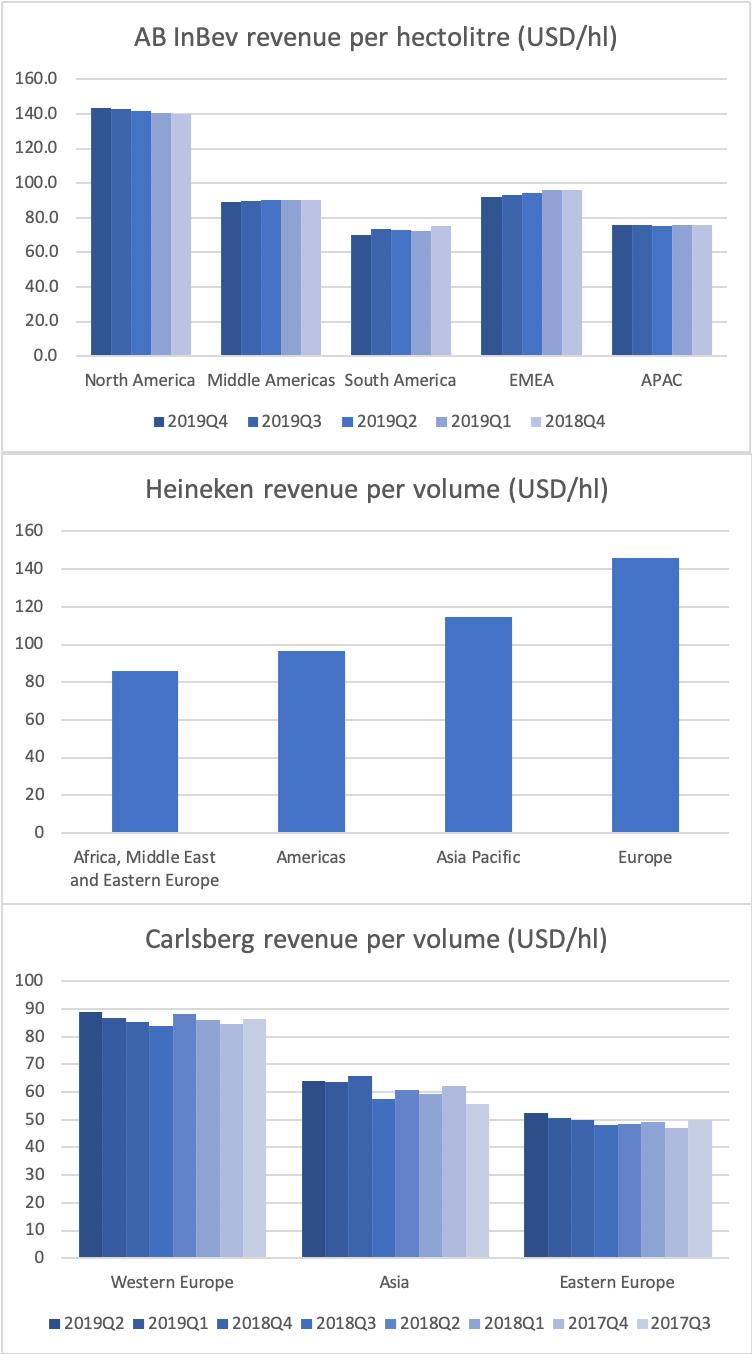

The AB InBev brands command a higher price per hectolitre than those of its competitors; Heineken and Carlsberg.

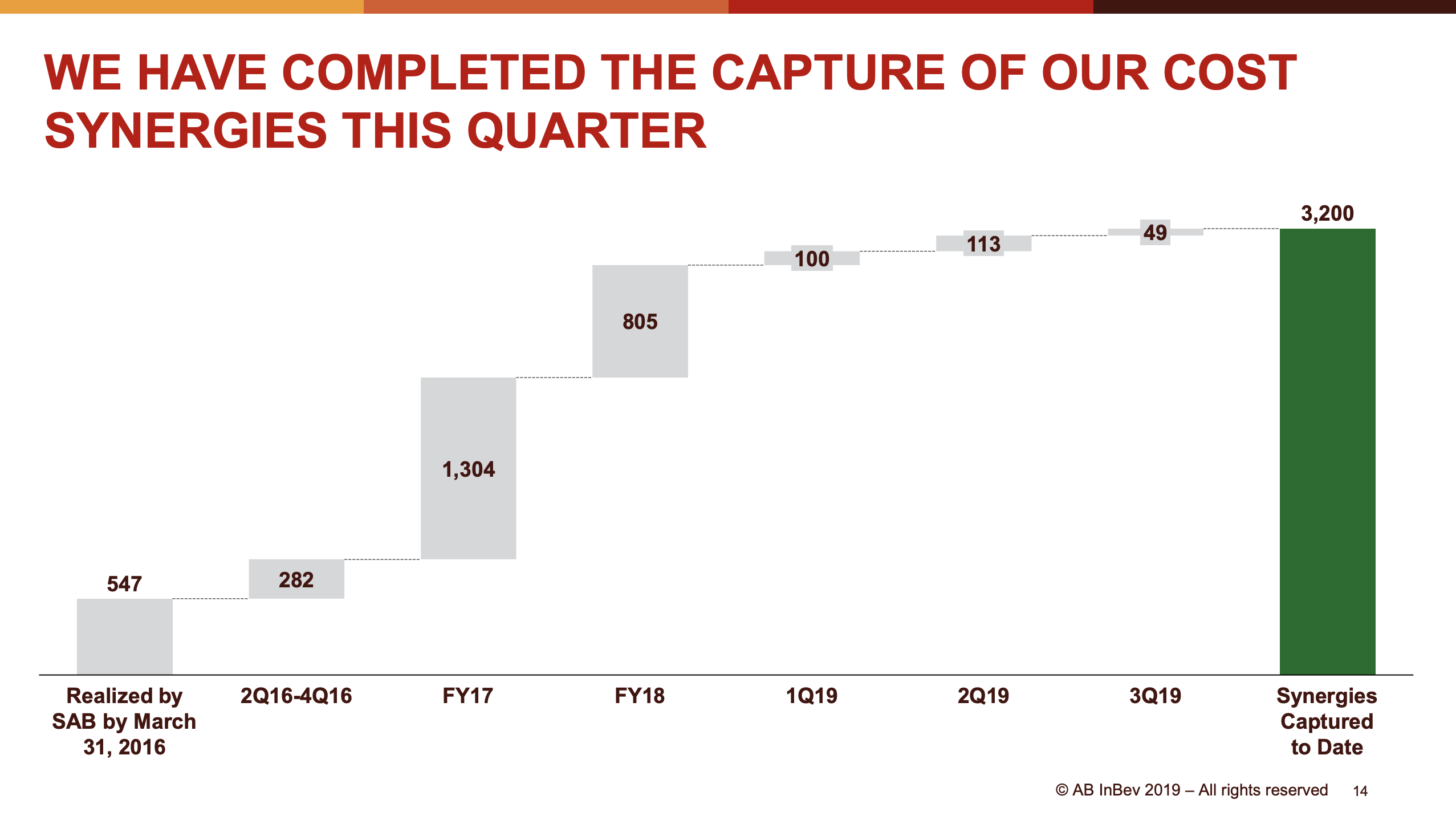

In terms of economies of scale, cost synergies of USD3.2B have been realized three years after the acquisition of SABMiller.

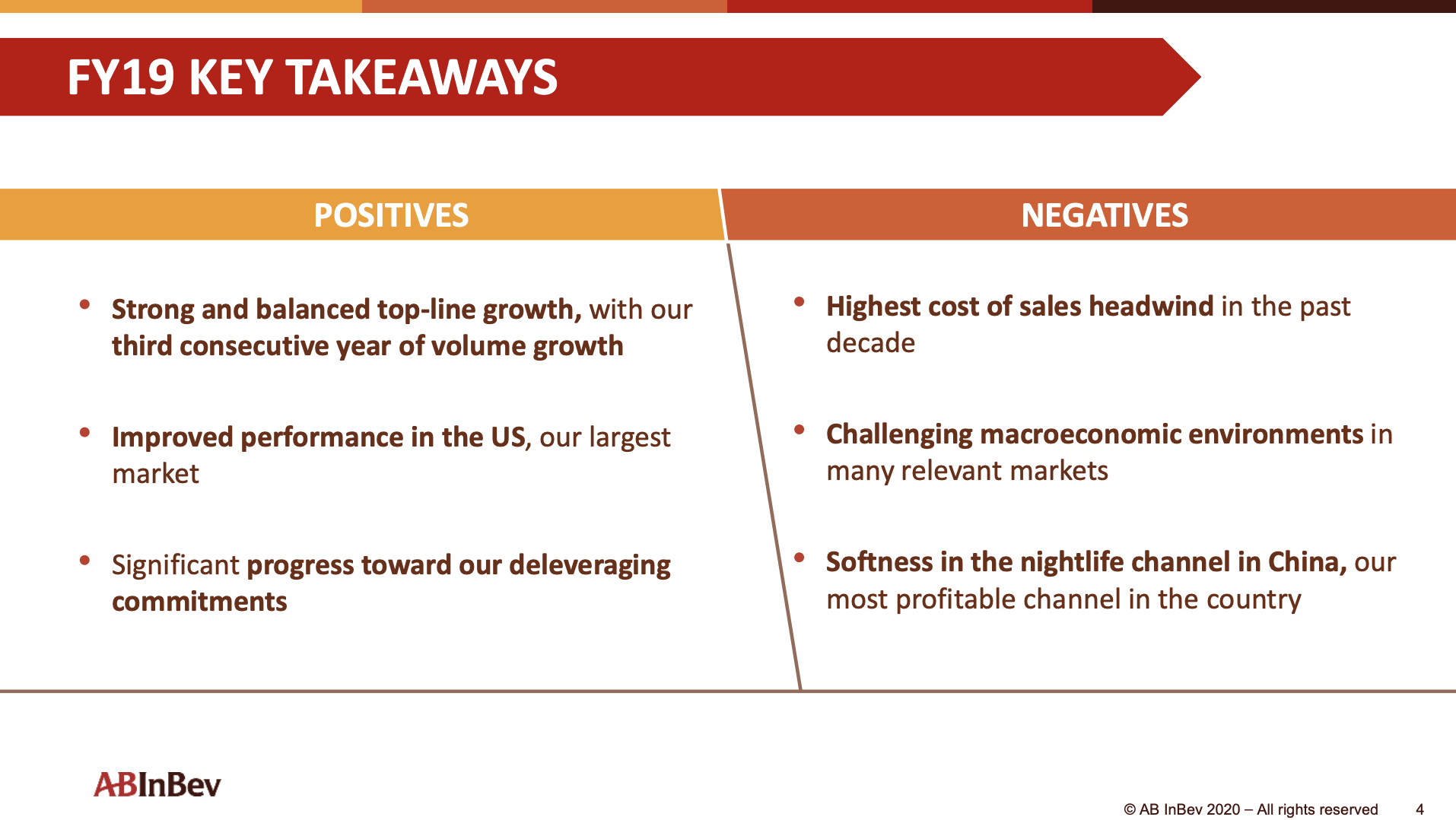

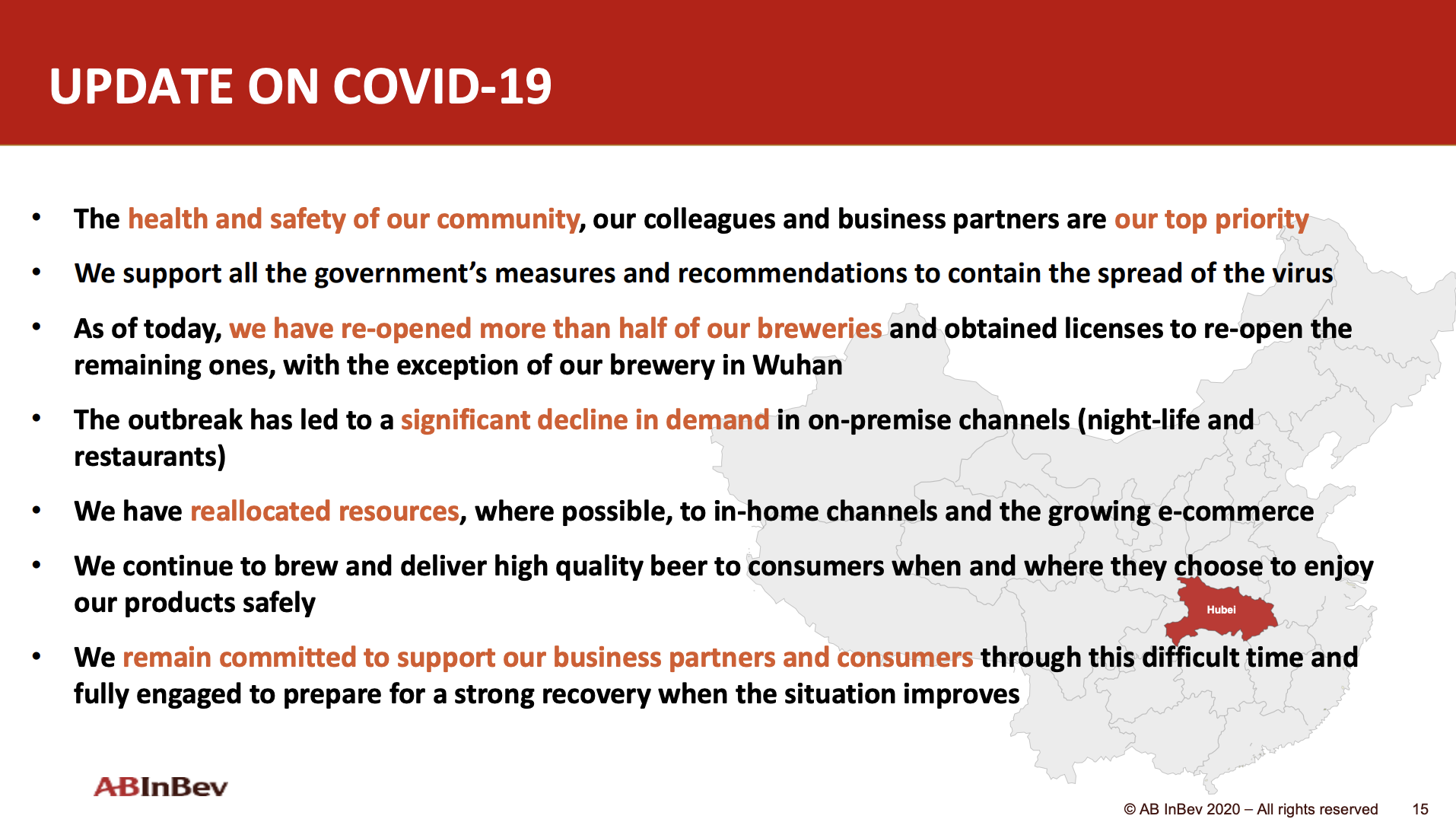

AB InBev has a large presence in the Asian markets, which experienced negative organic volume growth in Q3 (-6.5%) and Q4 (-5.2%). The business in Asia is seeing a further decline due COVID19.

In the light of the temporary decline in on-premise channels it is interesting to not that the DTC business is now a billion dollar business growing by double digits.

AB InBev has better margins and cash flow generation than those of its competitors and it is deleveraging. Yet it trades at low multiples in absolute and historical terms and has reached the lows of December 2018. AB InBev is too good an investment to pass at current prices.

References

2020-02-27 Reuters – AB InBev sees 10% hit to first-quarter profit from coronavirus

2020-02-27 Bloomberg – AB InBev Cuts CEO Bonus as Brewer Sees Worst Quarter in a Decade

2020-02-06 Bloomberg Opinion – Beer Drinkers Want More Than a Typical Lager These Days

2019-10-25 Bloomberg Opinion – The King of Beers Is in a Bind

2019-10-25 Midgard Finance – AB InBev increases prices in South Korea and Brazil and sees volume decline

2019-10-06 CNBC – Budweiser wants to take on China, the world’s largest beer market where local brews rule