- Record net cash from operations of $803 million for full year. Guidance for 2020 is $700-800M.

- Expectation of $200 million in share repurchases early in 2020.

- Debt repayments greater than $600 million in 2019 and year-end inventory 7% lower.

- Net debt reduced from 3.3 to 2.9 times adjusted EBITDA.

- Shares seems undervalued given low multiples, share buyback, organic growth and debt reduction.

Hanesbrands issued a press release on their 4th quarter 2019 financial results on February 7th. The quarter was summarized by the CEO as follows:

“HanesBrands delivered a solid fourth quarter right in line with our guidance and concluded a very successful year with record operating cash flow, significantly reduced debt, continued organic revenue growth, and strong underlying business fundamentals.”

The quarter and the year is briefly visually summarized below before turning to the investment thesis.

Record operating cash flow

Hanesbrands achieved a record operating cash flow in 2019 of $803M.

This was achieved through a combination of increased net income and the reduction of year-end inventory.

Inventory Net

Inventory Work In Process

Inventory Raw Materials

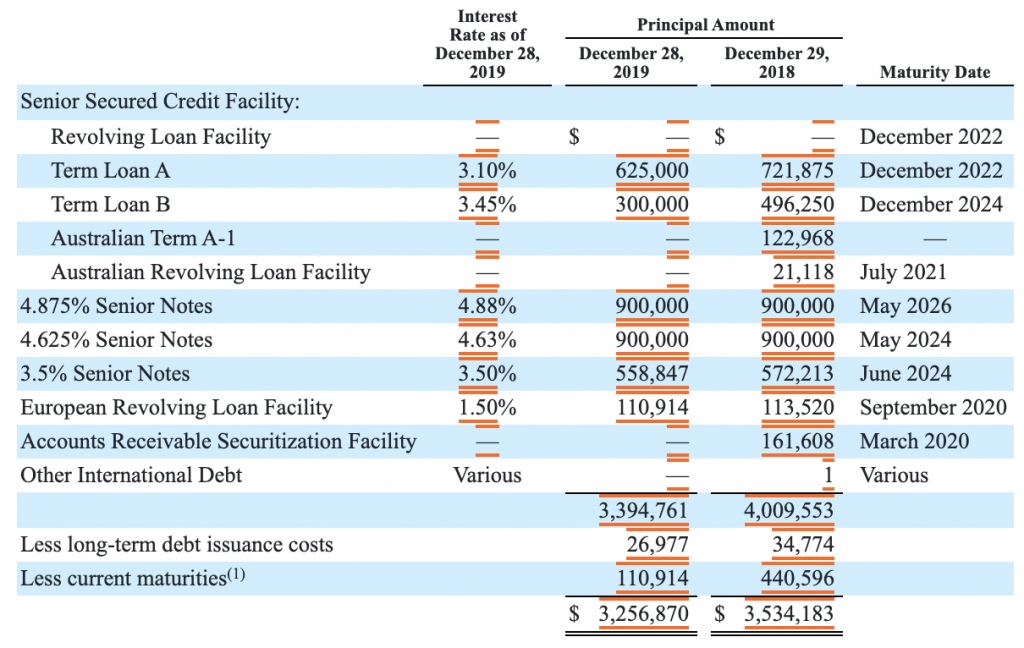

Significantly reduced debt

Hanesbrands used their annual record operating cash flow of $803M to reduce their debt by $609M to $3394M; from 3.3 to 2.9 times EBITDA. The figures and tables below summarise their debt reduction.

The development over time of the individual loans and credit facilities are visualized below.

Term Loan A

Term Loan B

Australian Term A-1

Australian Revolving Loan Facility

European Revolving Loan Facility

Accounts Receivable Securitization Facility

4.875% Senior Notes

4.625% Senior Notes

3.5% Senior Notes

Current maturities of 110 USDm.

Long term debt (3394 USDm) less current maturities (European Revolving Loan Facility of 110 USDm) and issuance costs (26 USDm) of 3256 USDm.

The quarterly interest expenses have dropped to $40M in large part as a consequence of the debt repayments and to some extent also lower interest rates.

Organic revenue growth

“In the fourth quarter, constant-currency organic sales increased slightly, while full-year constant-currency organic sales increased 4%.”

“Consumer-directed sales, defined as all sales to consumers online or through brand stores, continue to increase and account for a larger portion of total sales. Consumer-directed sales in constant currency increased 17% in the fourth quarter and 16% for the full year. Consumer-directed sales in constant currency represented 30% of total sales in the quarter and 25% for the full year.”

Third party brick and mortar

Directly to Consumer

“Global Champion sales, excluding C9 Champion in the U.S. mass channel, totaled $1.9 billion in constant currency in 2019, an increase of 40% over last year as a result of expanded product offerings and increased distribution. With balanced growth in the fourth quarter, Champion sales increased 22% both domestically and internationally.”

“Total International constant currency organic sales increased 10% in the fourth quarter and 12% for 2019. In the quarter, sales increased in all International regions, including the Americas, Asia, Australia and Europe.”

Activewear

Innerwear

International

Gross profit margins have improved over the years and operating expenses have been kept somewhat in check.

COGS (USDm).

Gross profit (USDm).

SG&A (USDm).

This has led to an improvement in operating income and operating margins, which is led by the international segment.

Operating income (USDm).

Segmental operating income (USDm).

Innerwear segment operating income (USDm, bars, left) and margin (%, line, right).

Activewear segment.

International segment operating income (USDm, bars, left) and margin (%, line, right).

Share repurchase plan

Buying back shares worth $200M would equate to between 10.3 and 15.5 million shares, if $HBI continues to trade in the 52-week range between 12.90 and 19.38. That equates to 2.8-4.2% of the 367.3 million outstanding shares. Management is authorized to buy back as many as 40 million shares.

The dividend is $0.15 per share, which equates to approximately $200M per year. However for 2020 net cash from operations is expected to be in the range of $700 million to $800 million. The company can continue to spend $200M on dividends, buy back shares worth $200M and reduce debt (European Revolving Loan Facility, Term Loan A, Term Loan B) by $300-400M. The share repurchase plan is consistent with previous communication.

Further evidence that management considers the share price to be undervalued is their insider buying at a share price below $15.

Valuation and conclusions

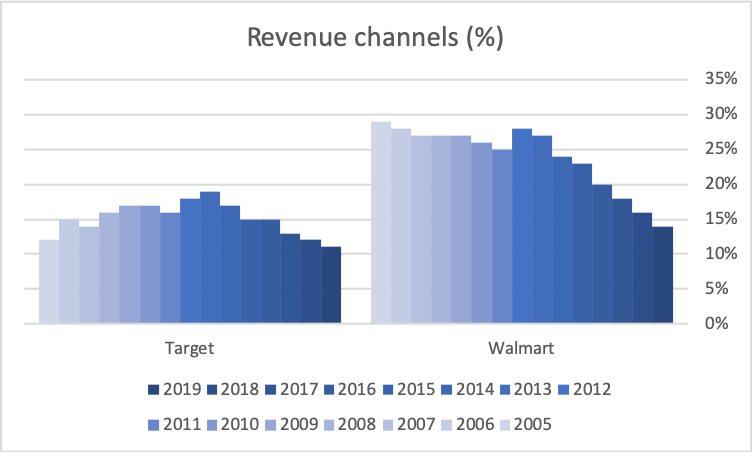

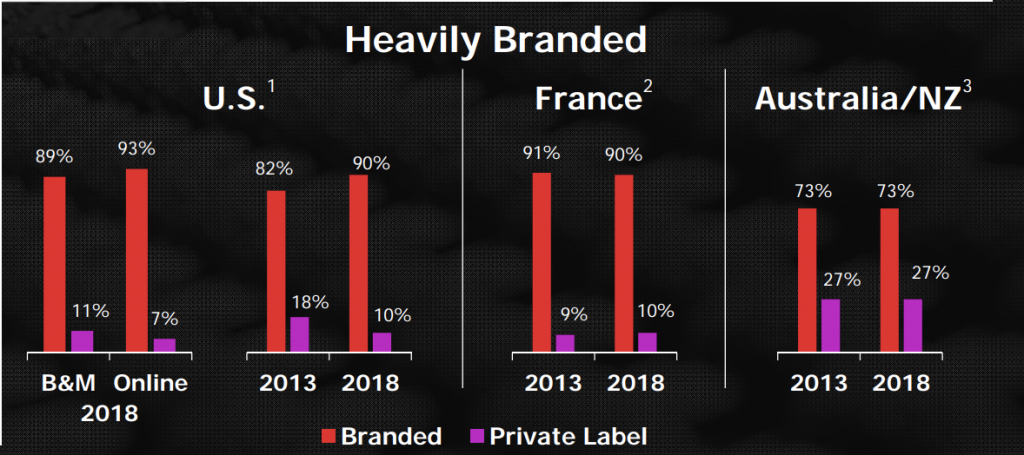

C9 Activewear was discontinued at Target after 15 years in favor of their own brand All in Motion, but Hanesbrands are already in final discussions with a new partner and will provide more specifics in the coming months. There is less dependence on Target and Walmart in 2019, which account for 11% and 14% of total sales, respectively. Those numbers were higher in 2017 at 13% and 18%, respectively. Furthermore online sales are more heavily branded than brick & mortar sales; and the latter is outpaced by the former.

Hanesbrands is trading at multiples not seen since 2012/2013. The company is attractively valued given the stable operating margins, the very decent return on capital, the low multiples, the share buyback, the organic growth and the debt reduction to the desired range of 2-3x EBITDA.

Operating margin (%).

Return on capital (%).

Earnings on net tangible assets (%).